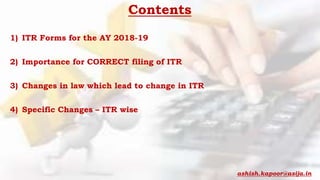

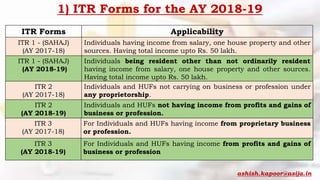

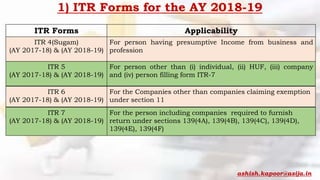

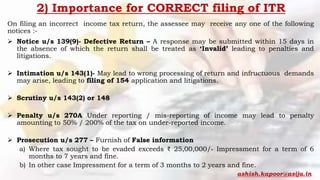

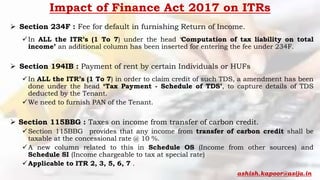

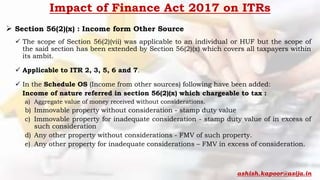

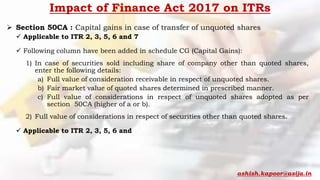

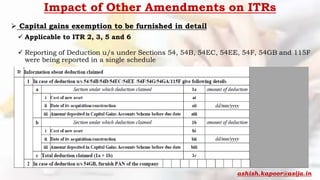

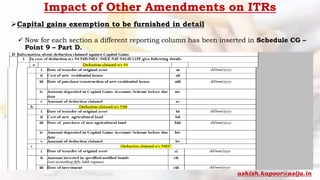

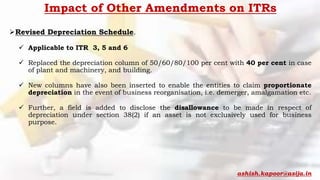

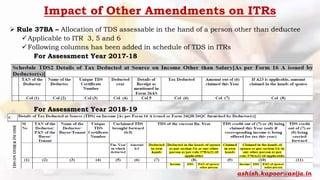

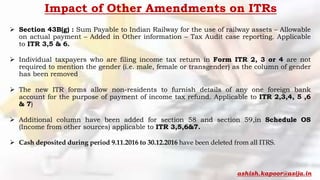

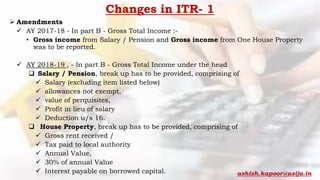

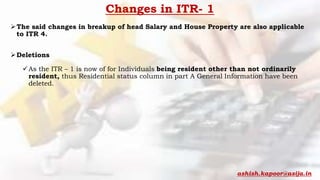

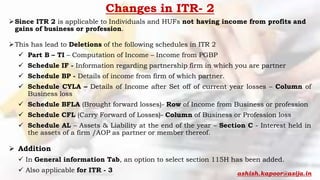

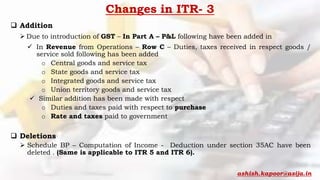

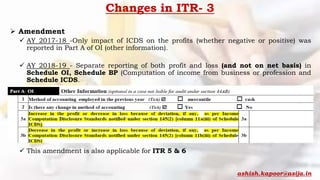

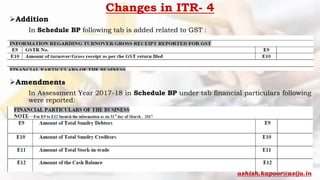

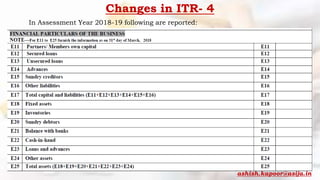

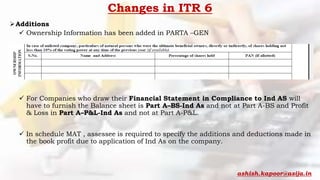

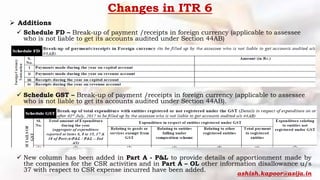

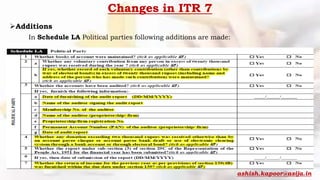

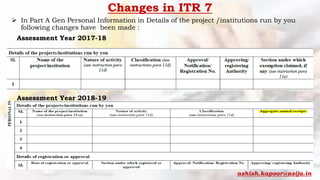

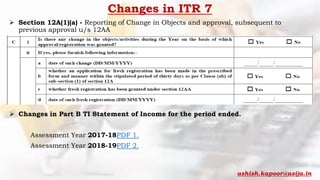

This document discusses the changes to the Income Tax Return (ITR) forms for the Assessment Year 2018-19 compared to the previous year. It covers changes to the applicable ITR forms based on income type, the importance of correctly filing ITR to avoid penalties, changes in law that led to ITR form changes, and specific changes made to ITR forms 1 through 3. Key changes include additional reporting requirements for capital gains, section 50CA, and section 56(2)(x) income.