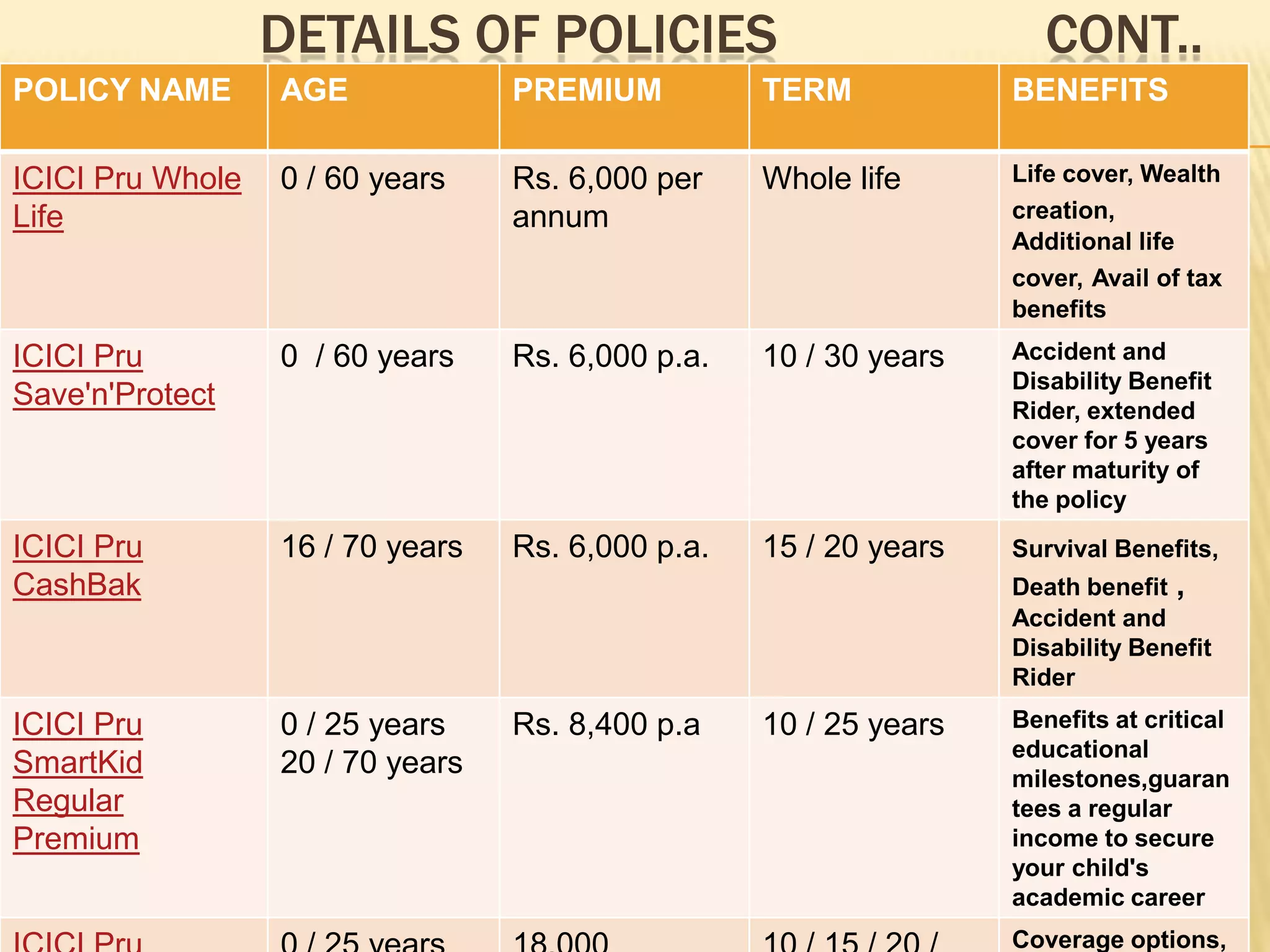

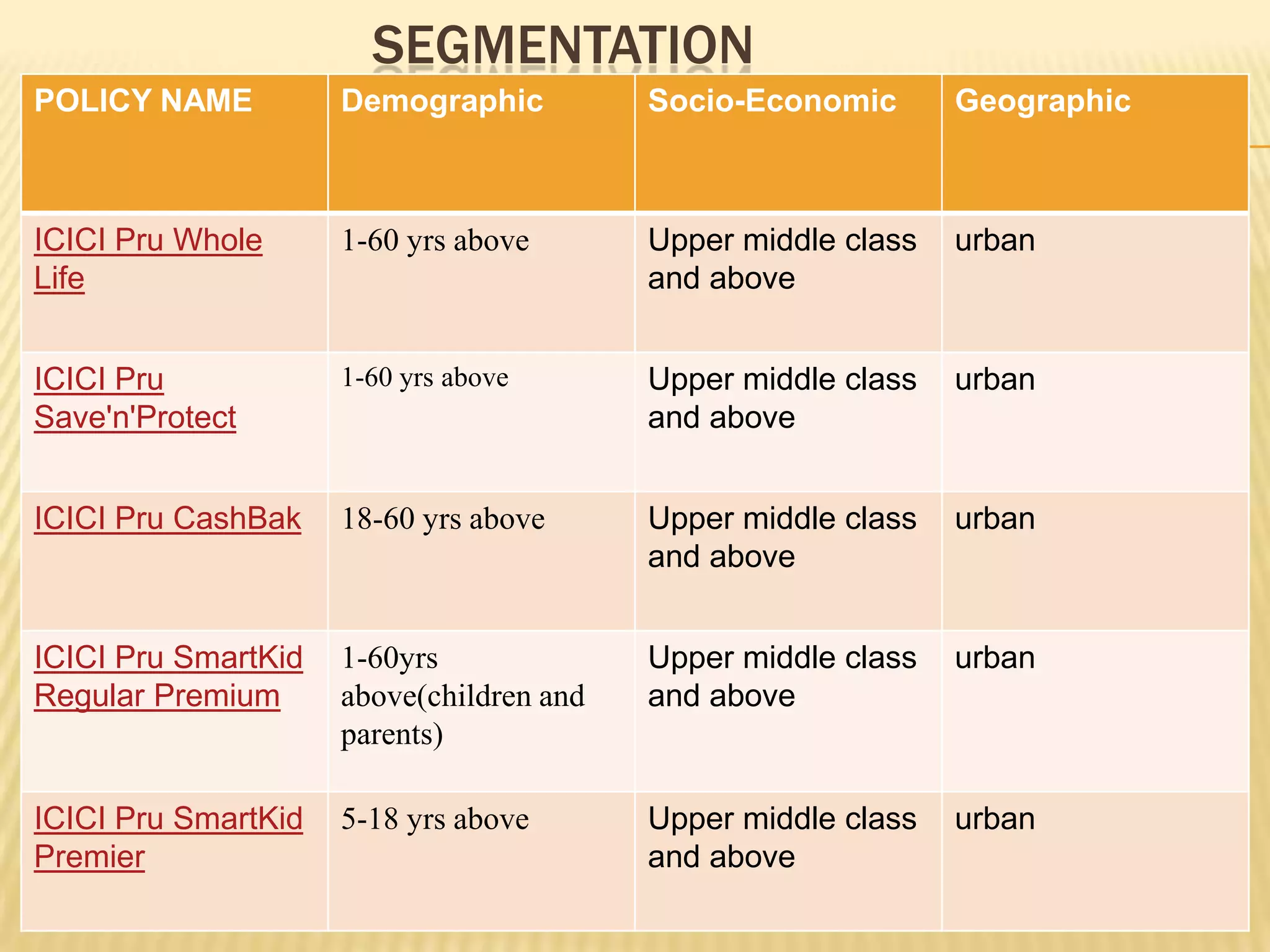

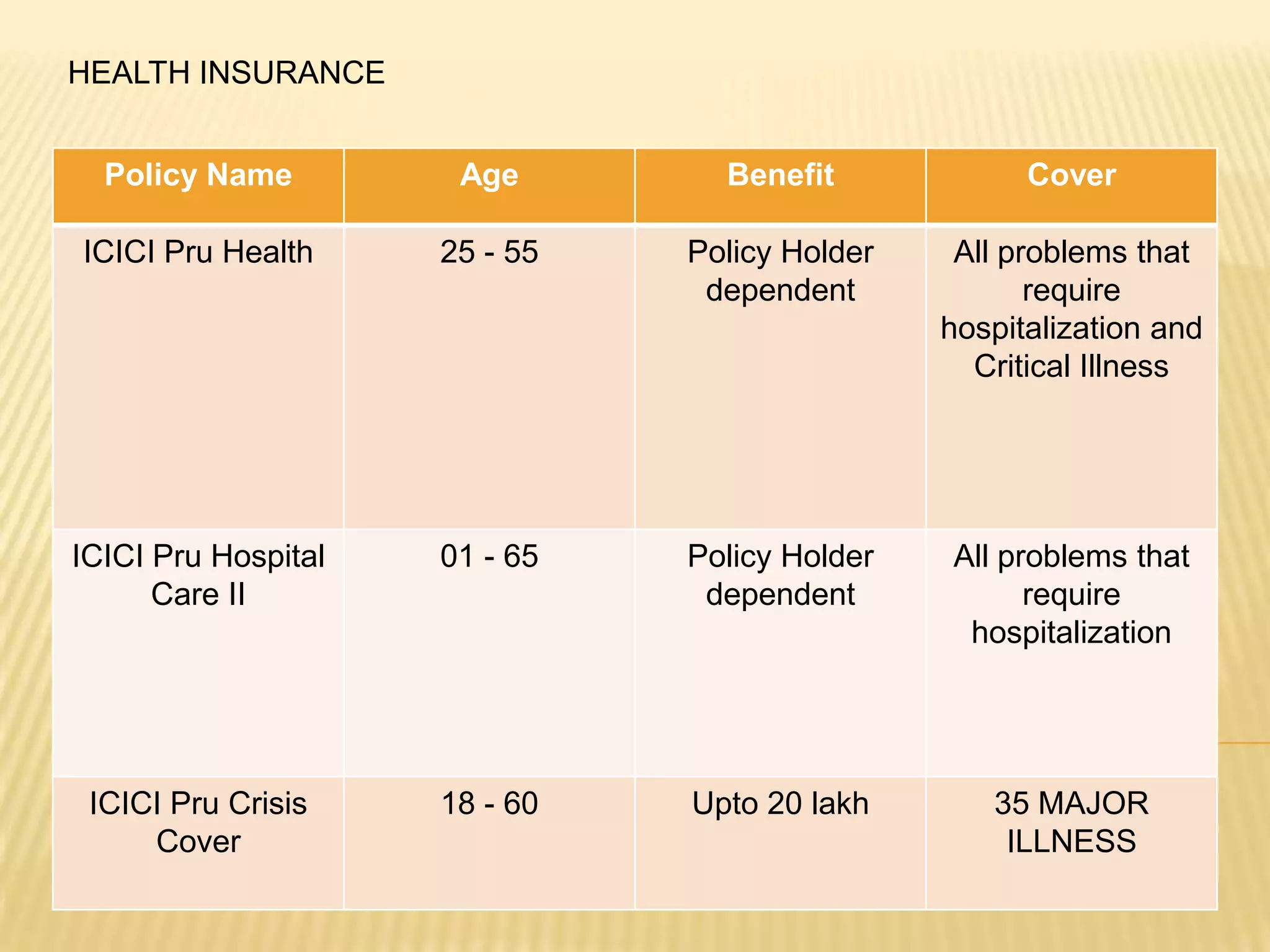

