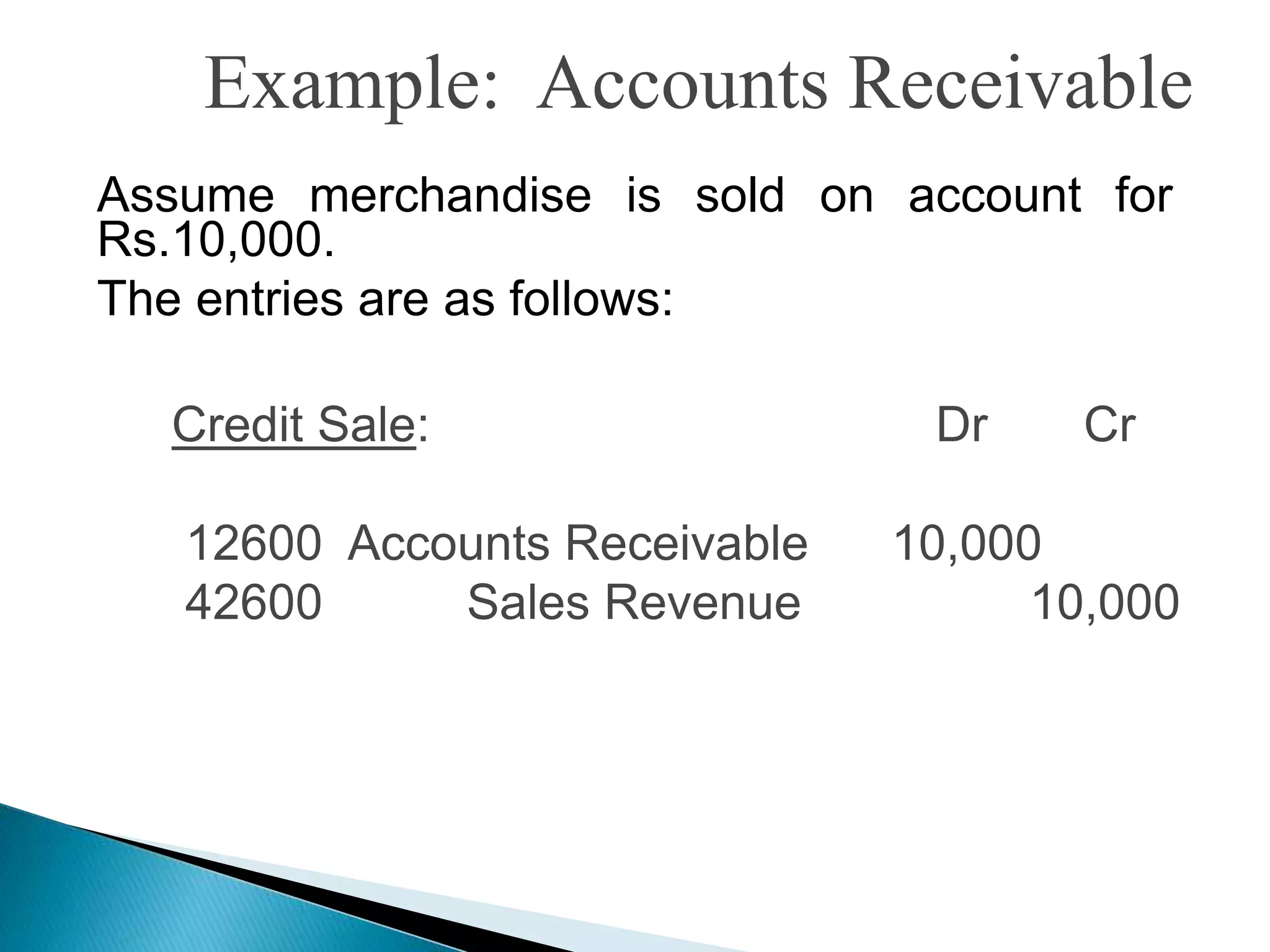

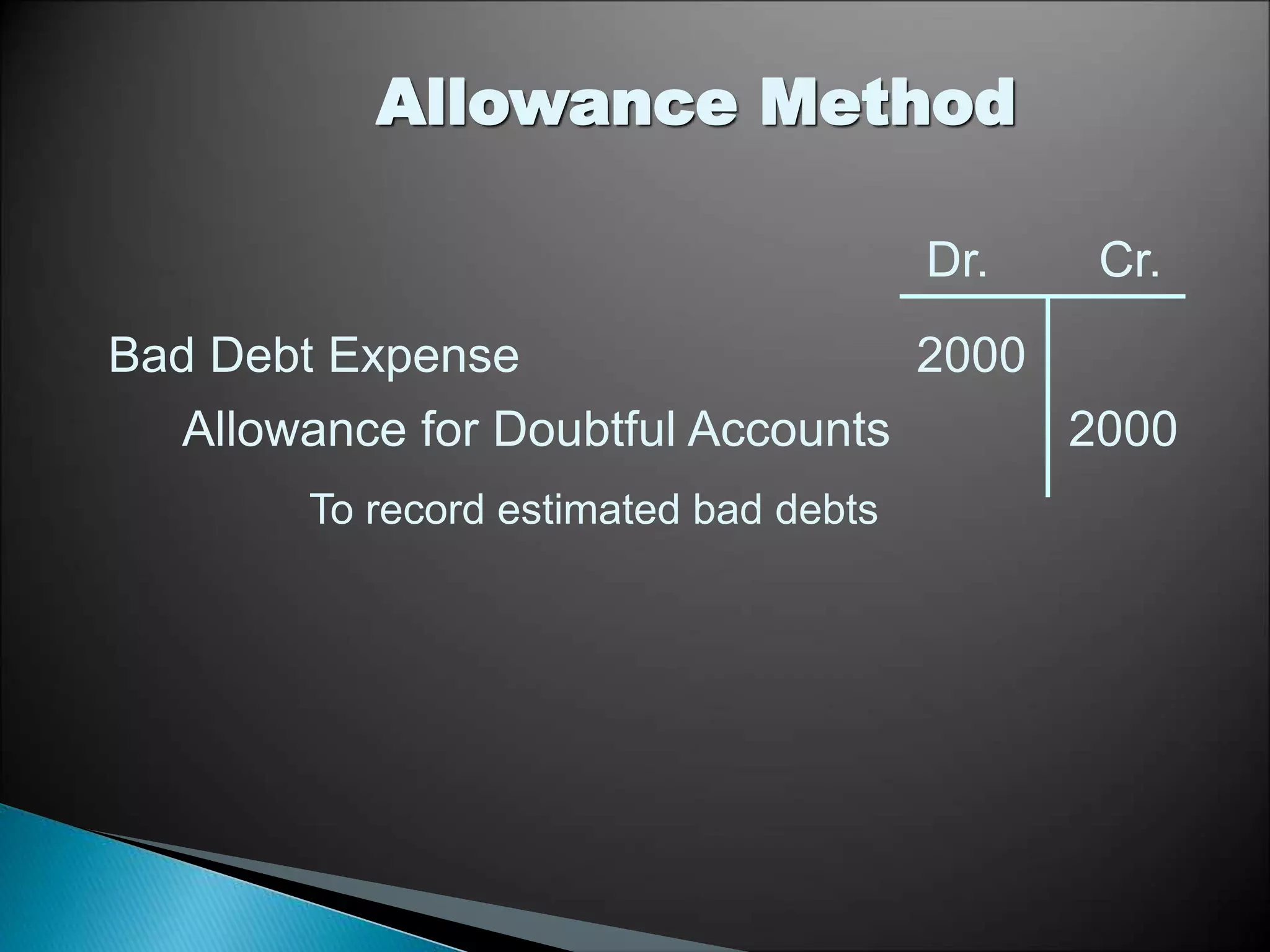

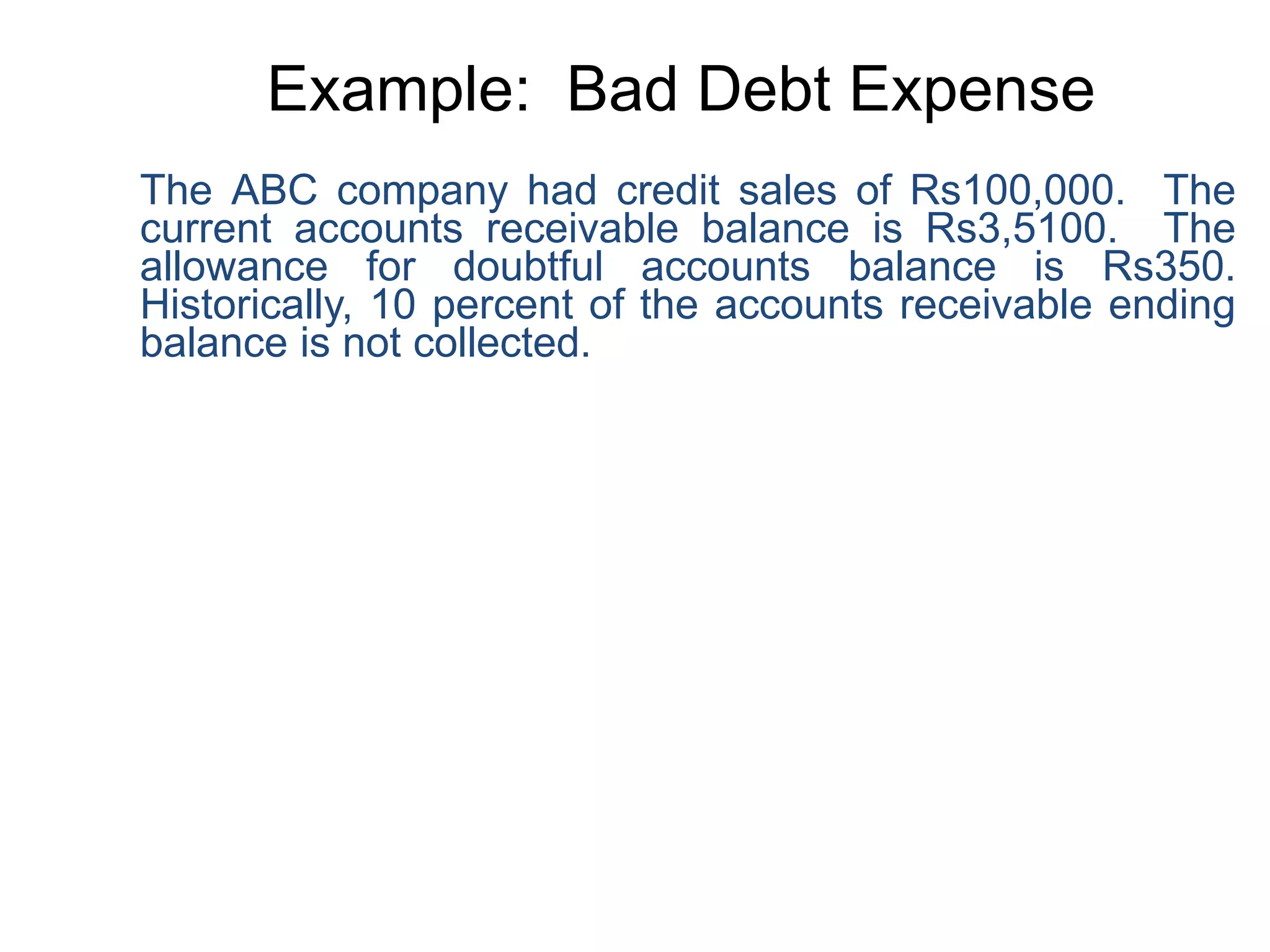

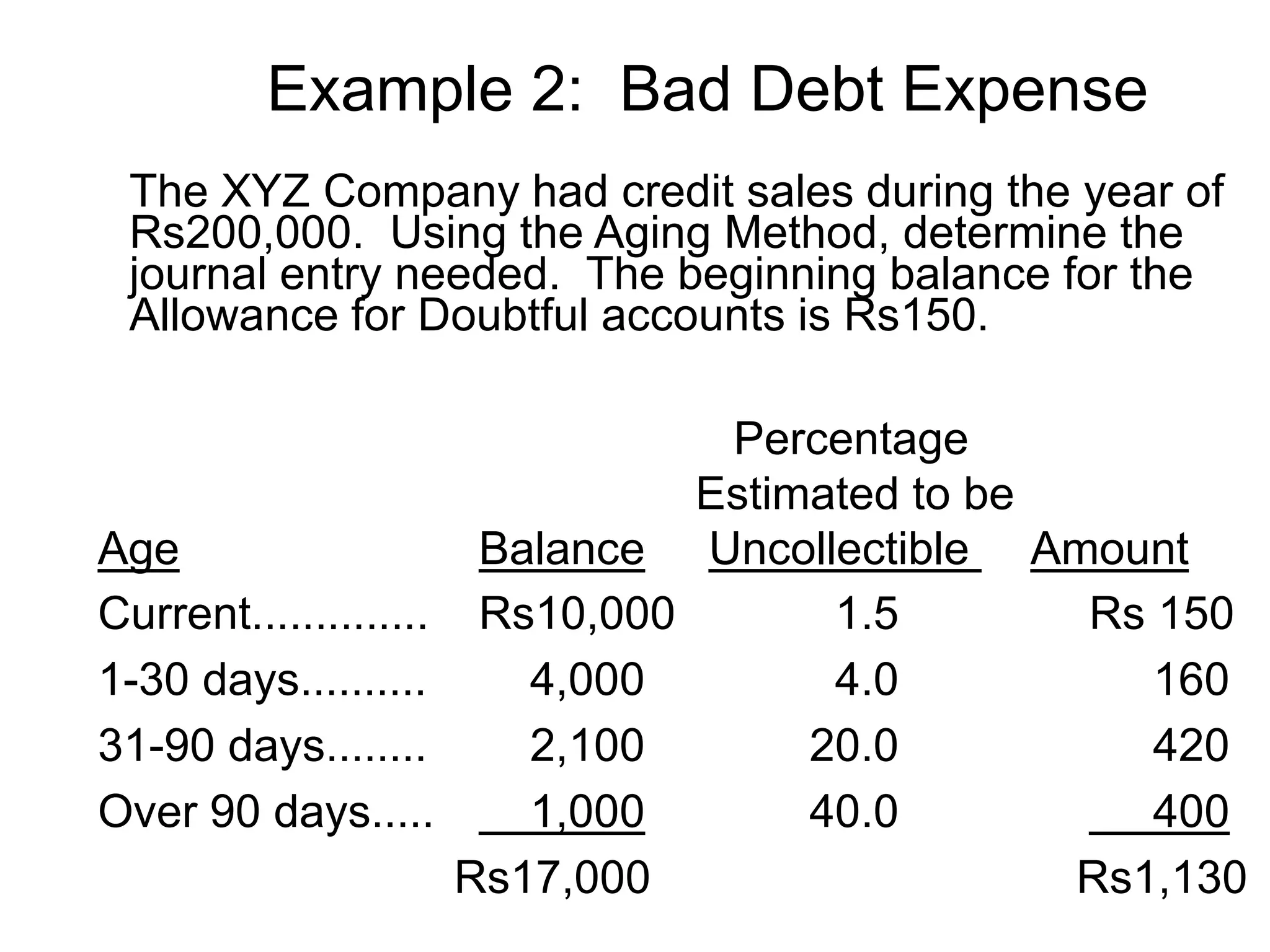

The document discusses accounts receivable, bad debts, and the allowance method for estimating uncollectible accounts receivable. It defines accounts receivable as amounts owed to a company for goods or services sold on credit. It explains that when accounts become uncollectible, a bad debt expense is recorded. The allowance method estimates the amount of accounts receivable that will be uncollectible and records that amount in an allowance for doubtful accounts contra-asset account rather than directly writing off specific receivables.