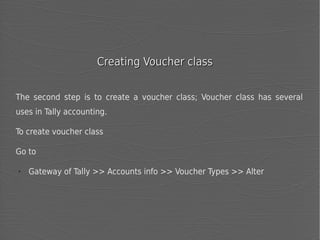

The document explains the automatic rounding feature in Tally ERP 9, which enhances the efficiency of sales and purchase transactions by adjusting amounts to their nearest rupee values. It discusses how to set up round off ledgers and voucher classes, as well as different rounding methods that can be applied, including upward, downward, and normal rounding. Additionally, it emphasizes the treatment of round off amounts as either an income or an expense in accounting and provides a procedural guide for implementing this in Tally ERP 9.