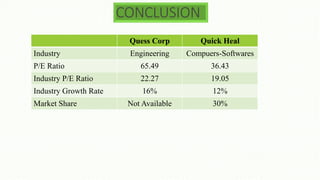

The document provides information on two IPOs: Quess Corp and Quick Heal.

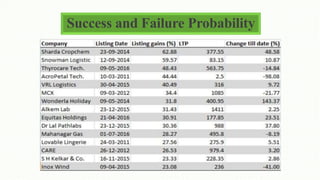

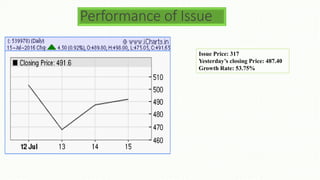

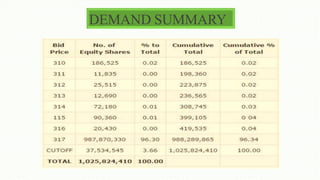

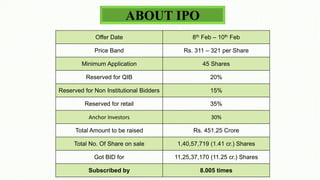

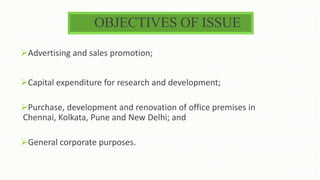

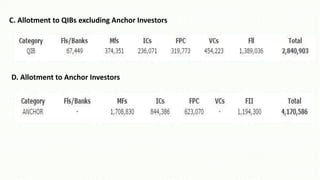

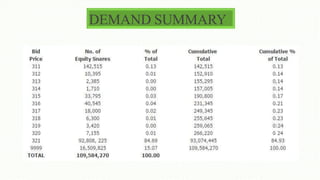

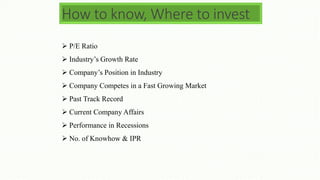

Quess Corp's IPO in June-July was oversubscribed 143.99 times and saw the stock price rise 53.75% since listing. The funds raised were intended to repay debt, fund capital expenditures, and acquisitions. Quick Heal's IPO in February was oversubscribed 8 times but the stock price has fallen 18.29% since. The proceeds were slated for advertising, R&D infrastructure, and general corporate purposes. Key metrics like P/E ratios and industry growth rates are provided to help analyze where to invest between the two IPOs.