The document discusses brand valuation and provides information on:

1) What brand valuation is and why it is important as brands make up most of company value today rather than tangible assets.

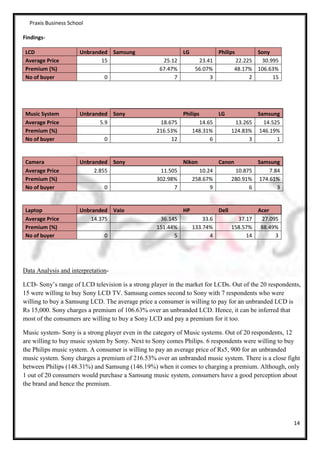

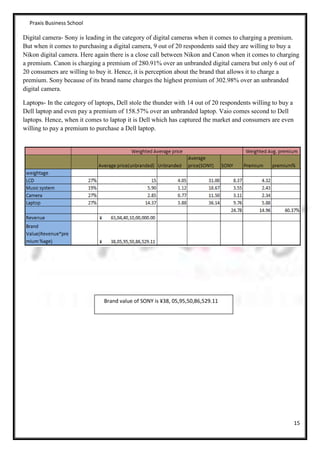

2) The main methods for valuing brands including discounted cash flow, price premia, and book to market.

3) How brand valuation became more standardized over the last 30 years and is now accepted under IFRS accounting standards.