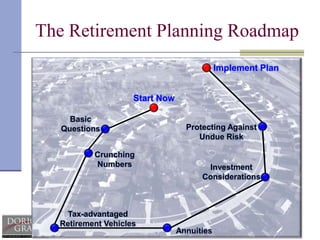

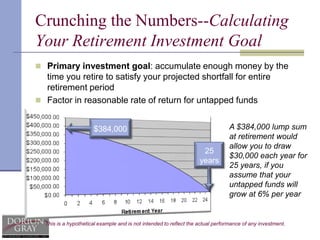

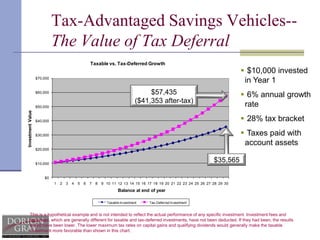

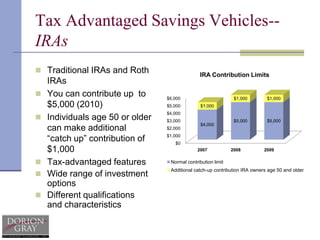

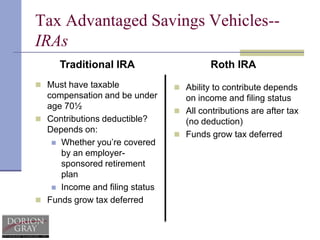

This document provides an overview of retirement planning and considerations. It discusses starting retirement planning early, estimating expenses and income, identifying savings goals, using tax-advantaged accounts like 401ks and IRAs, factors like inflation, diversifying investments, and protecting against risks with insurance. The key aspects are starting retirement planning as soon as possible, crunching numbers to calculate savings needs, and implementing a long-term strategy using various savings vehicles and accounts.