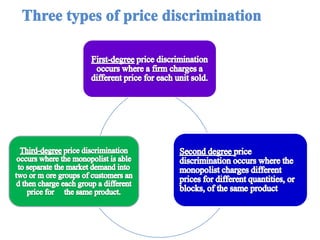

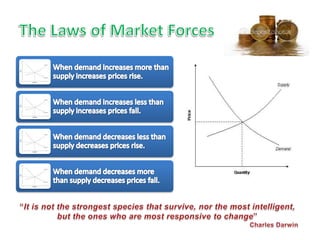

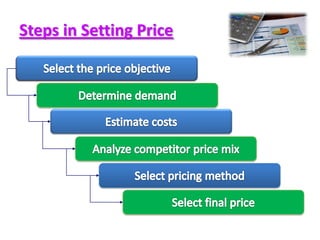

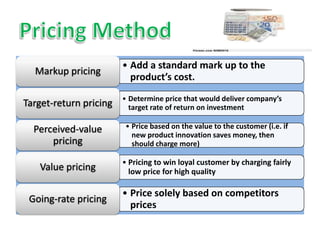

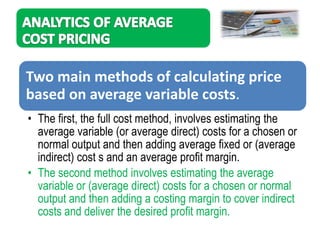

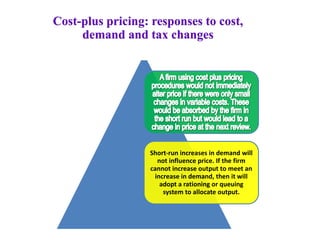

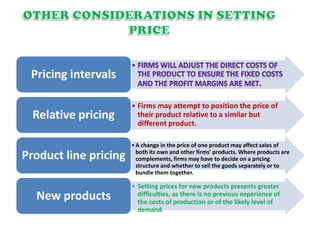

This document discusses various pricing strategies and considerations for setting prices. It defines what a price is and lists objectives a company may want to achieve through pricing, such as profitability, market share, or product positioning. The document also covers types of pricing like cost-based pricing, markup pricing, target-return pricing, and perceived-value pricing. Factors that influence pricing decisions are also examined, including customer demand, marketing mix, economic conditions, and customer perceived value.