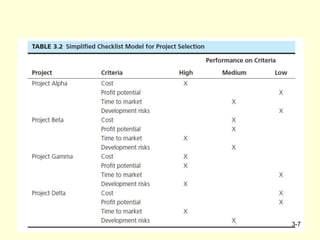

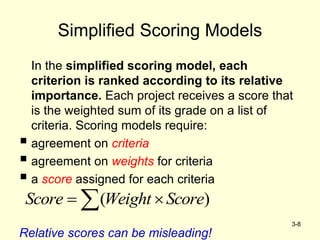

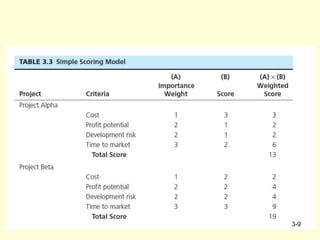

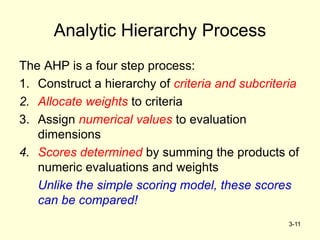

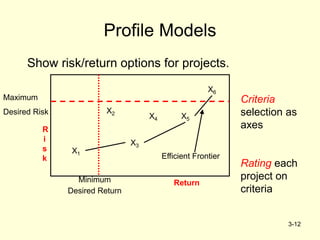

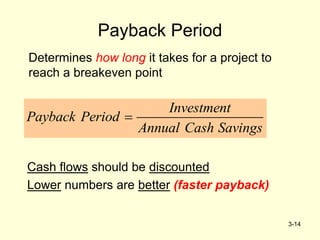

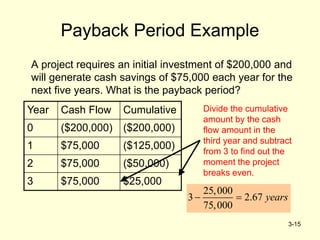

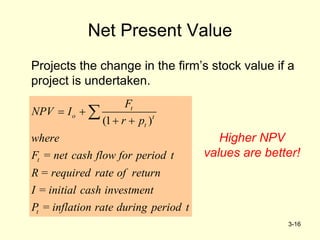

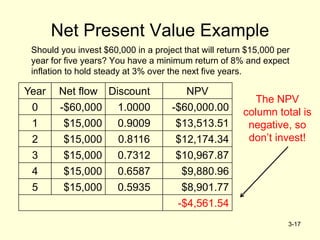

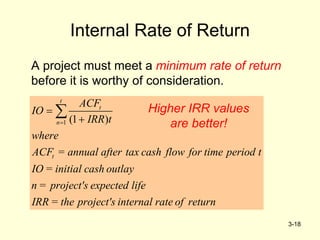

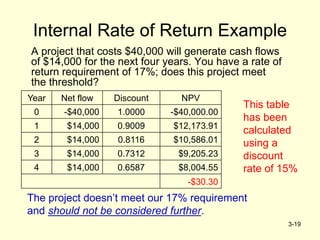

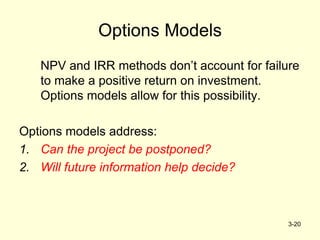

The document outlines project selection and portfolio management, emphasizing screening models that help managers identify viable projects based on criteria like realism, flexibility, and cost-effectiveness. Various approaches for project screening are detailed, including checklist models, scoring models, analytic hierarchy processes, and financial models such as payback period and net present value. Successful portfolio management is described as a systematic process involving decision-making and prioritization while addressing challenges like conservative technical communities and resource scarcity.