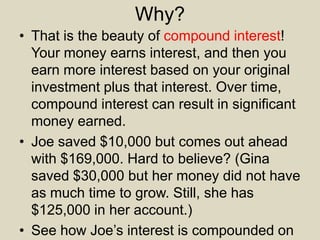

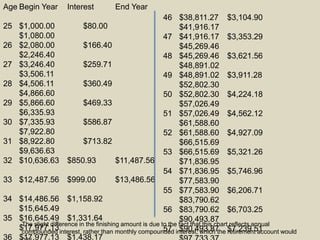

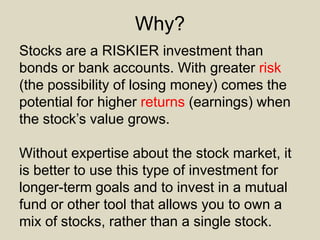

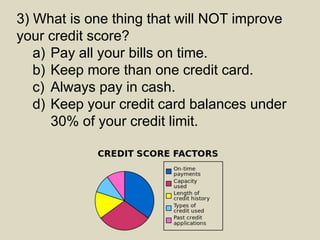

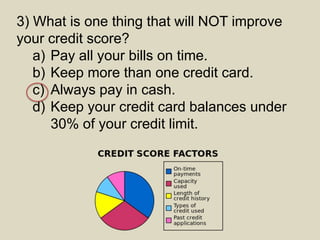

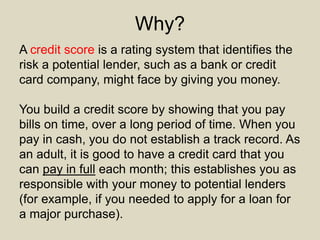

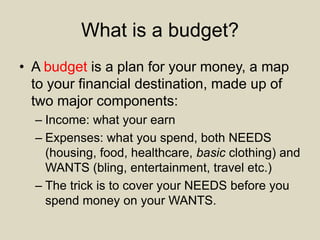

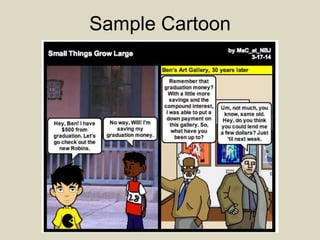

This document provides a quiz to test financial literacy. It contains questions about concepts like compound interest, types of bank accounts, credit cards, long-term savings plans, investments, credit scores, and budgets. After reviewing the concepts, students are assigned to create a comic strip teaching others about one of the financial topics.