Understanding of entity and inherent risk assessment (including case studies)

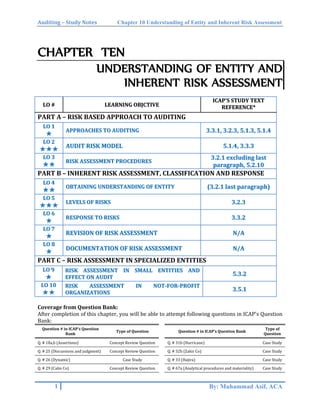

- 1. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment CHAPTER TEN UNDERSTANDING OF ENTITY AND INHERENT RISK ASSESSMENT LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE** PART A – RISK BASED APPROACH TO AUDITING LLOO 11 ✯✯ AAPPPPRROOAACCHHEESS TTOO AAUUDDIITTIINNGG 33..33..11,, 33..22..33,, 55..11..33,, 55..11..44 LLOO 22 ✯✯✯✯✯✯ AAUUDDIITT RRIISSKK MMOODDEELL 55..11..44,, 33..33..33 LLOO 33 ✯✯✯✯ RRIISSKK AASSSSEESSSSMMEENNTT PPRROOCCEEDDUURREESS 33..22..11 eexxcclluuddiinngg llaasstt ppaarraaggrraapphh,, 55..22..1100 PART B – INHERENT RISK ASSESSMENT, CLASSIFICATION AND RESPONSE LLOO 44 ✯✯✯✯ OOBBTTAAIINNIINNGG UUNNDDEERRSSTTAANNDDIINNGG OOFF EENNTTIITTYY ((33..22..11 llaasstt ppaarraaggrraapphh)) LLOO 55 ✯✯✯✯✯✯ LLEEVVEELLSS OOFF RRIISSKKSS 33..22..33 LLOO 66 ✯✯ RREESSPPOONNSSEE TTOO RRIISSKKSS 33..33..22 LLOO 77 ✯✯ RREEVVIISSIIOONN OOFF RRIISSKK AASSSSEESSSSMMEENNTT NN//AA LLOO 88 ✯✯ DDOOCCUUMMEENNTTAATTIIOONN OOFF RRIISSKK AASSSSEESSSSMMEENNTT NN//AA PART C – RISK ASSESSMENT IN SPECIALIZED ENTITIES LLOO 99 ✯✯ RRIISSKK AASSSSEESSSSMMEENNTT IINN SSMMAALLLL EENNTTIITTIIEESS AANNDD EEFFFFEECCTT OONN AAUUDDIITT 55..33..22 LLOO 1100 ✯✯✯✯ RRIISSKK AASSSSEESSSSMMEENNTT IINN NNOOTT--FFOORR--PPRROOFFIITT OORRGGAANNIIZZAATTIIOONNSS 33..55..11 Coverage from Question Bank: After completion of this chapter, you will be able to attempt following questions in ICAP's Question Bank: Question # in ICAP’s Question Bank Type of Question Question # in ICAP’s Question Bank Type of Question Q. # 18a,b (Assertions) Concept Review Question Q. # 31b (Hurricane) Case Study Q. # 25 (Discussions and judgment) Concept Review Question Q. # 32b (Zakir Co) Case Study Q. # 26 (Dynamic) Case Study Q. # 33 (Hajira) Case Study Q. # 29 (Calm Co) Concept Review Question Q. # 67a (Analytical procedures and materiality) Case Study 1 By: Muhammad Asif, ACA

- 2. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment PART A – RISK BASED APPROACH TO AUDITING LLOO 11:: AAPPPPRROOAACCHHEESS TTOO AAUUDDIITTIINNGG:: Transaction-based/ Vouching-based/ Direct verification / Substantive Approach: Under this approach no reliance is placed on entity’s system of internal control to determine level of detailed testing of transactions. This approach is used by auditor when entity’s internal controls are absent/weak, or number of transactions is low. Auditor may set testing level between 50% to 100% of the population. This approach is often used when auditing financial statements of a small entity. The system-based approach System based approach means auditor places reliance on entity’s system of internal control to determine level of detailed testing of transactions. This approach is used by auditor when entity’s internal controls are strong and auditor decides to rely on internal control. Following are stages of system-based approach: 1. Make preliminary assessment of strength of internal control. 2. Perform test of control to confirm whether preliminary assessment is correct. 3. Determine level of detailed testing of transactions based on results of tests of controls (i.e. if internal controls are strong, reduce level of testing and vice-versa). Risk-Based Approach: Under risk-based auditing, objective of auditor is to reduce audit risk to an acceptable level. This is achieved by performing detailed testing on areas where there is high risk of material misstatement. Following are stages of risk-based approach: 1. Auditor sets appropriate level of audit risk in accordance with nature of engagement and firm’s quality control policies and procedures. 2. Auditor performs risk assessment procedures to obtain understanding of entity and internal control to assess risk of material misstatement. 3. Auditor uses “audit risk model” to calculate acceptable level of detection risk i.e. DR = AR/(IR * CR) 4. Based on level of acceptable level of detection risk, auditor determines nature, timing and extent of audit procedures. CONCEPT REVIEW QUESTION “The auditing techniques for audit testing now takes cognizance of risk element in the modern audit”. In the light of this statement, explain risk based audit approach and vouching based audit approach. (04 marks) (ICMA Pakistan, Winter 2009) LLOO 22:: AAUUDDIITT RRIISSKK MMOODDEELL:: Below is a presentation of audit risk model which elaborates how risk is assessed and used by auditor in determining further audit procedures. This model is used by auditors in audit of all areas of financial statements. 2 By: Muhammad Asif, ACA

- 3. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Assessment Procedures Understanding of entity Understanding of Internal Control Inherent Risk Strength Weakness i.e. Control Risk RMM (IR * CR) Detection Risk (AR/RMM) Audit Risk (set by firm) Audit Procedures Area A 60% 80% 20% 12% 40% 4.8% Extensive TOC (because auditor relies more on internal control) Reduced Substantive Procedures (because detection risk is high) Area B 60% 20% 80% 48% 10% 4.8% Reduced TOC (because auditor relies less on internal control) Extensive Substantive Procedures (because detection risk is low) Inherent Risk: The susceptibility of an assertion about a class of transaction, account balance or disclosure to a misstatement that could be material (either individually or when aggregated with other misstatements), before consideration of any related controls. Control Risk: The risk that a misstatement that could occur in an assertion about a class of transaction, account balance or disclosure and that could be material (either individually or when aggregated with other misstatements) will not be prevented, or detected and corrected, on a timely basis by the entity’s internal control. Risk of Material Misstatement: The risk that the financial statements contain material misstatements (individually or in aggregate) prior to audit. This consists of two components at assertion level i.e. Inherent Risk (IR) and Control Risk (CR). Detection Risk: The risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material (either individually or when aggregated with other misstatements). Audit Risk: The risk that the auditor expresses an inappropriate opinion when financial statements are materially misstated. Audit risk is a function of Risk of Material Misstatement and Detection Risk. Study Tips 1. Audit Risk = Inherent Risk * Control Risk * Detection Risk. 2. Inherent risk cannot be controlled. 3. Control risk can be controlled/reduced by client through internal control. 4. Detection risk can be controlled/reduced by auditor through audit procedures. 3 By: Muhammad Asif, ACA

