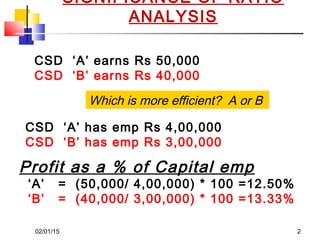

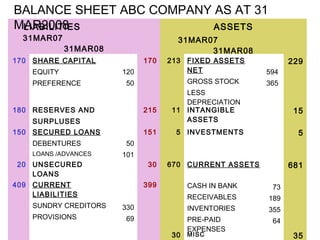

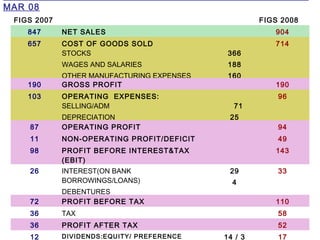

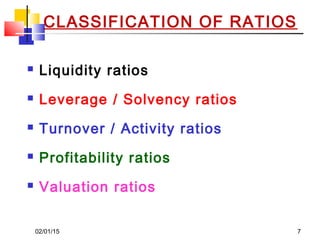

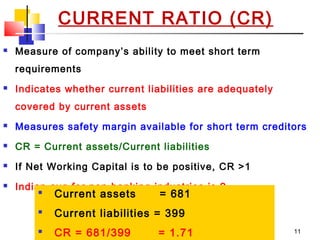

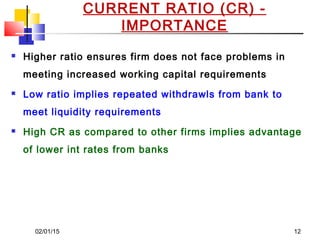

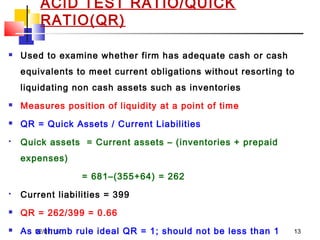

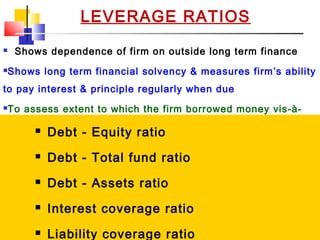

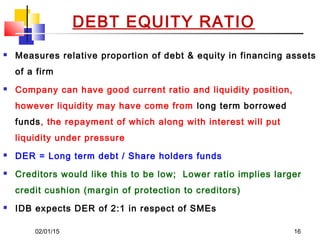

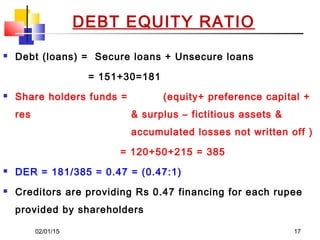

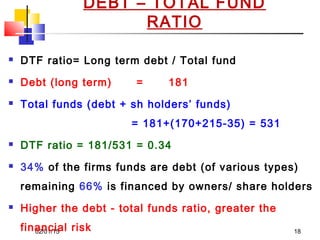

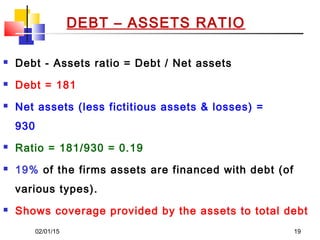

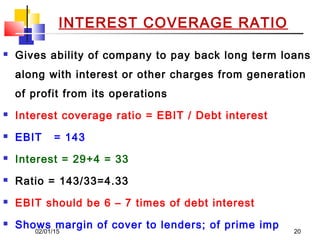

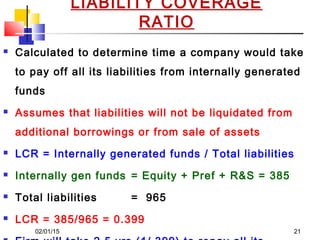

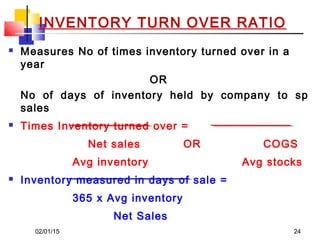

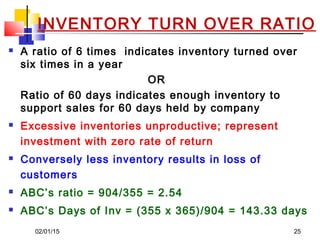

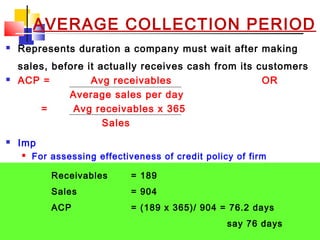

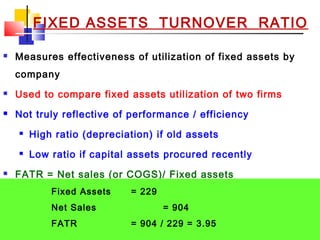

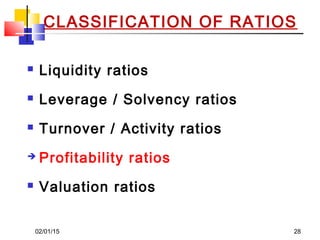

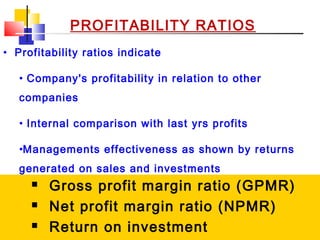

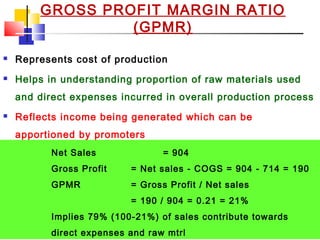

