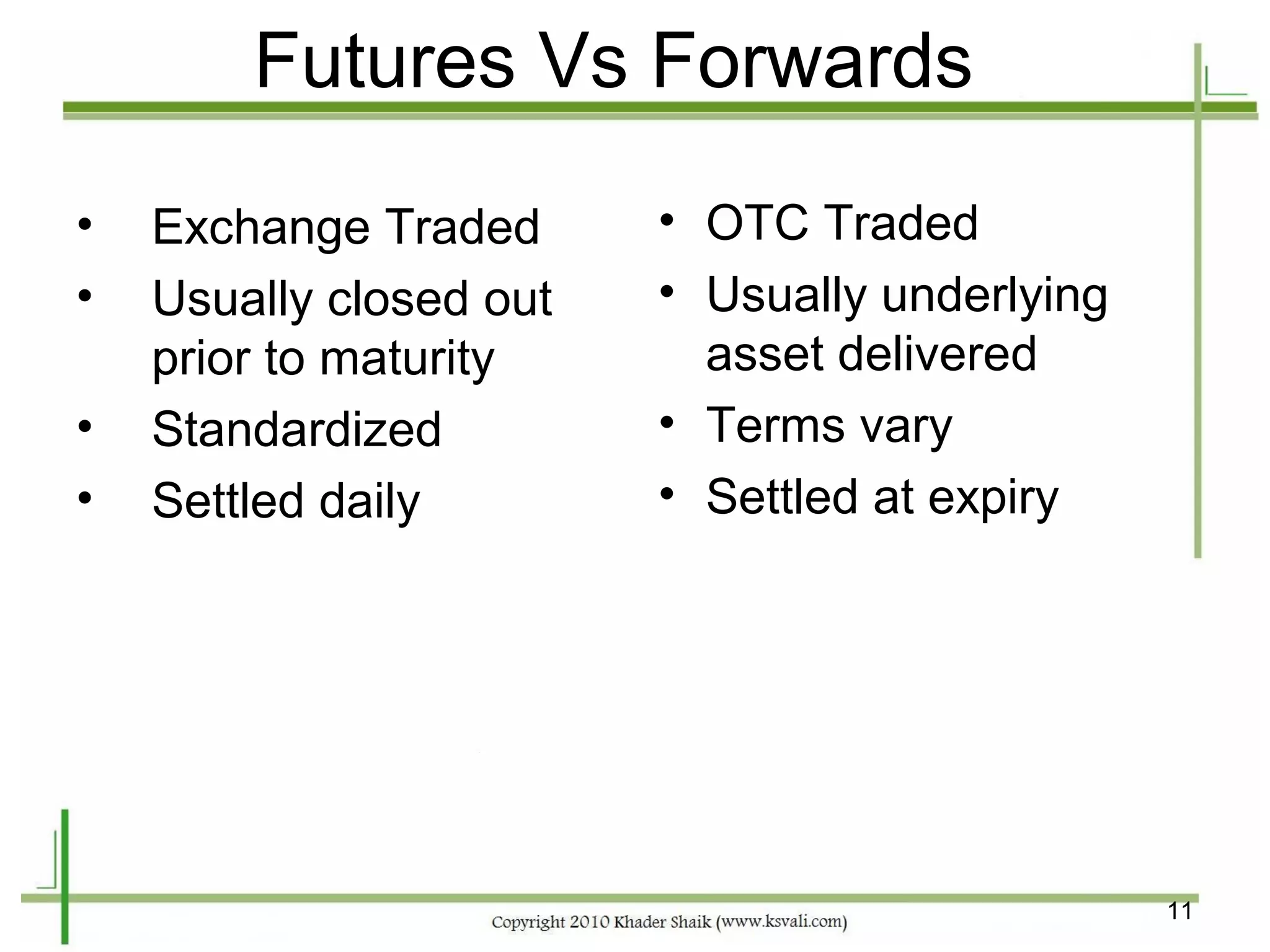

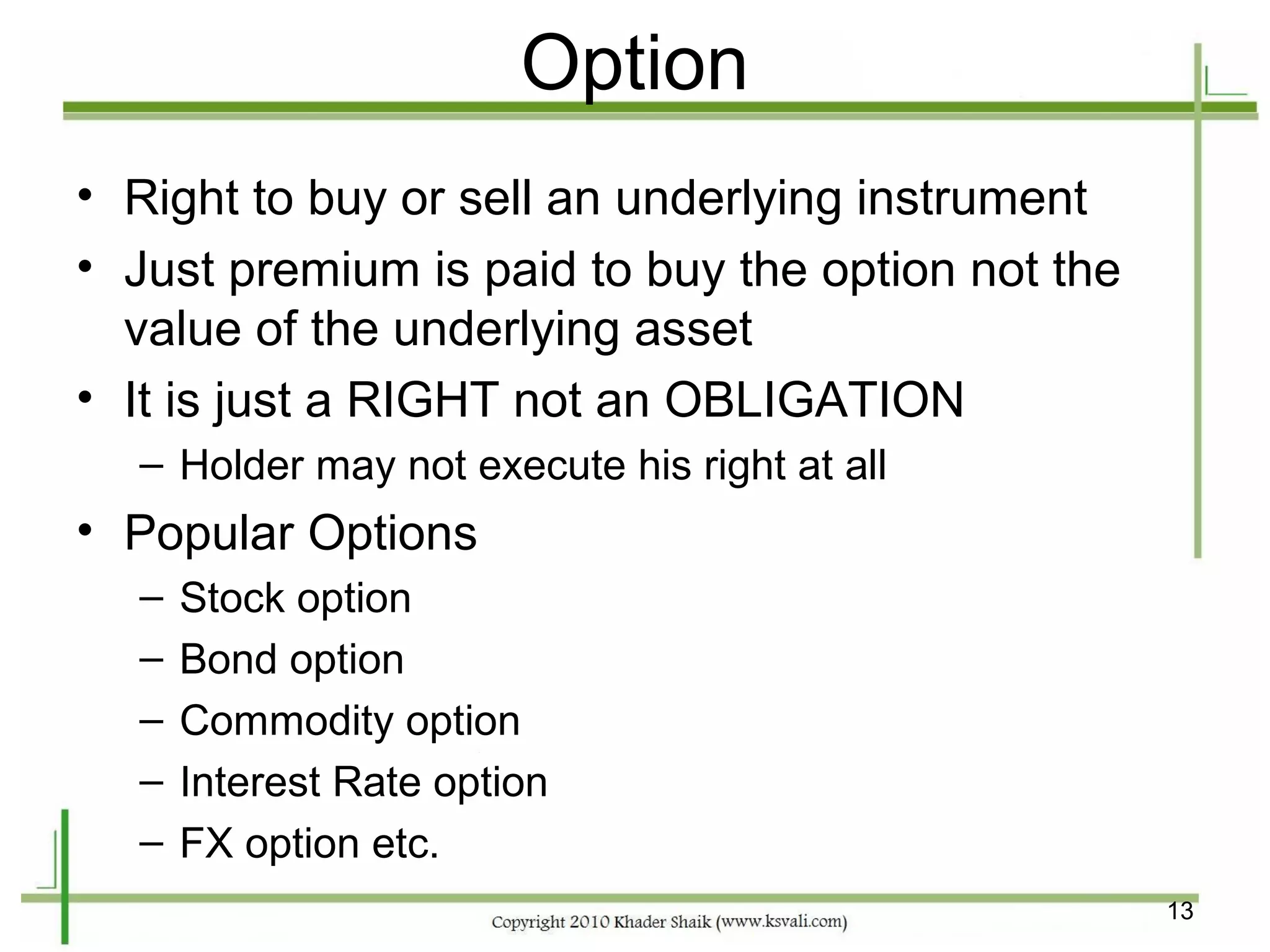

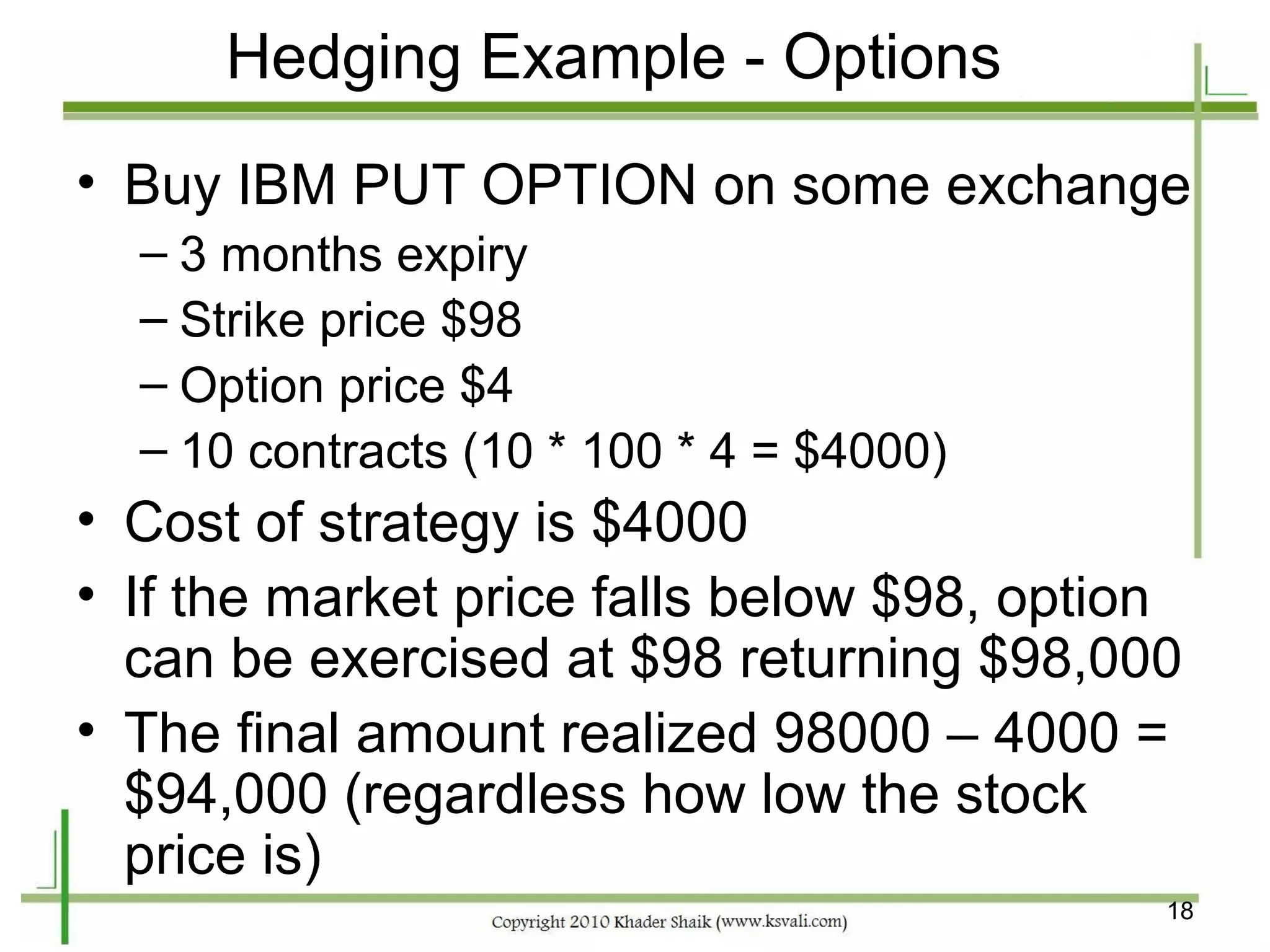