- 4. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment CONCEPT REVIEW QUESTION Suppose, you are an Audit Manager in a medium sized audit firm and M/s. Alpha Designers Limited is one of your key audit clients. You are in the process of audit planning of the client for the year ended December 31, 2014 and the initial meeting for briefing the engagement team has been scheduled next week. You have been requested by the team in-charge to brief the team on key aspects of the audit risk to be applied while carrying out the audit under the International Standards on Auditing. Required: (a)Discuss audit risk and its components in the meeting with the team. (08 marks) (b)Enumerate the possible overall responses to address the assessed risks of material misstatement at the financial statement level. (08 marks) (ICMA Pakistan - March 2015) What is the relationship between detection risk and combined level of inherent and control risk? (05 marks) (CA Inter, Spring 2002) LLOO 33:: RRIISSKK AASSSSEESSSSMMEENNTT PPRROOCCEEDDUURREESS:: Definition: Risk Assessment Procedures are auditor’s procedures to obtain understanding of entity and its internal control to assess the risk of material misstatement at financial statement level and at assertion level. Examples of Risk Assessment Procedures (and sources of information): Inquiry of management and others within the entity: Auditor may inquire from management and others within the entity which may have information relating to risk assessment. These others to inquire may include Internal audit function, TCWG, In- house legal counsel, marketing or sales personnel and Employees involved in initiating, processing and recording transactions. Observation and Inspection: Observation and inspection supports inquiries of management and others; and also provides information about entity and its internal control e.g. observation and inspection of: Entity’s operations The entity’s premises and plant facilities Business plans, strategies, accounting records, and internal control manuals. Reports prepared by management and TCWG (e.g. interim financial statements, or minutes of board of directors’ meetings). Analytical Procedures: Analytical procedures may identify unusual or unexpected ratios and relationships in financial statements and may help in assessing the risk of material misstatement e.g. calculation and comparison of debtors’ turnover ratio. Discussion among engagement team The engagement partner and other key engagement team members shall discuss the susceptibility of the entity’s financial statements to material misstatement. Objectives/Benefits of discussion among engagement team: 1. More experienced members share their insights based on their knowledge of the entity. 2. Team members exchange information about the business risks of entity and how financial statements may be misstated. 3. Team members gain a better understanding of audit risk in specific areas assigned to them, and how the results of their work can affect other aspects of audit. 4. Team members communicate and share new information obtained throughout the audit that may affect the audit risk or audit procedures 4 By: Muhammad Asif, ACA

- 5. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment CONCEPT REVIEW QUESTION The auditor performs risk assessment procedures to obtain an understanding of the entity and its environment, including its internal controls. Briefly discuss all such procedures. (09 marks) (CA Inter, Autumn 2007) List the benefits associated with holding timely discussion among the team members in respect of matters susceptible to material misstatements. (05 marks) (CA Inter, Autumn 2011) Your audit firm has just won a new audit client, Milky Way Technologies Co (Milky Way), and you have been asked by the audit engagement partner to gain an understanding about the new client as part of the planning process. Required: Identify FIVE sources of information relevant to gaining an understanding of Milky Way Technologies Co and describe how this information will be used by the auditor. (05 marks) (ACCA F8 – December 2015) PART B – INHERENT RISK ASSESSMENT, CLASSIFICATION AND RESPONSE LLOO 44:: OOBBTTAAIINNIINNGG UUNNDDEERRSSTTAANNDDIINNGG OOFF EENNTTIITTYY:: Auditor is required to obtain understanding of entity and its environment. This understanding shall cover following: 1. Relevant industry, regulatory and other external factors, including relevant accounting requirements. 2. The nature of the entity and its operations, ownership and management structures. 3. The entity’s selection and application of accounting policies, including whether they are consistence with applicable financial reporting framework, consistent with industry, and any change in accounting policies is appropriate. 4. The entity’s objectives and strategies and those related business risks that may result in risks of material misstatement in financial statements. 5. The measurement and review of the entity’s financial performance (through analytical procedures). CONCEPT REVIEW QUESTION List FOUR examples of matters the auditor may consider when obtaining an understanding of the entity. (02 marks) (ACCA F8 – December 2010) Define and explain the term ‘business risk’. (05 marks) (ICMA Pakistan, Winter 2008) LLOO 55:: LLEEVVEELLSS OOFF RRIISSKKSS:: Business Risk: Business risk is a risk resulting from significant conditions, events, circumstances, actions or inactions that could adversely affect an entity’s ability to achieve its objectives. Business risks can also occur as a result of setting of inappropriate objectives, strategies or goals. Understanding of business risks helps auditor in his risk assessment because most of the business risks ultimately affect financial statements hence they also become risks of material misstatement. 5 By: Muhammad Asif, ACA

- 6. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment There are two levels of risk i.e. at Financial Statement Level and at Assertion Level. Risk at Financial Statement Level: Risks at the financial statement level refer to risks that affect financial statements pervasively and potentially affect many assertions. Examples of Inherent risks at financial statement level: 1. Risk of management override of control. 2. Integrity of management. 3. Management experience, knowledge and changes during the period. 4. Nature of the entity’s business and operations (e.g. high-tech or fashion based products, highly regulated business, expansion through new products or new locations, intended sale of business, significant transactions with related parties, new or complex IT system). 5. Declining economic conditions causing going concern problems (e.g. Poor liquidity/credit position, Decreasing sales and profits, loss of key customers, increased competition). 6. Risk of fraud (e.g. due to unusual pressure on management to meet targets). Risk at Assertion Level: Risk at assertion level refers to risks that do not affect financial statements pervasively and affect only specific identifiable assertions. Examples of Inherent risks at assertion level: 1. Complex transactions 2. Non-routine transactions (e.g. purchase or disposal of fixed assets) 3. Judgmental transactions (e.g. pending litigations) 4. Accounts with history of errors 5. Large transactions/adjustments at period end. 6. Assets with high risk of misappropriation (e.g. cash or other movable/marketable assets) CONCEPT REVIEW QUESTION The auditor is required to identify and assess the risk of material misstatement at both the financial statement and assertion levels. State what is meant by risk at financial statement level and assertion level. Give one example of risk at each level. (03 marks) (CA Inter, Spring 2015) What is an inherent risk? Give some examples of inherent risk at the financial statements level. (05 marks) (CA Inter, Spring 2003) “The auditor shall perform risk assessment procedures to provide a basis for the identification and assessment of risks of material misstatement at the financial statement and assertion levels.” (i) Briefly explain what do you understand by the risk of material misstatement at financial statement level. (04 marks) (ii) List down the risk assessment procedures as referred above. (02 marks) (CA Inter, Spring 2009) 6 By: Muhammad Asif, ACA

