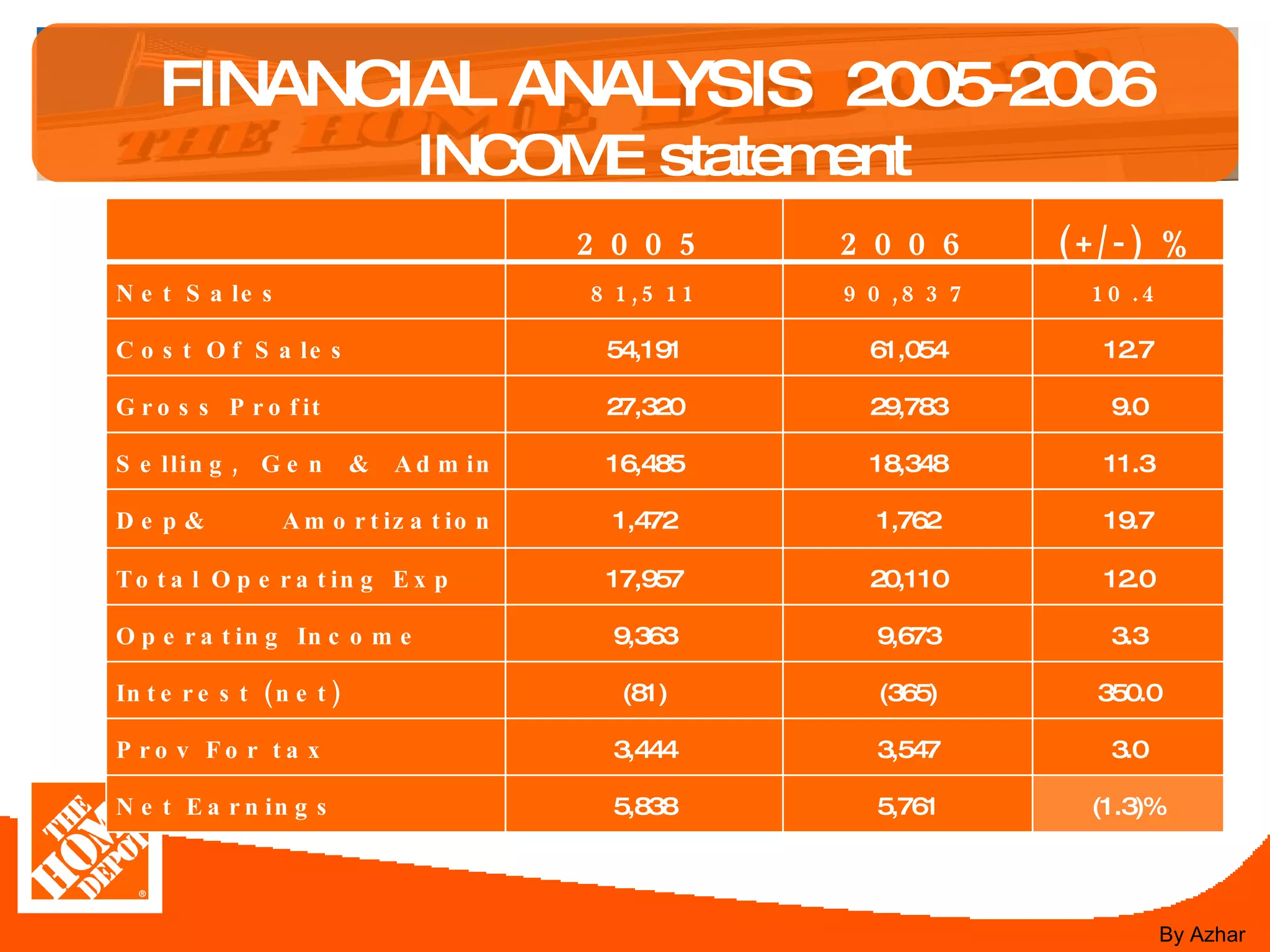

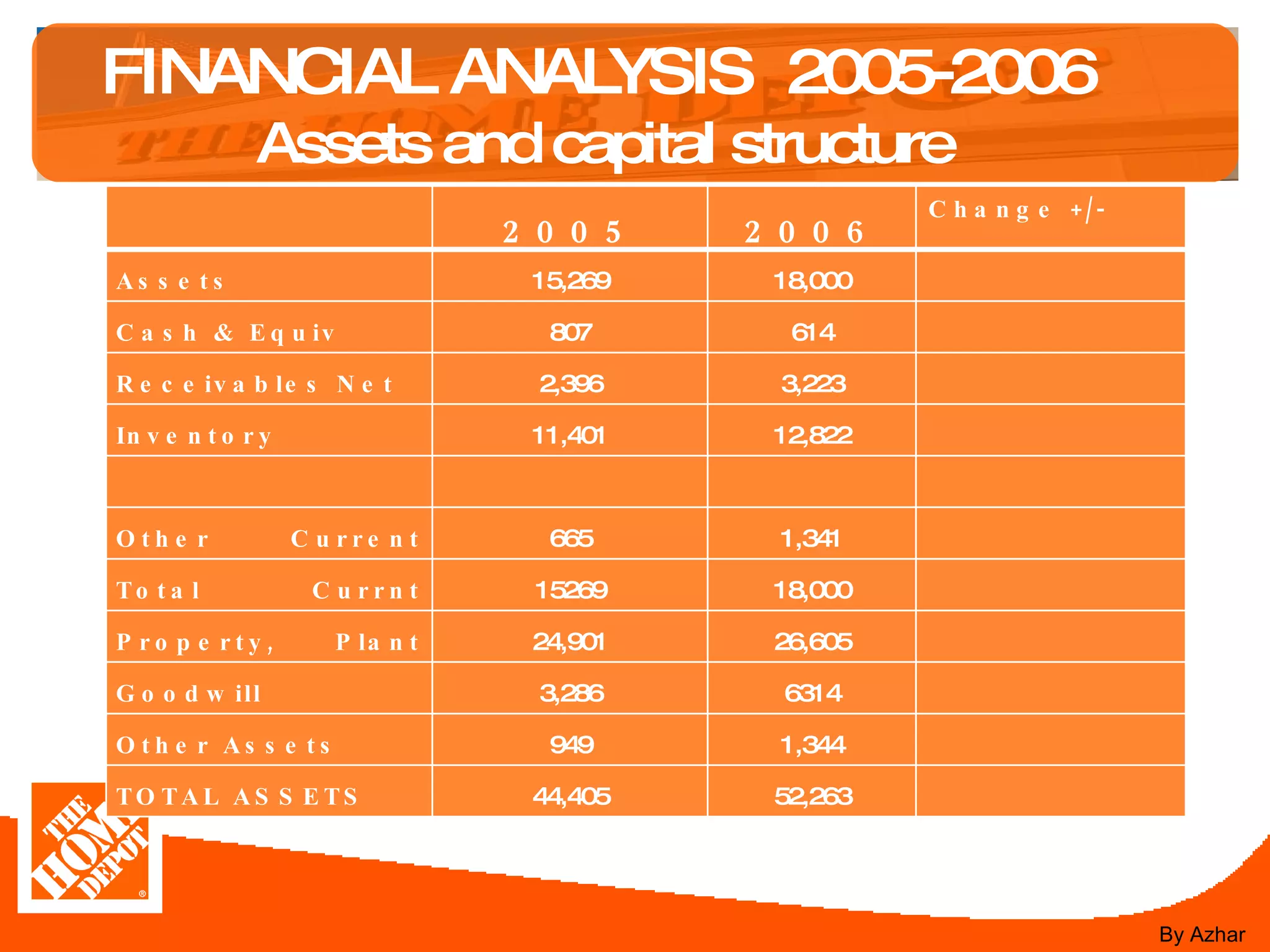

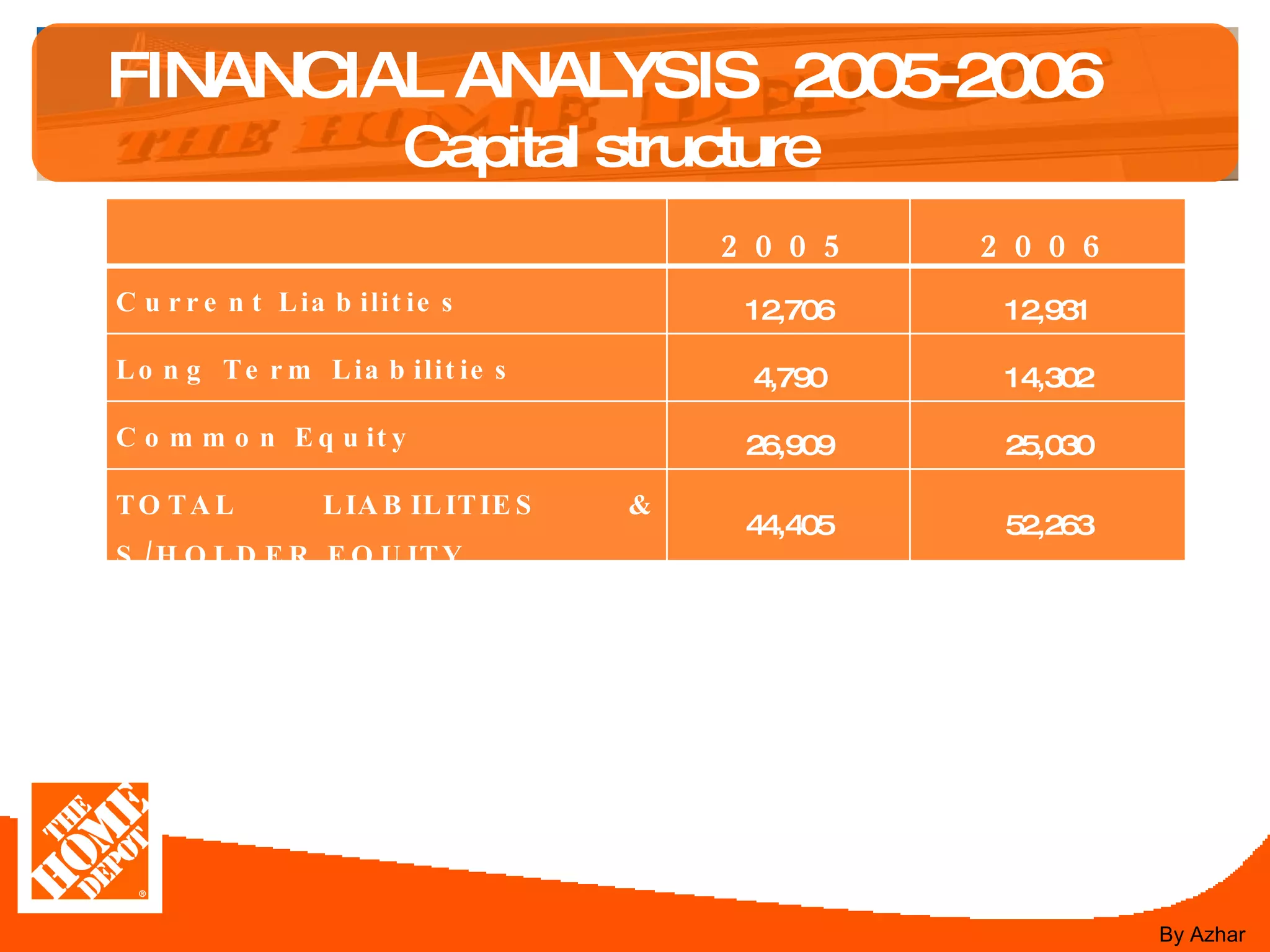

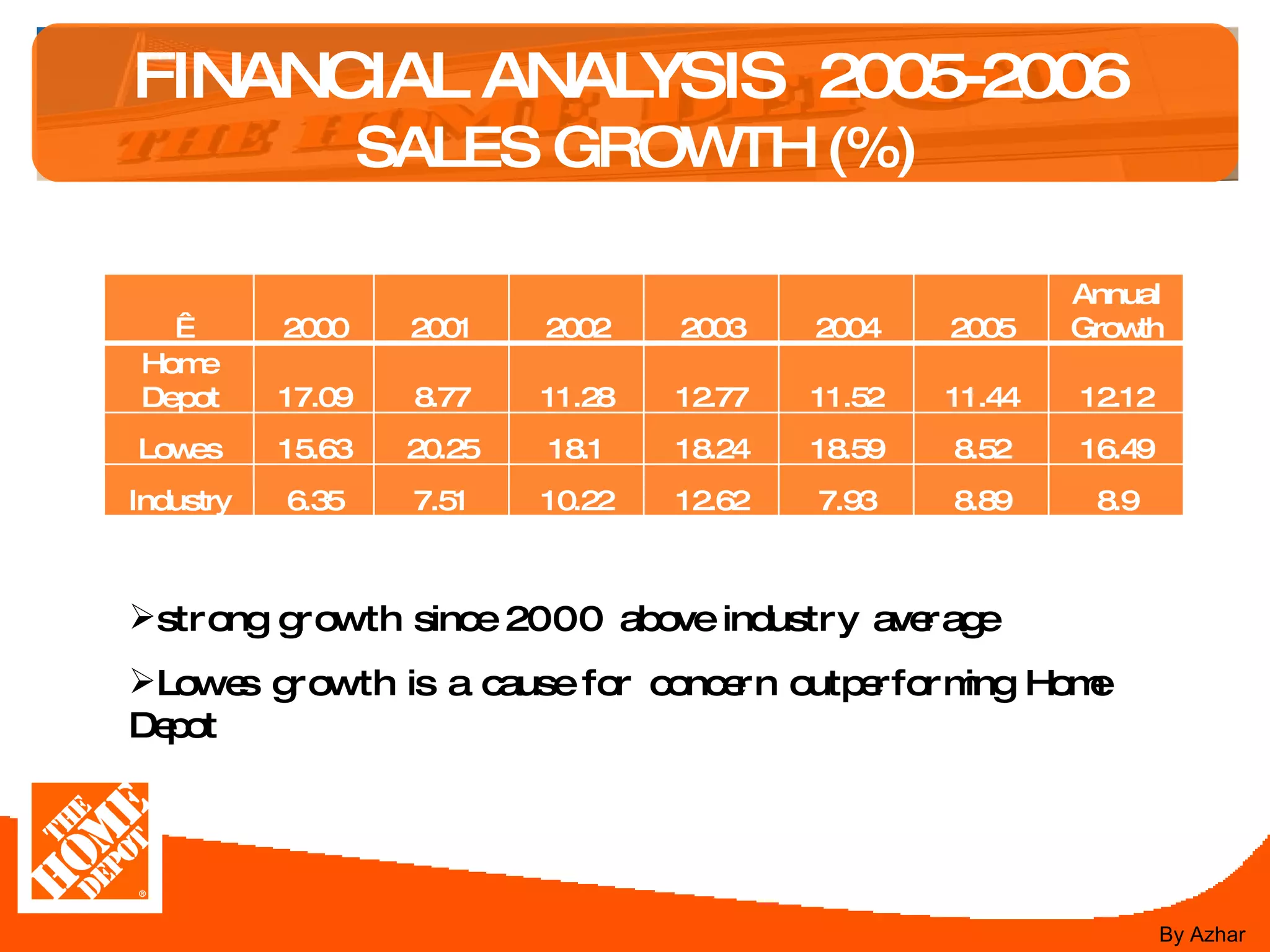

