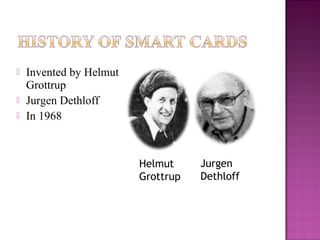

Smart cards are credit card sized devices with embedded integrated circuits that can store and process data. They can be used for identification, authentication, data storage and more. The document outlines the history of smart cards from their invention in 1968 to modern applications. Key benefits include security, portability and ease of use. Examples of smart card applications provided are banking, healthcare, access control and telecommunications. Advantages include flexibility and security while disadvantages include potential fees and data access if lost or stolen.