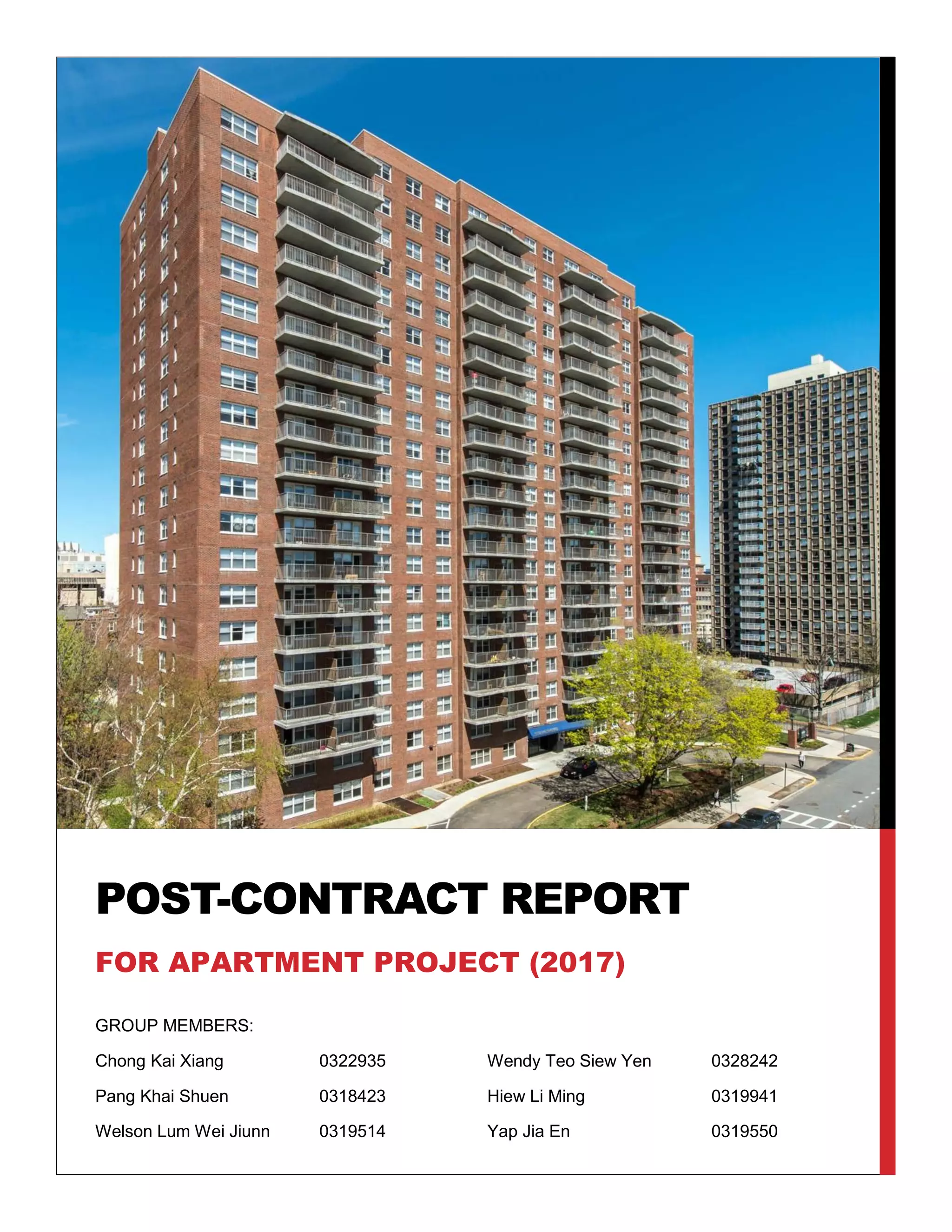

The post-contract report summarizes adjustments that need to be made for the final account of an apartment project. It discusses how omitted items like an apartment entrance arch can be treated as a variation and valued. It also addresses how to assess a contractor's final account submission and price unpriced variations, like relocating an installed door based on day rates or adjusting excavation rates based on a significant change in quantity. The report provides an overview of elements to include in the project's final account, such as variations, remeasuring provisional quantities, and claims for additional expenses or losses.