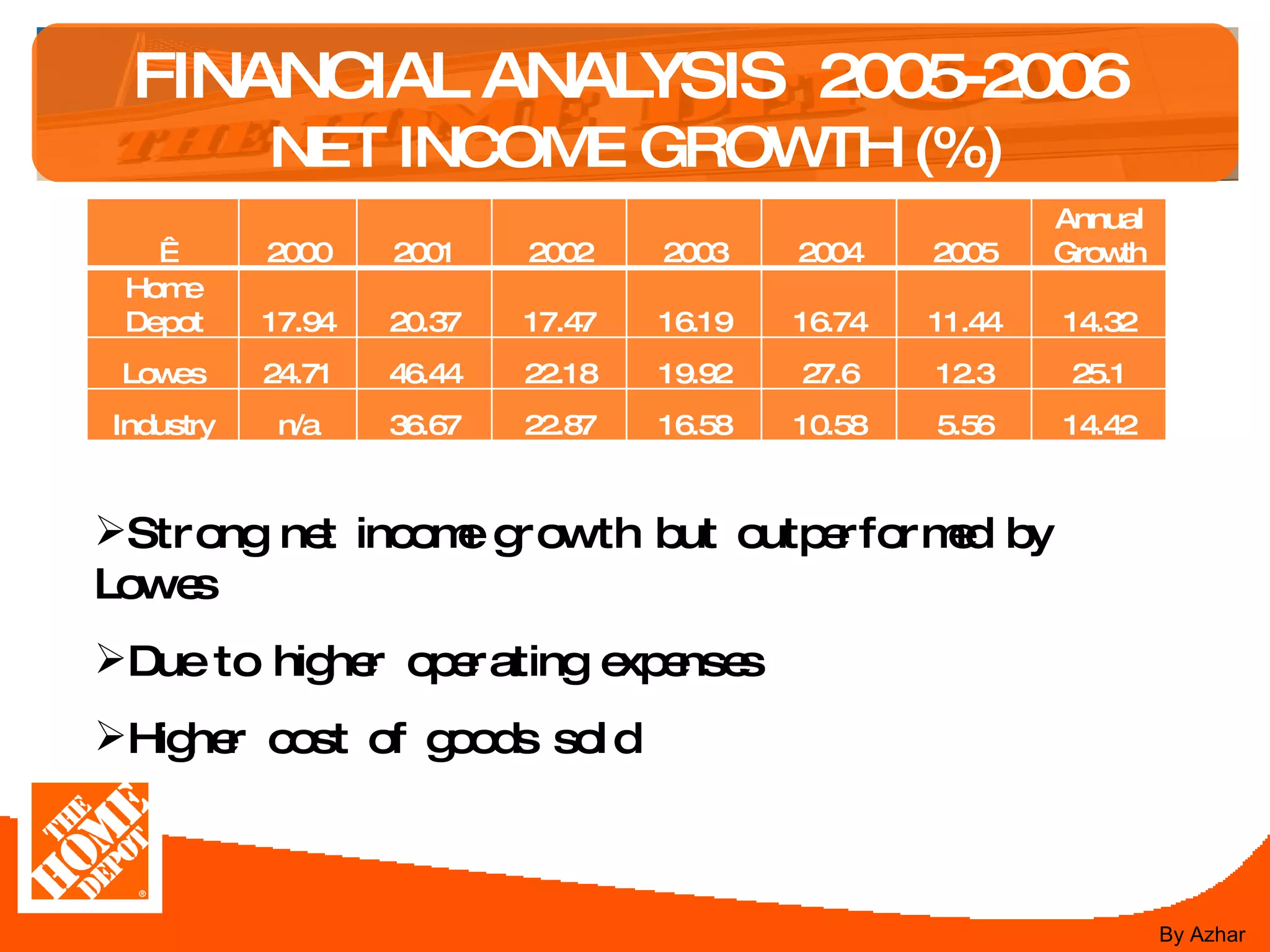

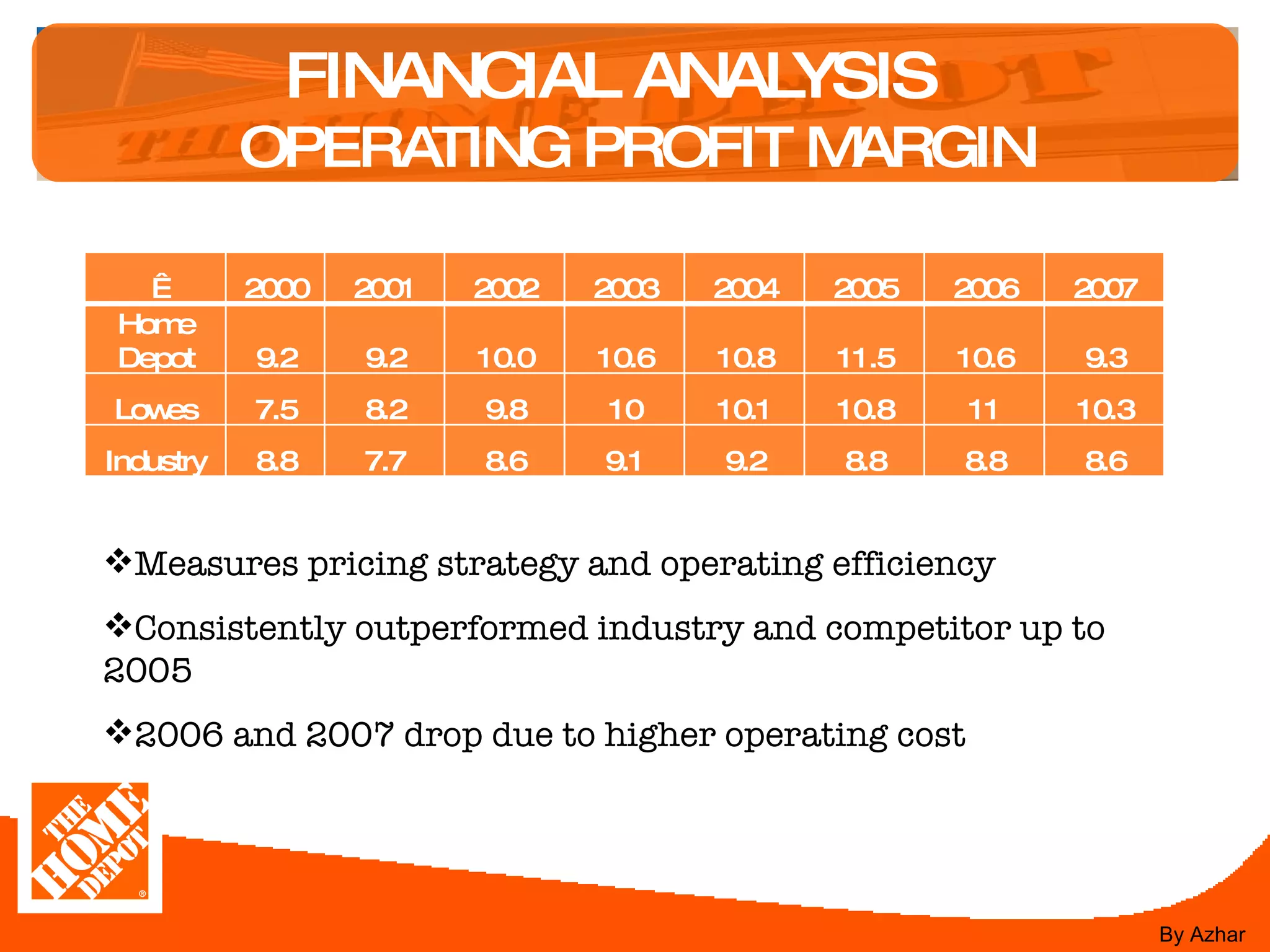

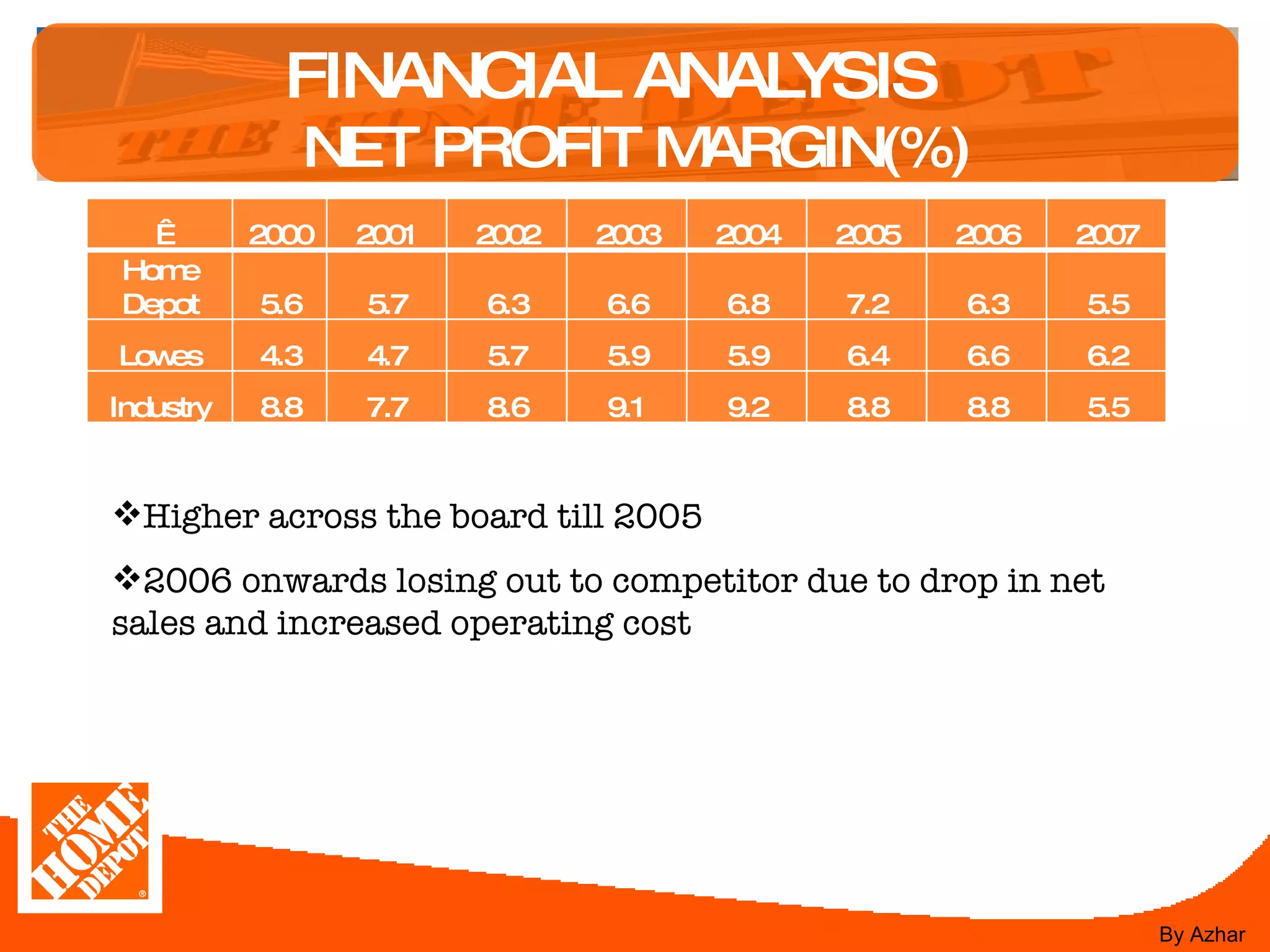

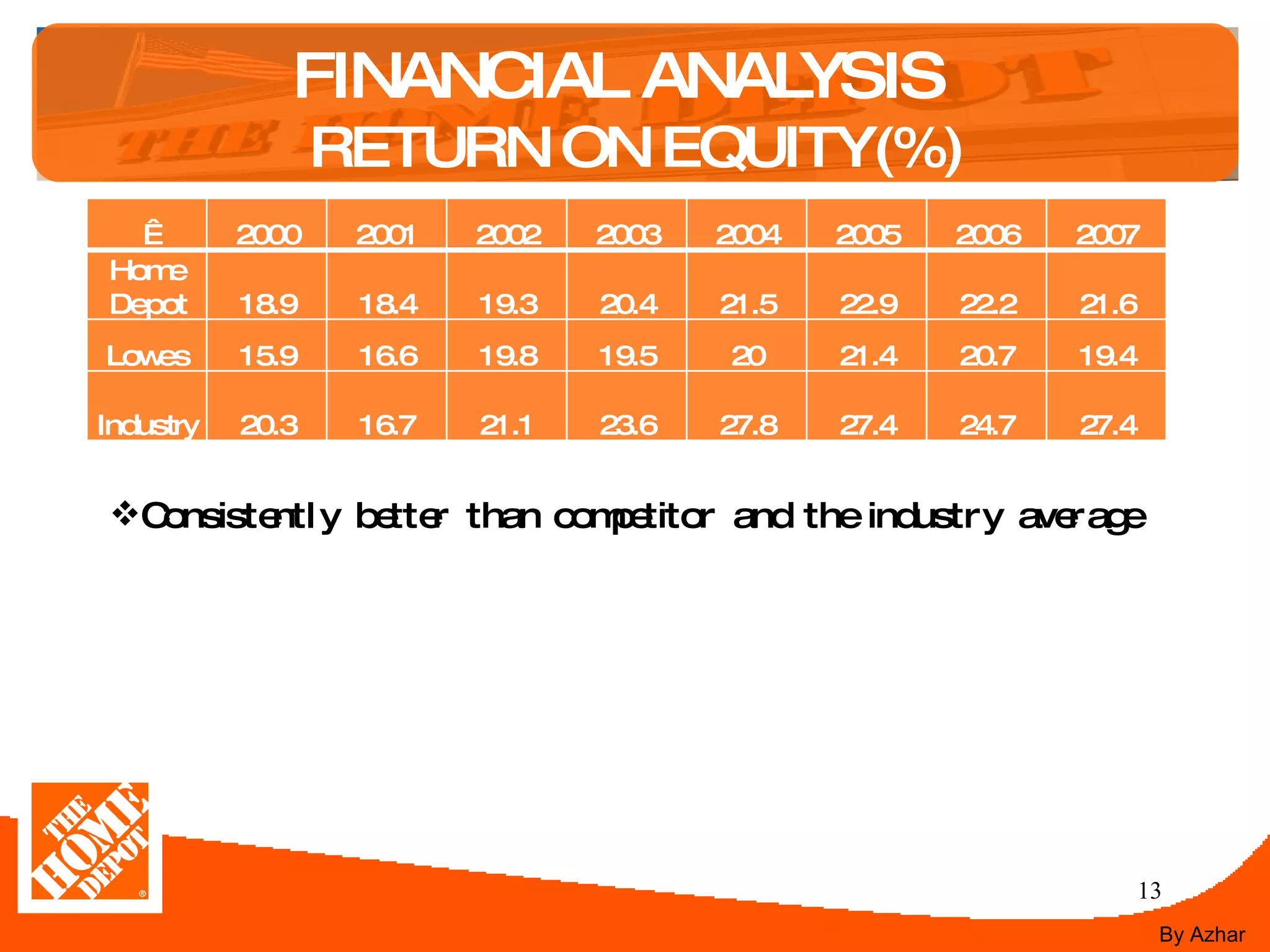

