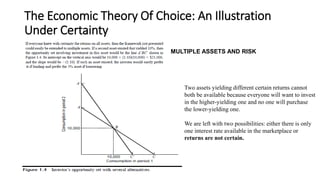

This document discusses portfolio management and the economic theory of choice. It provides an overview of key concepts in portfolio analysis including portfolio diversification, modern portfolio theory, the portfolio management process, and an illustration of choice under certainty. Specifically:

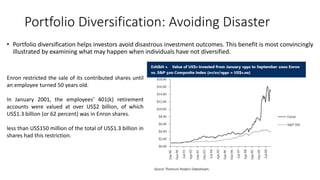

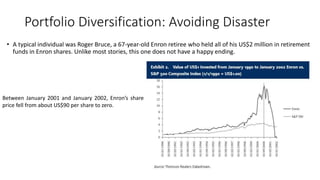

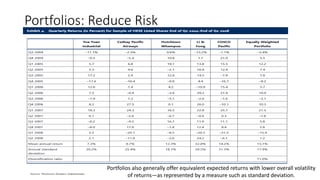

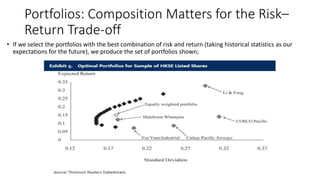

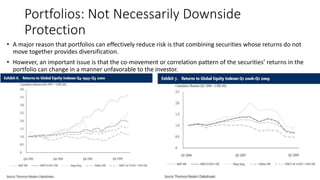

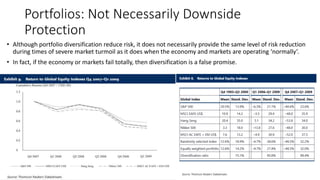

- Portfolio analysis aims to find the optimal group of securities given each security's properties. Diversification helps reduce risk without lowering expected returns.

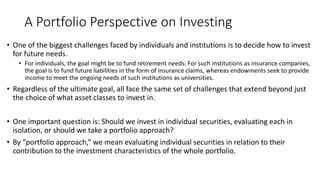

- Modern portfolio theory established that investors should consider how individual securities relate to each other in a portfolio. This theory underpins the benefits of diversification and asset pricing models.

- The portfolio management process involves planning investments based on objectives, executing the portfolio through asset allocation and security selection, and providing feedback through ongoing monitoring and reporting.