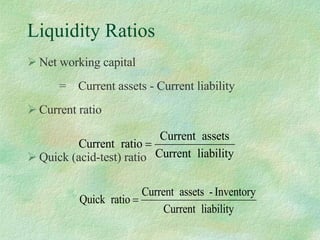

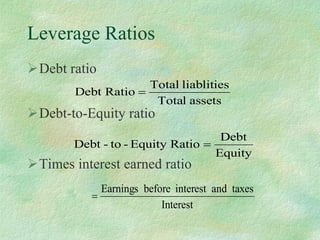

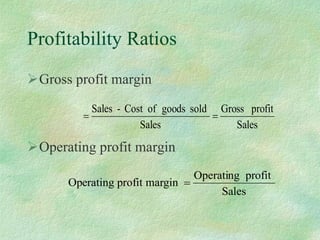

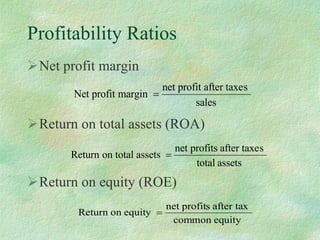

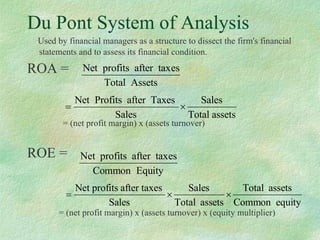

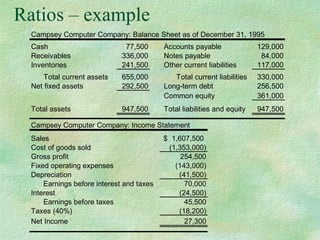

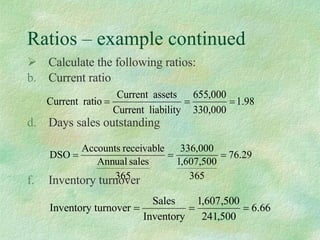

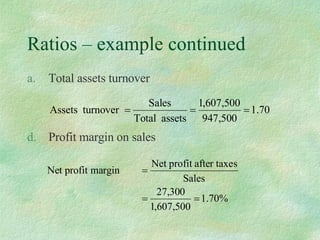

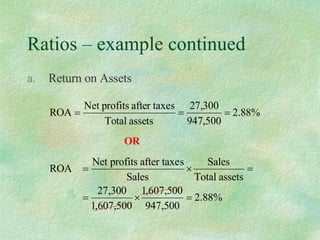

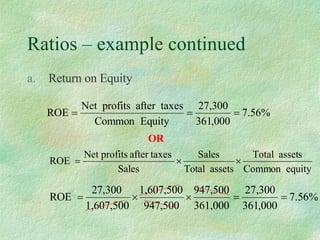

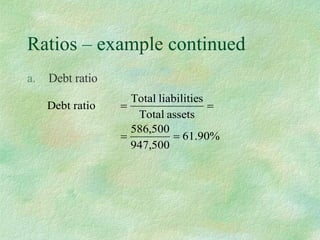

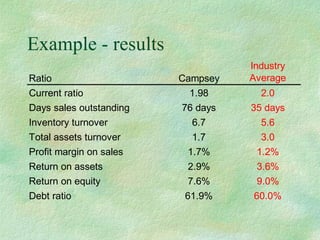

Ratio analysis is a quick way to analyze a firm's financial statements that can help shareholders, investors, and management evaluate performance and make decisions. However, ratios alone cannot pinpoint all problems and should be compared to benchmarks. Ratios are categorized as liquidity, efficiency, leverage, and profitability and measure risk and performance differently. The DuPont analysis further breaks down return on equity. Ratios are calculated using financial data and help assess a firm's financial condition.