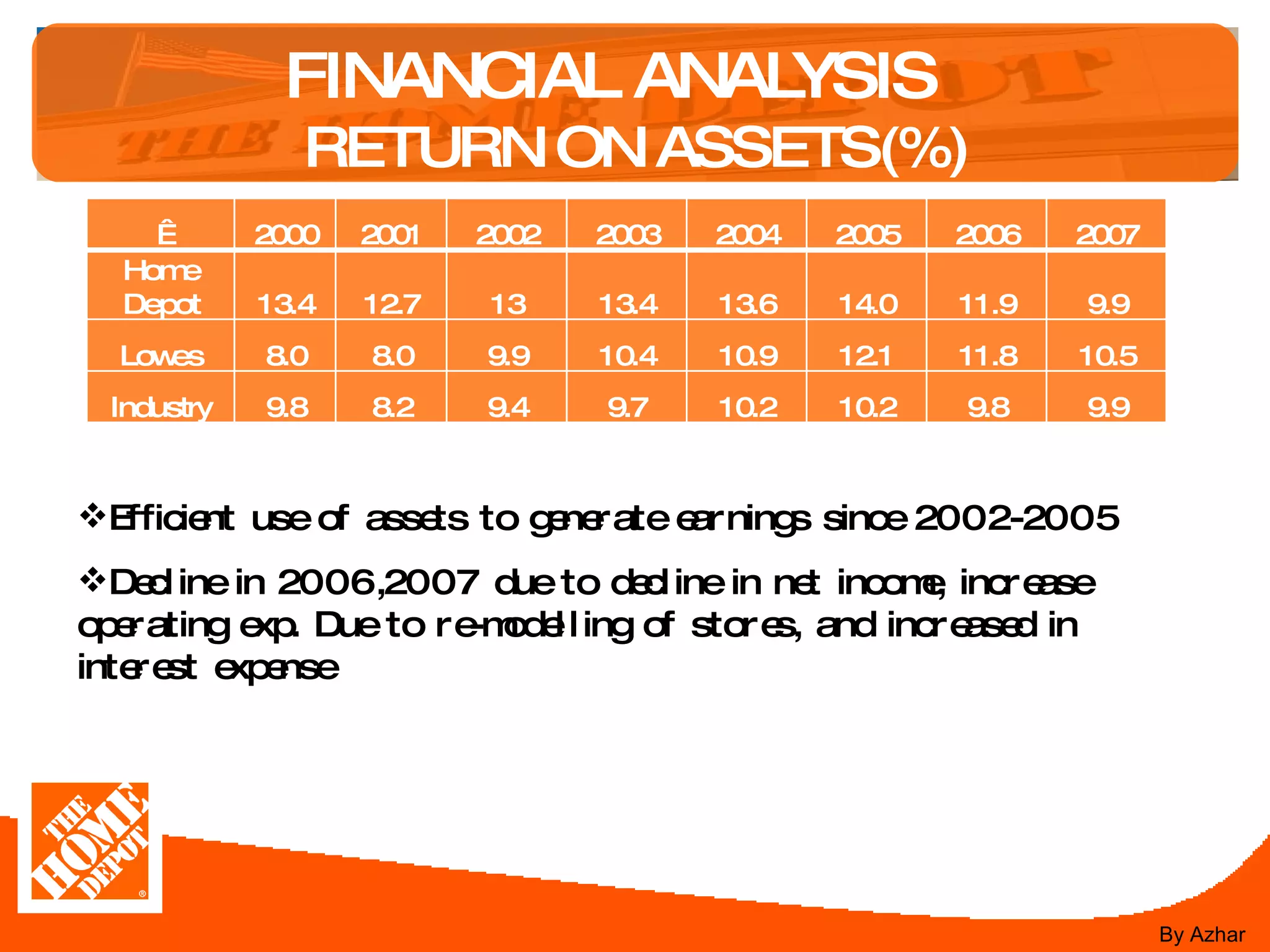

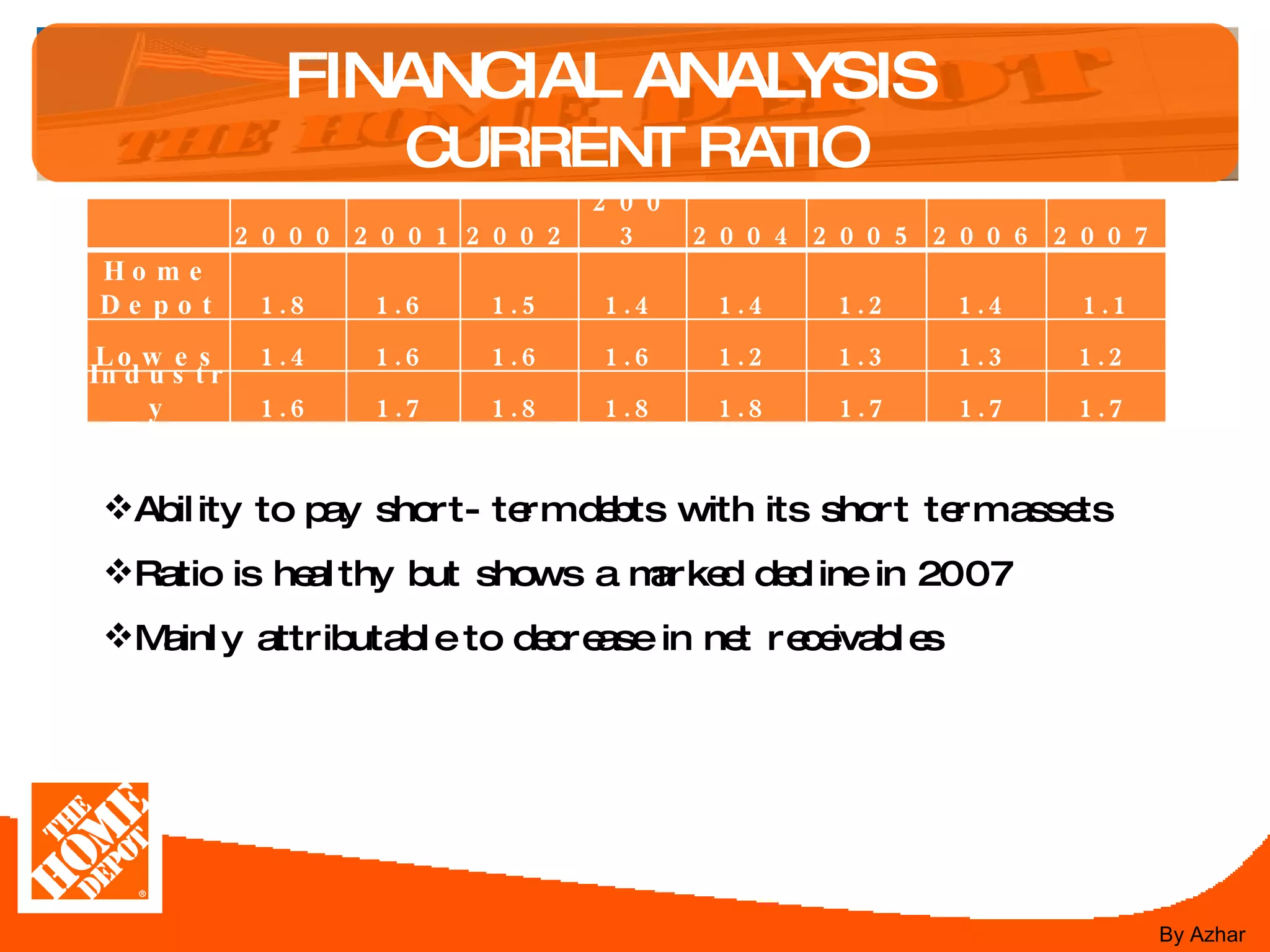

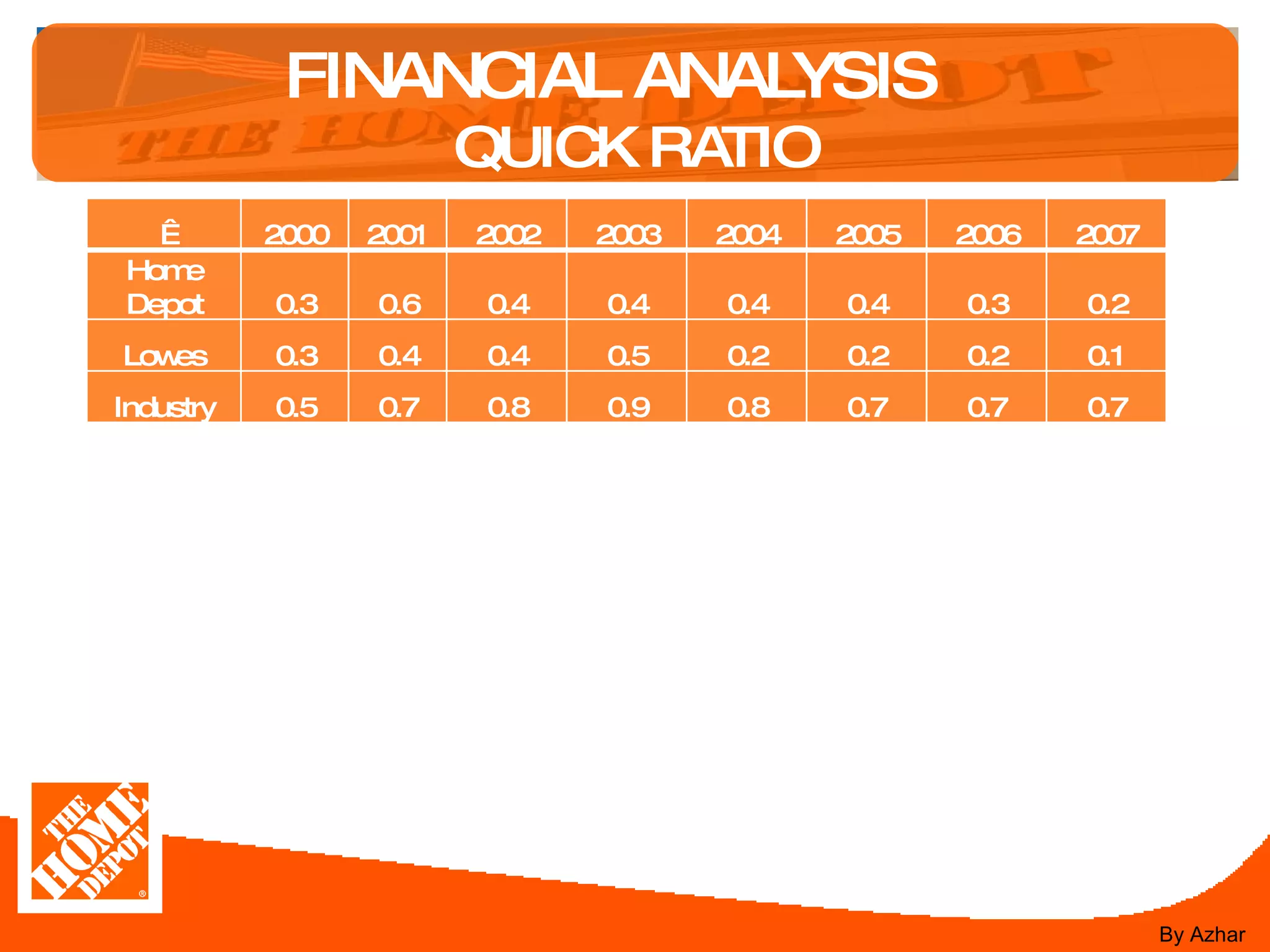

