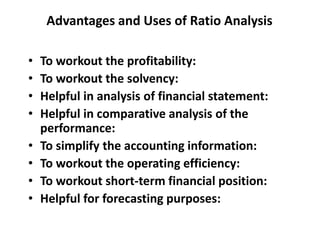

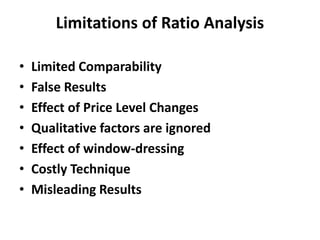

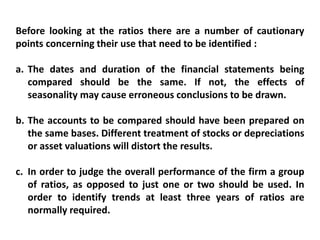

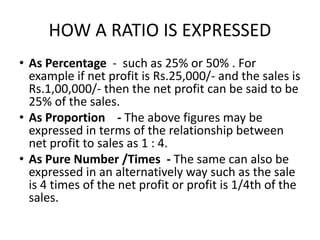

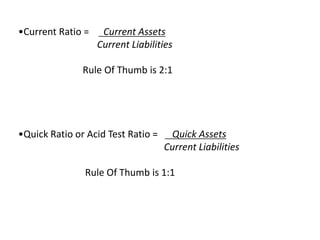

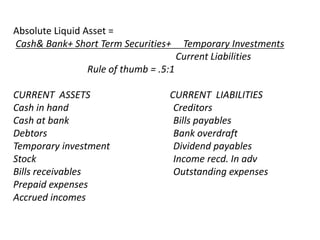

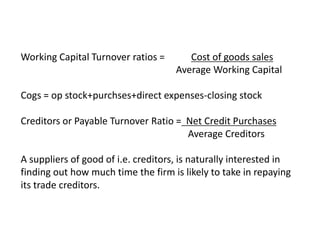

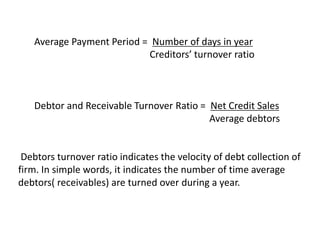

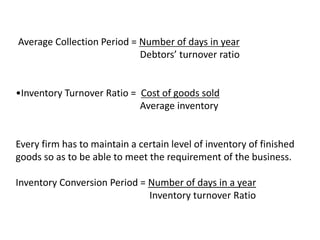

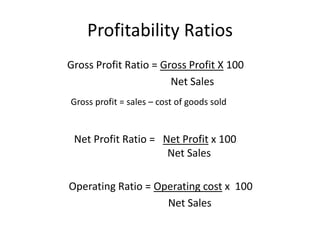

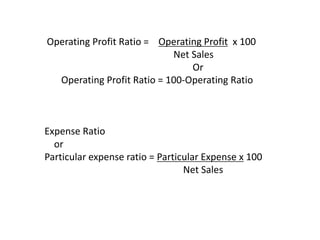

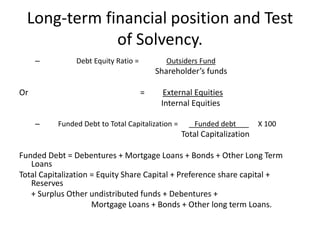

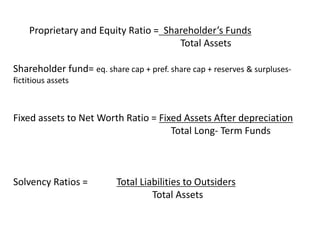

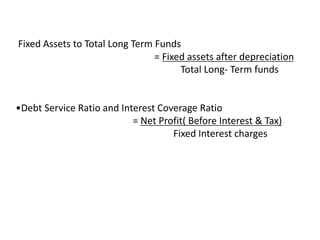

This document discusses ratio analysis, which involves calculating relationships between financial statement items to analyze a company's performance and financial position. Ratio analysis can be used to evaluate profitability, solvency, operating efficiency, short-term financial position, and more. Some common ratios mentioned include the current ratio, quick ratio, debt-to-equity ratio, and gross profit ratio. The document outlines how ratios are calculated and expressed, and provides examples of liquidity, activity, profitability, and long-term financial position ratios. Caution is advised when interpreting ratios, as different accounting treatments, time periods, or single ratios can provide misleading results.