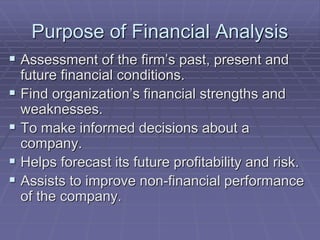

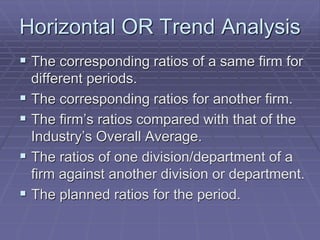

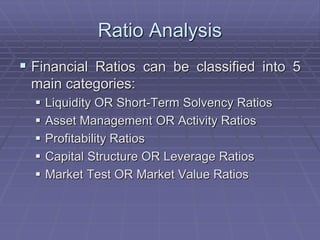

This document discusses financial ratio analysis. It begins by outlining the six key principles of accounting: recording, classifying, summarizing, analyzing, interpreting, and reporting. It then discusses the five major categories of financial ratios - liquidity, asset management, debt management, profitability, and market value - and what key financial questions they aim to answer. The document provides examples of various ratios under each category, such as current ratio, debt-to-equity ratio, return on assets, and price-to-earnings ratio. It concludes by noting some limitations of ratio analysis, such as reliance on accurate financial data and accounting policies.

![Liquidity OR Short-Term Solvency

Ratios

Net Working Capital =

Current Assets - Current Liabilities

Current Ratio = Current Assets

Current Liabilities

Acid Test/Liquid/Quick Ratio =

(Current Assets – Prepaid Expenses – Stock [Closing] – Loose Tools)

Current Liabilities](https://image.slidesharecdn.com/aqibfsanalysis-221102052812-d6888708/85/Financial-Statement-Analysis-18-320.jpg)