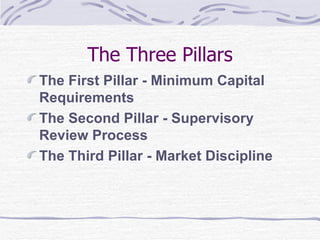

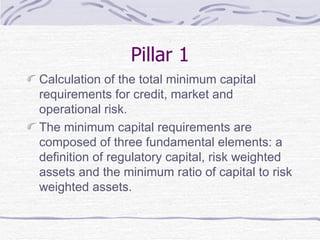

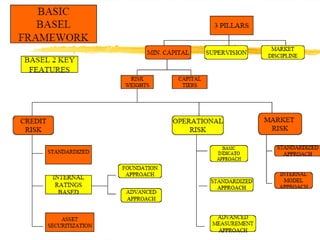

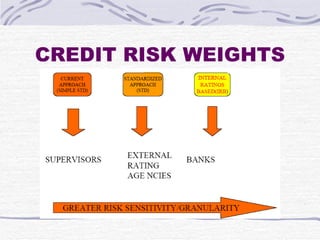

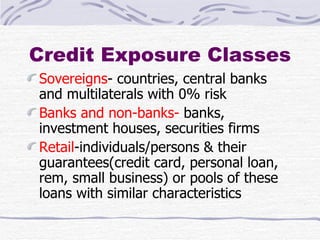

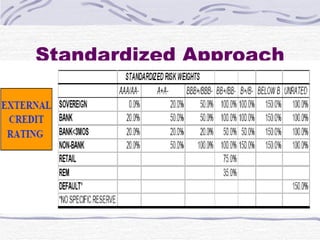

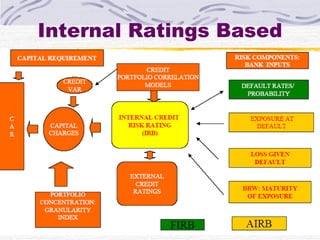

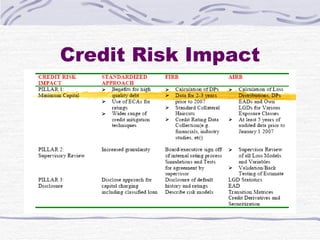

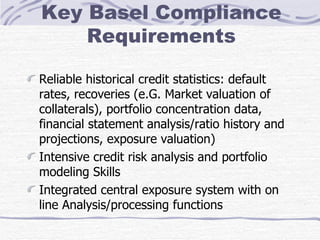

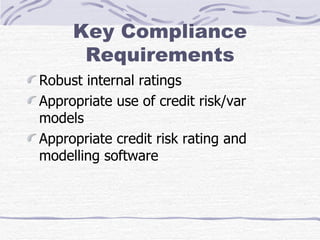

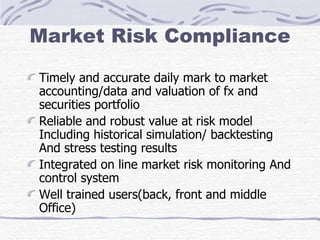

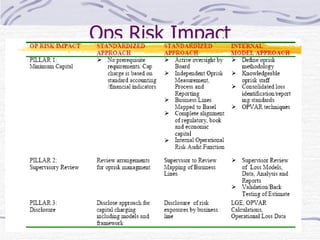

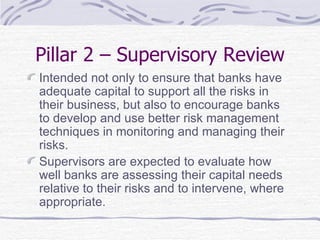

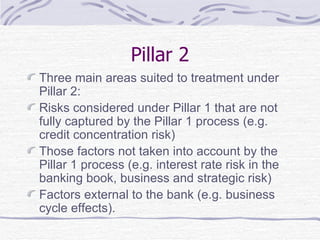

Basel II aims to establish a more risk-sensitive approach to capital adequacy by addressing three main areas or pillars: minimum capital requirements, supervisory review, and market discipline. It requires banks to hold capital reserves proportional to their credit, market, and operational risk. The framework allows two approaches for calculating credit risk - a standardized approach and internal ratings-based approaches. Pillar 2 covers supervisory review to ensure banks have adequate capital for all risks and encourage better risk management. Pillar 3 focuses on market discipline through public disclosures.