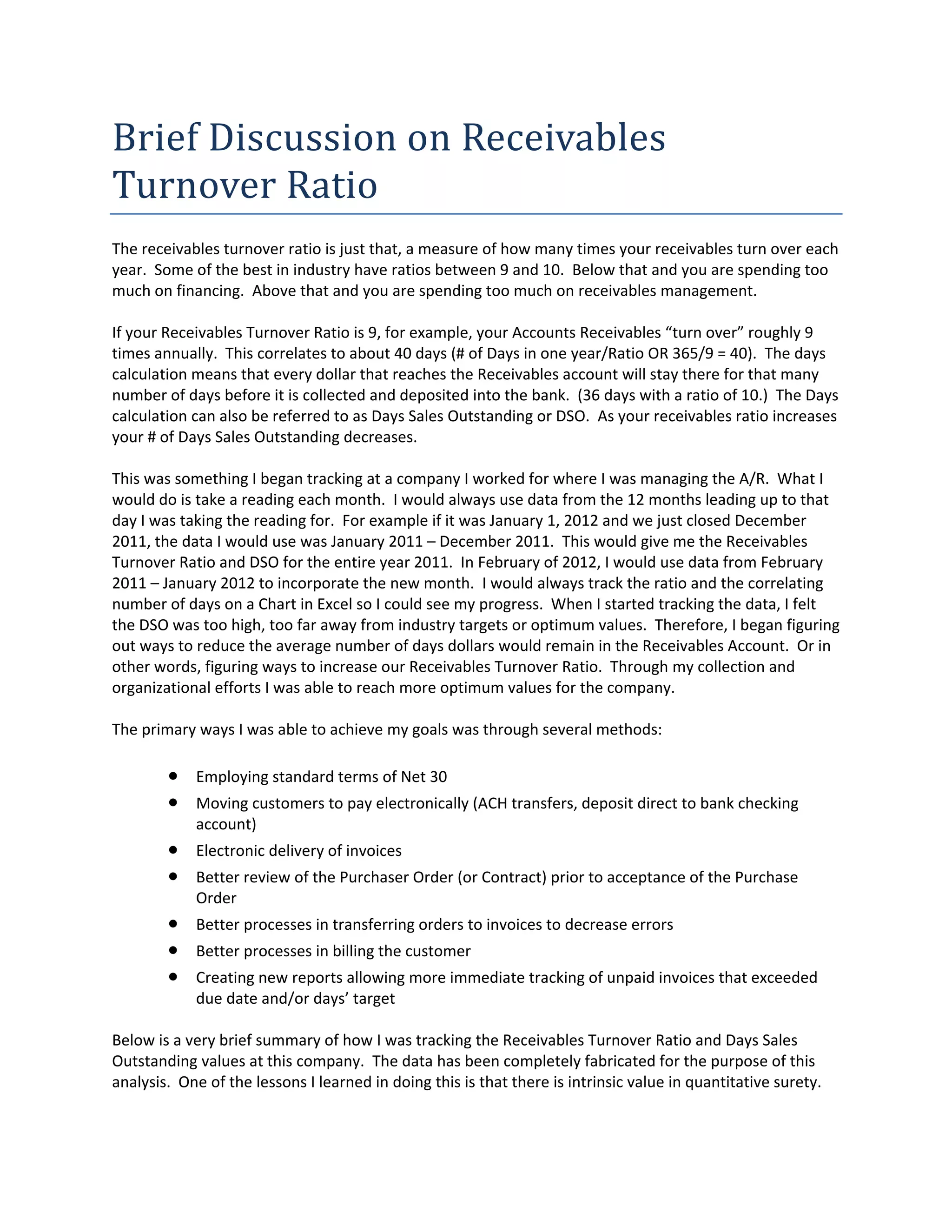

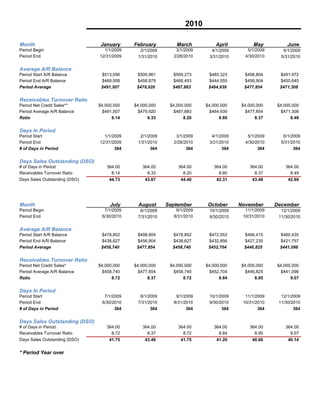

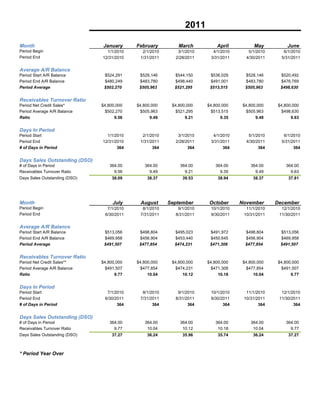

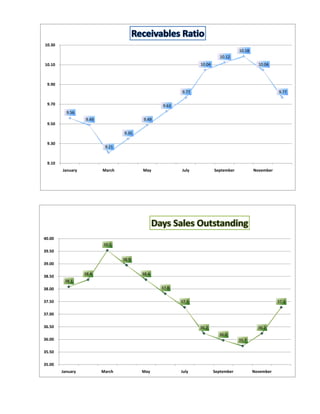

The document discusses the receivables turnover ratio as a metric to evaluate how effectively a company manages its accounts receivable, with optimal industry values between 9 and 10. It highlights the correlation between this ratio and days sales outstanding (DSO), emphasizing techniques for improving the ratio such as implementing standard payment terms and electronic invoicing. The author shares their personal experience tracking these metrics over time, resulting in improved financial management and operations.