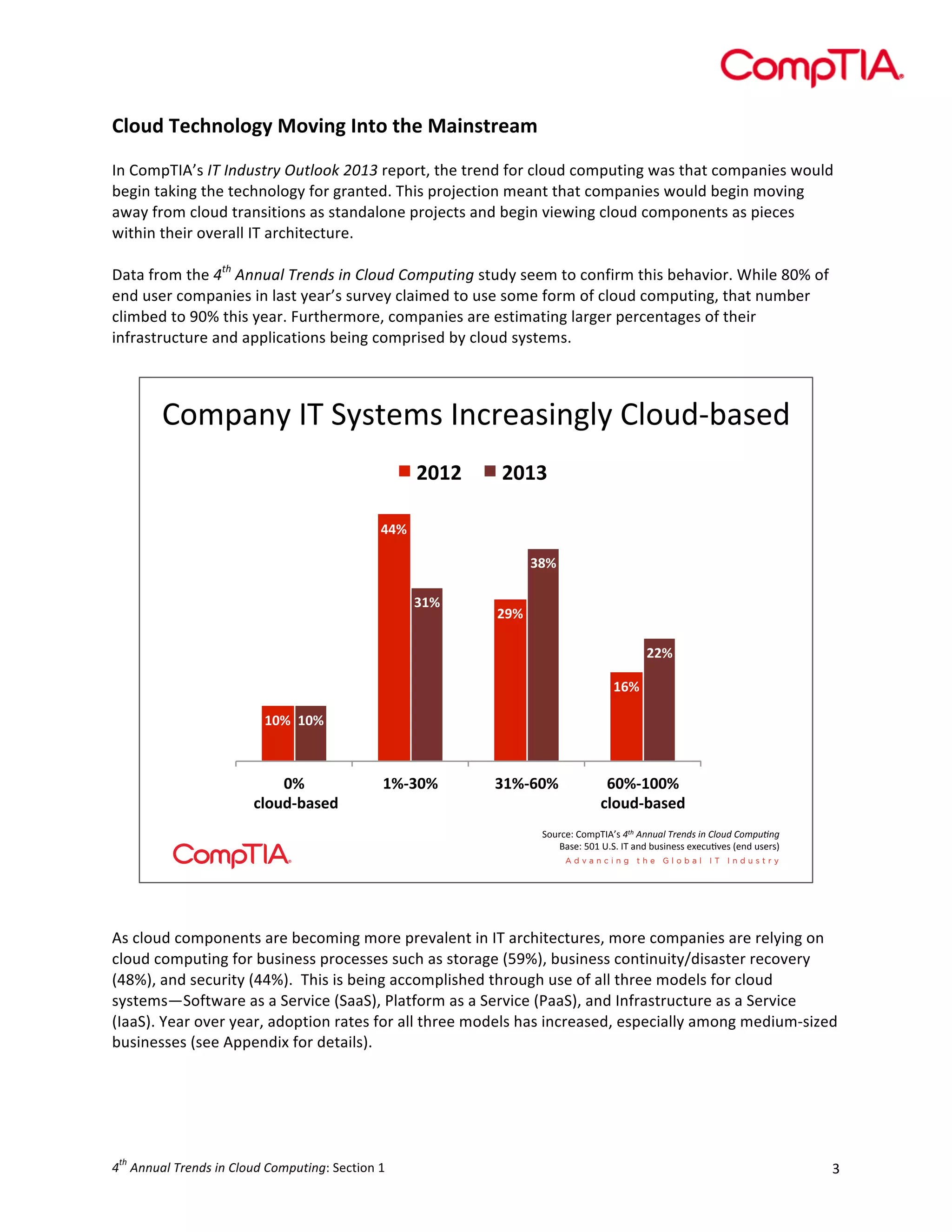

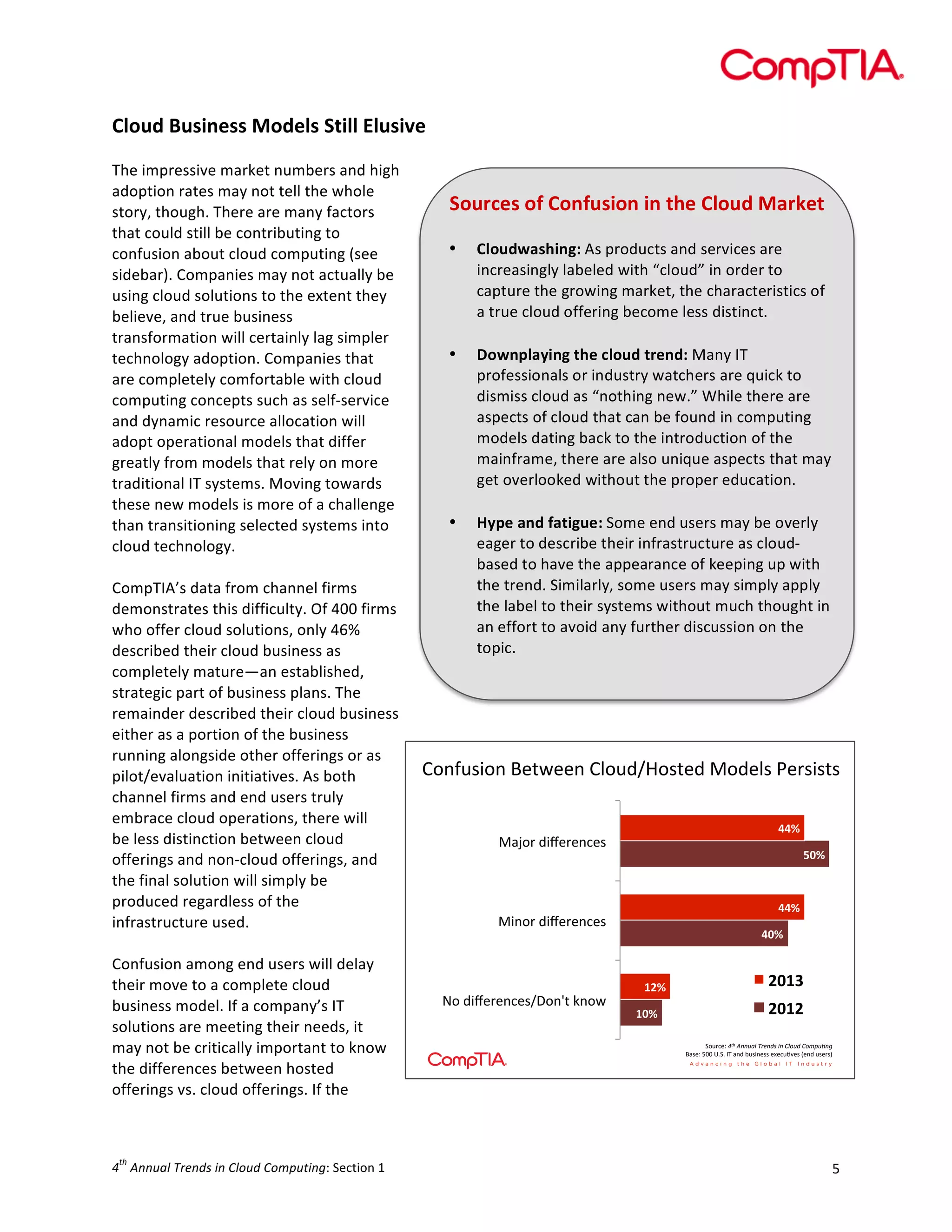

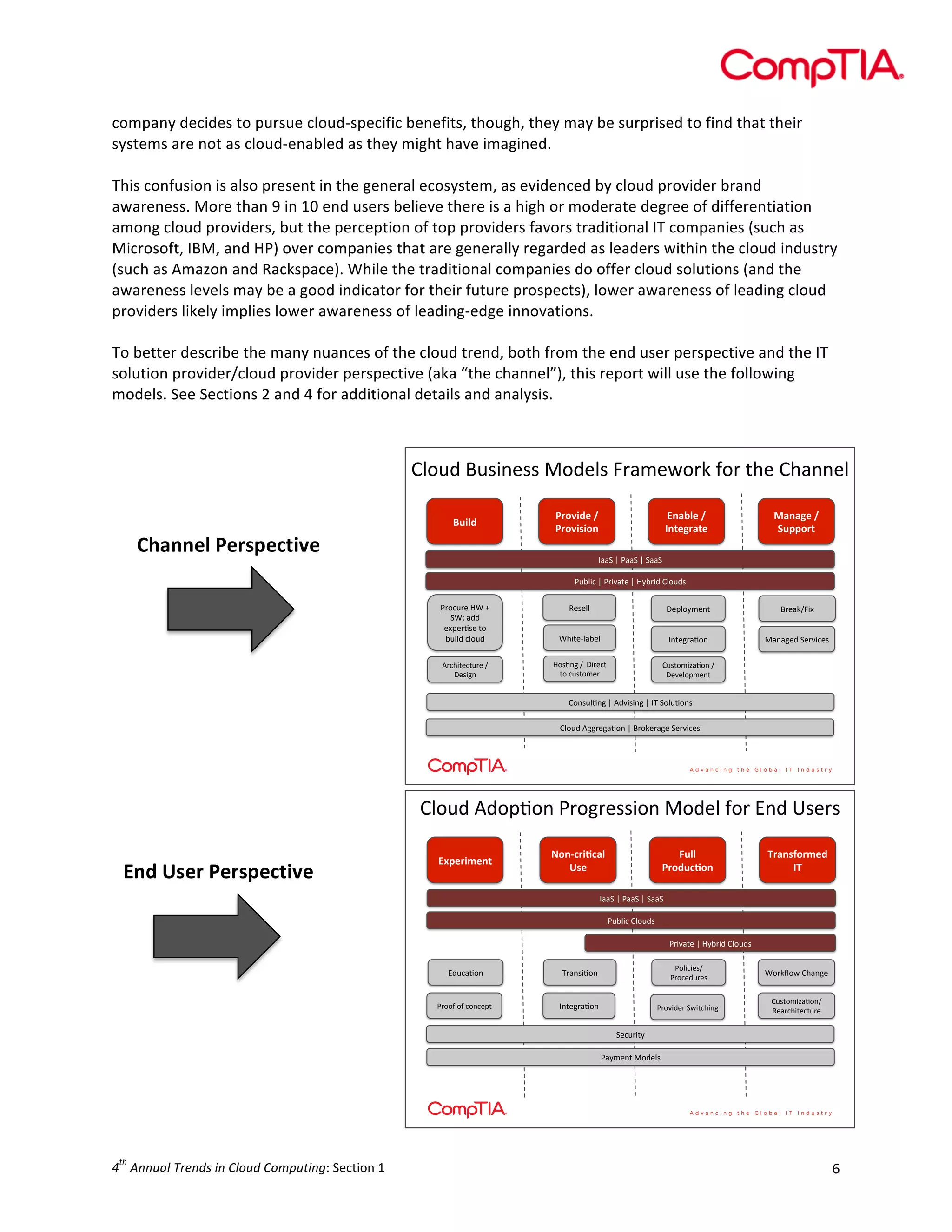

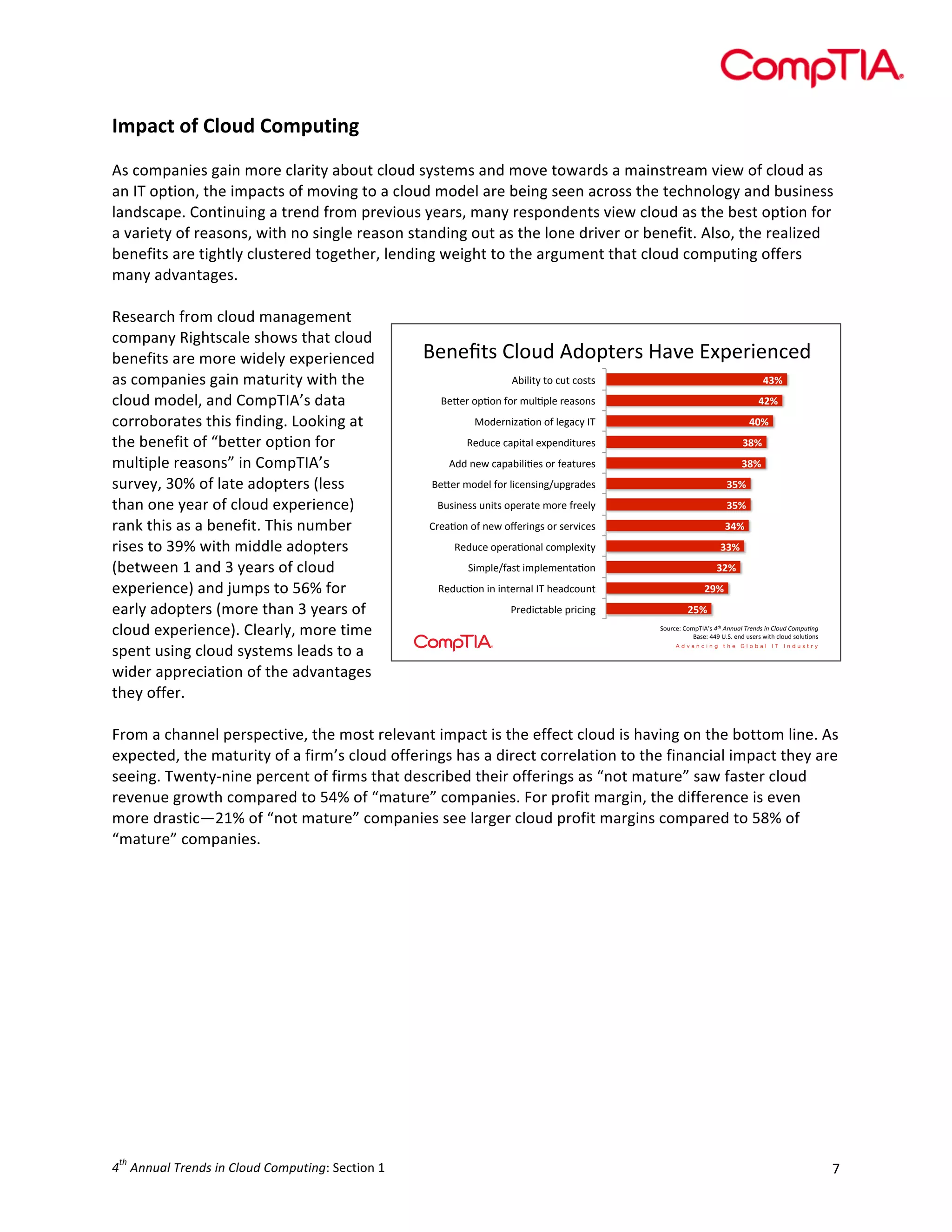

