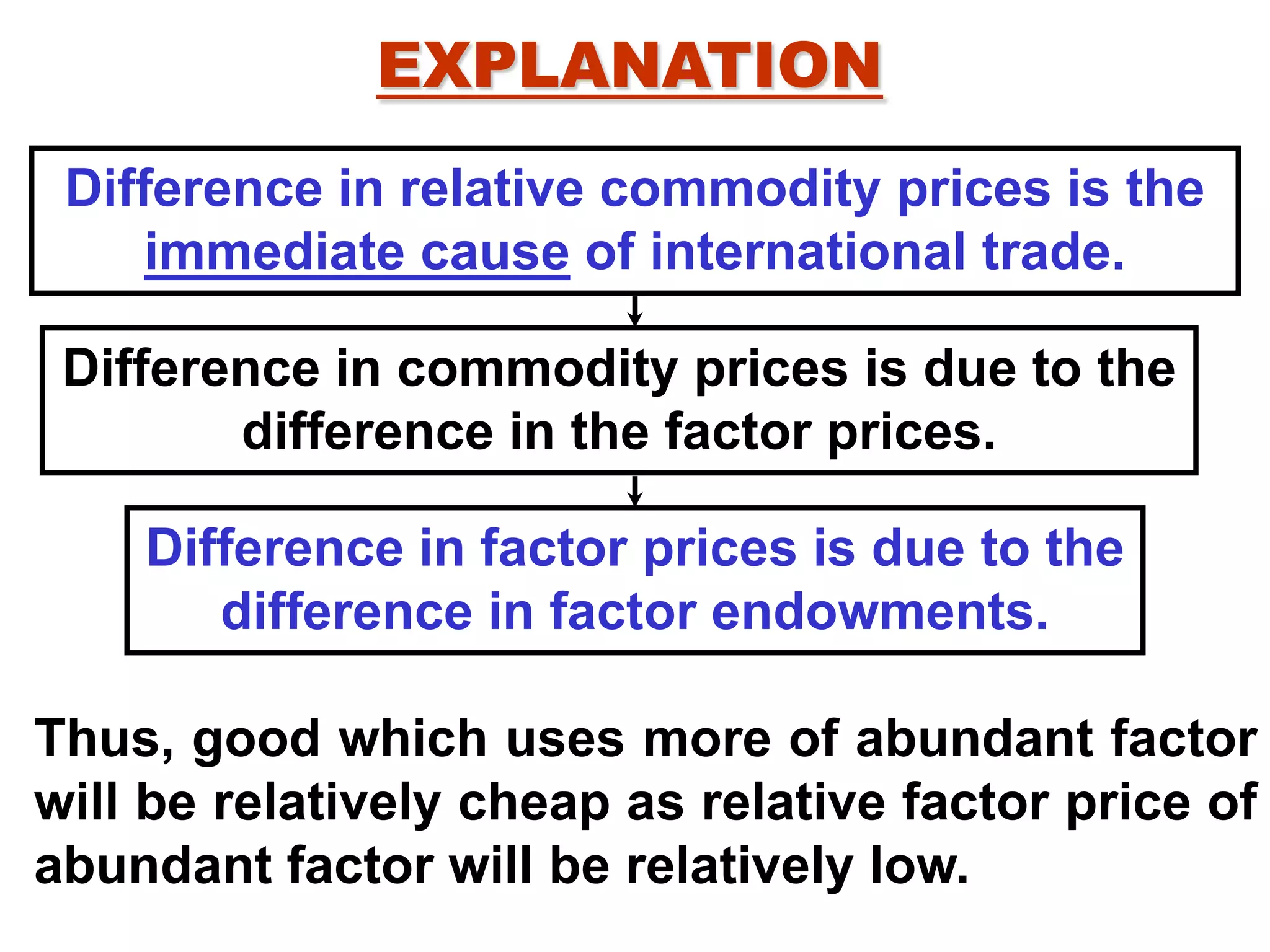

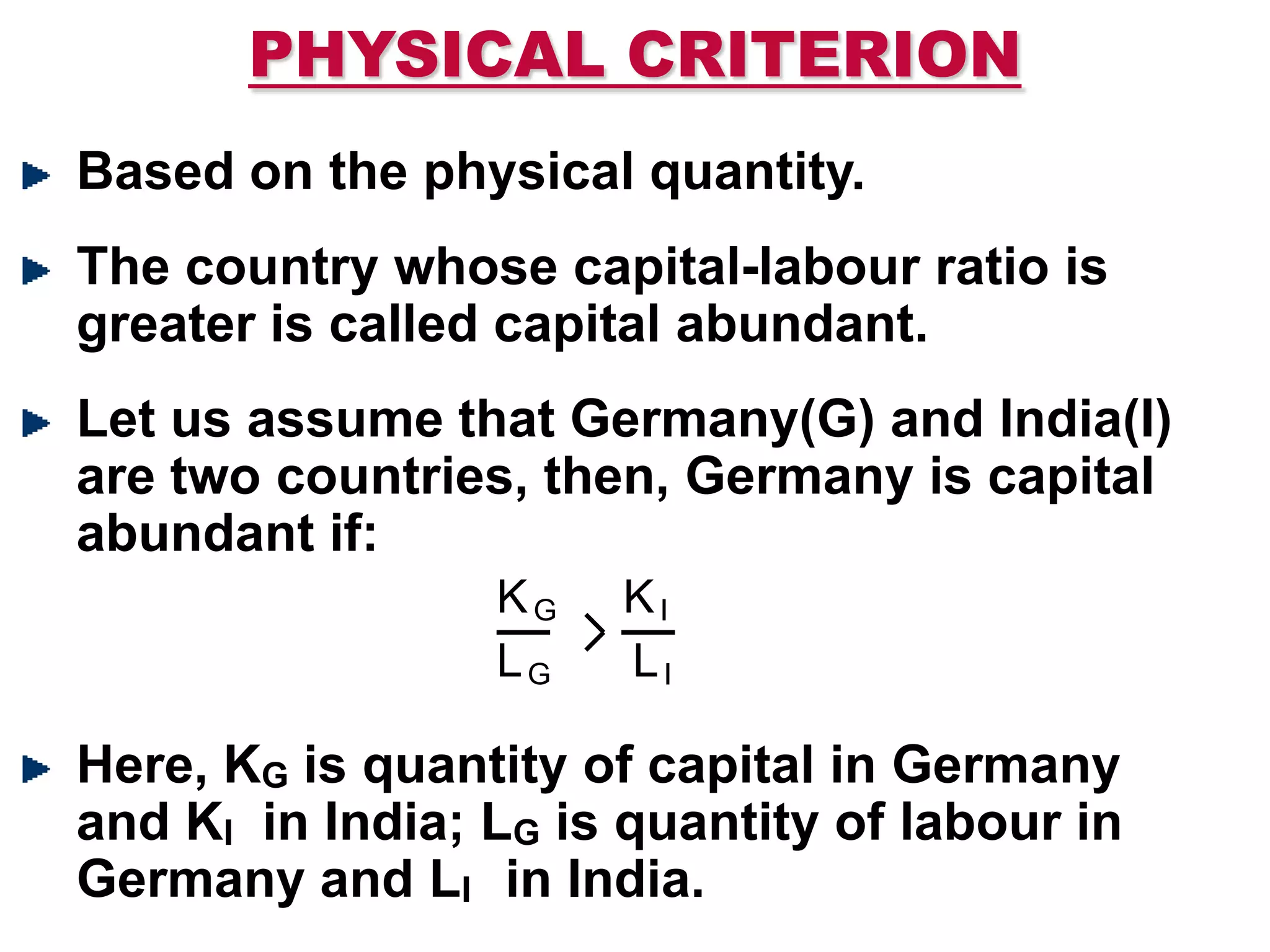

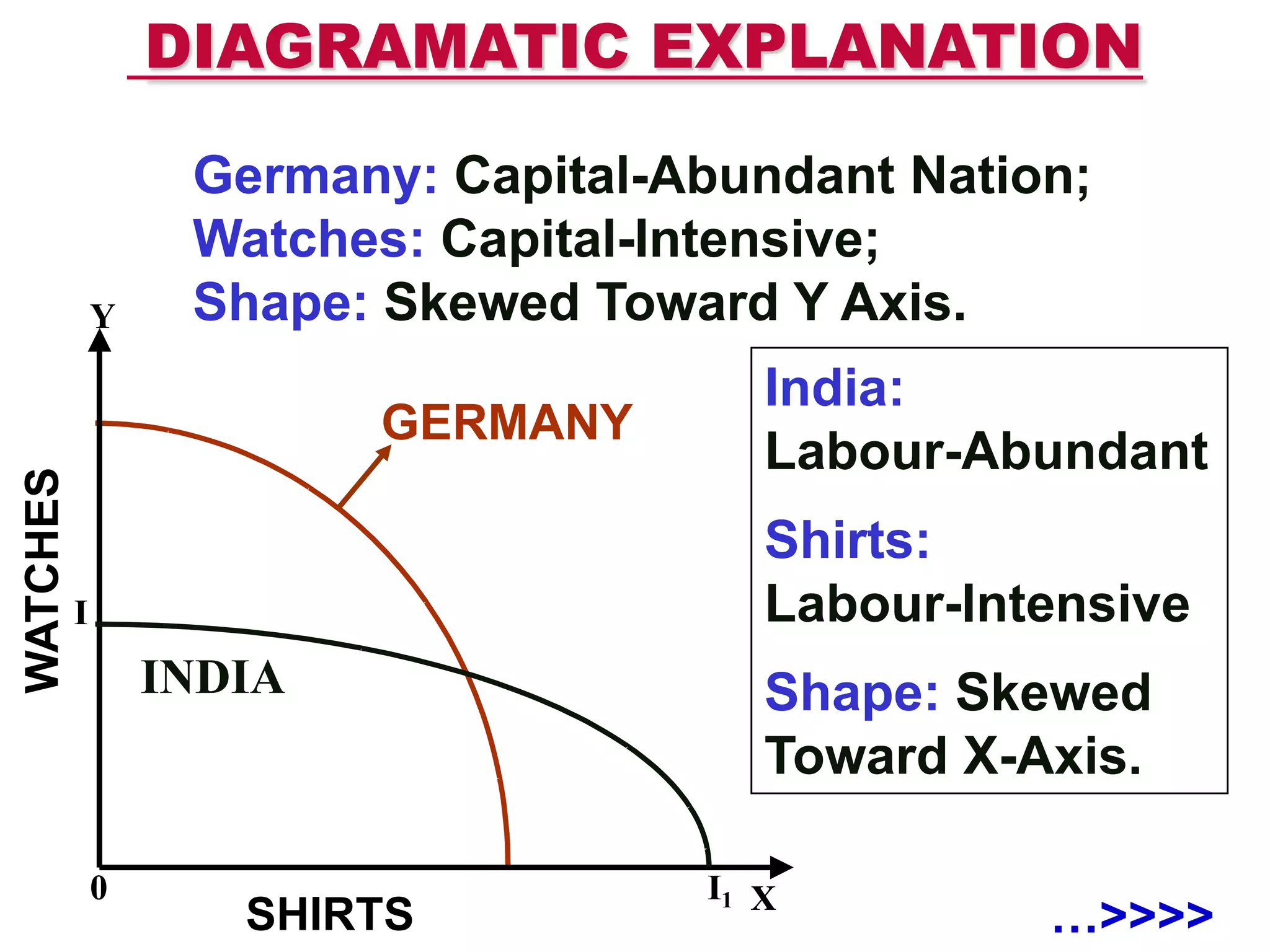

