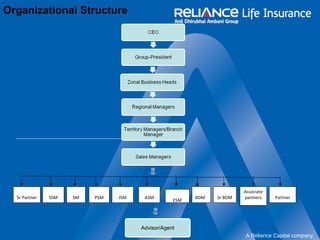

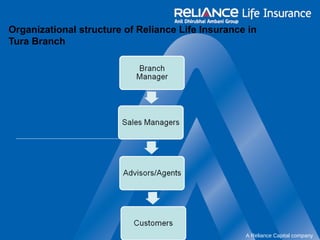

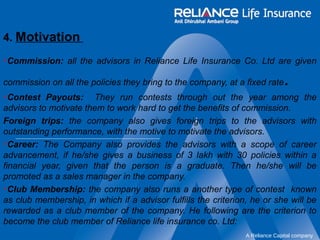

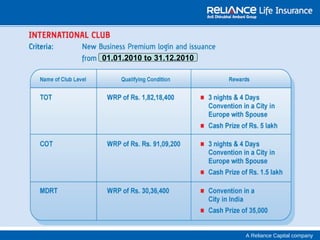

Reliance Life Insurance is a subsidiary of Reliance Capital, which is one of India's leading private sector financial services companies. The document outlines Reliance Life Insurance's organizational structure, methods of directing employees and communication, motivational techniques, and processes for controlling sales. Key aspects of the organizational structure include hierarchical levels of managers from advisors up to national heads. Motivation is achieved through commissions, contests, career growth opportunities, and club memberships based on sales targets. Controls are also sales-focused and ensure managers monitor and report on employee routines and quotas.