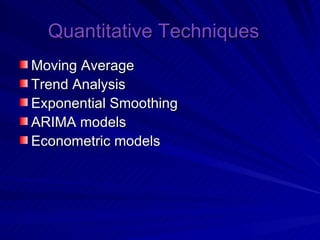

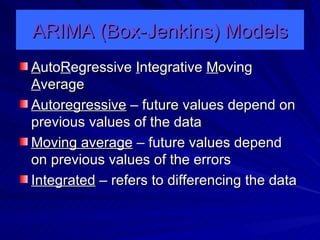

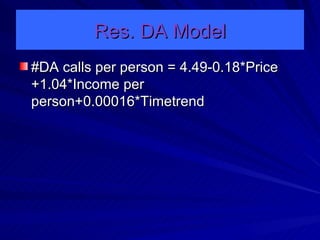

This document provides an overview of various quantitative forecasting techniques, including moving averages, trend analysis, exponential smoothing, ARIMA models, and econometric models. It describes when each technique is best used, their advantages and disadvantages, and provides examples. The techniques range from simple methods like moving averages to more complex approaches like ARIMA and econometric models, with the key being choosing the right technique based on the characteristics of the data and forecasting needs.