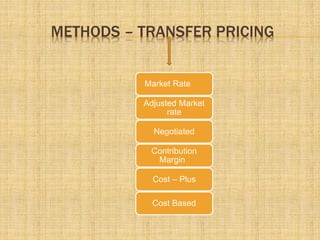

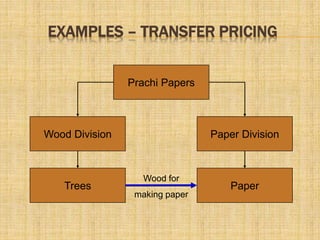

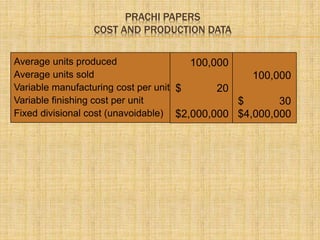

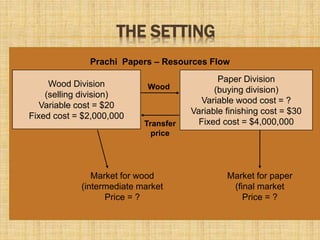

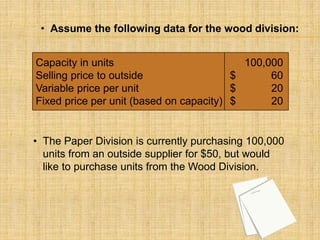

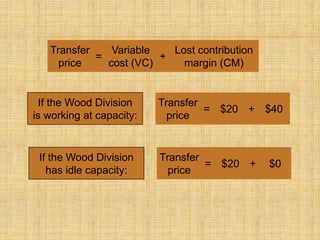

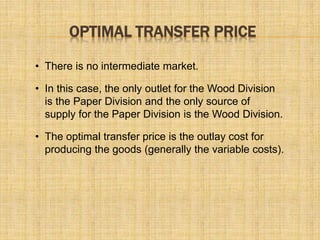

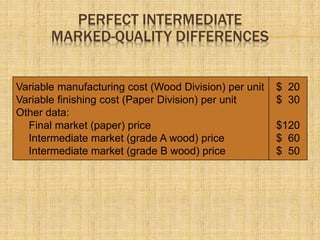

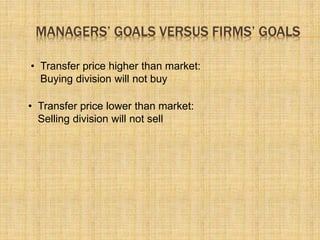

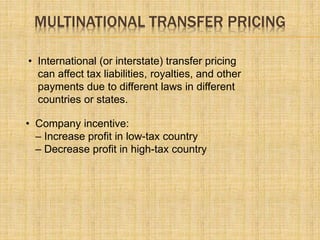

This document discusses transfer pricing, which refers to the prices at which divisions within a company transact with each other. It begins by defining transfer pricing and providing an example. Key issues are then outlined, such as divisions prioritizing revenue, preferred customers, and preferred suppliers. Various methods for determining transfer prices are described, including using market rates, adjusted rates, negotiation, contribution margins, cost-plus pricing, and cost-based approaches. The document concludes by providing a case study example of an integrated wood and paper production company and discussing optimal transfer pricing between divisions.