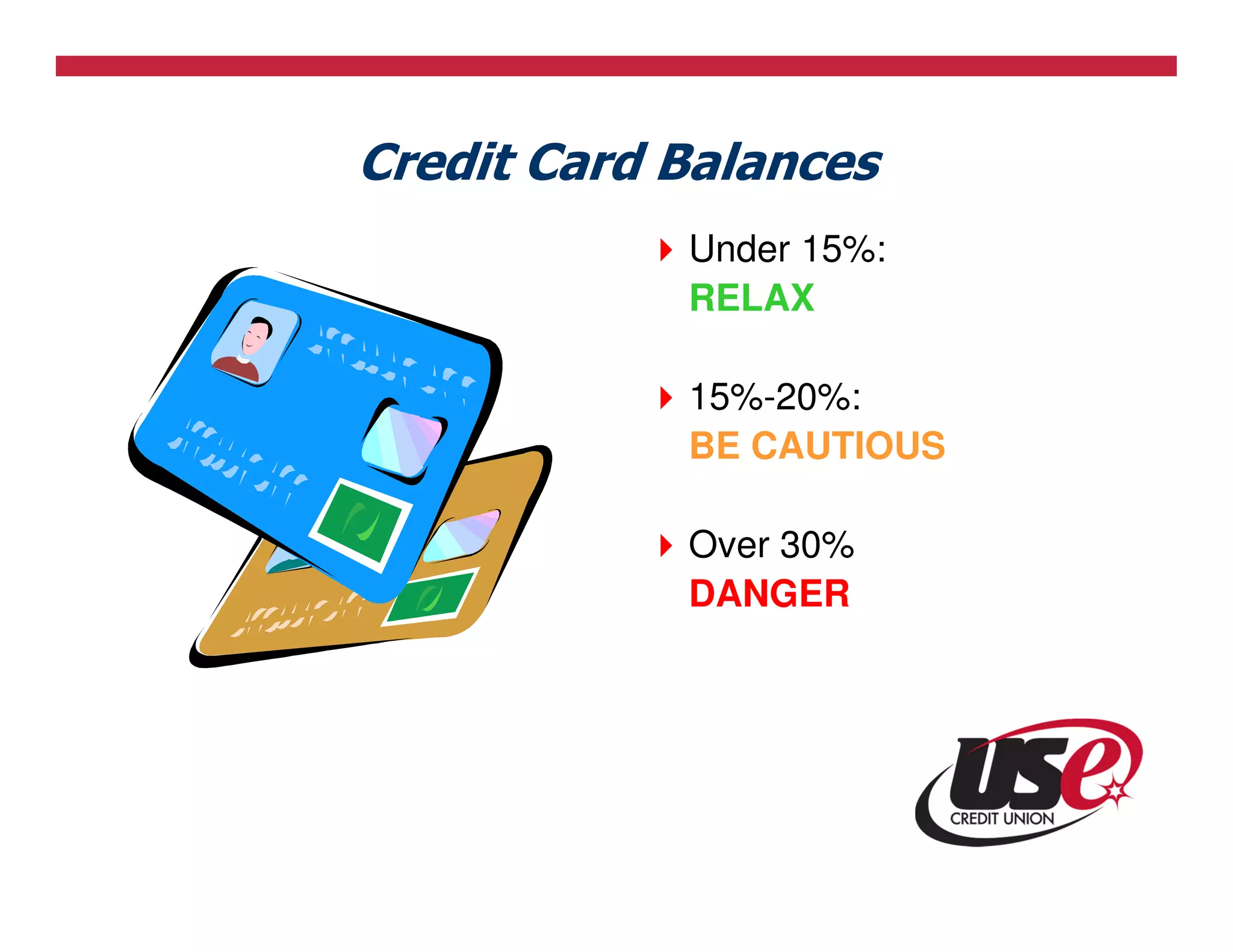

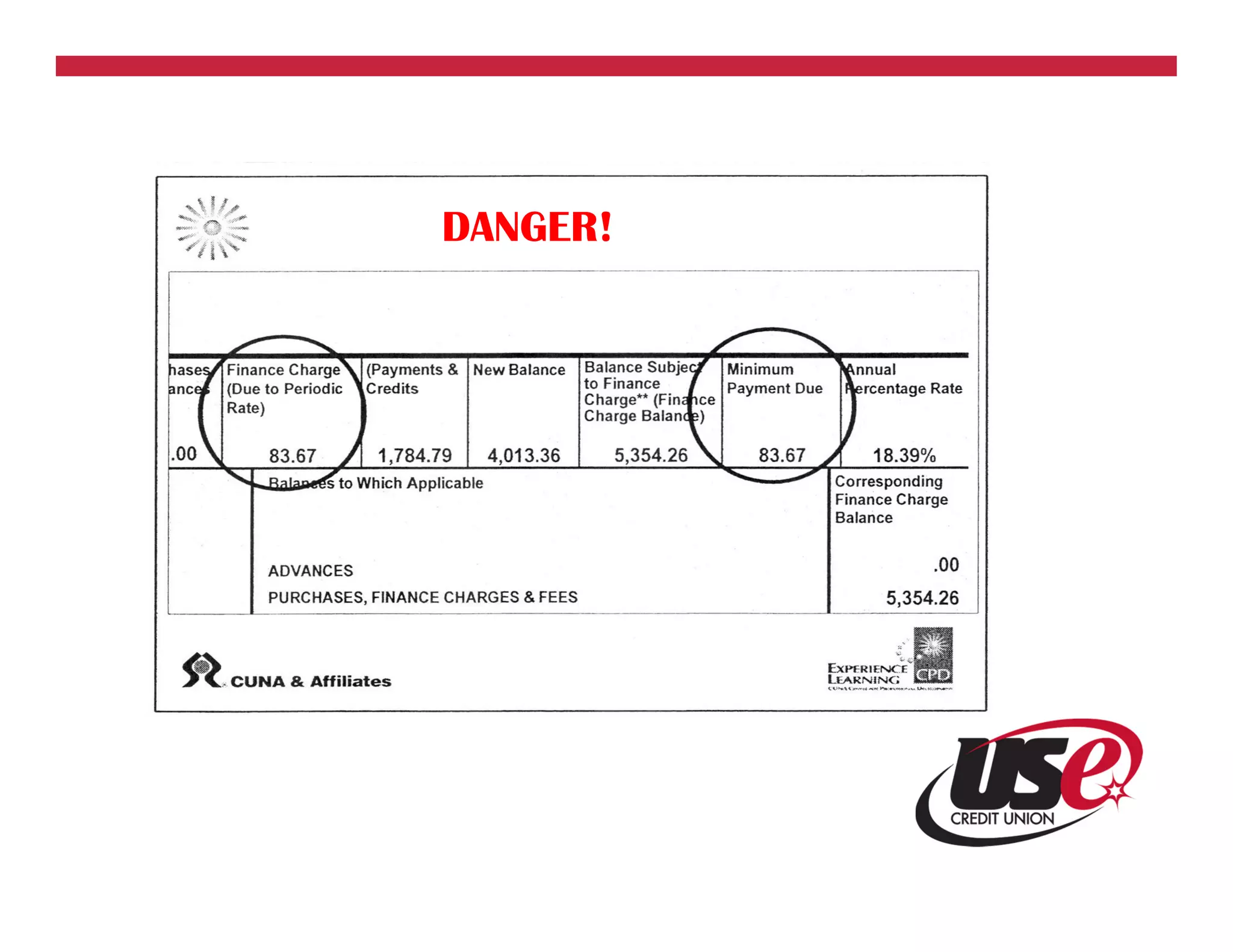

The document provides 5 steps to achieving financial freedom: 1) assessing your current net worth and financial goals, 2) analyzing your budget and spending, 3) creating a spending plan, 4) wisely using credit, and 5) saving money. It emphasizes the importance of spending less than you earn, tracking expenses, paying down debt, and saving consistently over time to build wealth. The key messages are that financial freedom comes from managing your money well and having savings to withstand life's uncertainties.