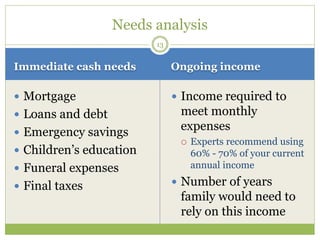

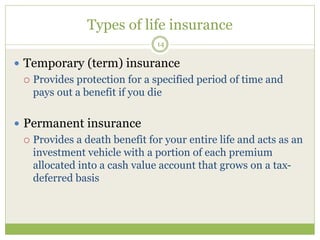

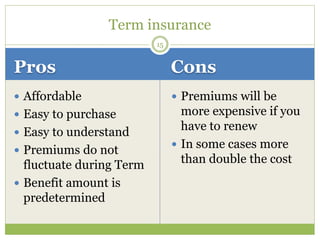

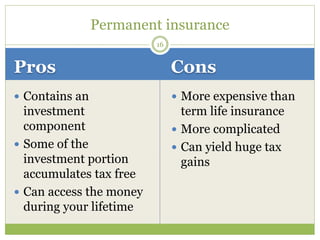

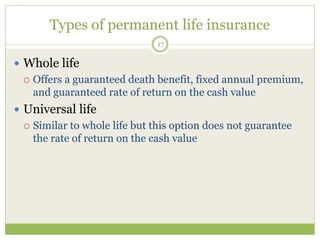

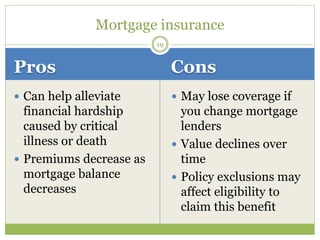

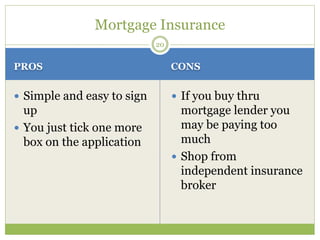

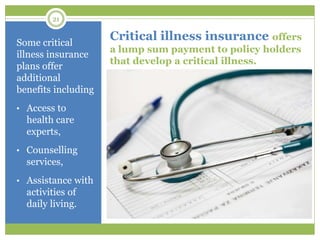

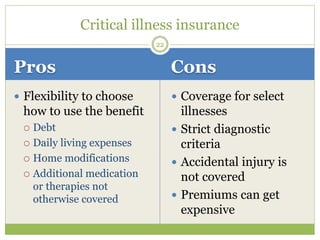

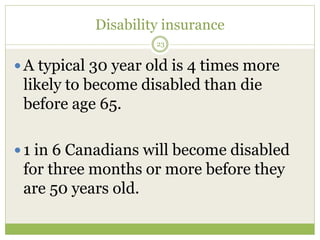

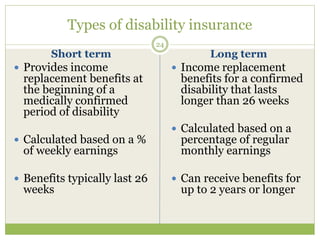

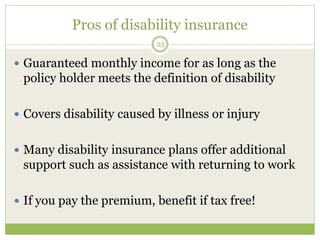

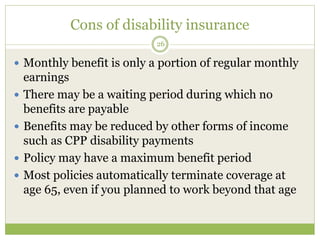

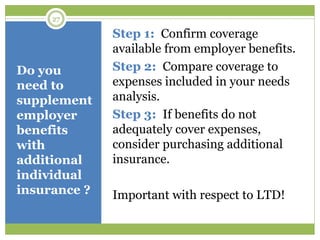

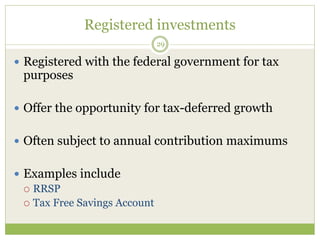

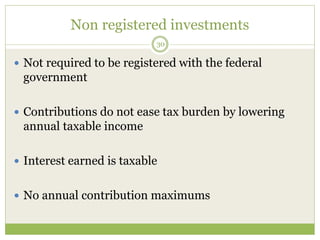

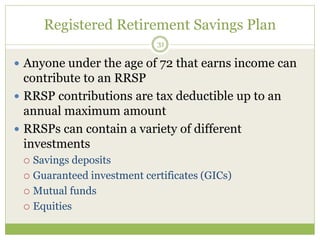

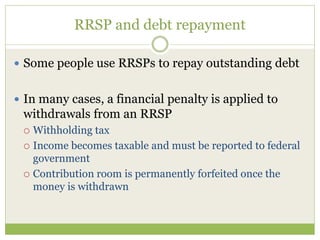

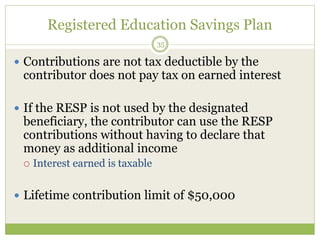

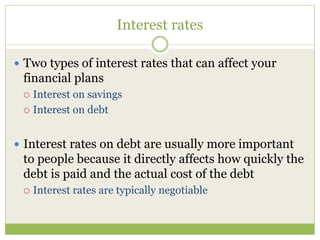

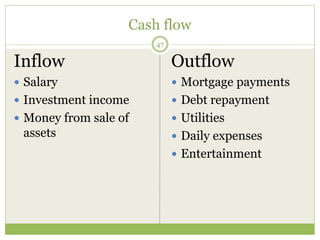

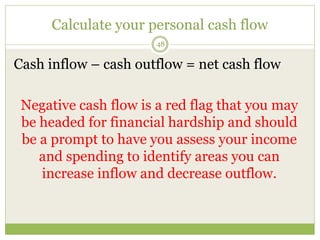

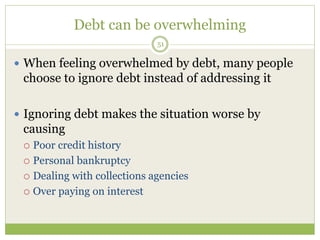

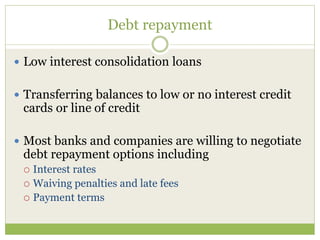

The document outlines key financial planning concepts presented in a workshop, including common mistakes people make and the importance of insurance, savings, and investments. It covers various types of insurance, debt management strategies, tax and estate planning, and the significance of understanding personal cash flow. The goal is to enhance participants' knowledge and skills in effective personal financial management.