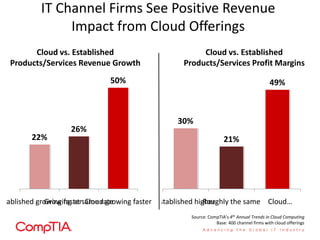

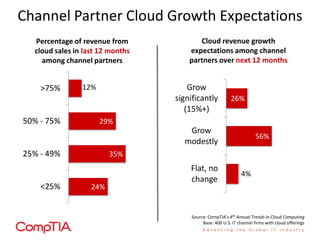

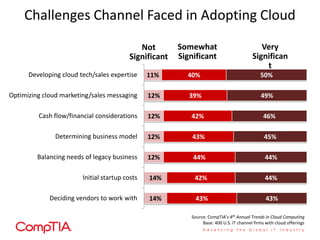

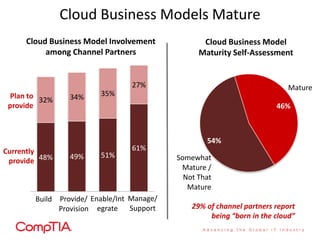

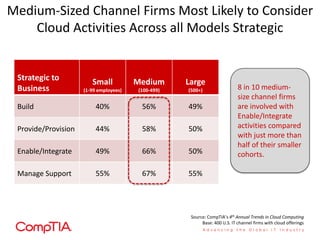

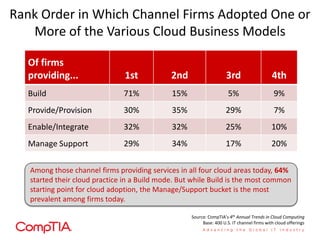

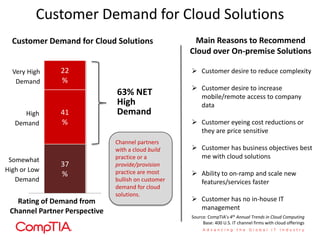

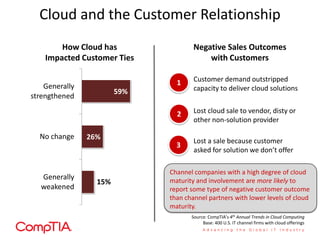

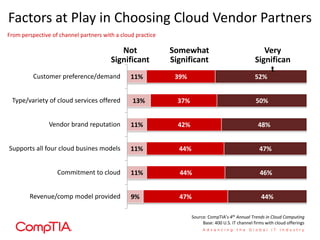

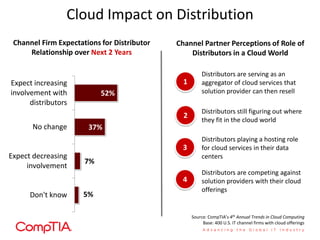

The document summarizes findings from CompTIA's 4th Annual Trends in Cloud Computing report. It finds that the majority of IT channel firms see their cloud offerings having a positive revenue impact. Most channel partners expect their cloud revenue to grow over the next 12 months. Medium-sized channel firms are most likely to consider cloud activities like integration, provisioning and support as strategic. The top challenges for channel firms in adopting cloud are deciding on vendors and balancing needs of legacy businesses. Customer demand is driving channel partners' recommendations of cloud over on-premise solutions.