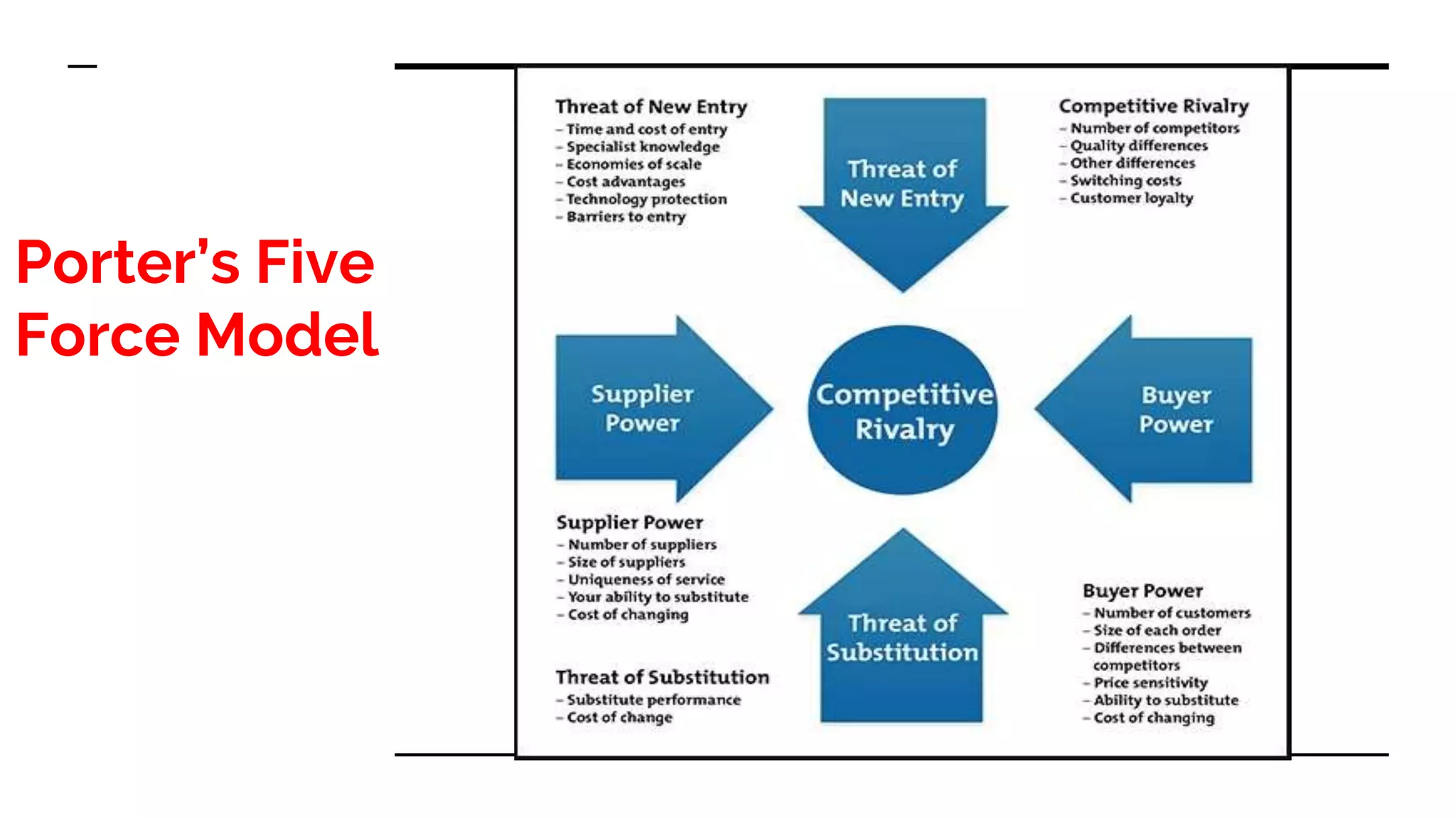

Porter's Five Forces Model is a strategic tool for analyzing competition and profitability within an industry by examining five key forces: competitive rivalry, supplier power, buyer power, the threat of new entrants, and the threat of substitutes. The model highlights that the intensity of competition can vary greatly between industries and is influenced significantly by factors such as the number of competitors, differentiation among products, and market entry barriers. Through examples from various companies like McDonald's, Toyota, Coca-Cola, and Starbucks, the document illustrates how each of these forces impacts their market positioning and strategic decisions.