- 7. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment LLOO 66:: RREESSPPOONNSSEE TTOO RRIISSKKSS:: Response to Risk at Financial Statement Level: To address risk at financial statement level, auditor shall design and implement overall responses e.g.: Adequate planning Adequate application of professional skepticism Assigning more experienced and specialized staff e.g. use of experts if necessary. Adequate supervision and review of the audit work performed Incorporating unpredictability in nature, timing and extent of audit procedures o Performing procedures on account balances not usually tested. o Using different sampling methods. o Performing audit procedures at different locations on unannounced basis. Making changes to audit procedures. More audit procedures at period end rather than at interim date. Obtaining more reliable audit evidence. Response to Risk at Assertion Level: To address risk at assertion level, auditor shall perform following further audit procedures: Tests of Controls (to be discussed in chapter # 11) and Substantive Procedures (to be discussed in chapter # 12). LLOO 77:: RREEVVIISSIIOONN OOFF RRIISSKK AASSSSEESSSSMMEENNTT:: If during the course of audit, additional evidence is obtained by auditor from performing further audit procedures which is inconsistent with information/evidence on which original risk assessment was based, auditor shall revise risk assessment. For example: In performing tests of controls, the auditor detects deviations greater than original assessment. In performing substantive procedures, the auditor detects misstatements greater than original assessment. CONCEPT REVIEW QUESTION “The auditor’s assessment of materiality and audit risk may be different at the time of initially planning the engagement from at the time of evaluating the results of audit procedures.” Briefly describe the reasons which may lead to such a change in the auditor’s assessment. (03 marks) (CA Inter, Spring 2009) LLOO 88:: DDOOCCUUMMEENNTTAATTIIOONN OOFF RRIISSKK AASSSSEESSSSMMEENNTT:: Auditor is required to document following regarding risk assessment: 1. The discussion among the engagement team about the susceptibility of the entity’s financial statements to material misstatement and decisions reached. 2. Risk assessment procedures performed, and understanding obtained regarding each aspect of entity, and the sources of information from which the understanding was obtained 3. Risk of material misstatement assessed at financial statements level and at assertion level. 4. Significant risks identified and controls related to significant risks. 7 By: Muhammad Asif, ACA

- 8. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment CONCEPT REVIEW QUESTION An auditor is required to identify and assess the risks of material misstatements to provide a basis for designing and performing further audit procedures. Required: State the matters which you would include while documenting the risk identification and risk assessment procedures. (06 marks) (CA Inter, Spring 2014) PART C – RISK ASSESSMENT IN SPECIALIZED ENTITIES LLOO 99:: RRIISSKK AASSSSEESSSSMMEENNTT IINN SSMMAALLLL EENNTTIITTIIEESS AANNDD EEFFFFEECCTT OONN AAUUDDIITT:: What is a Small Entity: Small entity means a sole-proprietorship or a partnership. Features, Risks and Effect on Audit of Small Entity: Features/Characteristics of Small Entity Risks and Effect on Audit Common ownership and management This can increase audit risk (as owner-manager is easily able to override any internal controls) or decrease audit risk (as owner is actively involved in day to day operations). Risk assessment will depend on auditor’s knowledge of the integrity and competencies. Few Employees There will be lack of internal control e.g. no segregation of duties or no authorization controls. Control risk will be increased. Auditor shall place less reliance on controls and large amount of substantive procedures will be performed. Less sophisticated accounting system Use of standardized or less sophisticated accounting system may fail to provide adequate audit trail as they are not specific to needs of entity. Further, system errors may occur due to inadequate programming or training of staff on use of package. Auditor is unlikely to use CAATs. No full time well-qualified accountant Auditor is likely to himself prepare financial statements which may create self-review threat. Therefore, safeguards should be applied to reduce threats (e.g. use of different teams). CONCEPT REVIEW QUESTION Describe the specific risks involved in the audit of a small business. (05 marks) (CA Inter, Spring 2003) How is the audit of a small business different from that of a large organization? (05 marks) (CA Inter, Autumn 2004) 8 By: Muhammad Asif, ACA

- 9. Auditing – Study Notes Chapter 10 Understanding of Entity and Inherent Risk Assessment LLOO 1100:: RRIISSKK AASSSSEESSSSMMEENNTT IINN NNOOTT--FFOORR--PPRROOFFIITT OORRGGAANNIIZZAATTIIOONNSS ((NNFFPPOO)):: What is a Charity or NFPO: A not for profit organization raises funds from general public and spends its funds on defined beneficiaries in accordance with its objects. Inherent Risks in NFPO and their effect on Audit Approach: Risks associated with Income: Risk and explanation of risk Effect on Audit Approach Risk Factor: If income of charity is derived wholly from donations. Donation income is likely to be unpredictable and will fall in poor economic conditions. Audit report may need to be modified because of going concern assumption affected by uncertainty of future income. Risk Factor: If cash is collected by volunteers from various places. There is a risk that donation may be stolen by volunteers due to lack of controls (as no sales invoices are raised). Audit report may need to be modified because lack of evidence to ensure completeness of income. Risks associated with Expenses: Risk and explanation of risk Effect on Audit Approach Risk Factor: If constitution of charity specifies how the income is to be spent/expended: There is a risk that expenditures can be incurred for objects outside of constitution of Charity. Expenditures will have to be carefully reviewed to ensure that expenditures are not ‘ultra vires’ the objectives of Charity. Risk Factor: If there are specific instructions about utilization of donation. There is a risk that donation may be recorded inappropriately (e.g. misclassification between recording as liability or income) or may be spent inappropriately (e.g. it may not be spent in accordance with instructions of the donor). Auditor will carefully check whether: Specific donations is recorded as liability. Specific donation is expended in accordance with instructions of donor. Risk Factor: If constitution of charity requires that administration expenditure cannot exceed a certain percentage of income. There is a risk that administration expenditure can exceed this limit and may be misclassified by management. Auditor will check whether this limit has exceeded. Auditor will also check other areas if there are unusual increase in expense for possibility of misclassification. Risk Factor: If there are complex regulations and tax rules applicable on charity. There is a risk that rules will be broken due to lack of knowledge and expertise. Auditor will ensure that staff is familiar and complying with relevant regulations and tax rules. CONCEPT REVIEW QUESTION Al-Madad Foundation (AMF) is a charitable organization. It receives donations which are utilized to help the destitute persons in accordance with the rules and regulations prescribed by the AMF’s Trust Deed. The donations are received from the following sources: (i) Cash collected from the general public through charity boxes placed at key points in hospitals, airports, superstores etc., (ii) cash and cheques received from individuals and institutions at AMF’s office; and (iii) cash from generous individuals who prefer to remain anonymous. Donations received in case of (ii) and (iii) above, often contain specific instructions for utilisation of the donated amount for specific purposes e.g. for education of orphan children. Required: (a) Identify the inherent risks in the operations of AMF. (03 marks) (b) Briefly discuss the effect of each of these risks on the audit of AMF. (03 marks) (CA Inter, Autumn 2010) 9 By: Muhammad Asif, ACA

