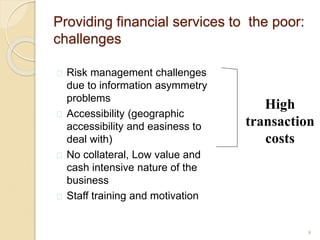

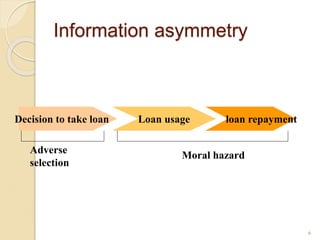

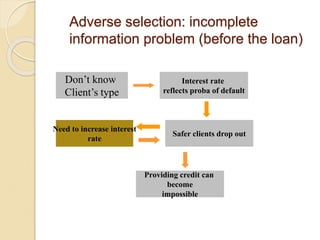

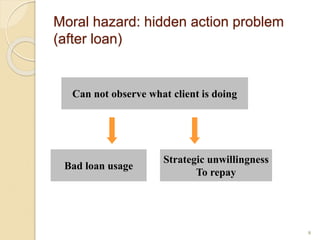

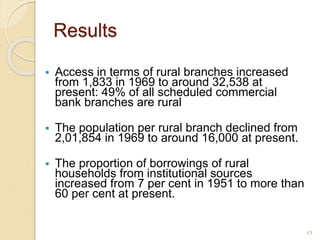

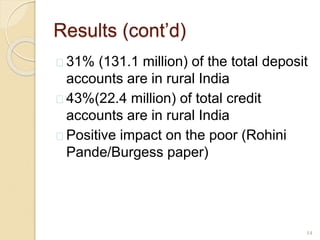

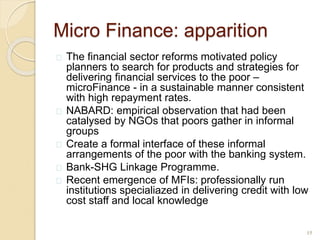

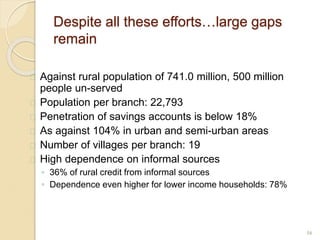

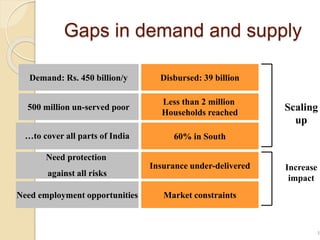

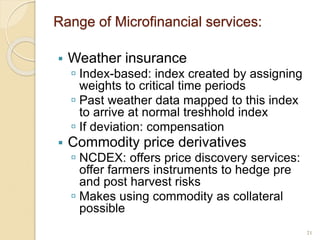

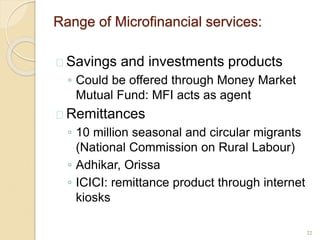

Microfinance in India provides financial services to the poor who lack access to traditional banking. It began as social initiatives but is now a profitable sector. Key challenges include high transaction costs due to information asymmetry about clients and their loan usage. Most clients are rural with low literacy and lack collateral. Staff training and motivation are also issues. Government programs and microfinance institutions have expanded access but large gaps remain, with 500 million people still unserved. Future growth requires addressing demand, scaling up, using technology, and offering more products like insurance to increase impact.