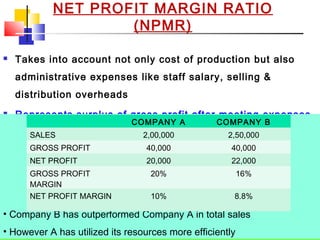

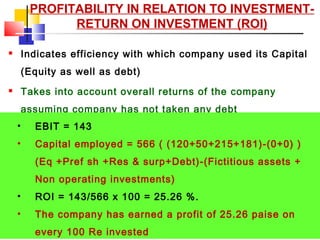

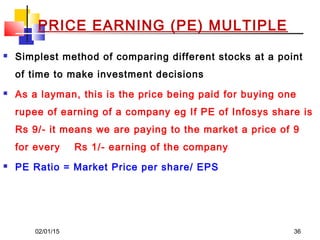

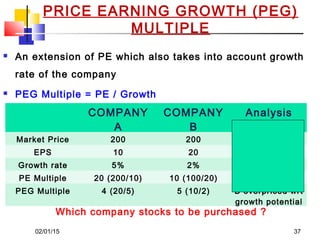

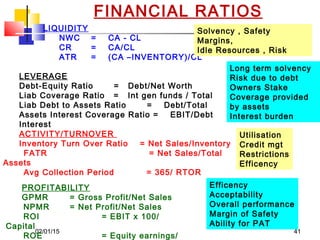

The document provides information on various types of financial ratios used to analyze the financial performance and position of a company. It discusses liquidity ratios like current ratio and quick ratio, leverage ratios like debt-equity ratio and debt-total fund ratio, activity ratios like inventory turnover ratio and average collection period, profitability ratios like gross profit margin ratio and net profit margin ratio, and valuation ratios like earnings per share. Formulas to calculate these ratios are given along with an example company's ratios. The document emphasizes the importance of ratio analysis for comparing performance over time, between companies, and against industry standards.