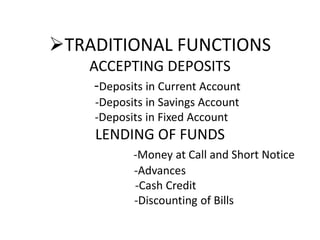

This document provides an overview of commercial banking. It defines commercial banks as institutions that accept deposits and extend credit to meet business and individual needs. The document outlines traditional commercial banking functions like accepting deposits and lending funds, as well as modern functions such as intermediation, transaction, and transformation services. It also discusses different types of banks, including commercial, cooperative, and specialized banks. The structure of banking in India is reviewed, including public sector banks, private sector banks, and cooperative banks. Credit planning in India is also summarized.