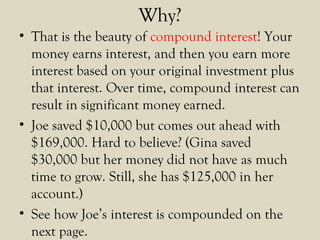

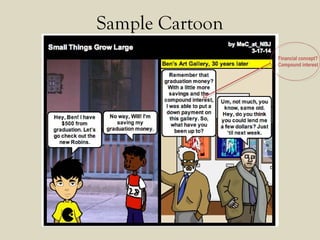

Here is a 3-panel comic strip teaching others about compound interest:

Panel 1:

Two friends, Sam and Emma, are talking. Sam says "I just opened a savings account that earns 5% interest each year. I deposited $1000."

Panel 2:

Emma replies "That's great! But do you know the power of compound interest? Your interest will earn interest each year, helping your money grow faster."

Panel 3:

Sam looks surprised. The bank teller overhears and says "She's right! In 10 years, with compound interest your $1000 will grow to over $1600. Your money works for you even when you're not adding more deposits."