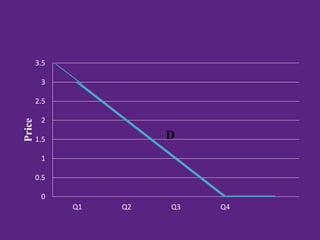

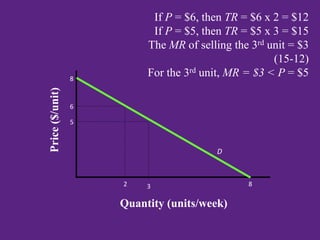

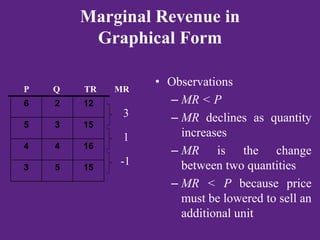

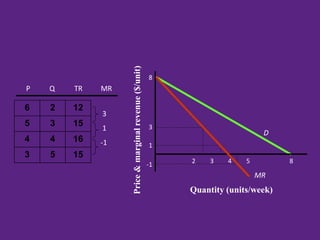

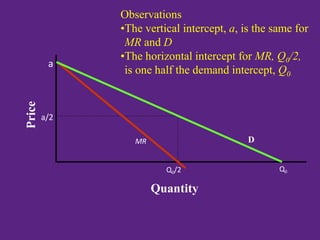

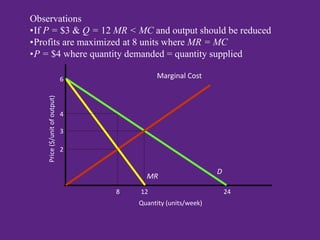

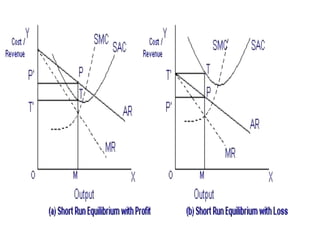

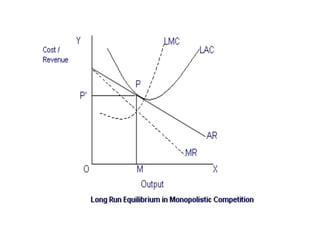

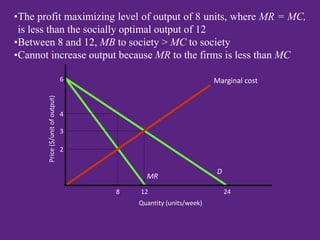

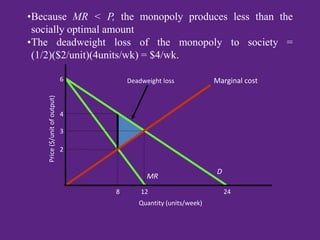

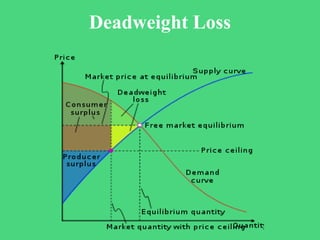

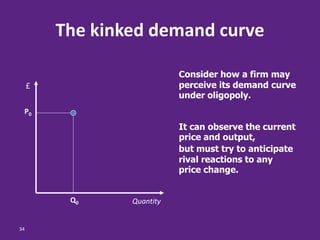

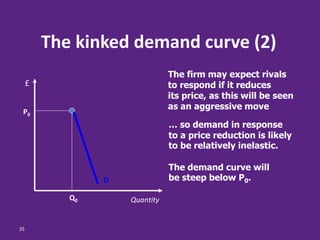

Imperfect competition refers to market situations between perfect competition and monopoly, characterized by firms having some price control and facing downward-sloping demand curves. Key features include product differentiation, large numbers of firms, and non-price competition, with specific classifications such as monopolistic competition and oligopoly. The document also discusses profit maximization strategies for monopolists and outlines concepts such as deadweight loss and collusion within an oligopolistic market.