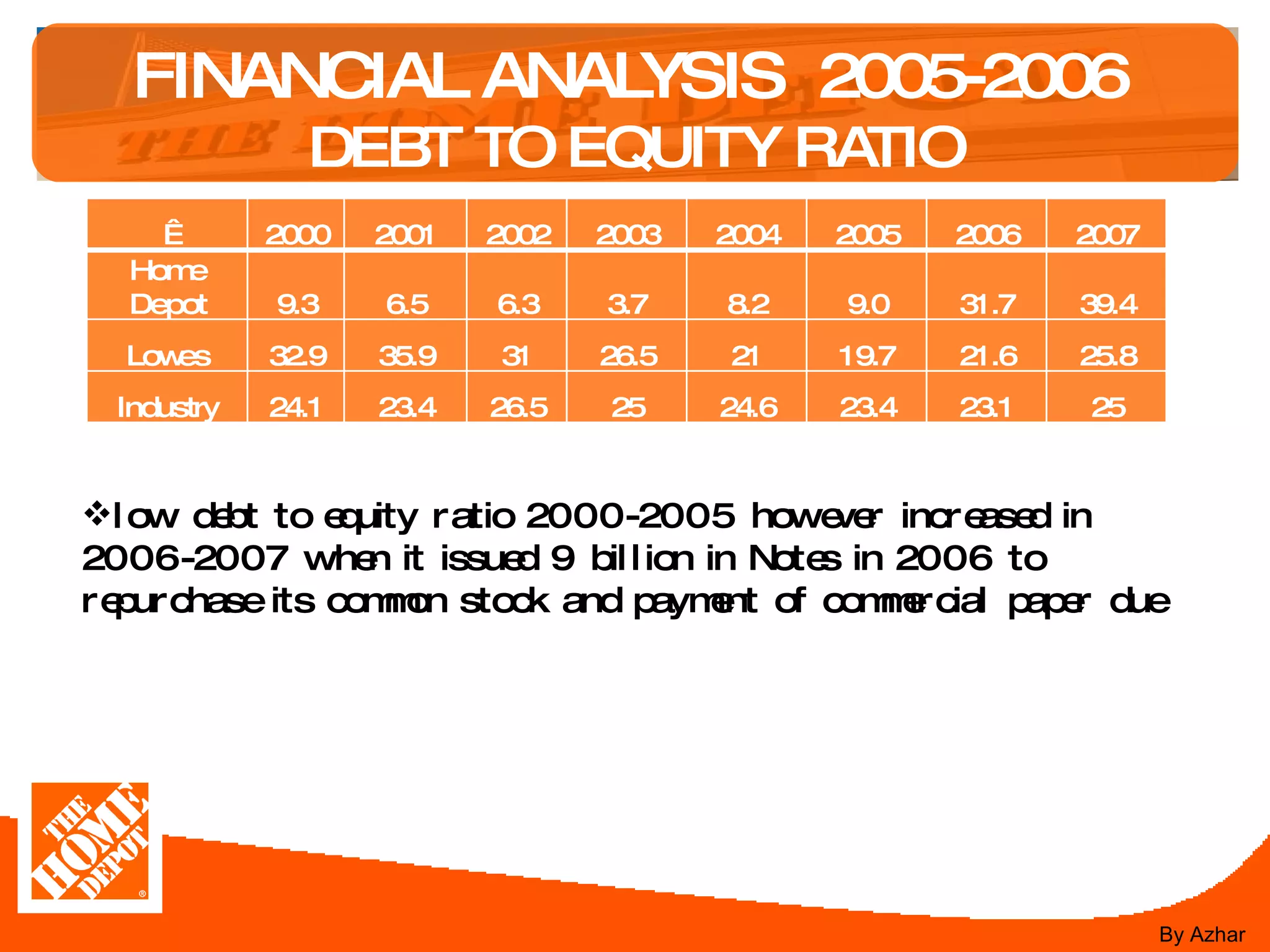

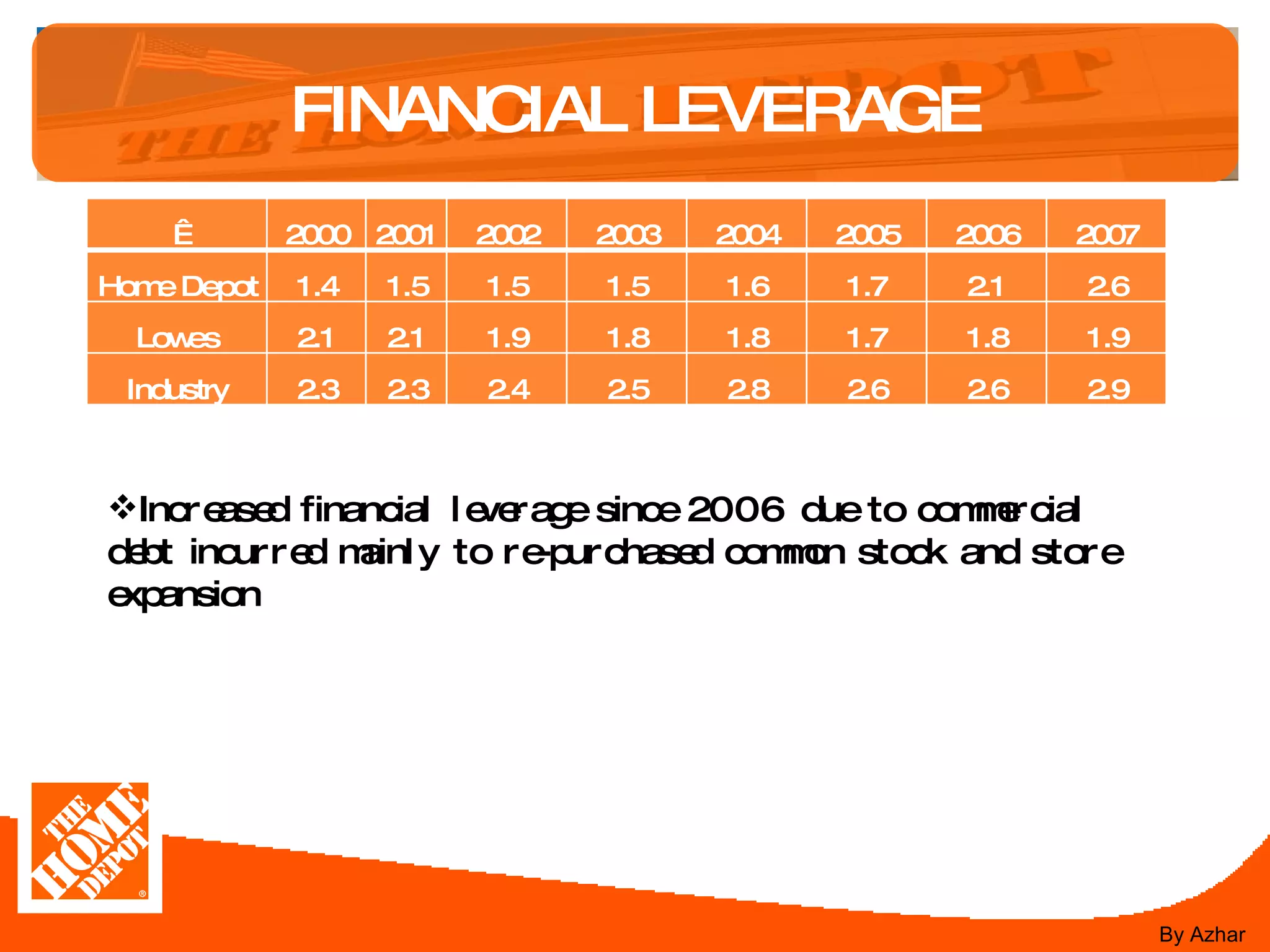

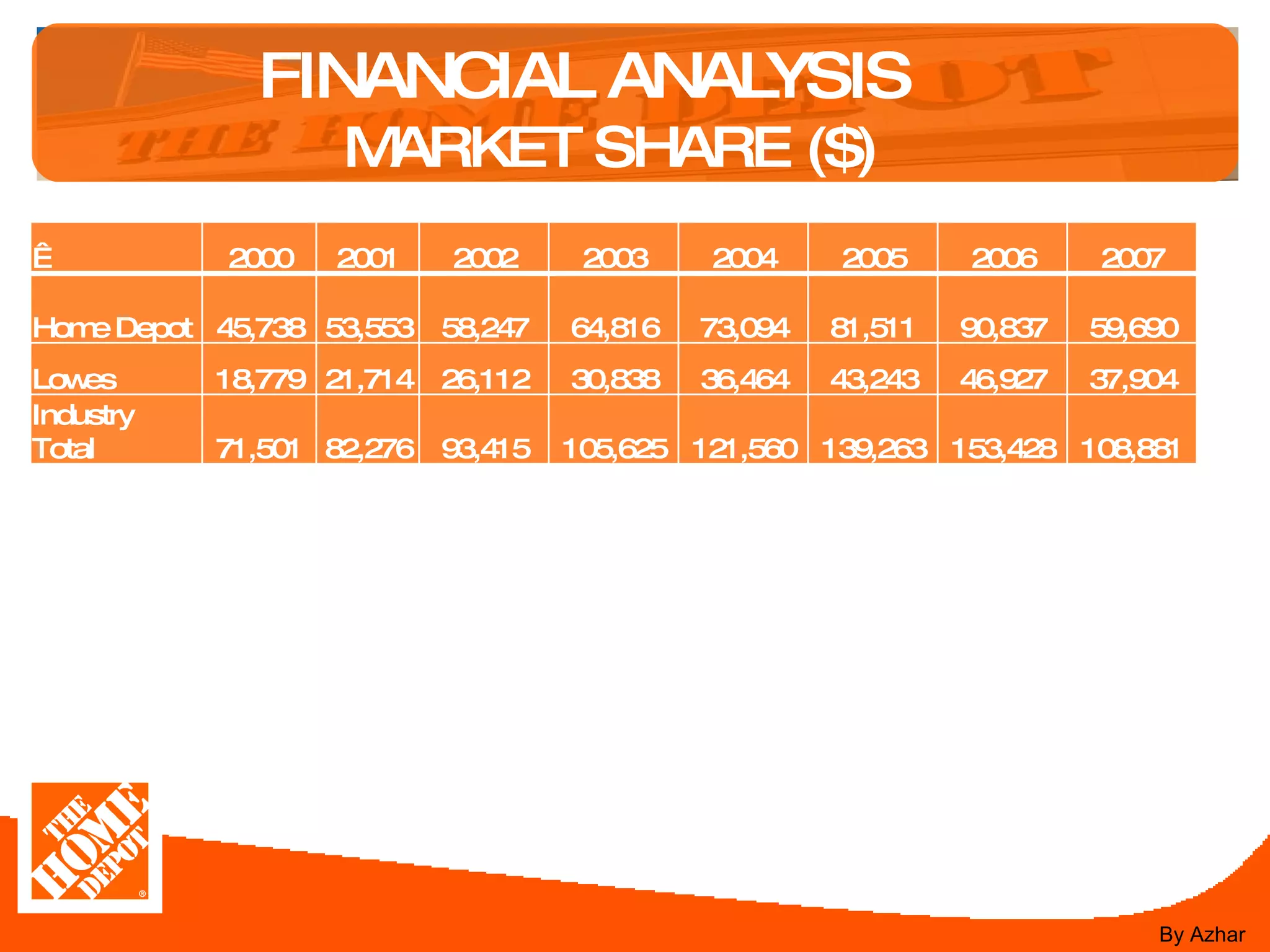

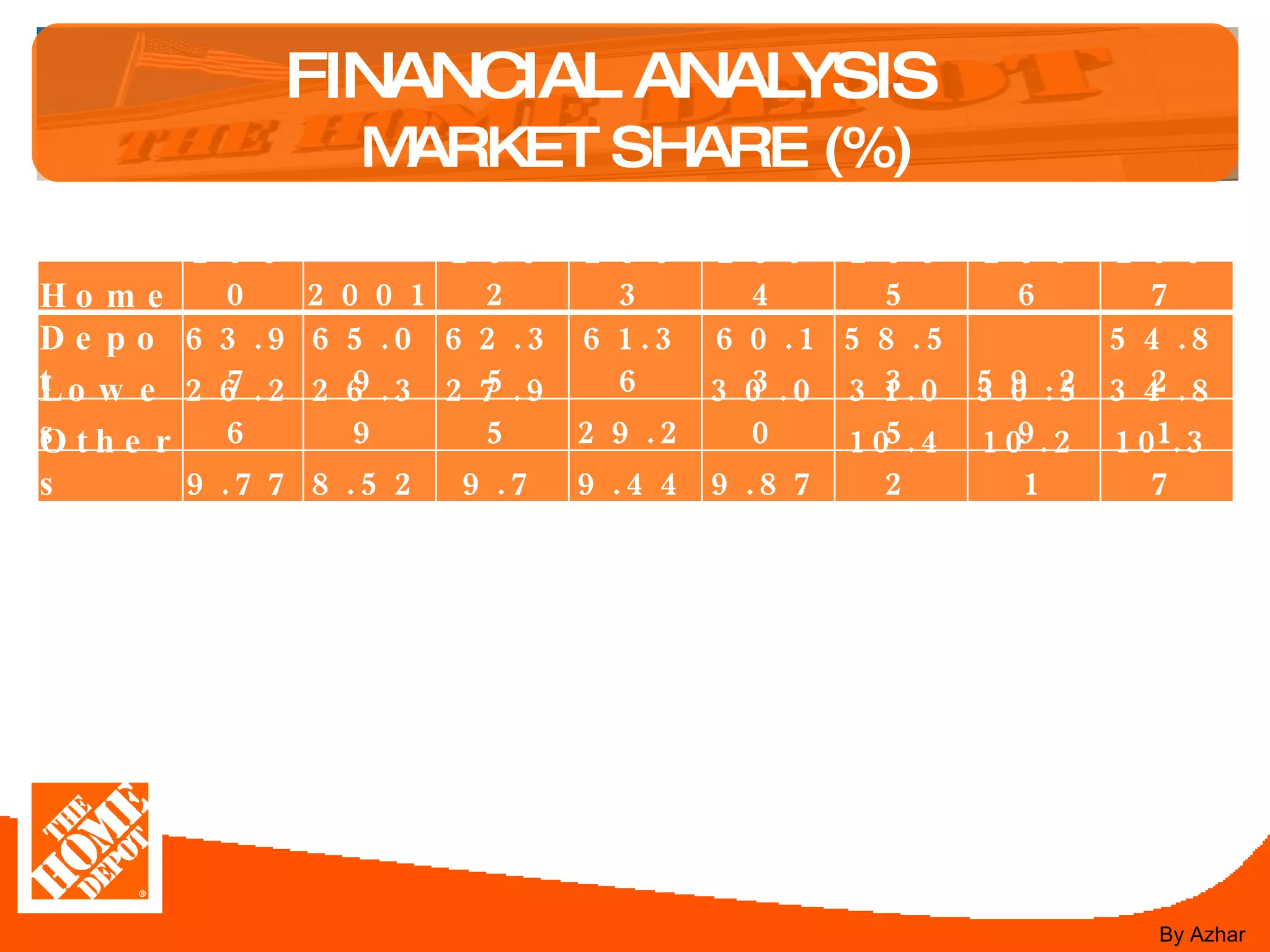