- 10. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment CHAPTER TEN (CASE STUDIES) INHERENT RISK ASSESSMENT AAPPPPEENNDDIIXX 11:: IINNHHEERREENNTT RRIISSKK AASSSSEESSSSMMEENNTT TTHHRROOUUGGHH FFAACCTTSS:: ((33..33..44)) Structure of the Case: Inherent risk assessment through facts means performing inquiry, observation and inspection of entity and identifying areas where there is potential of misstatement. In exam, you may be given non-financial (i.e. descriptive) information about audit client and you will be required to identify and describe audit risks i.e. areas where there is high risk and give explanation of risks. In advanced questions, you may also be required to describe how you would address these audit risks. Suggested Approach to Solve: Read the paragraphs carefully and identify risk-factors (i.e. information which increases risk) one by one. Also explain risk-factor by referring account balance and assertion impacted by risk. (however, there is no need to explain whether identified risk is inherent, control or detection) Examples of Frequently Asked Risks and Their Explanation Risk Factor: Long-standing Inventory OR Technology/Fashion based Inventory OR Launch of new product by competitor OR Decrease in selling price/sales: Inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Valuation and Allocation assertion of Inventory is at risk. Risk Factor: Client deals in significant imports and/or exports: Some items may be in-transit at year end which may be wrongly included in or excluded from inventory. Therefore, cut- off assertion of sales or purchases is at risk and consequently debtors and creditors may also be overstated or understated. Further, incorrect exchange rates may be used to translate into transactions into local currency. Therefore, accuracy of Sales or Purchases is also at risk. Risk Factor: Existence of precious and portable Inventory or Cash: Inventory or Cash may be misappropriated by dishonest individuals. Therefore, Existence assertion of inventory or cash is at risk. Risk Factor: “Standard costing” or “S.P less profit margin” method is used for Inventory valuation: At year end, actual Cost may be different from standard cost/S.P less profit margin method. Therefore, Valuation and Allocation assertion of inventory is at risk. Risk Factor: Inventory is held at various locations OR Inventory is held with third party OR Physical count was not done at balance sheet date: It is difficult to determine correct amount of inventory at balance sheet date. Therefore, Existence and Completeness assertions of inventory are at risk. Risk Factor: Client has work-in-process inventory It is difficult to determine correct cost of work-in-process because it involves estimation of stage of completion (which is subjective); and absorption of overhead (which is complex). Therefore, Valuation and Allocation assertion of Inventory is at risk. 1 By Muhammad Asif, ACA

- 11. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Dispute with debtors It may be difficult to recover full amount from disputed debtor. Therefore, Valuation and Allocation assertion of Debtors is at risk. Further, if dispute arises with a major customer, there is also a risk that going concern assumption may not be appropriate because future income stream is lost. Further, if dispute arises because of malfunctioning of goods, inventory may also require provisioning. Therefore, Valuation and Allocation assertion of inventory is also at risk. Risk Factor: Long-standing Debtors OR Debtor experiencing financial difficulty OR Extension in Credit Period: Poor debtors may exist from whom full recovery is not expected, and may require provisioning. Therefore, Valuation and Allocation assertion of Debtors is at risk. Risk Factor: Specialized/Customized inventory: If customer cancels order or goes bankrupt, i Risk Factor: Sales-based remuneration being paid to staff: There is a risk that fake sales (particularly at year-end) or next-period’s sales may be recorded to earn sales-commission. Therefore, Occurrence and Cut-off assertions of Sales are at risk. Further, Goods may be sold to debtors with poor financial position, from whom full recovery is not expected. Therefore, Valuation and Allocation assertion of Debtors is also at risk. Risk Factor: Cash is received from sales at different phases (i.e. before delivery or after delivery): Revenue may be recognized pre-mature (if cash received before delivery) or delayed (if cash received after delivery). Therefore, there is a risk of Occurrence and Completeness assertions of sales. Risk Factor: Significance Purchases of Fixed Assets during the year: Directly attributable costs on acquisition may be incorrectly calculated. Therefore, Valuation and Allocation assertion of fixed assets is at risk. Risk Factor: Significance Disposals of Fixed Assets during the year: Profit or loss on disposal may be incorrectly calculated. Therefore, Accuracy assertion of gain/loss on disposal of fixed assets is at risk. Risk Factor: Heavy Repair and Maintenance or Construction of fixed assets during the year: There may be incorrect categorization of cost between Revenue and Capital Expenditure. Therefore, Classification assertion of repair expense is at risk. Further, all expenditures of project may not be recorded. Therefore, Completeness assertion of Repair Expense or Fixed Assets is at risk. Risk Factor: Destroyed OR Unused OR Under-utilized Fixed Assets: Fixed assets may have been impaired. Therefore, Valuation and Allocation assertion of fixed assets is at risk. Risk Factor: Revaluation of Fixed Assets: Revaluation may be incorrectly calculated and recorded because it involves Subjectivity (e.g. determination of useful life) and Complexity (e.g. deferred tax implication). Therefore, Valuation and Allocation assertion of fixed assets is at risk. Risk Factor: Change in estimates of depreciation: Change in useful life or residual value or method of depreciation may be unreasonable, to increase profit. Therefore, Valuation and Allocation assertion of fixed assets is at risk. 2 By Muhammad Asif, ACA

- 12. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Goods sold over internet: Internet sales may be recorded before risk and rewards are transferred because high level of sales return is expected on such sales because of wrong specification, late delivery or dissatisfaction of customer. Therefore, Occurrence and Cut-off assertion of Sales is at risk. Risk Factor: Warranty on Sales: Warranty may be incorrectly calculated because it involves estimation and complexity. Therefore, Accuracy assertion of Warranty is at risk. Risk Factor: Pending litigations and contingent liabilities (e.g. unfair dismissal of staff, or physical injury to staff due to poor working conditions, physical injury to customers because of defective good): There is a risk that disclosure or provision relating to litigation may not be appropriately recorded in financial statements. Therefore, Completeness assertion of Liabilities and Disclosures is at risk. If litigation relates to customer, there is also risk that amount receivable may not be fully recovered, Valuation and Allocation of Debtors is at risk. If customer is major, there is also a risk that going concern assumption may not be appropriate. If dispute arises because of malfunctioning of goods, inventory may also require provisioning. Therefore, Valuation and Allocation assertion of inventory is also at risk. If product is major, there is also a risk that going concern assumption may not be appropriate. Risk Factor: High turnover of workers: There is a risk that payments may be made to ghost employees, or salaries expense may not be accurately or completely calculated. Therefore, Occurrence, Accuracy and Completeness of Payroll expense is at risk. Risk Factor: Intangible asset recognized by client (e.g. Capitalization of Development cost, brand name, web-site development): Intangible assets may not have met recognition criteria, or may be incorrectly valued because of subjectivity and complexity in valuation (e.g. issue of useful life, issue of internal expenses). Therefore, Valuation and Allocation assertion of Intangible Assets is at risk. Risk Factor: Deferred tax asset is recognized by client: Deferred tax asset may not have met recognition criteria (e.g. when future profit/sales are declining) or may be incorrectly calculated because of complexity involved in calculation. Therefore, Valuation and Allocation assertion of Deferred Tax Asset is at risk. Risk Factor: Investigation by tax authorities: Tax expense may be understated. Therefore, Completeness and Accuracy assertions of tax expense are at risk. Risk Factor: Redundant workforce: Compensation payable to redundant workforce may not be completely recorded. Therefore, Completeness assertion of Provision for Redundancy is at risk. Risk Factor: Loan from Bank: Split of loan between current and non-current portion, and disclosures (e.g. charges on assets) may be inappropriately included in financial statements. Therefore, Presentation and Disclosure assertions of loan are at risk. Further, if default is made in debt-covenant requirements, , there is also a risk that bank may call-back entire loan and if company does not have alternate source of financing, going concern assumption may not be appropriate. Risk Factor: Reconciliations not being prepared (in bank, debtors, creditors, inventory): There is an increased risk that errors may not be identified timely. Completeness, Valuation and Allocation, and Accuracy assertions are at risk. Risks at Financial Statement Level: New/inexperienced staff in accounting and finance department: Errors may occur in financial statements because of lack of experience. 3 By Muhammad Asif, ACA