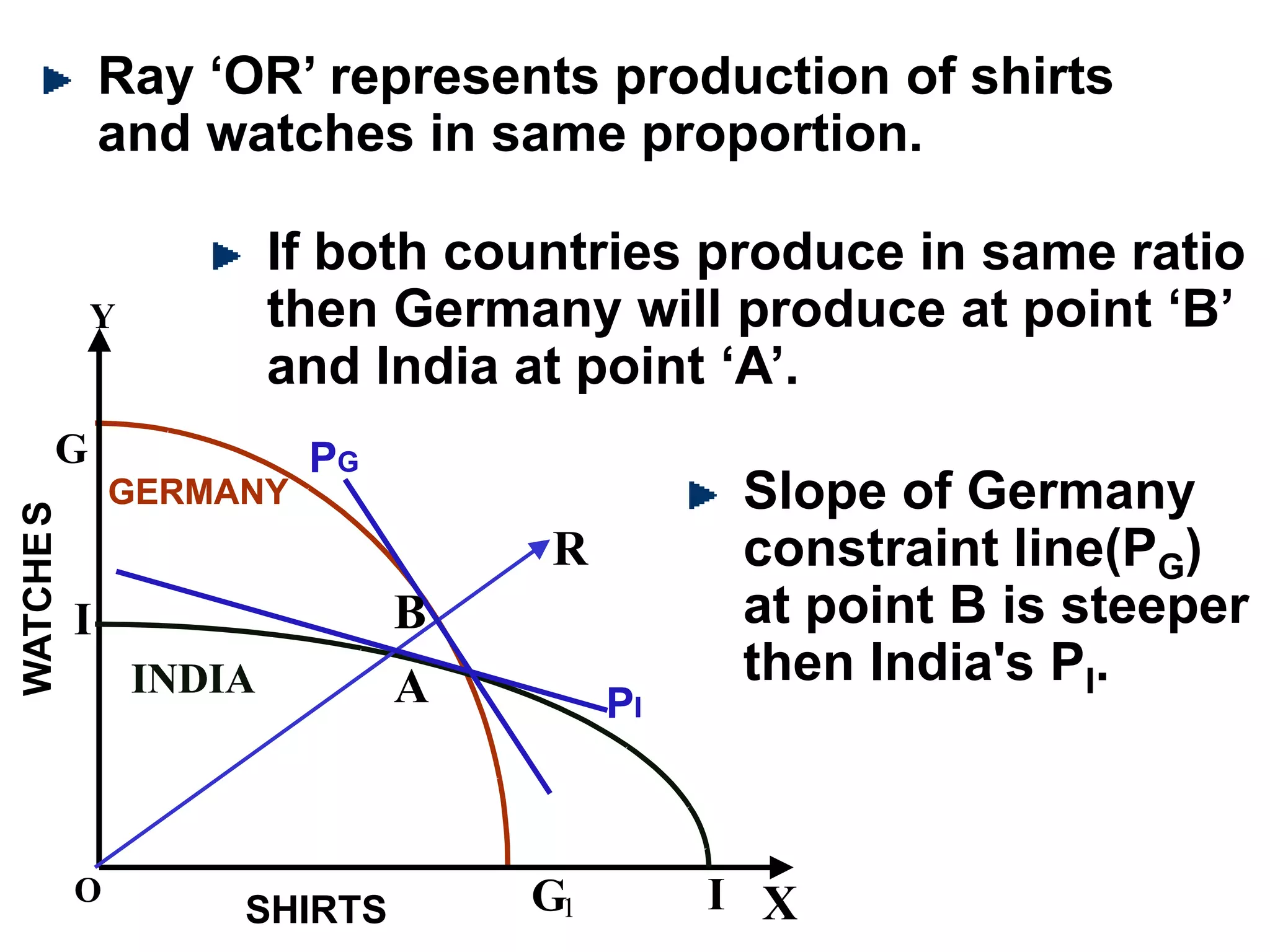

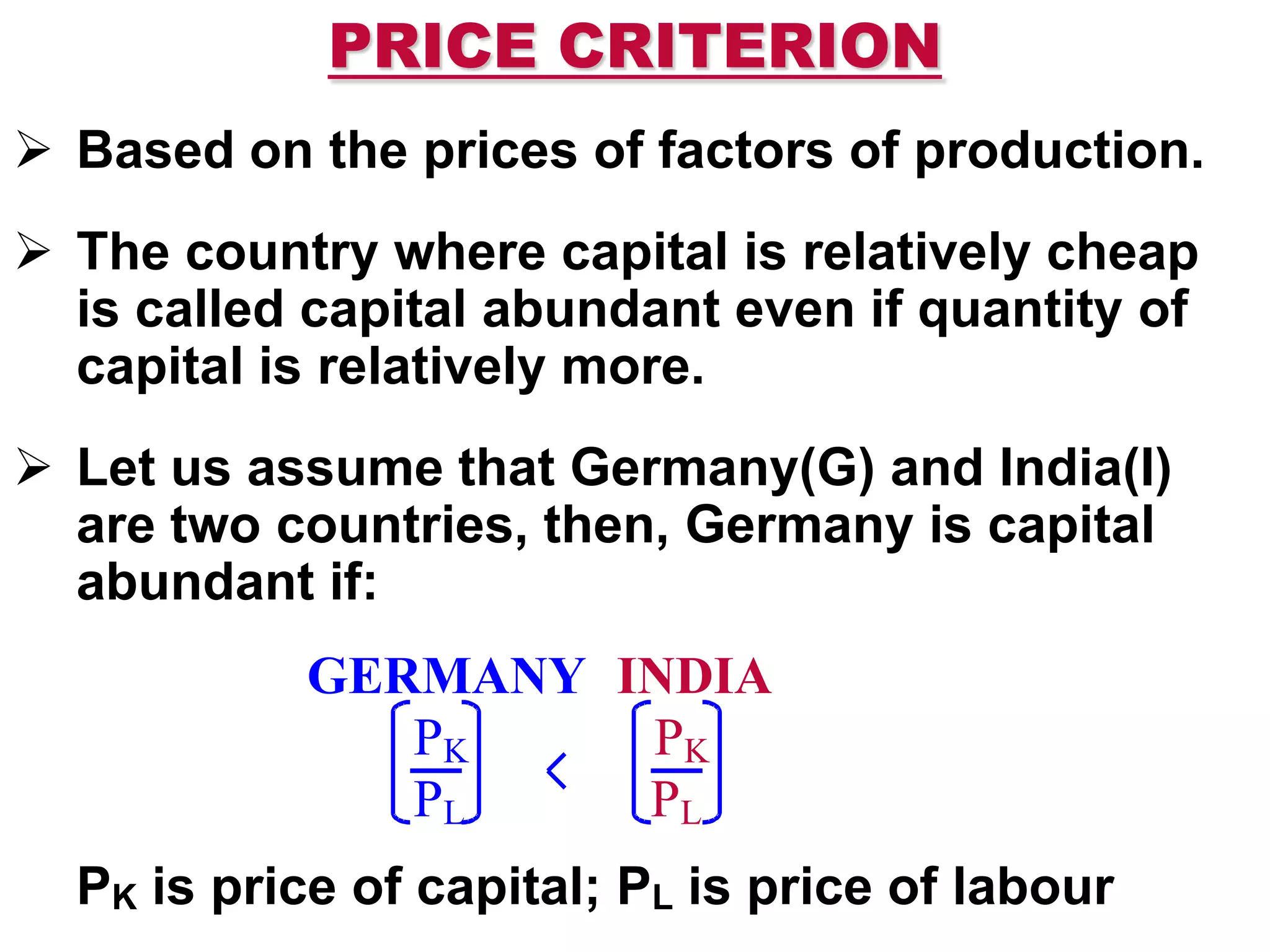

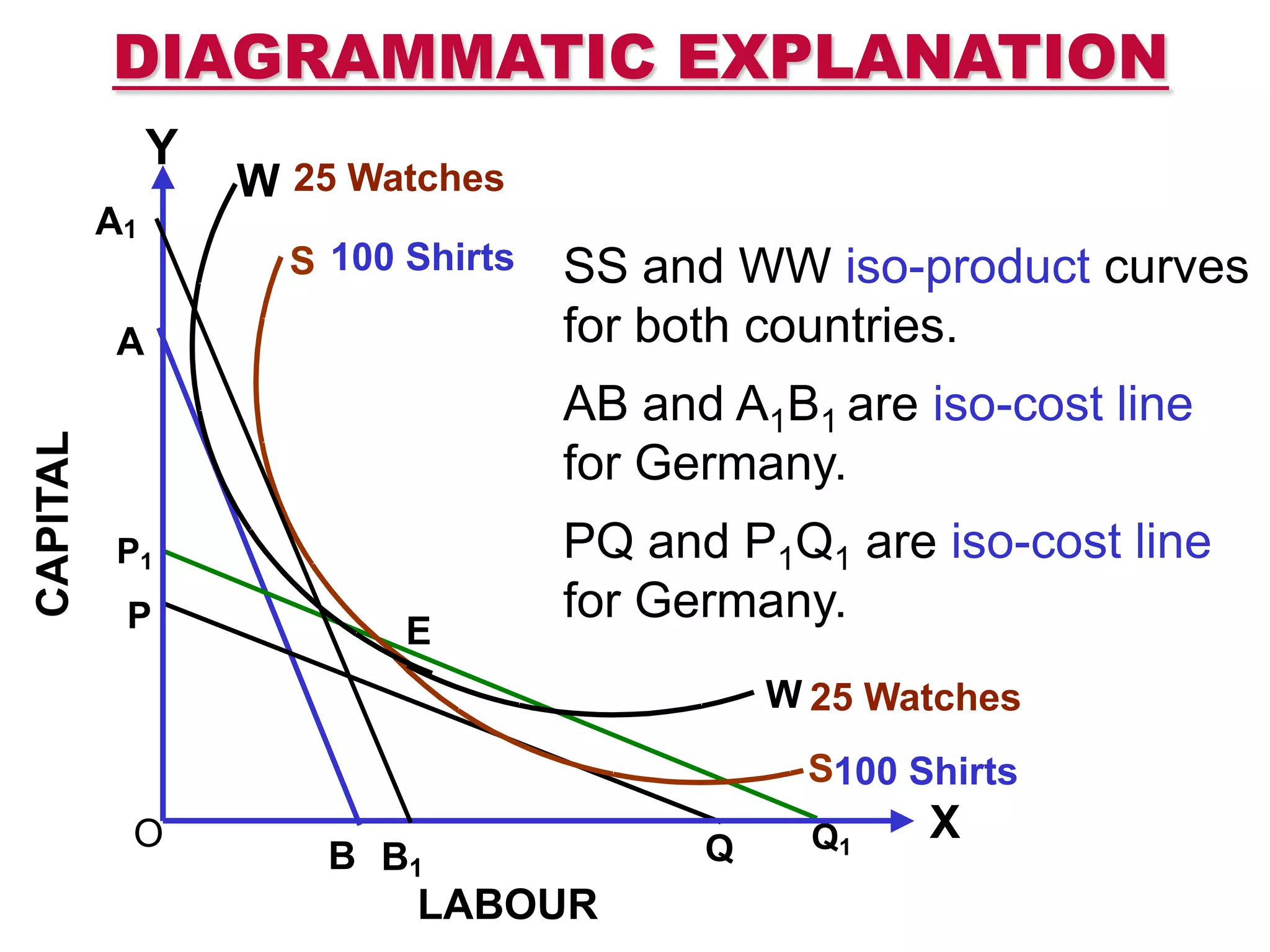