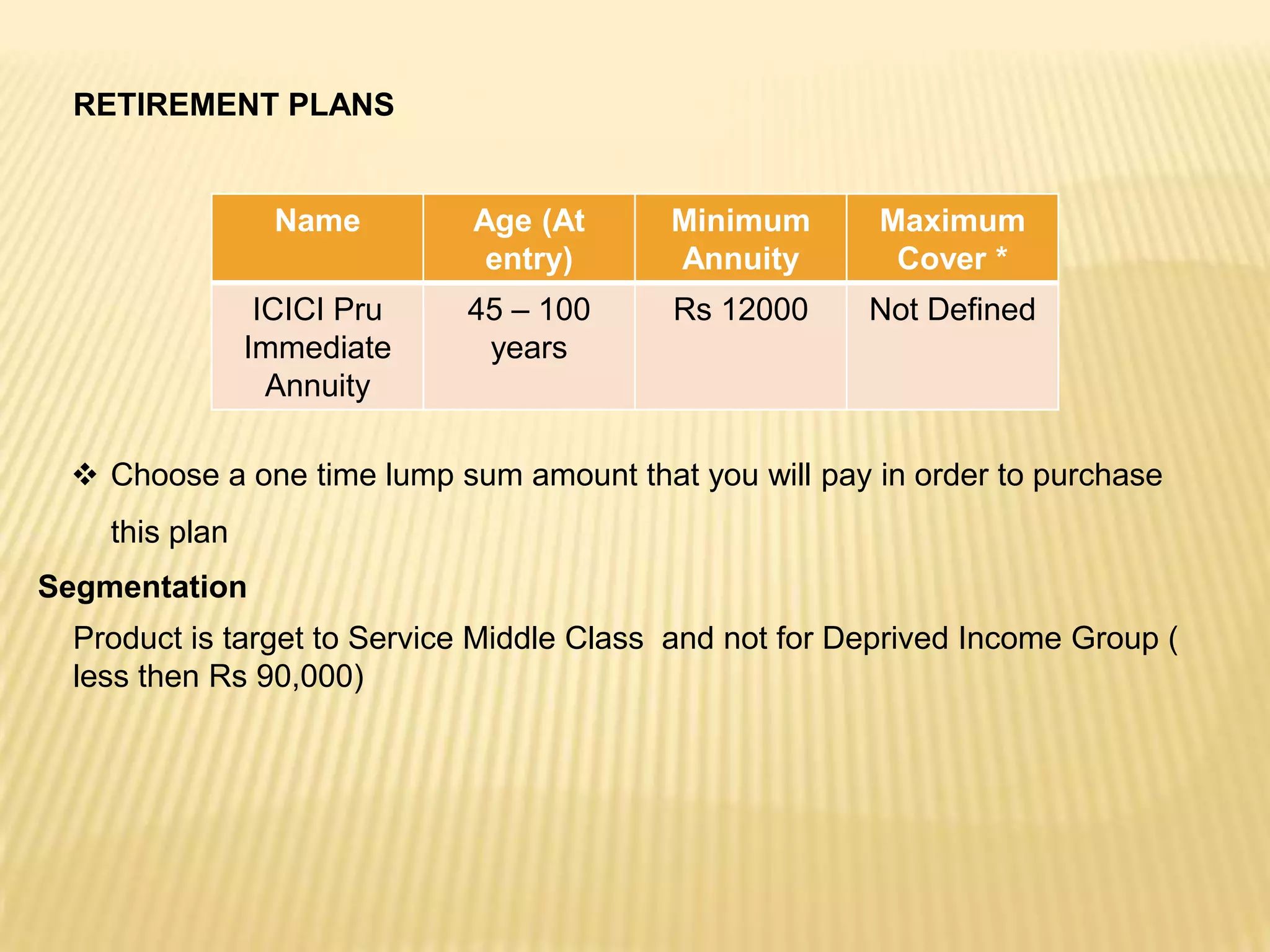

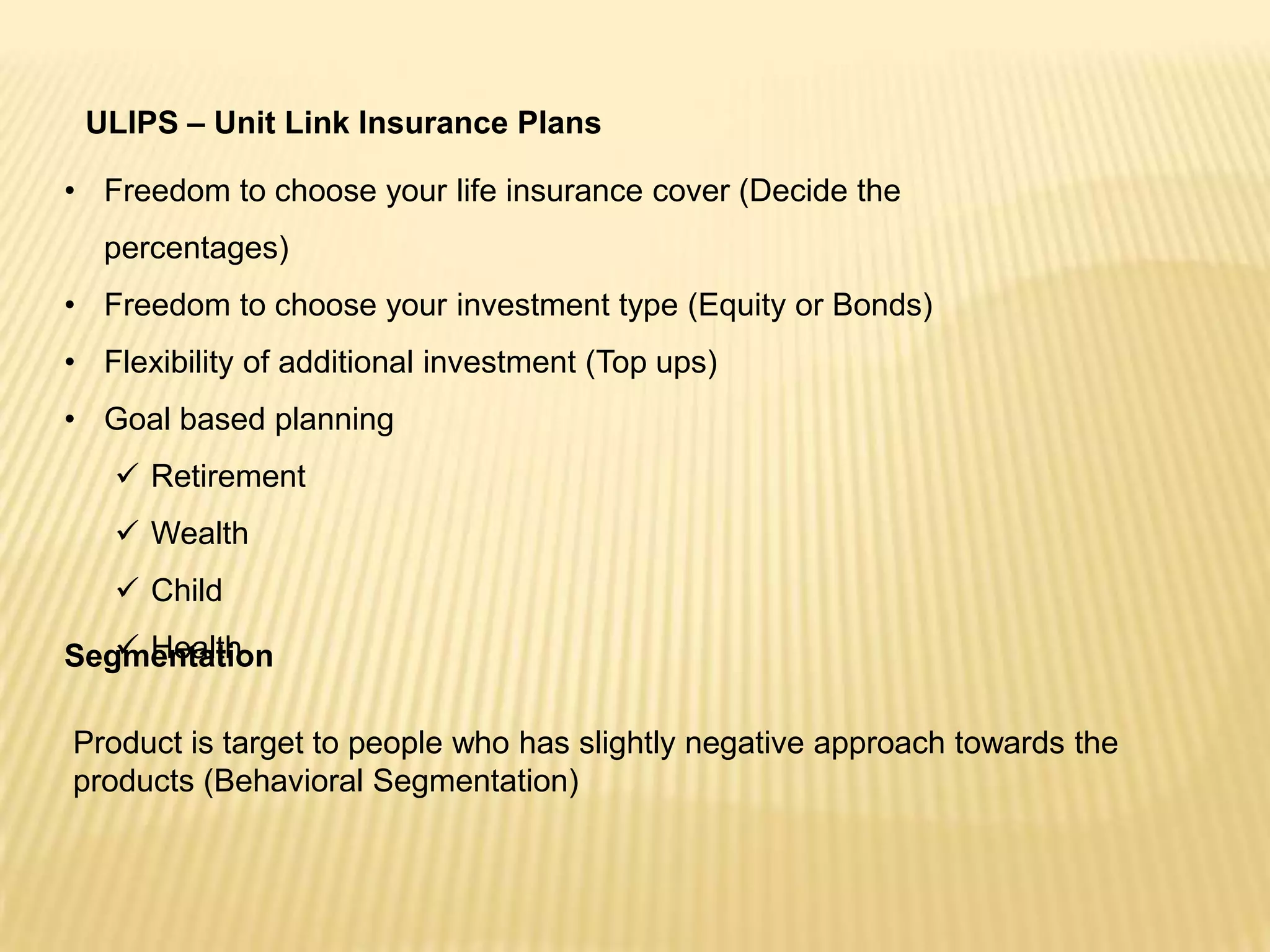

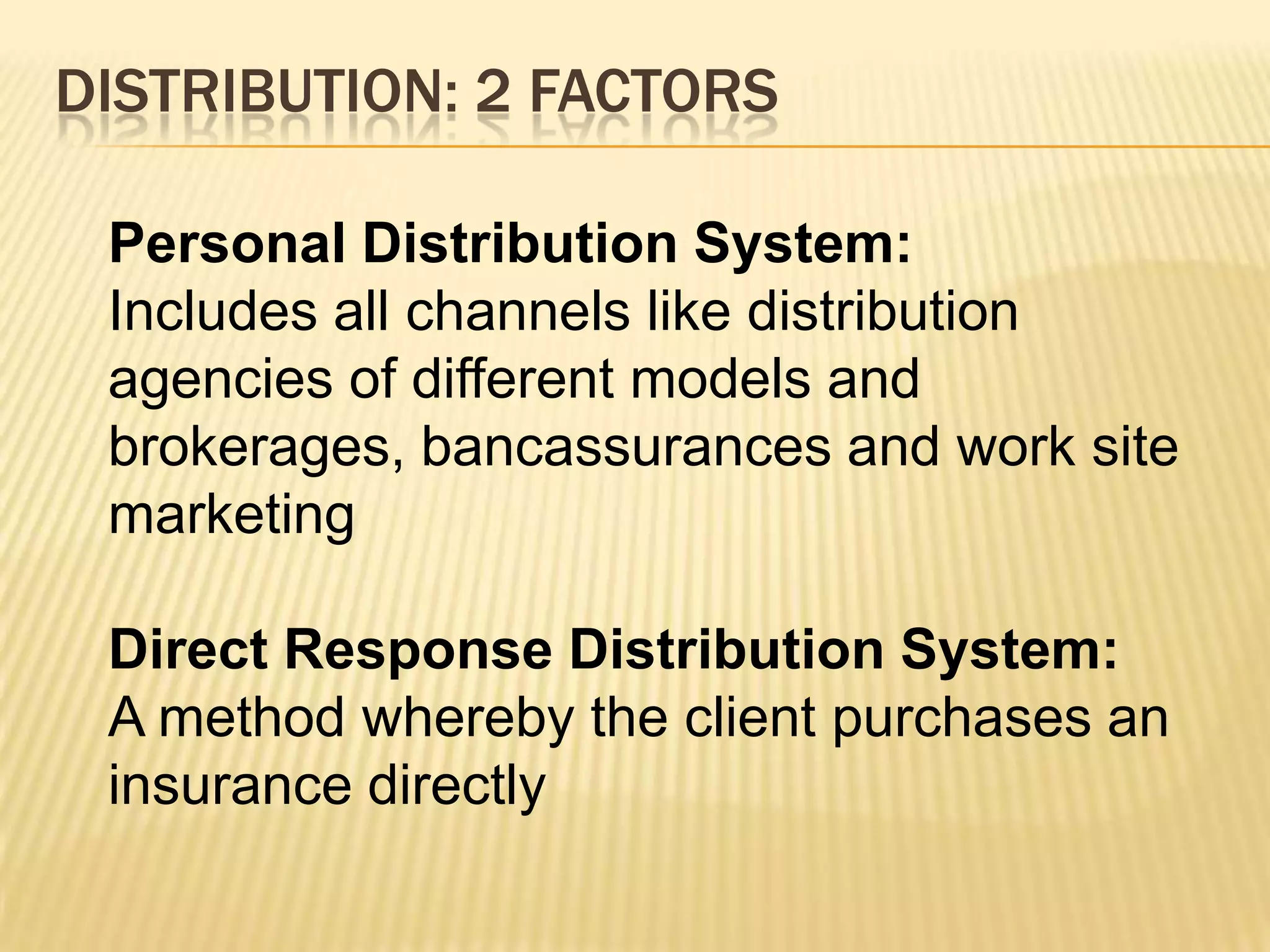

