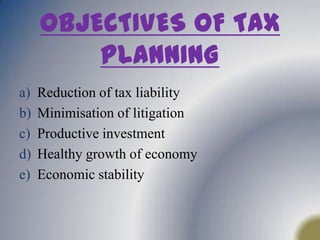

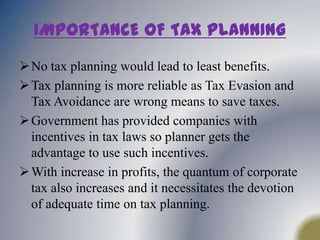

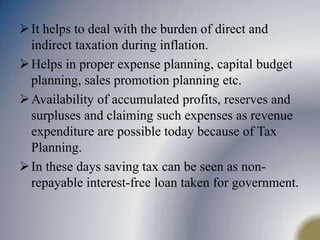

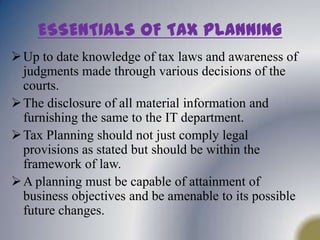

Tax planning involves legally arranging one's financial affairs to minimize tax liability and takes advantage of deductions and exemptions allowed by law. It is different from tax avoidance and tax evasion which are not legitimate ways to reduce taxes. Tax planning works within the legal framework while tax avoidance uses loopholes and may be illegitimate. Tax evasion involves illegally underreporting income or overreporting expenses. The objectives of tax planning are to reduce liability, minimize litigation and support economic growth. It is important for taxpayers to understand tax laws and plan accordingly to maximize benefits.