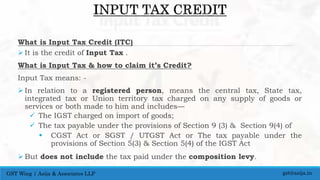

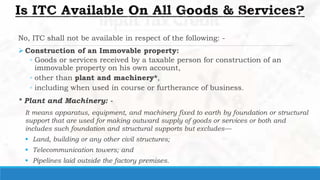

1. The document discusses the rules around input tax credit (ITC) under the CGST Act. ITC is a credit for taxes paid on inputs and can be claimed by registered taxpayers.

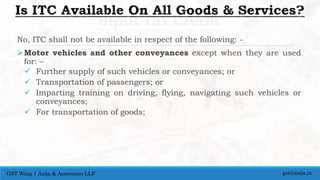

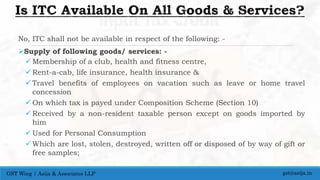

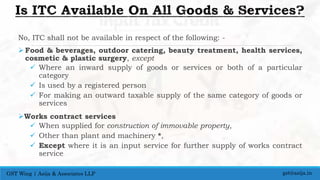

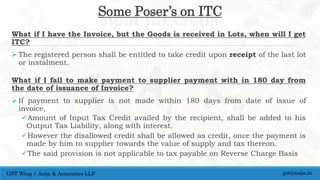

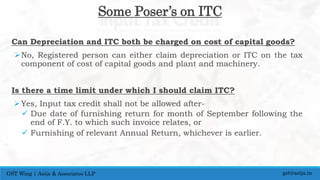

2. To claim ITC, the input must be used for business purposes. Certain items like motor vehicles and membership fees do not qualify for ITC. ITC must be claimed within a certain timeframe.

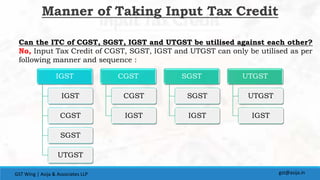

3. The document outlines conditions for claiming ITC such as possessing valid documents and ensuring tax has been paid. ITC of CGST, SGST, IGST, and UTGST can only be utilized in a certain manner.