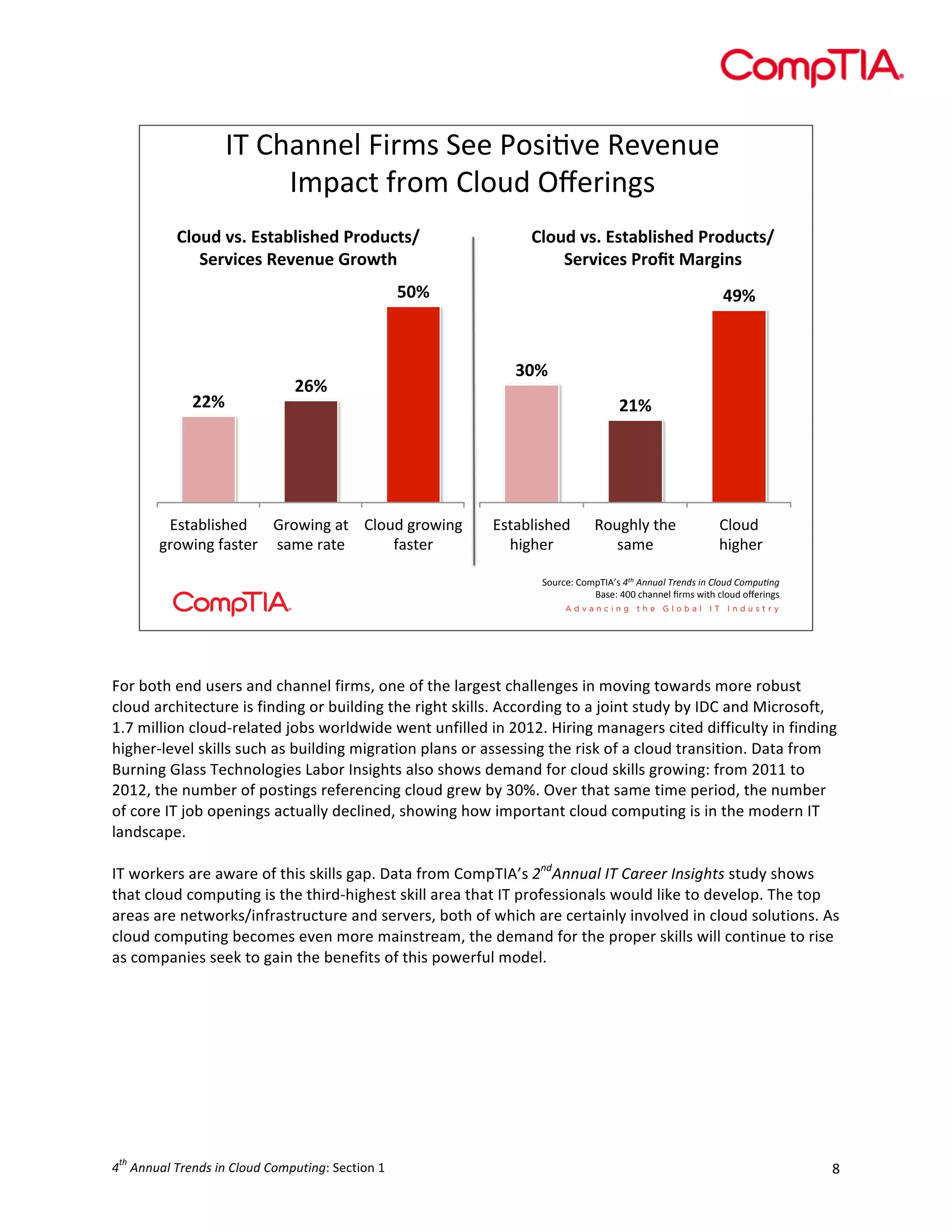

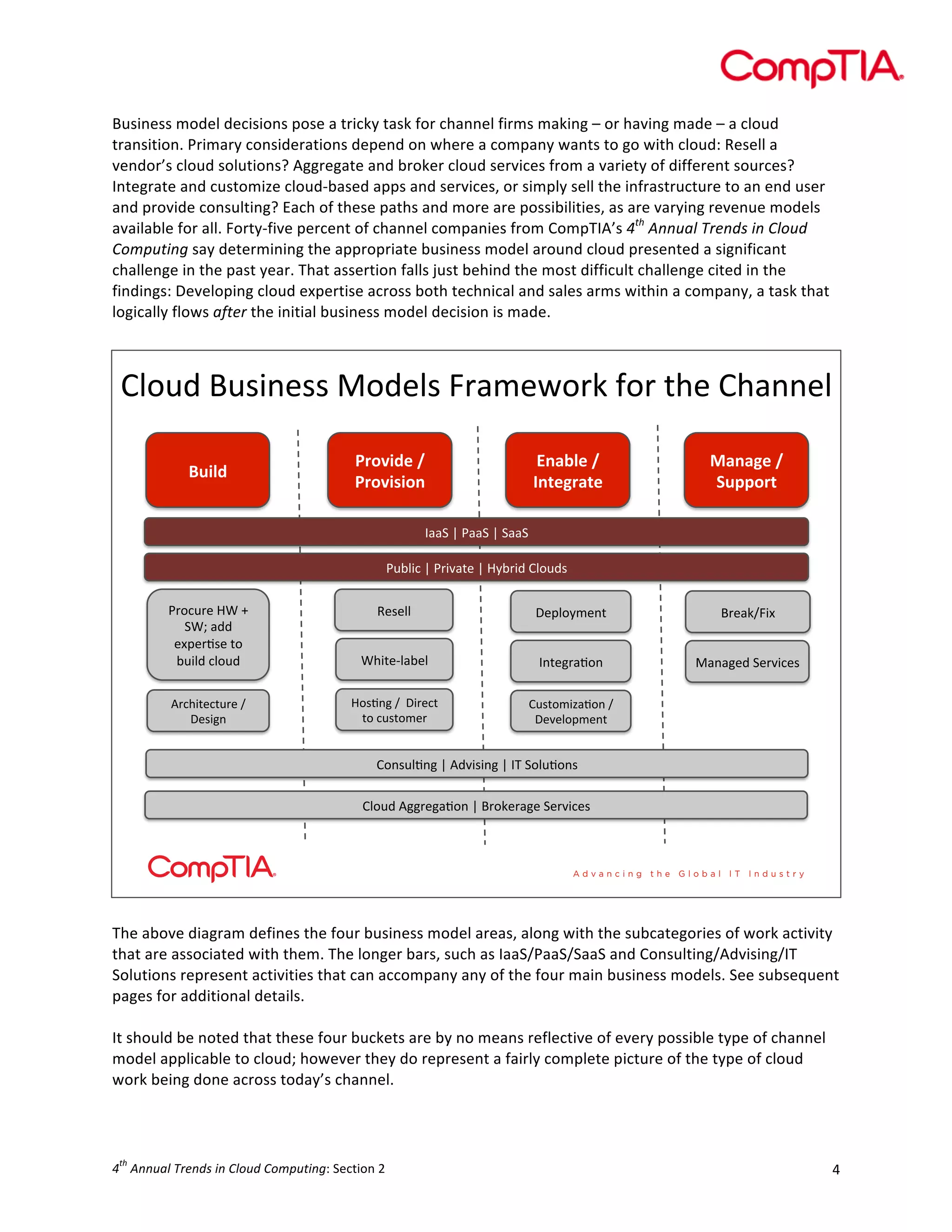

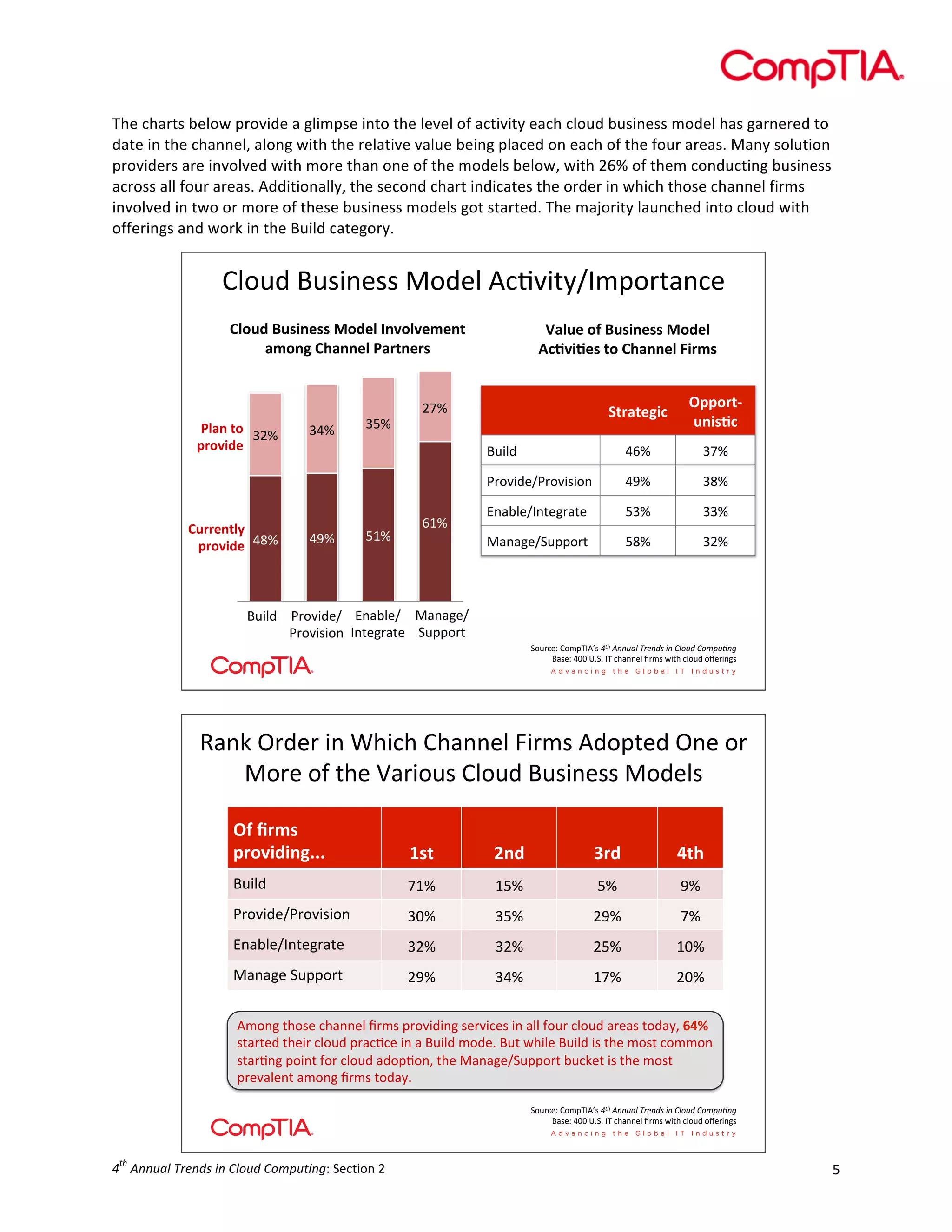

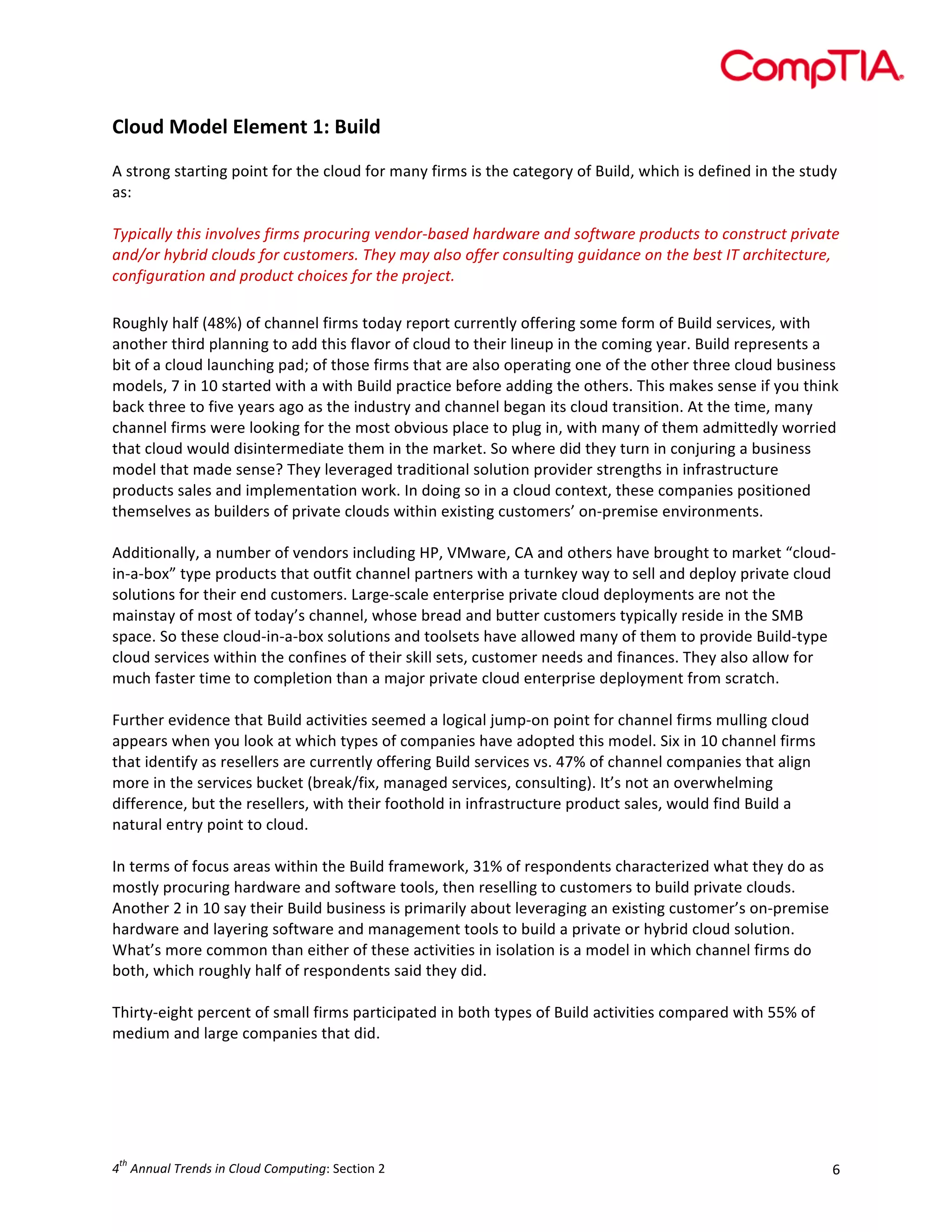