- 13. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Few/overburdened staff in accounting and finance department: Errors may occur in financial statements because of lack of segregation of duties. Finance department is working without financial controller (or IT department working without IT manager): Staff may have some problems and without support from departmental head, errors may occur in financial statements due to lack of knowledge and experience. Introduction of new IT system: Errors may occur during changeover process which may impact financial statements. Sales/Operations being made at various distant locations: Accuracy and Completeness of transaction in financial statements may be incorrect. This is first year of audit of client (i.e. initial audit): Audit risk is increased in first year of audit because it may be difficult to verify opening balances and auditor has limited knowledge about entity. Reduced reporting timetable: Audit risk is increased as audit team will have less time and will be under-pressure in obtaining sufficient appropriate audit evidence. Prospective sale of business, OR Contingent remuneration of management or CEO with majority shareholding: There is a risk of management bias to manipulate financial statements, to increase personal wealth of management/shareholders. Model Case Study From Examination Questions: Case Study – First Example: You are the audit supervisor of Seagull & Co and are currently planning the audit of your existing client, Eagle Heating Co (Eagle), for the year ending 31 December 2014. Eagle manufactures and sells heating and plumbing equipment to a number of home improvement stores across the country. Eagle has experienced increased competition and as a result, in order to maintain its current levels of sales, it has decreased the selling price of its products significantly since September 2014. The finance director has informed your audit manager that he expects increased inventory levels at the year end. He also notified your manager that one of Eagle’s key customers has been experiencing financial difficulties. Therefore, Eagle has agreed that the customer can take a six-month payment break, after which payments will continue as normal. The finance director does not believe that any allowance is required against this receivable. In October 2014 the financial controller of Eagle was dismissed. He had been employed by the company for over20 years, and he has threatened to sue the company for unfair dismissal. The role of financial controller has not yet been filled and so his tasks have been shared between the existing finance department team. In addition, the purchase ledger supervisor left in August and a replacement has been appointed in the last week. However, for this period no supplier statement reconciliations or purchase ledger control account reconciliations were performed. You have undertaken a preliminary analytical review of the draft year to date statement of profit or loss, and you are surprised to see a significant fall in administration expenses. Required: Explain FIVE audit risks, and the auditor’s response to each risk, in planning the audit of Eagle Heating Co. (10 marks) (ACCA F8 – December 2014) Suggested Solution: Risk Factor: Decrease in selling price and Increase in inventory level at year end: Inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Valuation and Allocation assertion of Inventory is at risk. 4 By Muhammad Asif, ACA

- 14. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Debtor experiencing financial difficulty and Extension in Credit Period: Debtor facing financial difficulty may not pay full amount of debt, and may require provisioning. Therefore, Valuation and Allocation assertion of Debtors is at risk. Risk Factor: Threat by ex financial controller to sue company for unfair dismissal: There is a risk that disclosure or provision relating to threatened litigation may be inappropriately recorded in financial statements. Therefore, Completeness assertion of Liabilities and Disclosures is at risk. Finance department is working without financial controller: Staff may have some problems and without support from departmental head, errors may occur in financial statements due to lack of knowledge and experience. Risk Factor: Purchase ledger reconciliation not being performed: There is an increased risk that errors in purchases and creditors may not be identified timely. Completeness, Valuation and Allocation, and Accuracy assertions are at risk. Risk Factor: Significant fall in admin expenses Admin expenses are fixed in nature and do not change with sales. Significant decrease in admin expenses indicates understatement or misclassification of admin expenses. Therefore, Completeness and Classification assertion of admin expenses are at risk. (Note for students: In this chapter, you are expected to learn only to identify and explain audit risks. Therefore, requirement relating to auditor’s response to each risk will be discussed in chapter # 12 Substantive Procedures.) Case Study – Second Example: Abrahams Co develops, manufactures and sells a range of pharmaceuticals and has a wide customer base across Europe and Asia. You are the audit manager of Nate & Co and you are planning the audit of Abrahams Co whose financial year end is 31 January. You attended a planning meeting with the finance director and engagement partner and are now reviewing the meeting notes in order to produce the audit strategy and plan. Revenue for the year is forecast at $25 million. During the year the company has spent $2·2 million on developing several new products. Some of these are in the early stages of development whilst others are nearing completion. The finance director has confirmed that all projects are likely to be successful and so he is intending to capitalise the full $2·2 million. Once products have completed the development stage, Abrahams begins manufacturing them. At the year end it is anticipated that there will be significant levels of work in progress. In addition the company uses a standard costing method to value inventory; the standard costs are set when a product is first manufactured and are not usually updated. In order to fulfill customer orders promptly, Abrahams Co has warehouses for finished goods located across Europe and Asia; approximately one third of these are third party warehouses where Abrahams just rents space. In September a new accounting package was introduced. This is a bespoke system developed by the information technology (IT) manager. The old and new packages were not run in parallel as it was felt that this would be too onerous for the accounting team. Two months after the system changeover the IT manager left the company; a new manager has been recruited but is not due to start work until January. In order to fund the development of new products, Abrahams has restructured its finance and raised $1 million through issuing shares at a premium and $2·5 million through a long-term loan. There are bank covenants attached to the loan, the main one relating to a minimum level of total assets. If these covenants are breached then the loan becomes immediately repayable. The company has a policy of revaluing land and buildings, and the finance director has announced that all land and buildings will be revalued as at the year end. The reporting timetable for audit completion of Abrahams Co is quite short, and the finance director would like to report results even earlier this year. Required: Using the information provided, identify and describe FIVE audit risks and explain the auditor’s response to each risk in planning the audit of Abrahams Co. (10 marks) (ACCA F8 – December 2011) 5 By Muhammad Asif, ACA