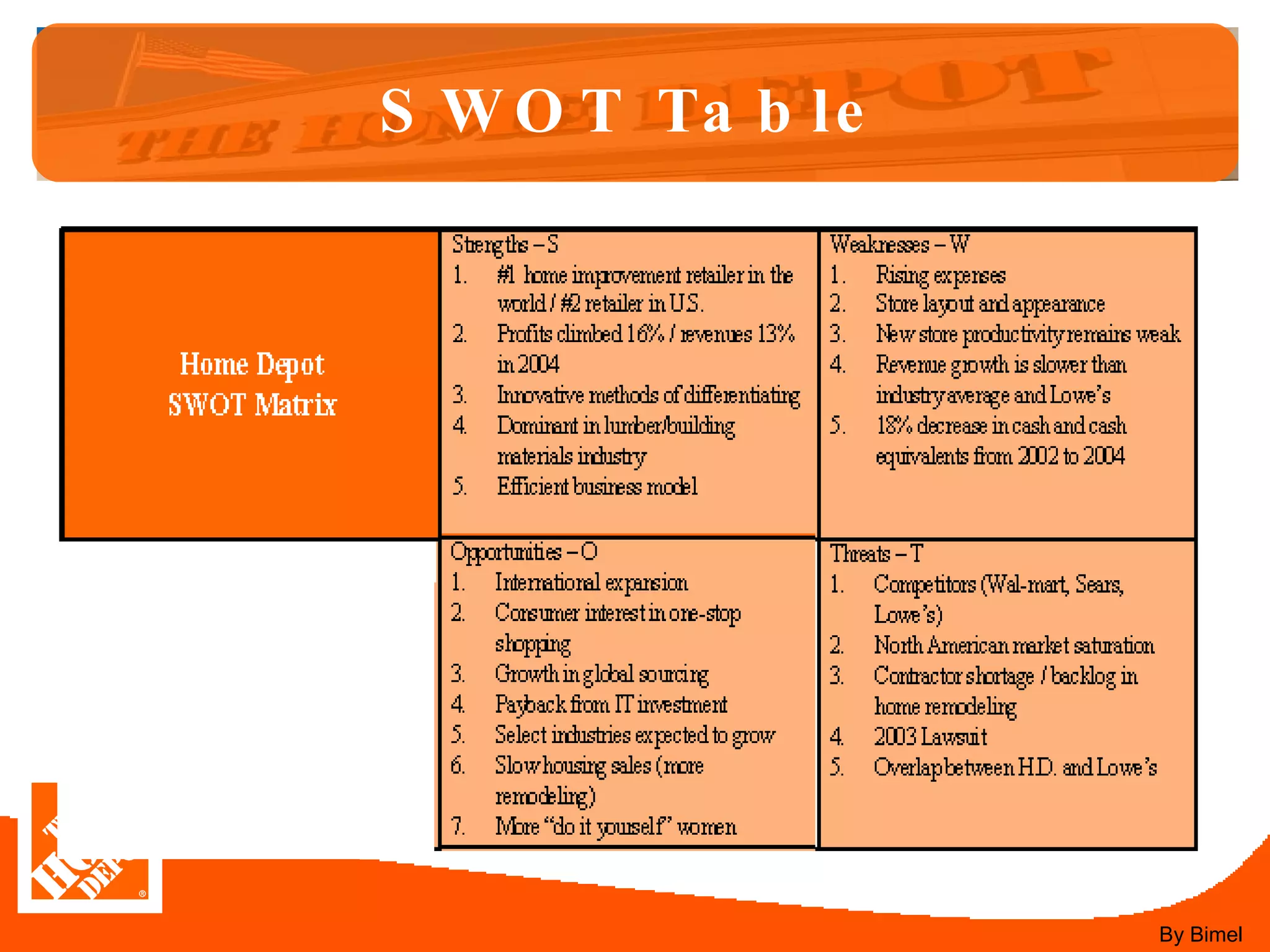

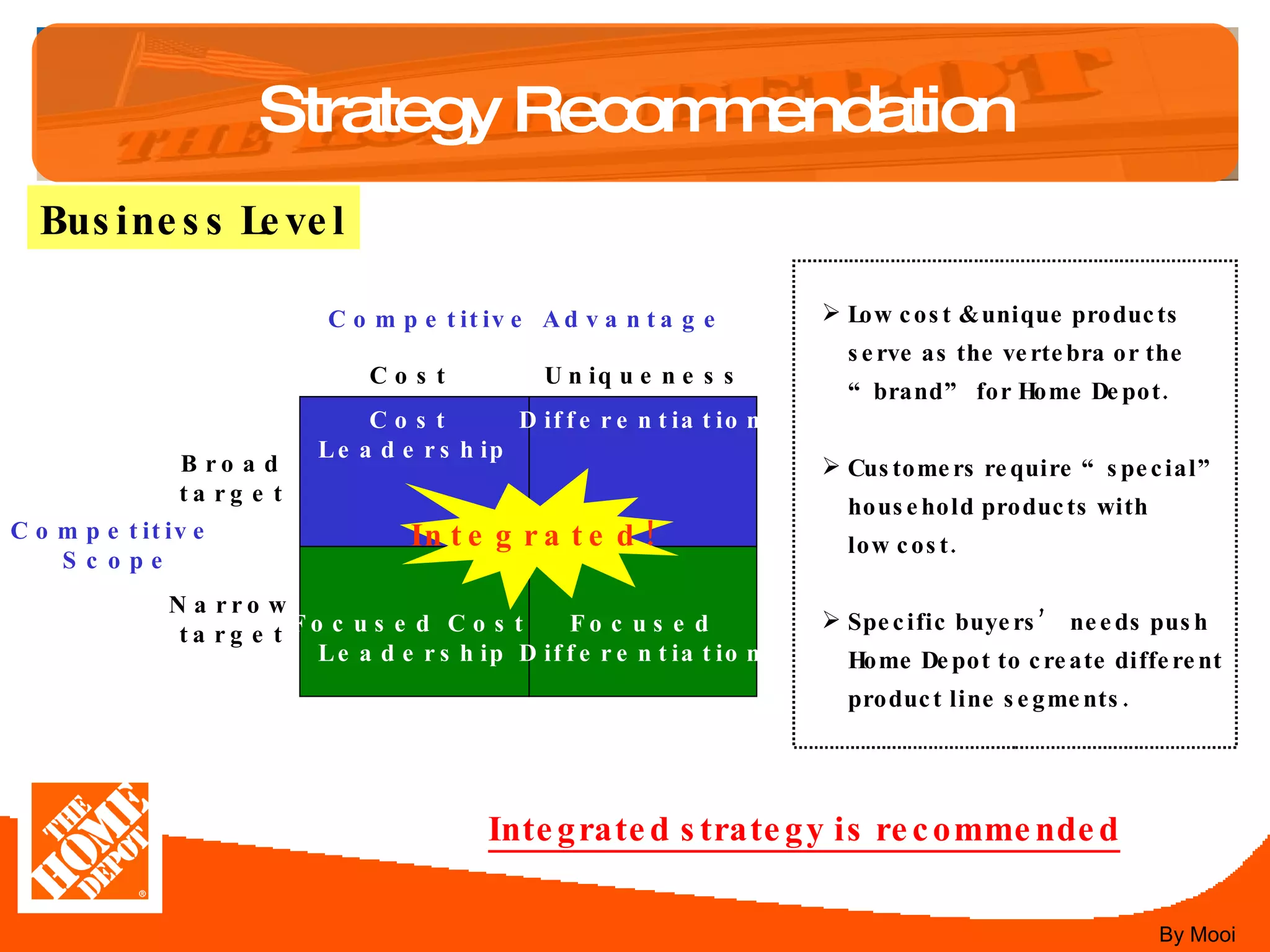

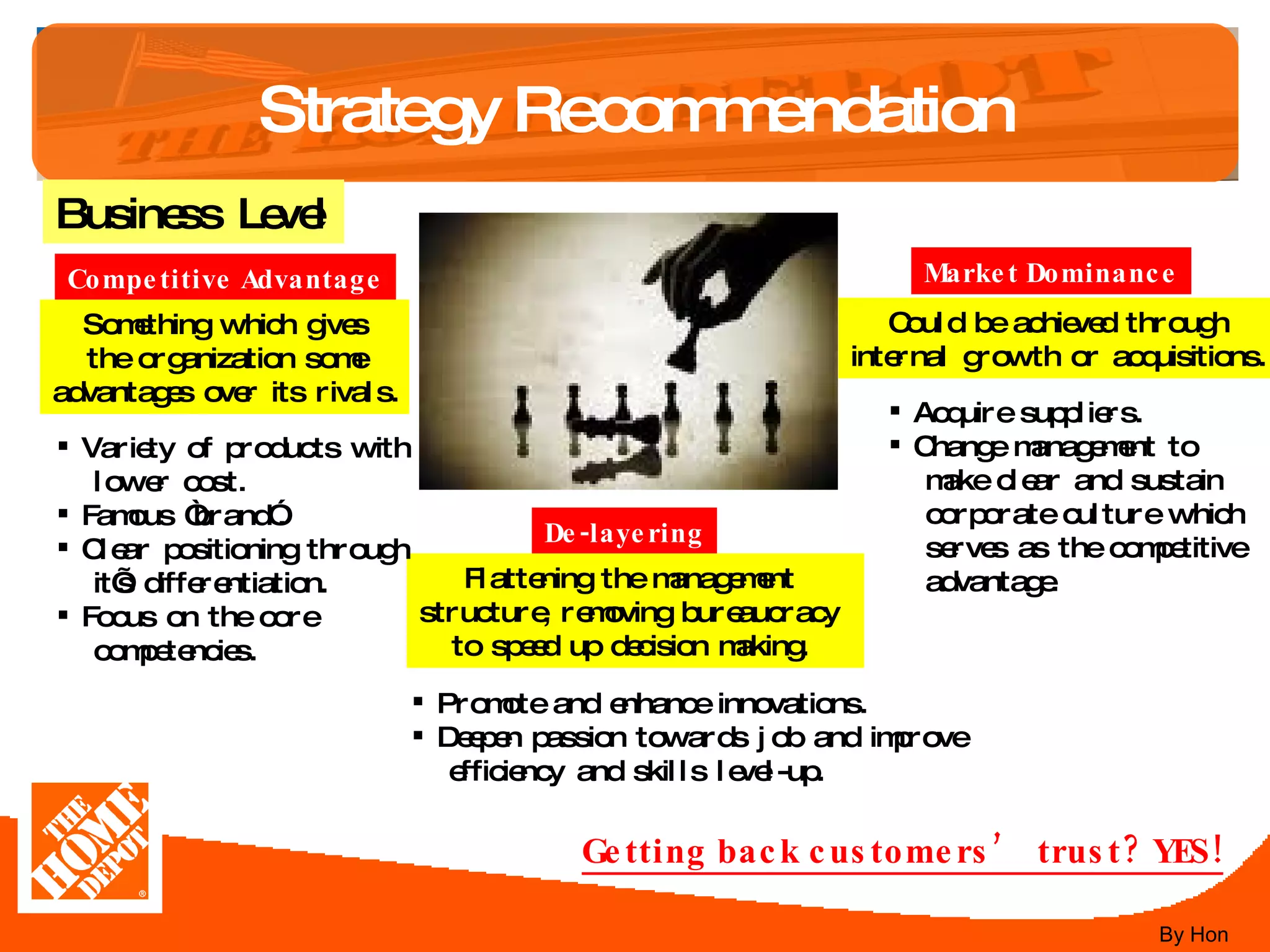

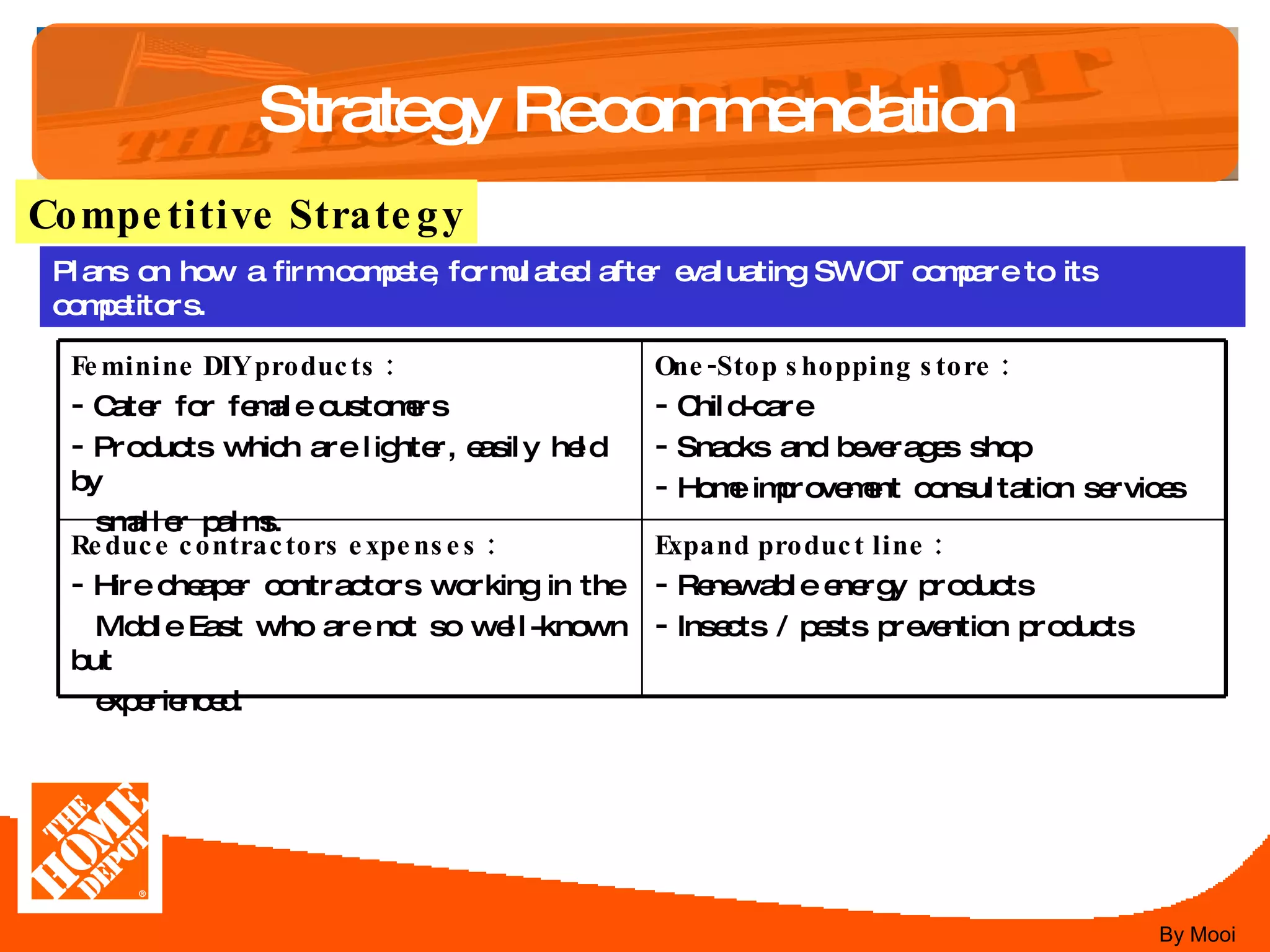