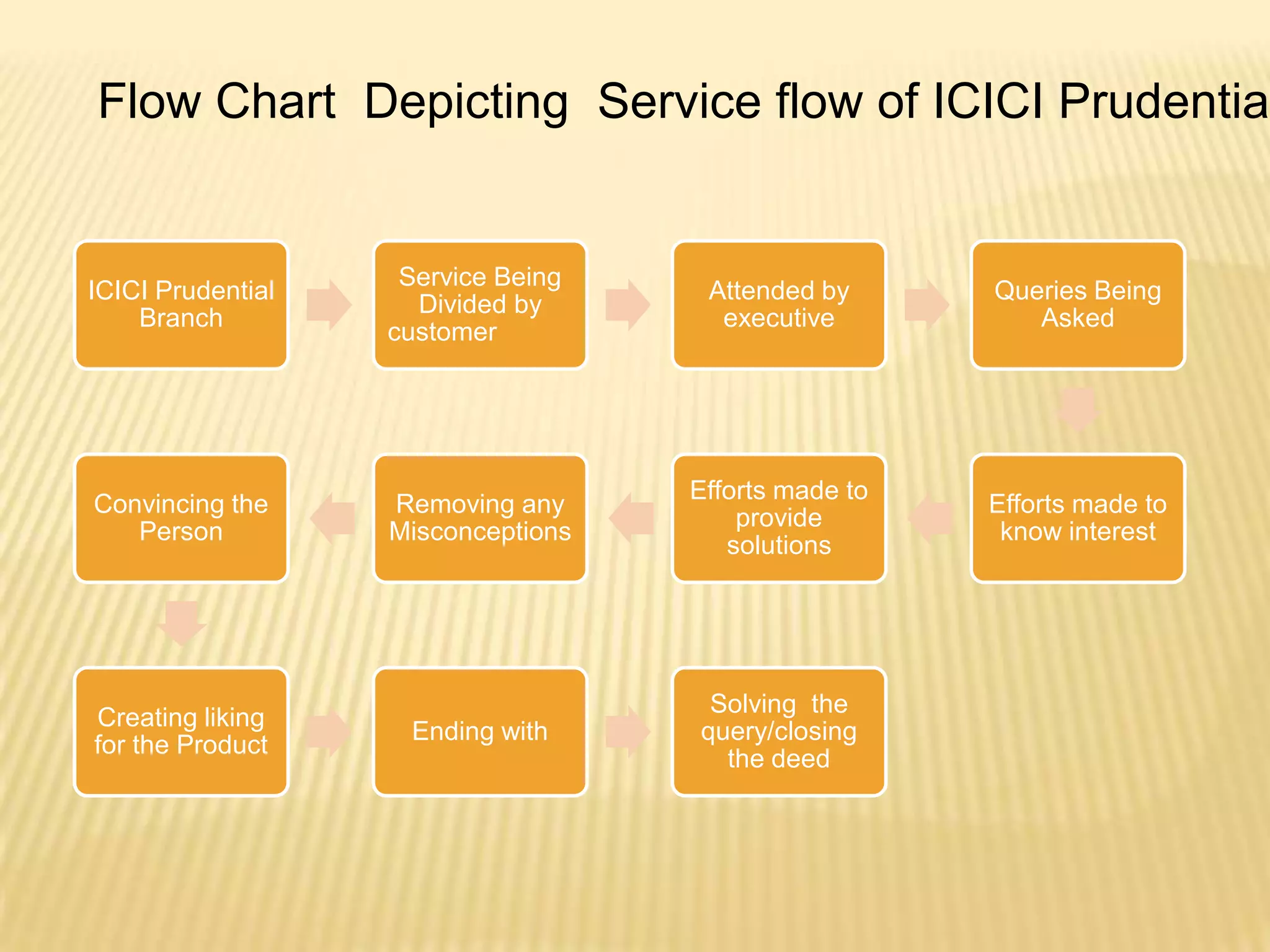

ICICI Prudential Life Insurance is a joint venture between ICICI Bank and Prudential Plc established in 2000. It offers various individual and group insurance plans like term plans, wealth plans, child plans, health plans, retirement plans, ULIPs and group plans. The plans cater to different demographics and socio-economic segments across India with the goal of providing financial protection and saving/investment solutions. The summary highlights the company details and provides an overview of the types of insurance products and plans offered to different customer segments.