- 15. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Suggested Solution: Risk Factor: All development cost have been capitalized: Some of the development cost may not have met recognition criteria. Therefore, Existence and Valuation and Allocation assertions of Capitalized Development Cost are at risk. Risk Factor: Significant level of work-in-process inventory It is difficult to determine correct cost of work-in-process because it involves estimation of stage of completion (which is subjective); and absorption of overhead (which is complex). Therefore, Valuation and Allocation assertion of Inventory is at risk. Risk Factor: “Standard costing” method is used for Inventory valuation: At year end, actual Cost may be different from standard cost, specially as it is not updated periodically. Therefore, Valuation and Allocation assertion of inventory is at risk. Risk Factor: Inventory is held at various locations: It is difficult to determine correct amount of inventory at balance sheet date. Therefore, Existence and Completeness assertions of inventory are at risk. Risk Factor: Introduction of new IT system: Errors may occur during changeover process which may impact financial statements. Risk Factor: IT department working without IT manager: Staff may have some problems and without support from departmental head, errors may occur in financial statements due to lack of knowledge and experience. Risk Factor: Loan from Bank: Split of loan between current and non-current portion, and disclosures (e.g. charges on assets) may be inappropriately included in financial statements. Therefore, Presentation and Disclosure assertions of loan are at risk. Further, if default is made in debt-covenant requirements, , there is also a risk that bank may call-back entire loan and if company does not have alternate source of financing, going concern assumption may not be appropriate. Risk Factor: Revaluation of Fixed Assets: Revaluation may be incorrectly calculated and recorded because it involves Subjectivity (e.g. determination of useful life) and Complexity (e.g. deferred tax implication). Therefore, Valuation and Allocation assertion of fixed assets is at risk. Risk Factor: Reduced reporting timetable: Audit risk is increased as audit team will have less time and will be under-pressure in obtaining sufficient appropriate audit evidence. (Note for students: In this chapter, you are expected to learn only to identify and explain audit risks. Therefore, requirement relating to auditor’s response to each risk will be discussed in chapter # 12 Substantive Procedures.) Case Study – Third Example: You are the audit manager of the Educational University (EU) for the year ended 31 December 2015. EU has a student base of 2,500 students. It follows a policy of receiving 50% of the fees at the start of the semester and 50% in the middle of the semester. However, 10% discount is allowed to those students who pay the entire amount in advance. The cost of course material is included in the fees. The semester starts in December and June each year. You have noticed that 30% of the students who were registered in December 2015 had not claimed the course material till 31 December 2015. Required: Discuss the audit risks in the above scenario and how you would deal with them. (07 marks) (CAF 09, Spring 2016) Suggested Solution: Risk Factor: Tuition Fee received in Advance: Tuition fee is being received in advance from students (i.e. before providing services). There is a risk that advance income received in December 2015 (for which services will be provided in 2016) may be recorded as income for 2015 (instead of liability). Therefore, cut-off assertion of Revenue is at risk. 6 By Muhammad Asif, ACA

- 16. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Cost of course material is included in fees: Providing tuition is a service activity whereas selling course material is a trading activity, so both must be reported as separate line item. If revenue for both is received combined, there is a risk that revenue is also recorded on combined basis. Therefore, Classification assertion of revenue is at risk. Risk Factor: 30% of students have paid for course fee but did not claim course material: If course material has not been provided at year end, then related receipt should be recorded as advance income (i.e. a liability). There is a risk that client has recorded it as income in current period. Therefore, Occurrence assertion of revenue is at risk. Risk Factor: Discount is given to students paying full fee in advance: Discount may not be appropriately classified. Therefore, Classification assertion of discount allowed is at risk. (Note for students: In this chapter, you are expected to learn only to identify and explain audit risks. Therefore, requirement relating to auditor’s response to each risk will be discussed in chapter # 12 Substantive Procedures.) 7 By Muhammad Asif, ACA

- 17. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment AAPPPPEENNDDIIXX 22:: IINNHHEERREENNTT RRIISSKK AASSSSEESSSSMMEENNTT TTHHRROOUUGGHH FFIIGGUURREESS:: ((88..22..22 AAnnaallyyttiiccaall pprroocceedduurreess aanndd tthhee eexxaamm,, 88..22..44,, 88..22..55)) Structure of the Case: Inherent risk assessment through figures means performing analytical procedures and identifying areas where there is potential of misstatement. Two types of cases are possible in exam: 1. You are given Rations/Percentages and are required to identify risks, or 2. You are given Extracts of Financial Statements and are required to identify risks. In advanced questions, you may also be required to describe how you would address these audit risks. Suggested Approach to Solve: 1. If you are given ratios/percentages, then you have to directly identify risks. 2. If you are given extracts of financial statements, then first you have to calculate ratios/percentages, and then you have to identify risks. Examples of Frequently Asked Risks and Their Explanation Risk Factor: Significant increase/decrease in Sales compared to last year (i.e. current year’s sales/last year’s sales * 100) Significant increase in sales indicates overstatement of sales. Therefore, Occurrence and Cut-off assertions of Sales are at risk. Significant decrease in sales indicates understatement of sales. Therefore, Completeness assertion of sales is at risk. Further, a decrease in sales due to decrease in demand or sale price of products also indicates inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Valuation and Allocation assertion of Inventory is also at risk. Risk Factor: Significant increase/decrease in Cost of Sales (as %age of sales) as compared to last year (i.e. Cost of Sales/Sales * 100 for both year) Significant increase in %age of cost of sales indicates overstatement of Purchases. Therefore, Occurrence and Cut-off assertions of Purchases are at risk. Further, it may also indicate overstatement of Overheads and understatement of Closing stock. Significant decrease in %age of cost of sales indicates understatement of Purchases. Therefore, Completeness assertion of Purchases is at risk. Further, it may also indicate understatement of Overheads and overstatement of Closing stock. Exam Tip If you are given GP ratio in exam, remember that it includes effect of both Sales and Cost of Sales. Therefore, your risk assessment through GP ratio should cover both. However, there will be no risk in sales if increase/decrease is due to launch of new products or discontinuance of existing products. However, there will be no risk in cost of sales if increase/decrease is due to change in cost of inputs or change in production technology. 8 By Muhammad Asif, ACA