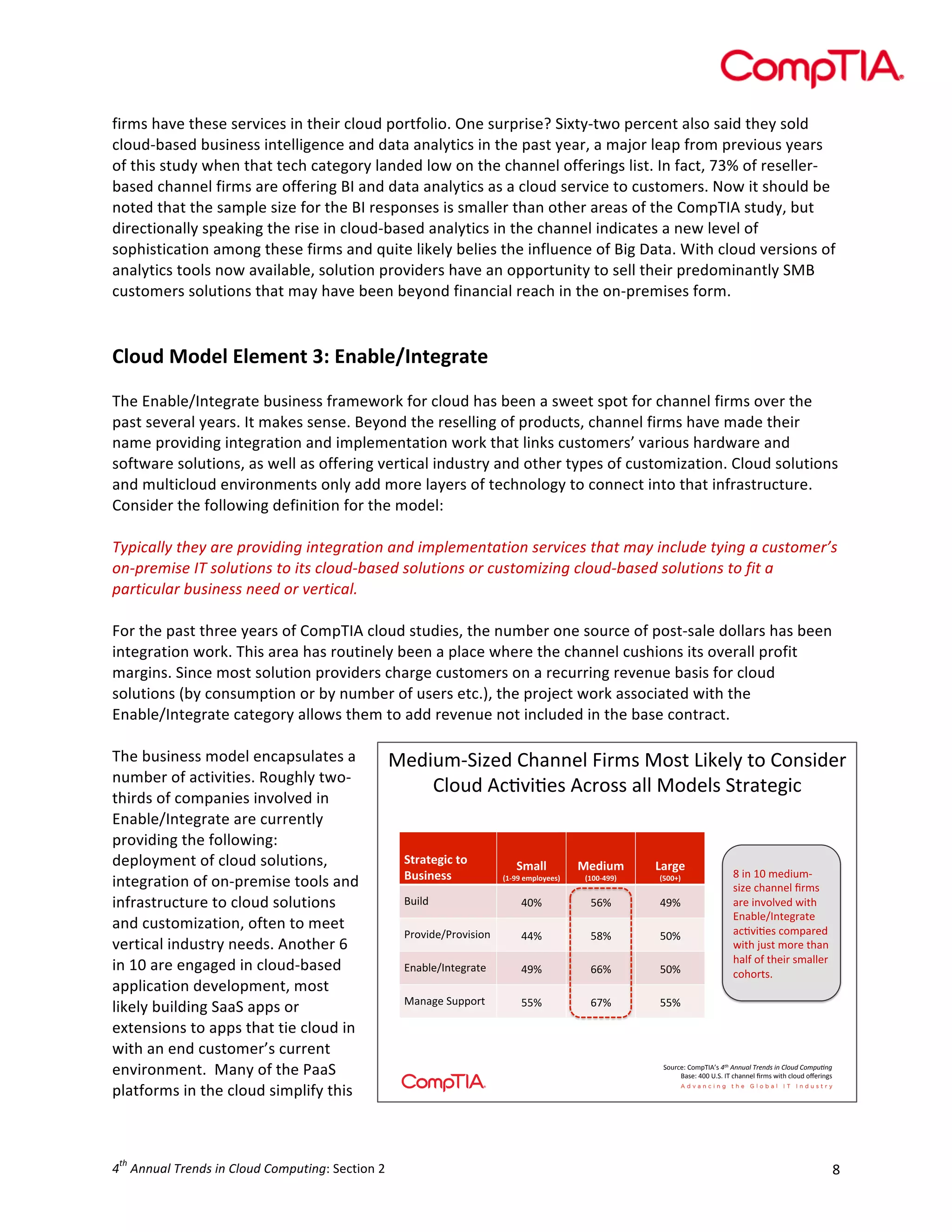

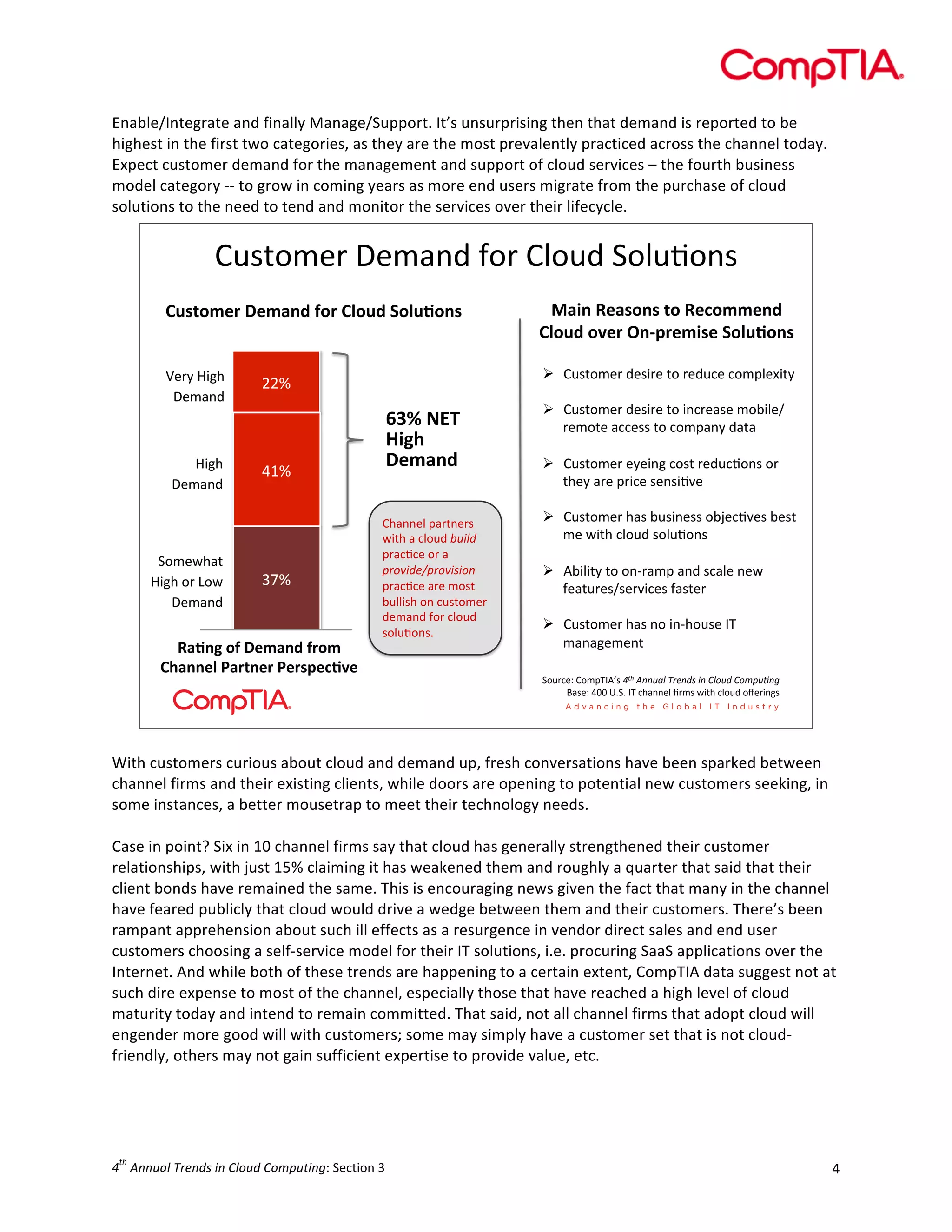

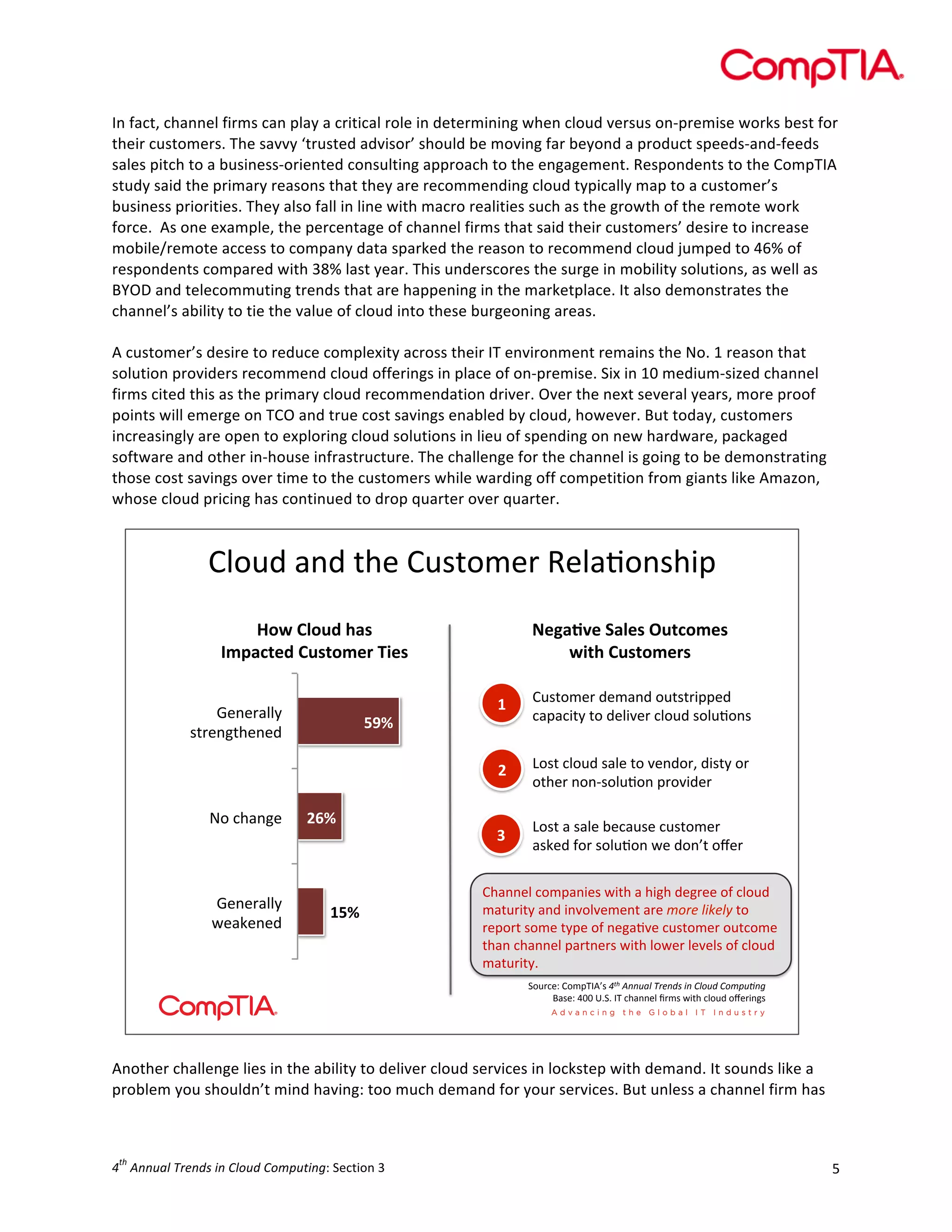