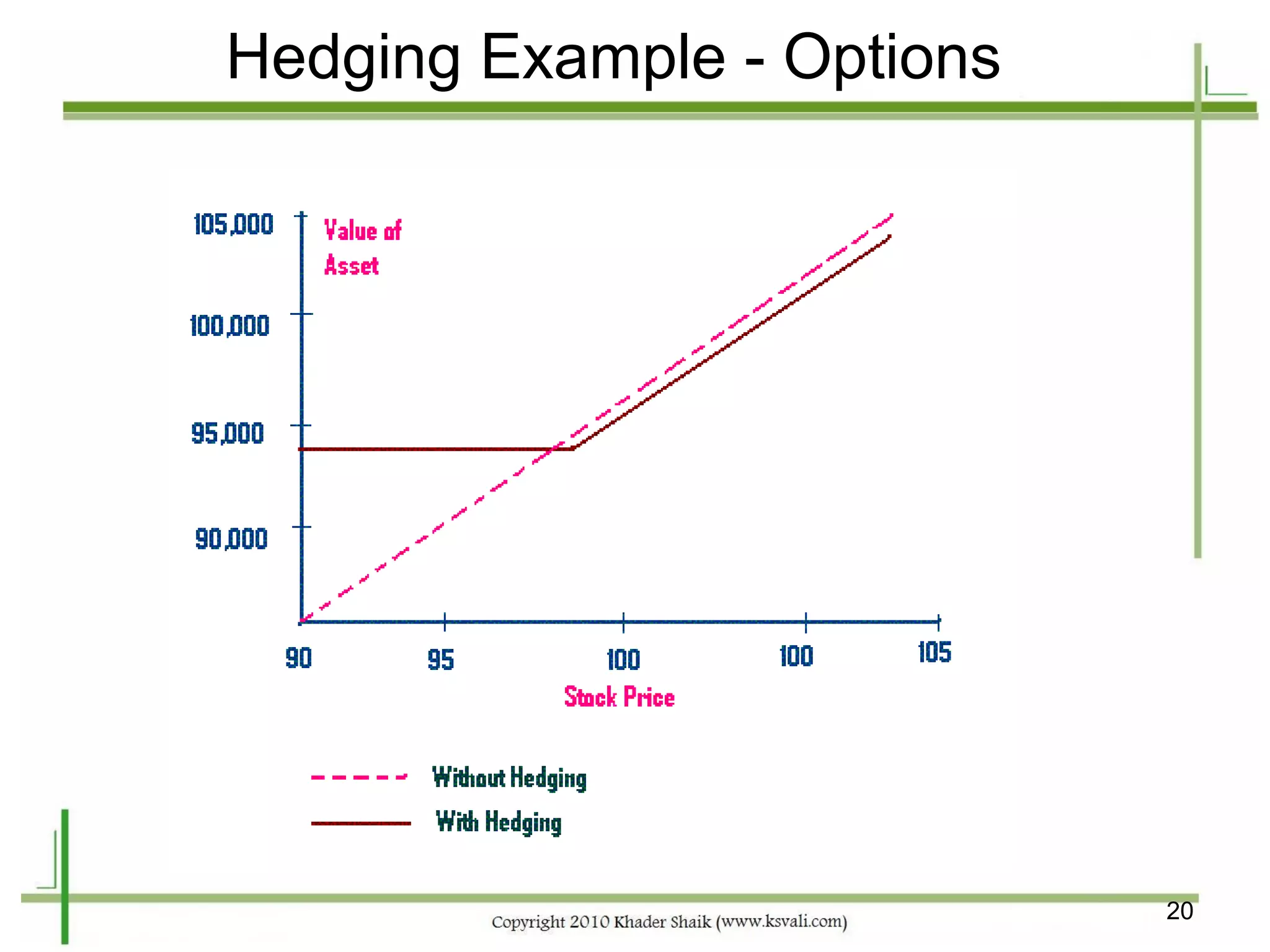

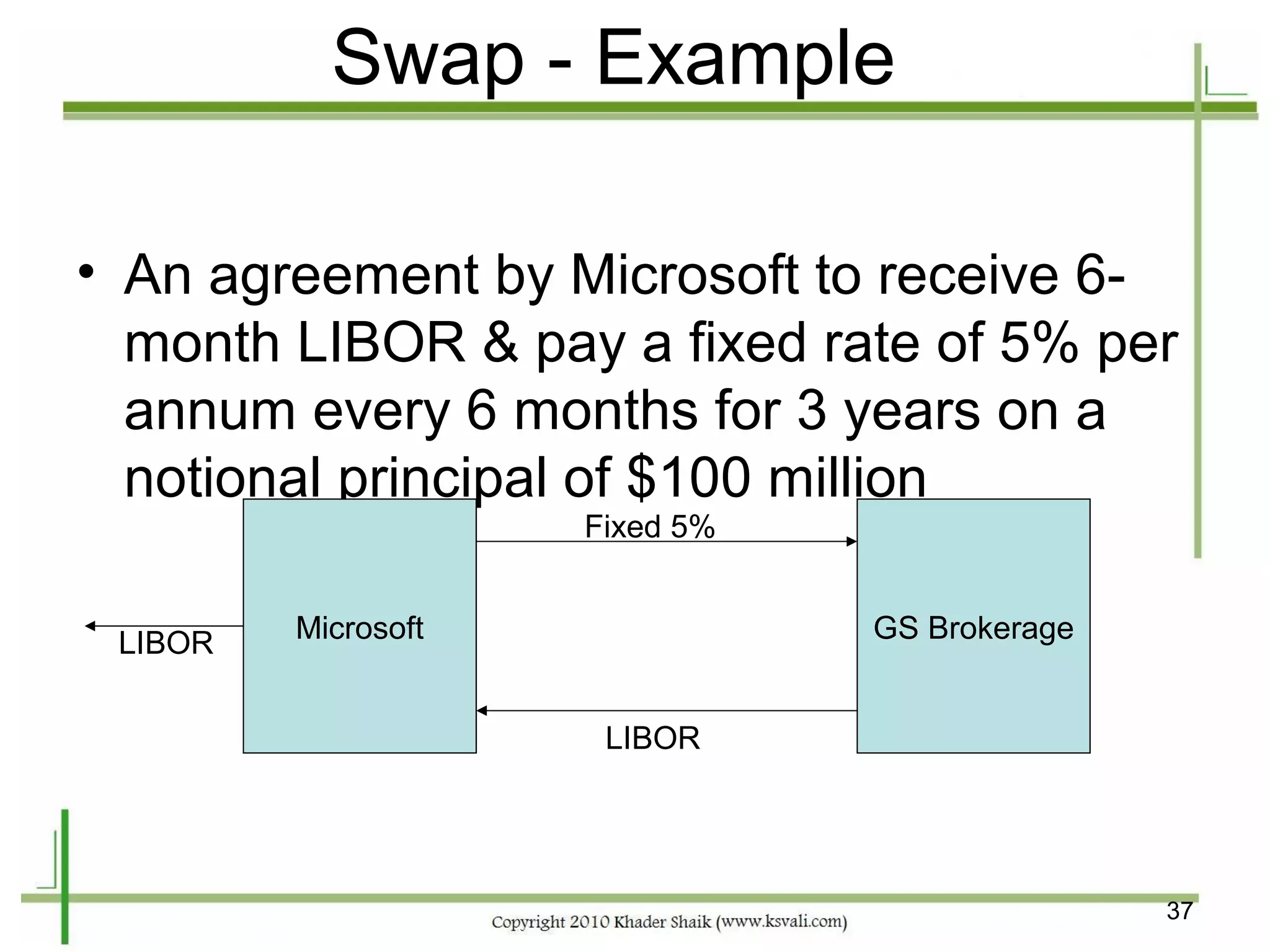

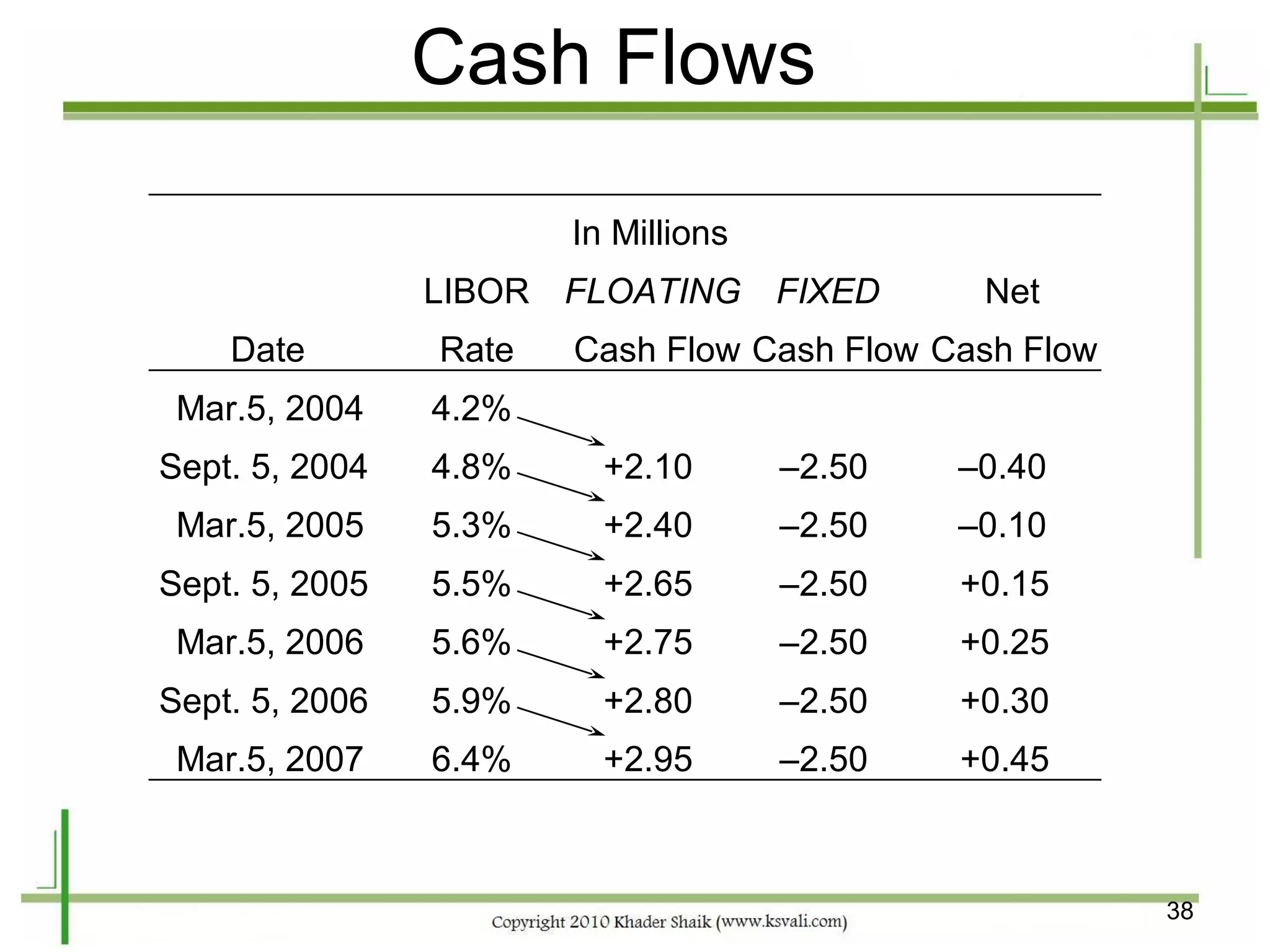

Derivatives are financial instruments whose value is derived from an underlying asset such as stocks, bonds, currencies, or commodities. The three main types of derivatives are futures, options, and swaps. Futures are standardized contracts to buy or sell an asset in the future at an agreed upon price. Options provide the right but not obligation to buy or sell an asset. Swaps involve exchanging one set of cash flows for another. Derivatives are used for hedging risk, speculation, and arbitrage opportunities.