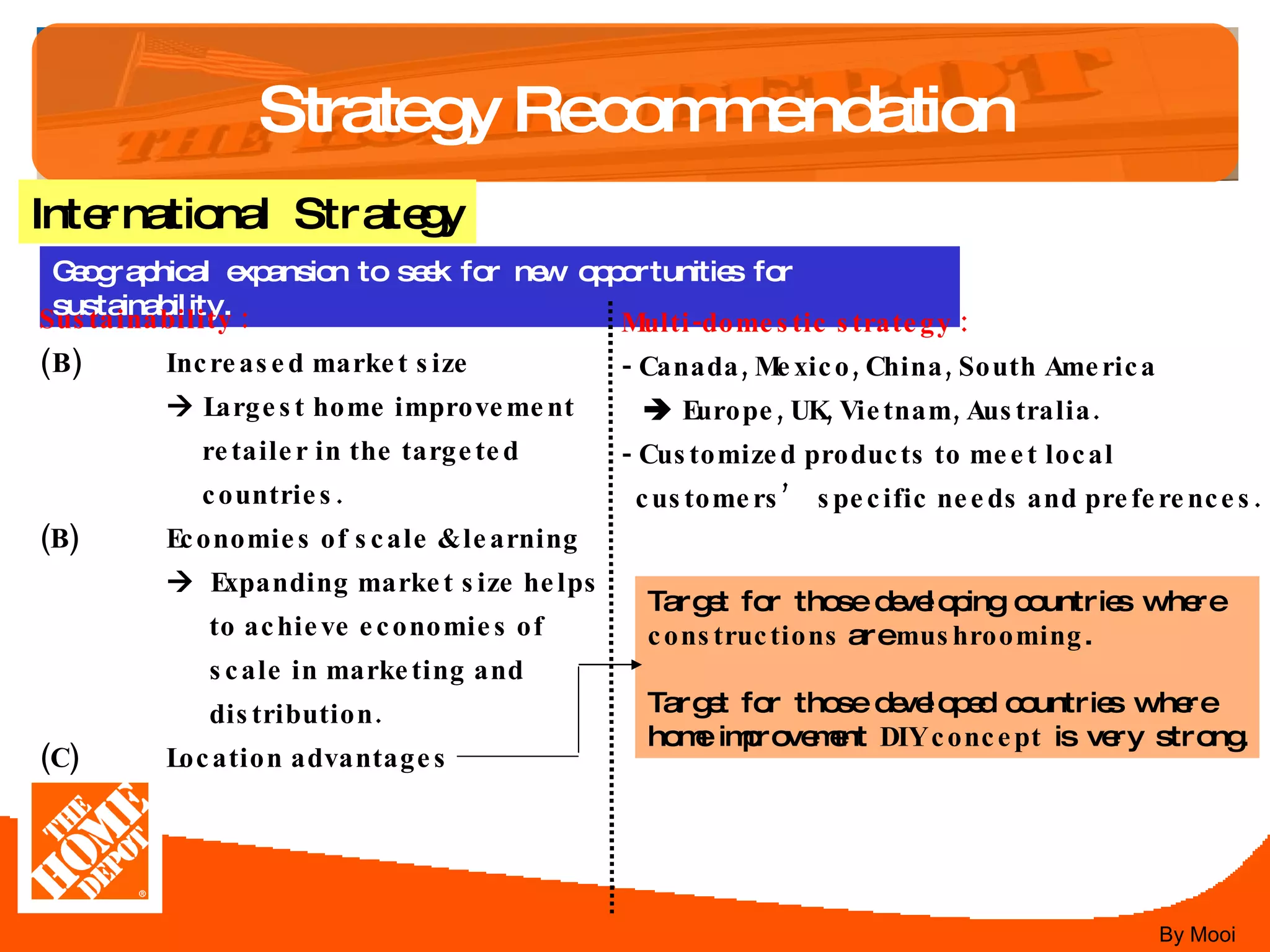

The document provides an analysis of The Home Depot's financial performance from 2005-2006 including income statements, assets and capital structure, sales growth, profit margins, and ratios. It also discusses the company's leadership over time and challenges it faces from competitors like Lowe's. External factors like economic, social, technological, political/legal, and global trends that influence the home improvement industry are examined.