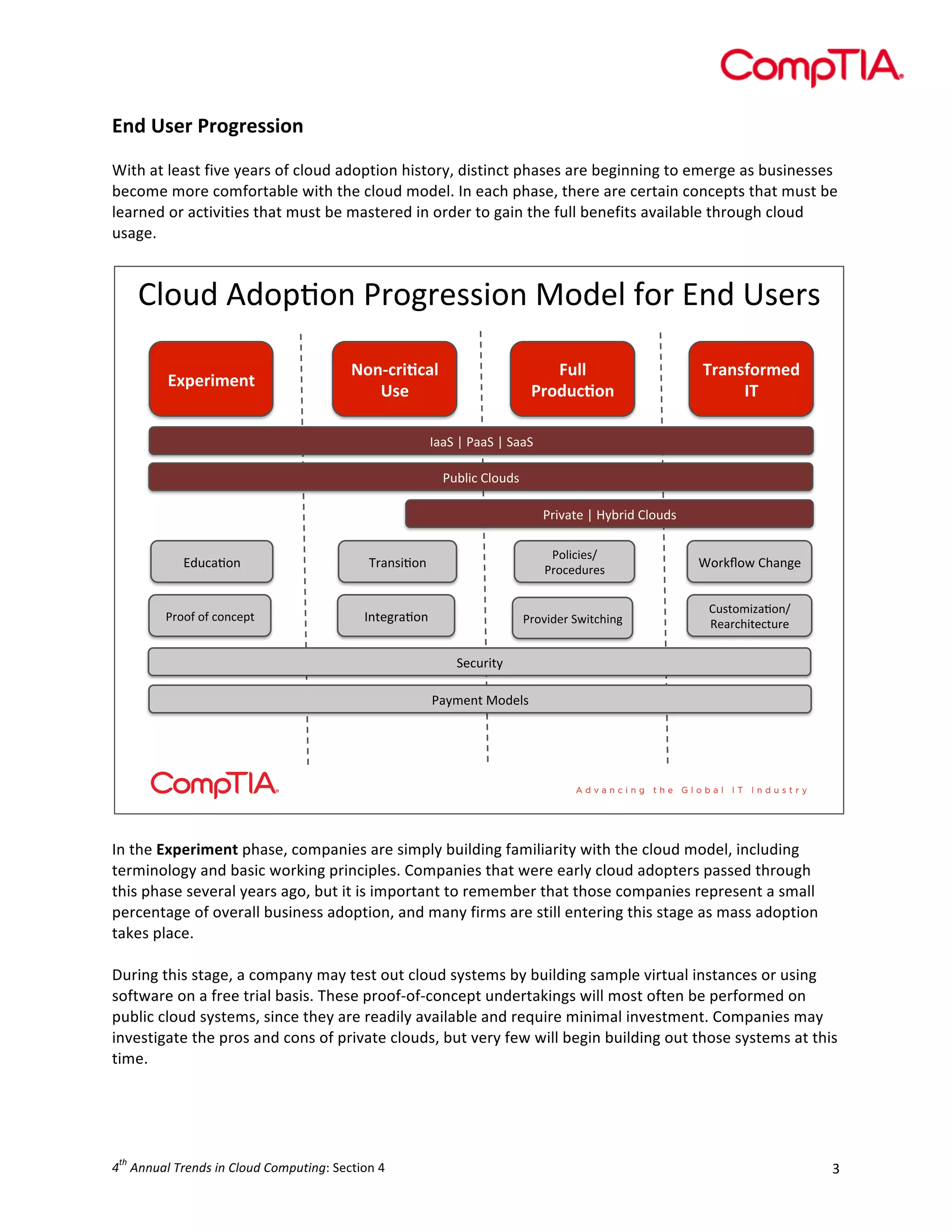

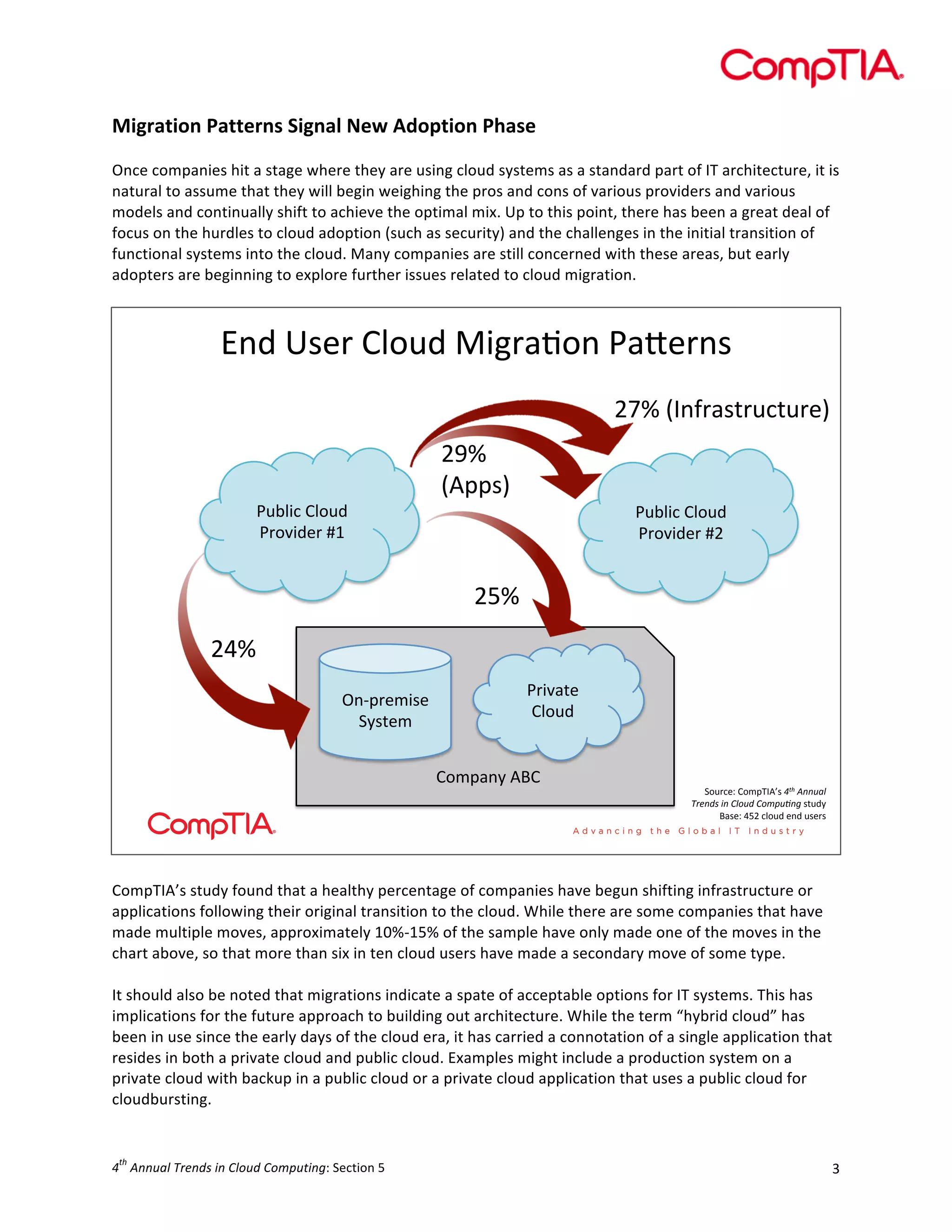

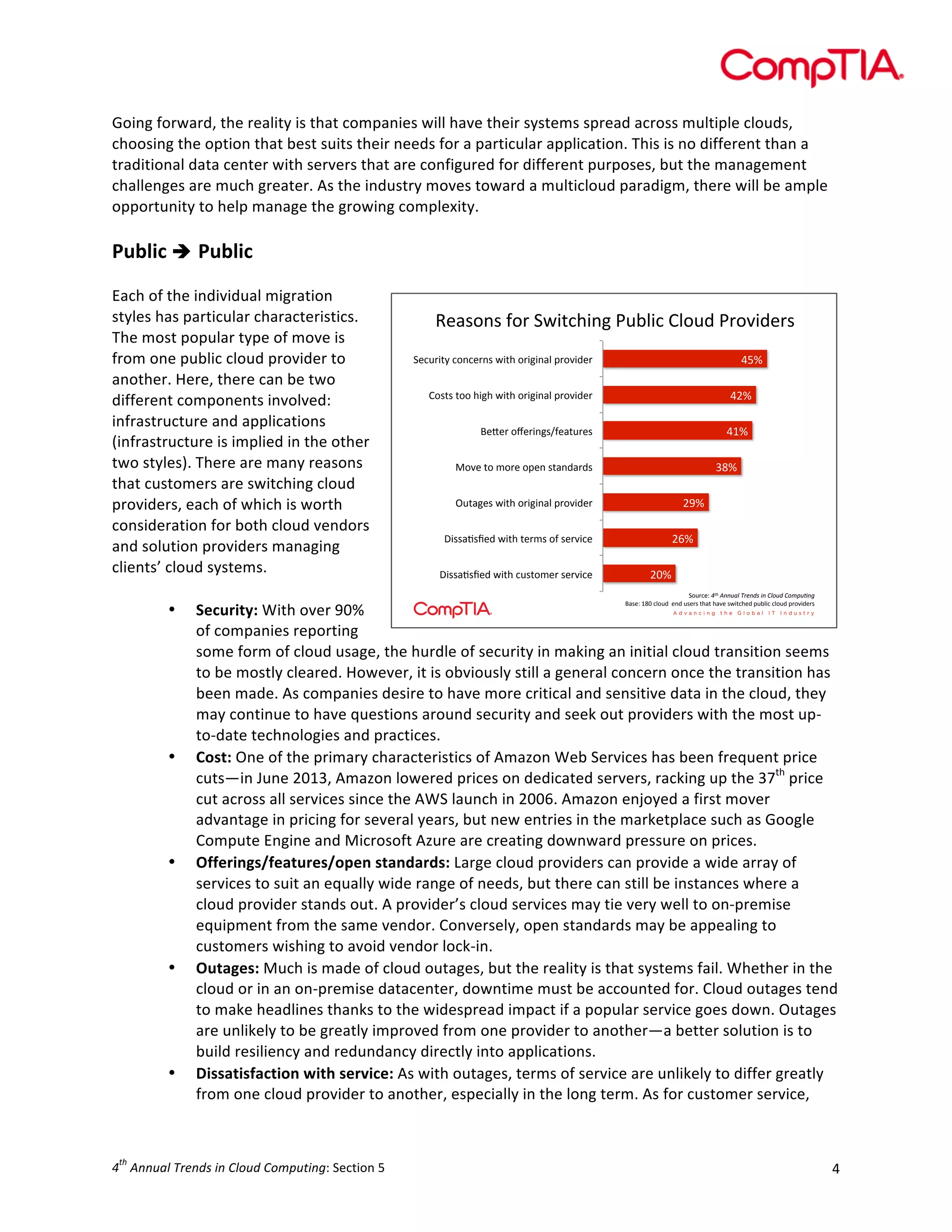

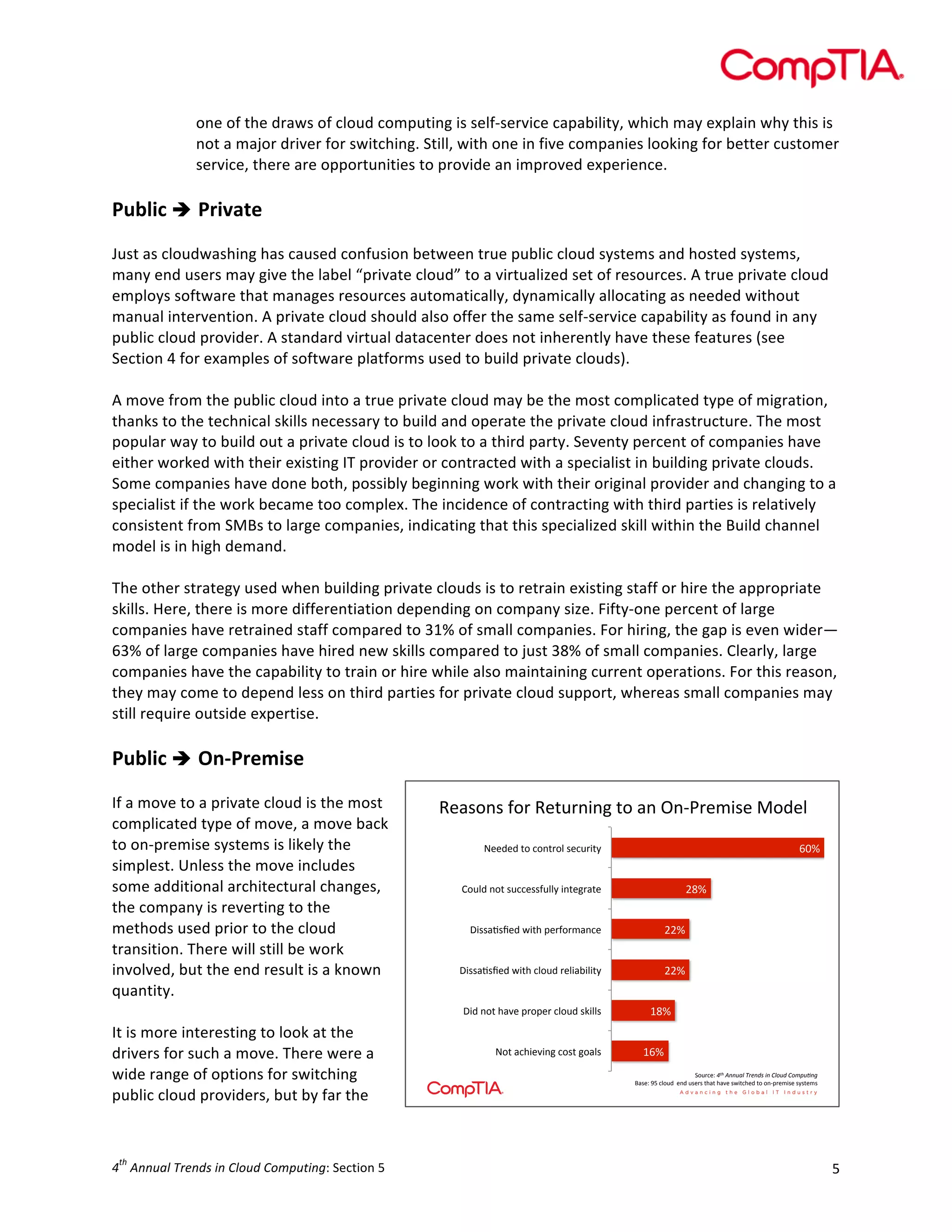

This document summarizes key findings from CompTIA's 4th Annual Trends in Cloud Computing study. The study surveyed 501 IT professionals and 400 IT firms to assess cloud adoption trends. It found that cloud computing is becoming mainstream, with most companies now relying on cloud services for storage, disaster recovery, and security. However, some confusion remains regarding cloud models and terminology. While adoption is high, only 46% of IT firms described their cloud business as fully mature. The impact of cloud computing continues to drive both end users and IT firms to better understand cloud and move toward more strategic cloud integration.