- 18. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Significant increase/decrease in Admin expenses as compared to last year (i.e. current year’s admin expense/last year’s admin expense * 100) Admin expenses are fixed in nature and do not change with sales. Significant increase in admin expenses indicates overstatement or misclassification of admin expenses. Therefore, Occurrence and Classification assertion of admin expenses are at risk. Significant decrease in admin expenses indicates understatement or misclassification of admin expenses. Therefore, Completeness and Classification assertion of admin expenses are at risk. Risk Factor: Significant increase/decrease in Selling/Operating Expenses (as %age of sales) as compared to last year (i.e. Selling Expenses/Sales * 100 for both year) Significant increase in selling/operating expenses indicates overstatement or misclassification of selling/operating expenses. Therefore, Occurrence and Classification assertion of selling/operating expenses are at risk. Significant decrease in selling/operating expenses indicates understatement or misclassification of selling/operating expenses. Therefore, Completeness and Classification assertion of selling/operating expenses are at risk. Risk Factor: Significant increase/decrease in Depreciation Expenses (as %age of tangible fixed assets) as compared to last year (i.e. Depreciation Expense/Tangible Fixed Assets * 100 for both year) Significant increase in depreciation expenses indicates overstatement of depreciation expenses. Therefore, Accuracy assertion of depreciation expenses is at risk. Significant decrease in depreciation expenses indicates understatement of depreciation expenses.. Therefore, Completeness assertion of depreciation expenses is at risk. Risk Factor: Significant increase/decrease in Interest/Finance charges (as %age of Borrowings/Loans) as compared to last year (i.e. Interest/Loans * 100 for both year) Significant increase in finance charges indicates overstatement of finance charges. Therefore, Occurrence and Accuracy assertions of finance charges are at risk. It may also indicate understatement of borrowings. Significant decrease in finance charges indicates understatement of finance charges. Therefore, Completeness and Accuracy assertions of finance charges are at risk. It may also indicate overstatement of borrowings. Risk Factor: Significant increase/decrease in Debtors’ Turnover Ratio in days compared to last year (i.e. Debtors/Sales * 360 for both year) Significant increase in debtors’ turnover days indicates that debtors may be overstated e.g. fake debtors may exist or poor debtors may exist from whom full recovery is not expected. Therefore, Existence and Valuation and Allocation assertions of Debtors are at risk. Significant decrease in debtors’ turnover days indicates that debtors may be understated. Therefore, Completeness assertion of debtors is at risk. However, there will be no risk in selling/operating expenses if increase/decrease is due to change in number of employees, advertisement and promotional schemes. However, there will be no risk in finance charges if increase/decrease is due to change in interest rates during the year. 9 By Muhammad Asif, ACA

- 19. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Risk Factor: Significant increase/decrease in Inventory’ Turnover Ratio in days compared to last year (i.e. Inventory/ Cost of Sales* 360 for both year) Significant increase in inventory turnover days indicates that Inventory may be overstated e.g. fake inventory may exist, or there may be incorrect valuation of inventory, or inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Existence and Valuation and Allocation assertions of Inventory are at risk. Significant decrease in inventory turnover days indicates that inventory may be understated e.g. some inventory may be omitted, or there may be incorrect valuation. Therefore, Completeness and Valuation and Allocation assertions of Inventory are at risk Risk Factor: Significant increase/decrease in Creditors’ Turnover Ratio in days compared to last year (i.e. Creditors/Purchases * 360 for both year) Significant increase in creditors’ turnover days indicates that creditors are overstated. Therefore, Existence assertion of Creditors is at risk. It also indicates that company is having financial problems and is unable to pay creditors timely. Significant decrease in creditors’ turnover days indicates that creditors may be understated. Therefore, Completeness assertion of Creditors is at risk. Risk Factor: Significant increase/decrease in current ratio compared to last year (i.e. Current Assets/Current Liabilities for both year) Significant increase in current ratio indicates overstatement of current assets or understatement of current liabilities. Therefore, Existence assertion of current assets and Completeness assertion of current liabilities are at risk. Significant decrease in current ratio indicates understatement of current assets or overstatement of current liabilities. Therefore, Completeness assertion of current assets and Existence assertion of current liabilities are at risk. Risk Factor: Ratios indicating liquidity or going concern problems of entity: 1. Decrease in Current Ratios 2. Decrease in NP ratio. 3. Decrease in interest coverage ratio (also called Times Interest Earned). 4. Increase in borrowings. However, there will be no risk in inventory if increase/decrease in days is due to change in methods of production and change in inventory levels to support future sales. However, there will be no risk in creditors if increase/decrease in days is due to change in credit period by suppliers. Exam Tip Risk Assessment through figures is to be done in the same order as given above i.e. first specific ratio and then general ratios. Exam Tip Turnover ratios (e.g. debtors /inventory/creditors turnover ratios) can be calculated in two ways i.e. in times or in days. You are advised to always calculate and interpret these ratios in days. 10 By Muhammad Asif, ACA

- 20. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Model Case Study From Examination Questions: Case Study – First Example In the planning phase of the audit of Dynamic Limited for the year ending 30 June 2012, you have calculated the following ratios from the management accounts of the company for the eight months ended 29 February 2012: Eight months period ended 29 February 2012 Year ended 30 June 2011 Year ended 30 June 2010 Gross profit percentage 35% 40% 40% Inventory turnover days 120 105 78 Current ratio 1.5 2.3 2.6 Quick asset ratio 0.78 1.6 1.7 Times interest earned 0.91 1.67 2.1 Debtors turnover days 132 86 68 Required: Identify the prospective audit risks which the auditor should consider while planning the audit. (09 marks) (CA Inter, Spring 2012) Suggested Solution: Risk Factor: Decrease in Gross Profit Percentage: Analysis of GP ratio can be subdivided into two aspects i.e. Sales and Cost of Sales. 1. Decrease in GP ratio indicates understatement of sales. Therefore, Completeness assertion of sales is at risk. 2. Decrease in GP ratio also indicates overstatement of Purchases. Therefore, Occurrence and Cut-off assertions of Purchases are at risk. Further, it may also indicate overstatement of Overheads and understatement of Closing stock. Risk Factor: Increase in Inventory turnover days: Significant increase in inventory turnover days indicates that Inventory may be overstated e.g. fake inventory may exist, or there may be incorrect valuation of inventory, or inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Existence and Valuation and Allocation assertions of Inventory are at risk. Risk Factor: Increase in Debtors turnover days: Significant increase in debtors’ turnover days indicates that debtors may be overstated e.g. fake debtors may exist or poor debtors may exist from whom full recovery is not expected. Therefore, Existence and Valuation and Allocation assertions of Debtors are at risk. Risk Factor: Decrease in Current ratio: Significant decrease in current ratio indicates overstatement of current liabilities. Therefore, Existence assertion of current liabilities is at risk. Further, this also indicates that entity is facing liquidity or going concern problems. Risk Factor: Liquidity problems of entity: Current ratio, quick asset ratio, times interest ratio and GP ratios are decreasing, which indicates company’s liquidity position is worsening. Therefore, there is a risk of management bias in financial statements (of next four months) to present best-view of financial statements, to increase personal wealth of management/shareholders. 11 By Muhammad Asif, ACA

