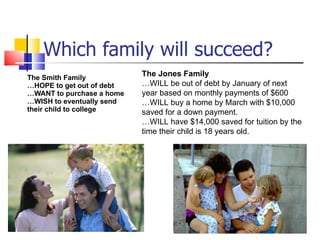

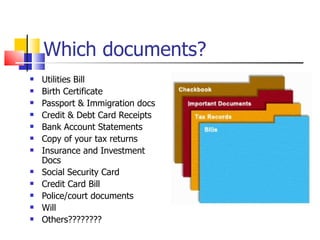

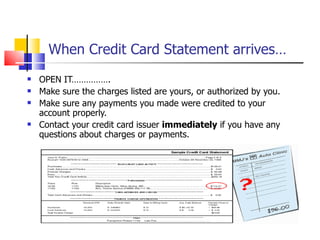

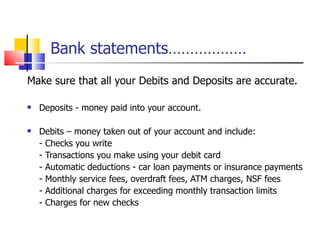

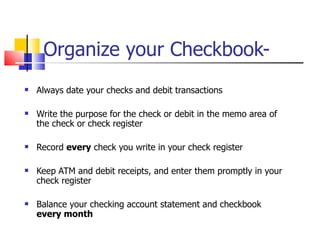

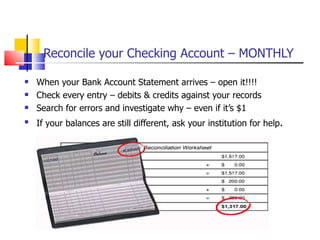

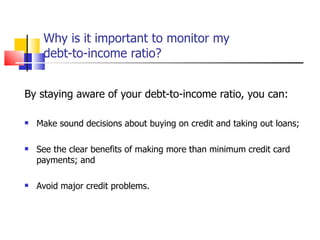

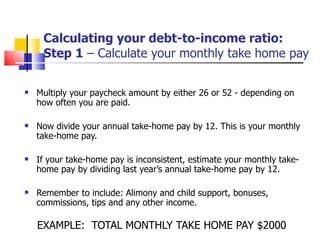

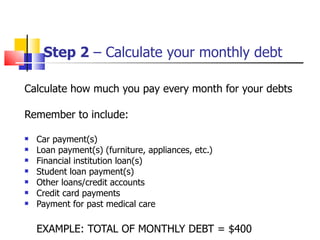

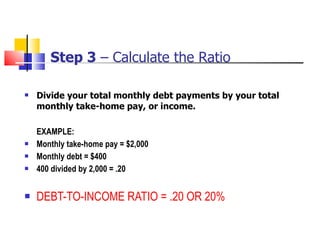

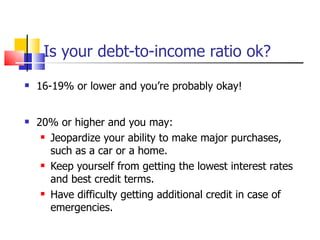

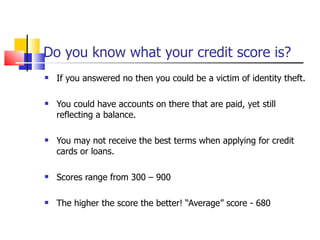

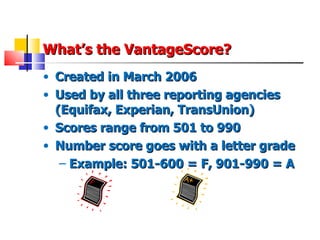

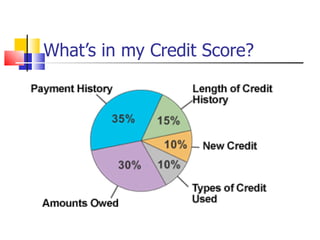

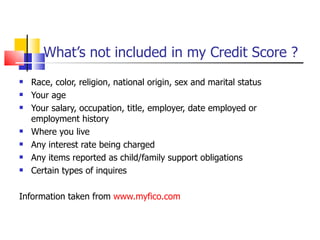

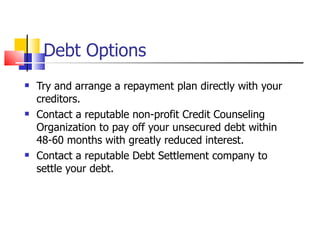

The document provides information on setting financial goals and maintaining good financial habits such as organizing financial records, monitoring debt-to-income ratios, understanding credit reports and credit scores, and repairing credit. It emphasizes the importance of writing down goals, tracking spending, paying bills on time, and disputing any incorrect information on credit reports to achieve financial stability and qualify for loans and credit cards.