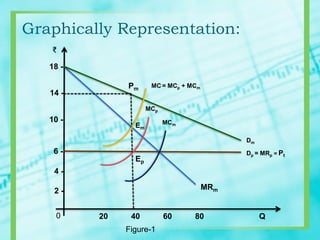

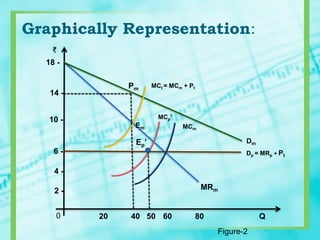

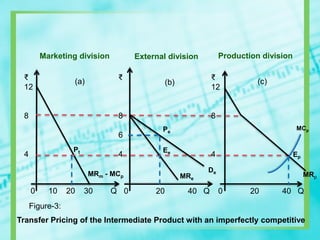

This document discusses transfer pricing, which refers to the rules and methods for pricing transactions within divisions of the same company. It provides examples of how the transfer price for an intermediate good is determined between a production and marketing division with no external market, a competitive external market, and an imperfectly competitive external market. In all cases, the transfer price is set to maximize total profits for the company based on the marginal costs and revenues of both divisions.