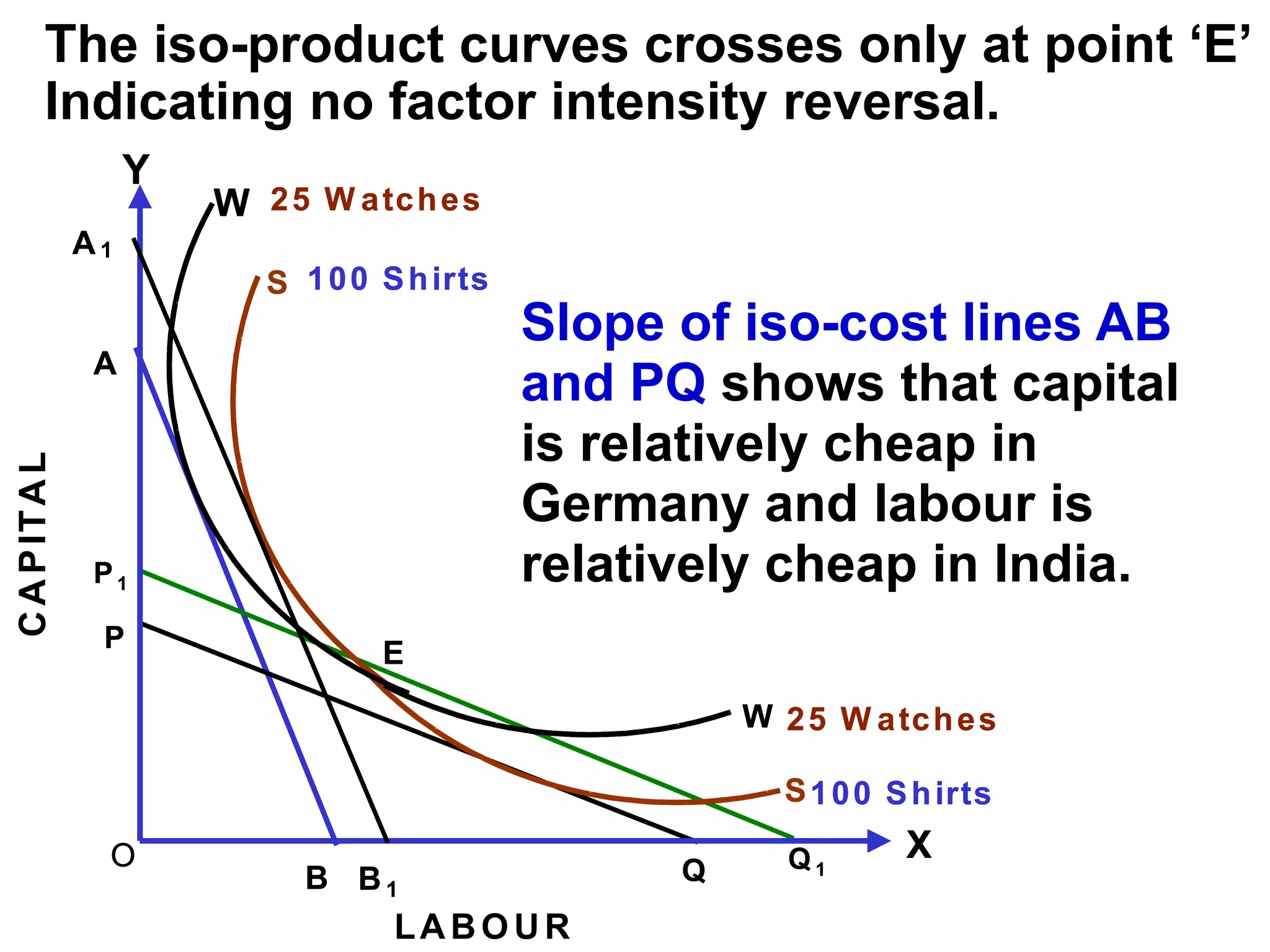

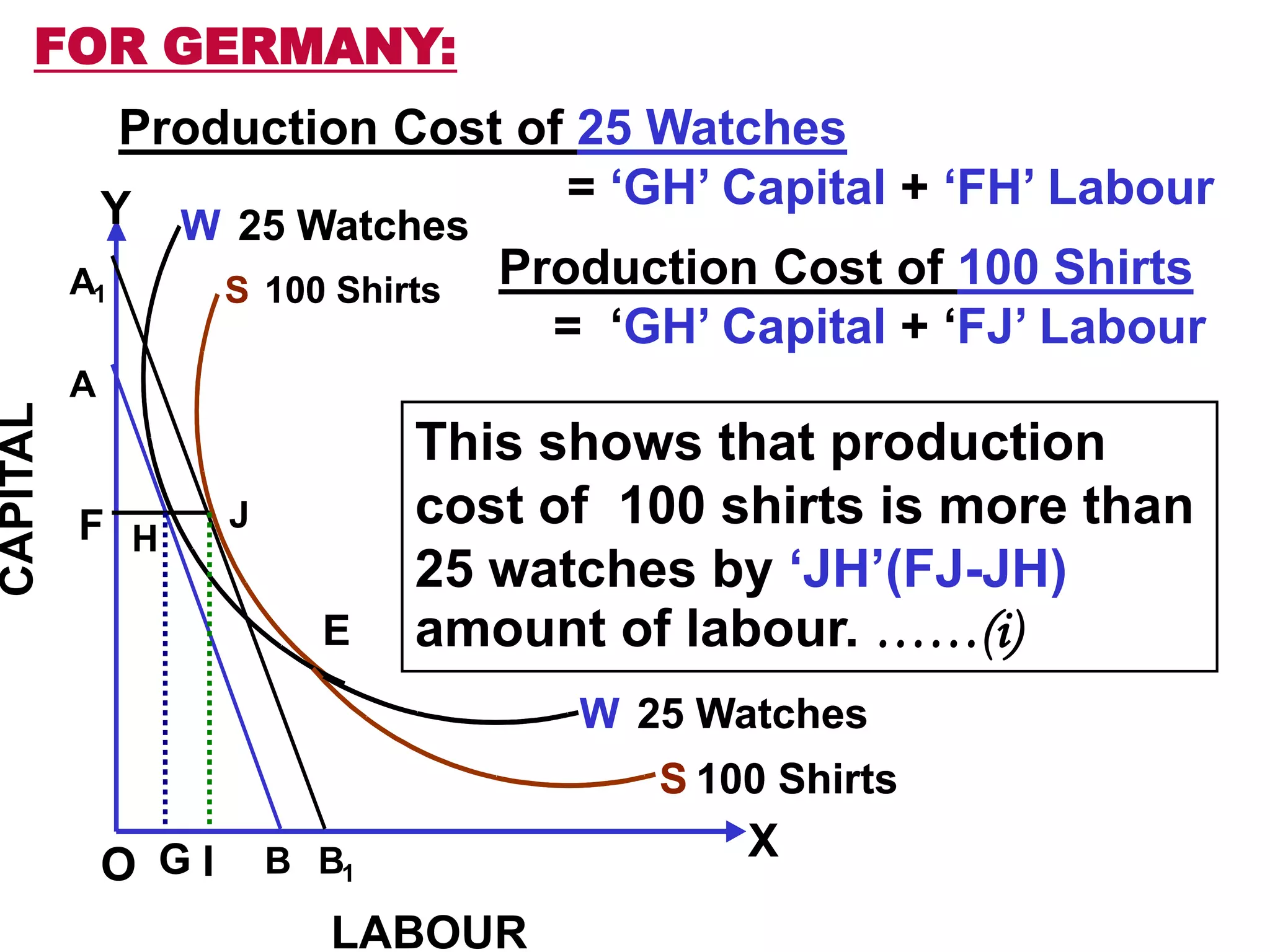