- 21. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Case Study – Second Example You are the Audit Manager of Mustafa and Company, Chartered Accountants, responsible for the audit of Standard Home Appliances Limited, a listed company. Extracts from the company’s financial statements are presented below: 30-Sep-2012 30-Sep-2011 Income statement ----------Rs. in million--------- Revenue 1,190 1,174 Gross profit 509 537 Operating profit 242 227 Finance charges (77) (69) Profit before tax 165 158 Statement of financial position Property, plant and equipment 1,054 833 Intangible assets 140 100 Inventory 423 260 Trade receivables 417 250 Cash and bank balances 29 54 Total assets 2,063 1,497 Equity and liabilities Share capital 1 000 1 000 Retained earnings 218 233 Long-term borrowings 277 50 Liabilities against assets subject to finance lease 180 - Bank overdraft 185 52 Trade and other payables 203 162 Total equity and liabilities 2,063 1,497 During the year, the company has introduced various products based on latest technologies. These new products are being manufactured on a new plant which has been acquired under a lease agreement for a period of four years. The plant commenced operations on 01 January 2012. The useful life of the plant is 5 years. Intangible assets represent cost of software installed and designs which have been acquired from a renowned multinational company. Required: Identify and evaluate the audit risks in the above situation. (12 marks) (CA Final, Winter 2012) Suggested Solution: Risk Factor: Stagnant Revenue despite launch of various new products There has been only 1% increase in sales (1,190/1,174) despite launch of various new products this year based on latest technologies. It indicates sales may be understated. Therefore, Completeness assertion of sales is at risk. Further, it also indicates that new products have not been successful or demand for existing products have decreased, and indicates inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Valuation and Allocation assertion of Inventory is also at risk. Further, new plant purchased for new products may also have become impaired as its value in use has decreased if new products are not successful. Risk Factor: Increase in Cost of Sales (as %age of Sales) Increase in cost of sales (681/1,190= 57.23% as compared to last year 637/1,174= 54.23%) may be because of 12 By Muhammad Asif, ACA

- 22. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment depreciation of new plant, but it also indicates overstatement of purchases or overheads. Further, it may indicate understatement of closing stock. Risk Factor: Decrease in operating expenses(as %age of Sales) Decrease in operating expenses (267/1,190 = 22.4% as compared to last year 310/1,174 = 26.4%) indicates understatement of operating expenses (specially advertisement and sales related cost should increase when new products are launched). It also indicates misclassification between operating expenses and cost of sales. Risk Factor: Decrease in finance charge (as %age of borrowings) Decrease in finance charge (77/642=11.99% as compared to last year 69/102=67.65%) indicates understatement of finance charges. Therefore, Completeness and Accuracy assertions of finance charges are at risk. It may also indicate overstatement of borrowings. Risk Factor: Increase in Inventory Turnover Days: Increase in inventory turnover days (423/1,190*360 = 128 days as compared to last year 260/1,174*360 = 80 days) indicates that Inventory may be overstated e.g. fake inventory may exist, or there may be incorrect valuation of inventory, or inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Existence and Valuation and Allocation assertions of Inventory are at risk. Risk Factor: Increase in Debtors Turnover Days: Increase in debtors turnover days (417/1,190*360 = 126 days as compared to last year 250/1,174*360 = 77 days) indicates that debtors may be overstated e.g. fake debtors may exist or poor debtors may exist from whom full recovery is not expected. Therefore, Existence and Valuation and Allocation assertions of Debtors are at risk. Risk Factor: Intangible assets recognized and purchased by company: Intangible assets may not have met recognition criteria, or may be incorrectly valued because of subjectivity and complexity in valuation (e.g. issue of useful life, issue of internal expenses). Therefore, Valuation and Allocation assertion of Intangible Assets is at risk. Risk Factor: Increased level of borrowing: Deteriorating current ratio and increased level of borrowing which indicates company’s liquidity position is worsening. 13 By Muhammad Asif, ACA

- 23. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment Case Study – Third Example You are the audit senior of Rhino & Co and you are planning the audit of Kangaroo Construction Co (Kangaroo) for the year ended 31 March 2013. Kangaroo specialises in building houses and provides a five-year building warranty to its customers. Your audit manager has held a planning meeting with the finance director. He has provided you with the following notes of his meeting and financial statement extracts: Kangaroo has had a difficult year; house prices have fallen and, as a result, revenue has dropped. In order to address this, management has offered significantly extended credit terms to their customers. However, demand has fallen such that there are still some completed houses in inventory where the selling price may be below cost. During the year, whilst calculating depreciation, the directors extended the useful lives of plant and machinery from three years to five years. This reduced the annual depreciation charge. The directors need to meet a target profit before interest and taxation of $0·5 million in order to be paid their annual bonus. In addition, to try and improve profits, Kangaroo changed their main material supplier to a cheaper alternative. This has resulted in some customers claiming on their building warranties for extensive repairs. To help with operating cash flow, the directors borrowed $1 million from the bank during the year. This is due for repayment at the end of 2013. Financial statement extracts for year ended 31 March DRAFT ACTUAL 2013 2012 $m $m Revenue 12.5 15.0 Cost of sales (7.0) (8.0) Gross profit 5.5 7.0 Operating expenses (5.0) (5.1) Profit before interest and taxation 0.5 1.9 Inventory 1·9 1·4 Receivables 3·1 2·0 Cash 0.8 1·9 Trade payables 1·6 1·2 Loan 1·0 – Required: Using the information above: (i) Calculate FIVE ratios, for BOTH years, which would assist the audit senior in planning the audit; and (05 marks) (ii) Using the information provided and the ratios calculated, identify and describe FIVE audit risks and explain the auditor’s response to each risk in planning the audit of Kangaroo Construction Co. (10 marks) (ACCA F8 – June 2013) Suggested Solution: (i) Ratio Formula Calculation 2013 2012 Gross Profit Ratio G.P. / Sales 44.0% 46.7% Net Profit Ratio N.P./Sales 4.0% 12.7% Inventory Turnover Ratio (days) Inventory/Cost of Sales * 360 97.7 63.0 Debtors Turnover Ratio (days) Debtors/Sales * 360 89.3 48.0 Current Ratio Current Assets/Current Liabilities 2.2 4.4 Quick Asset Ratio Current Assets - Inventory /Current Liabilities 1.5 3.3 14 By Muhammad Asif, ACA

- 24. Auditing – Case Studies Chapter 10 Understanding of Entity and Inherent Risk Assessment (ii) Risk Factor: Fall in demand of houses, Fall in price of houses, Increase in Inventory turnover days: Inventory may have become obsolete requiring write-down of inventory from cost to NRV. Therefore, Valuation and Allocation assertion of Inventory is at risk. Risk Factor: Extension in credit terms to customers and Increase in debtors’ turnover days Poor debtors may exist from whom full recovery is not expected. Therefore, Valuation and Allocation assertion of Debtors is at risk. Risk Factor: Change in useful life of fixed assets: Increase in useful life from 3 to 5 years may be unreasonable, to increase profit. Therefore, Valuation and Allocation assertion of fixed assets is at risk. Risk Factor: Management’s annual bonus based on target profit: There is a risk of management bias to manipulate financial statements, to increase personal wealth of management. Risk Factor: Shift to cheap supplier and increase in claims for warranty: Warranty may be incorrectly calculated because it involves estimation and complexity. Therefore, Accuracy assertion of Warranty is at risk. Risk Factor: Loan from Bank: Split of loan between current and non-current portion, and disclosures (e.g. charges on assets) may be inappropriately included in financial statements. Therefore, Presentation and Disclosure assertions of loan are at risk. Risk Factor: Liquidity problems of entity: Current ratio, and quick asset ratio are decreasing, which indicates company’s liquidity position is worsening. (Note for students: In this chapter, you are expected to learn only to identify and explain audit risks. Therefore, requirement relating to auditor’s response to each risk will be discussed in chapter # 12 Substantive Procedures.) 15 By Muhammad Asif, ACA