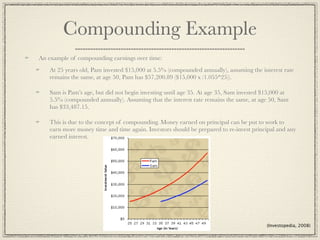

Personal finance and investing principles include creating a budget by listing income and expenses, setting financial goals, saving at least 10% of monthly income, and periodically reviewing expenses. Investing principles involve diversifying investments across stocks, bonds, and mutual funds for long-term growth. Investors should start early to benefit from compounding returns and plan for retirement by contributing to tax-advantaged 401(k) plans or annuities. Resources for learning include online tutorials and simulators.