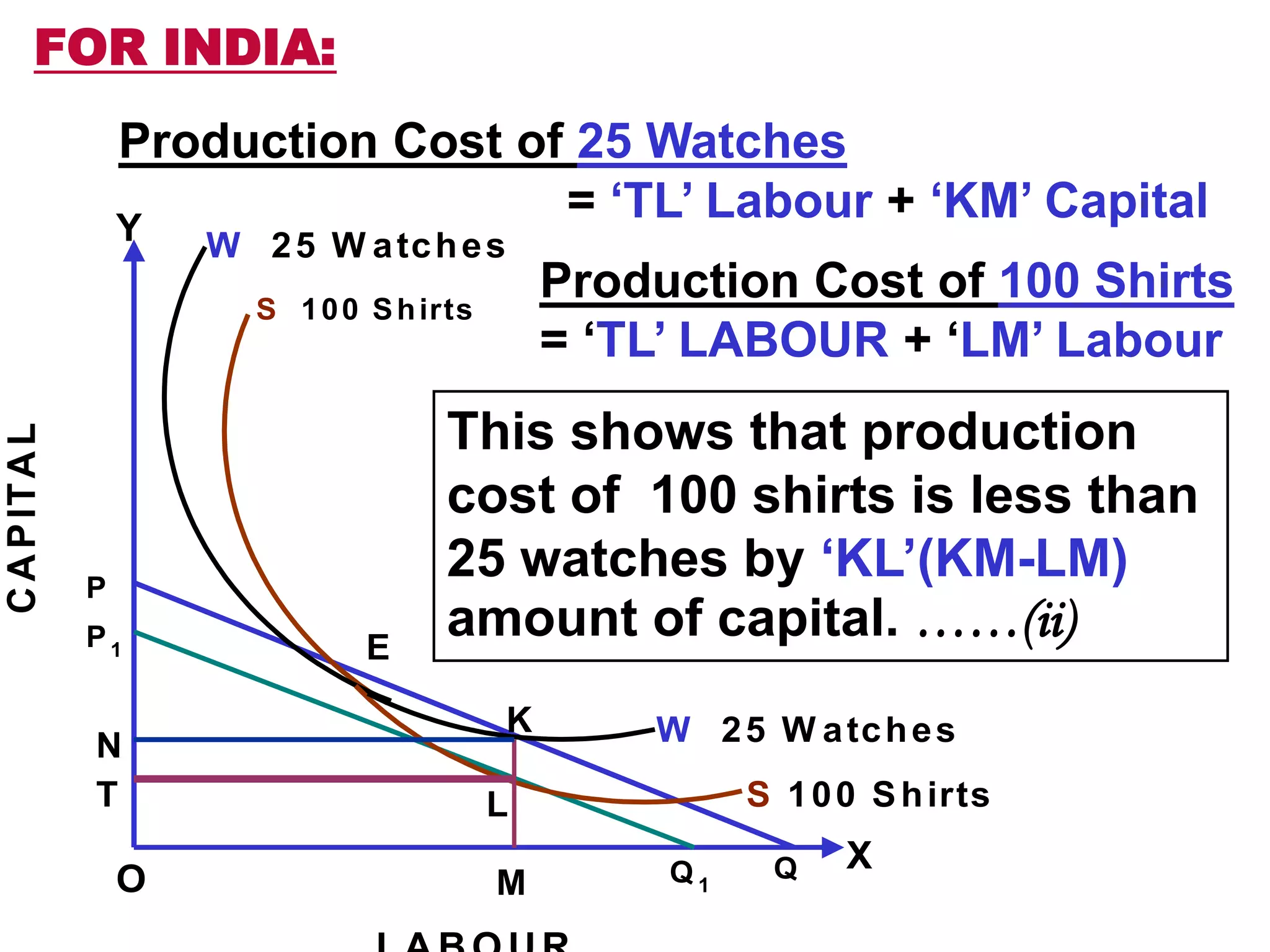

The document discusses the Heckscher-Ohlin theory of international trade, which explains that differences in factor endowments between countries leads to comparative advantage and trade. Specifically, countries will export goods that intensively use their relatively abundant and cheaper factors of production, and import goods that intensively use their scarce and expensive factors. This theory analyzes trade patterns based on differences in capital-labor ratios and resulting factor prices between capital-abundant and labor-abundant nations.