- Reverse charge mechanism was first introduced in 1997 for goods transport agencies and clearing agents but was struck down by the Supreme Court. It was reintroduced in 2000 and 2003 and upheld by the Supreme Court.

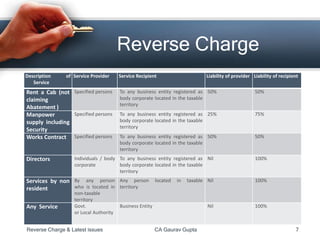

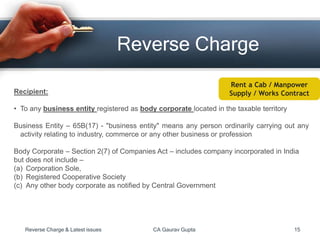

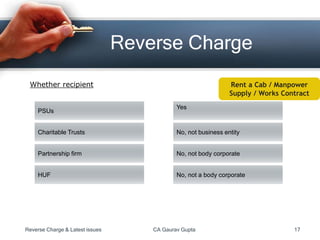

- As of July 2012, reverse charge was expanded to apply to 11 additional services including rent a cab, manpower supply, works contract, legal services, and services provided by non-residents.

- Under reverse charge, the liability to pay service tax shifts from the service provider to the service recipient. The recipient must register and file returns under reverse charge.

![Reverse Charge

• First sought to be introduced in 1997 for GTA and clearing Agents

• Finance Act, 1994 was not amended to provide for liability of payment service recipient and

amendment was primarily sought by amending Rules

• Held as ultravires the Act by Apex Court in Laghu Udyog Bharati (2006) (2) STR 276 (SC)

• Reintroduced by amendments in charging section vide amendments in 2000 and 2003

• This time upheld by Apex Court in Gujarat Ambuja Cement Ltd. 2006 (3) STR 608 (SC).

• Validity of the collection of service tax from service receiver was upheld in the case of All

India Tax Payers Welfare vs Union Of India [(2006) 205 CTR Mad 360, 2006 4 STR 14]

Reverse Charge & Latest issues CA Gaurav Gupta 3](https://image.slidesharecdn.com/reversecharge-160618061326/85/Reverse-charge-3-320.jpg)