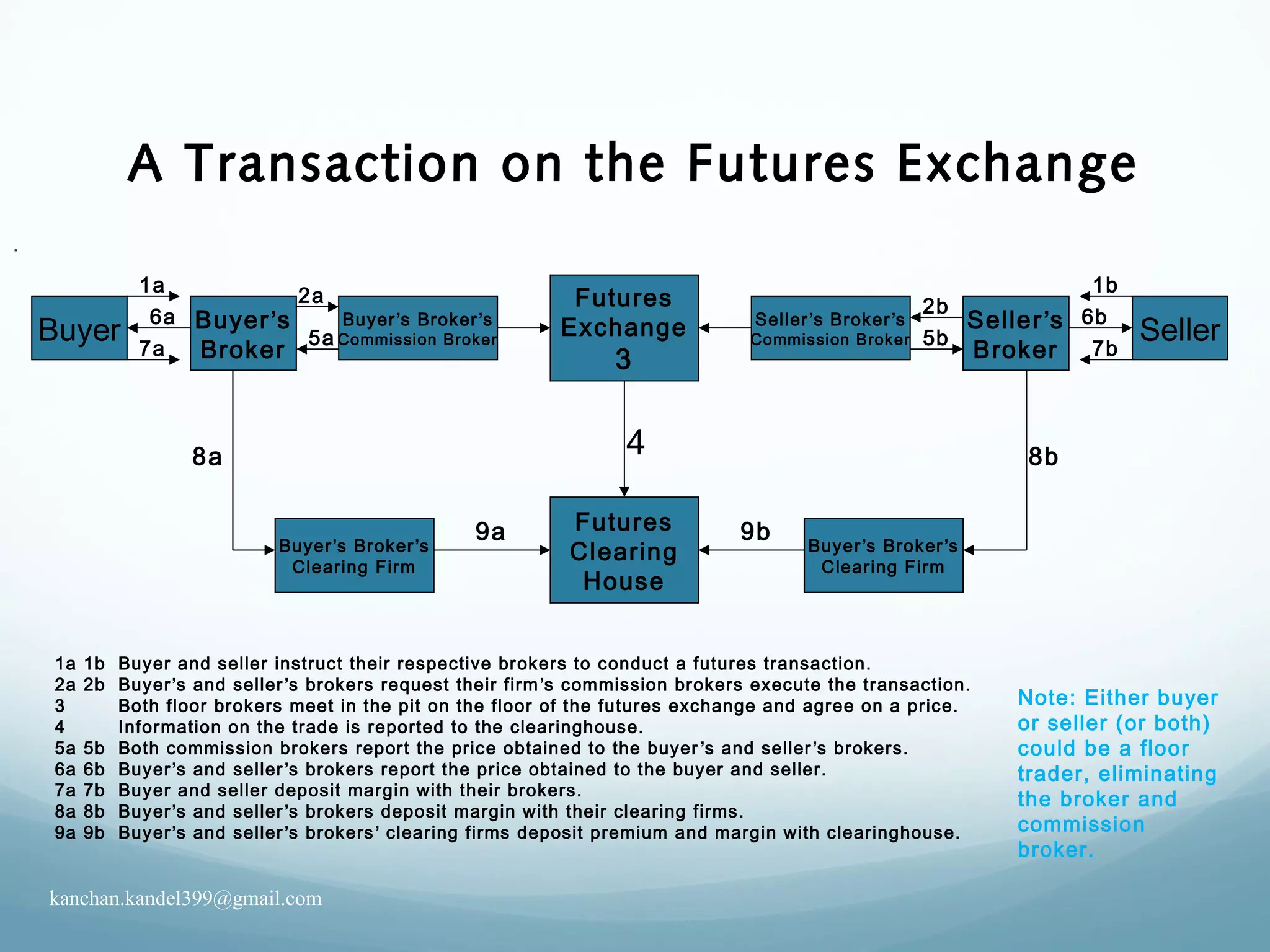

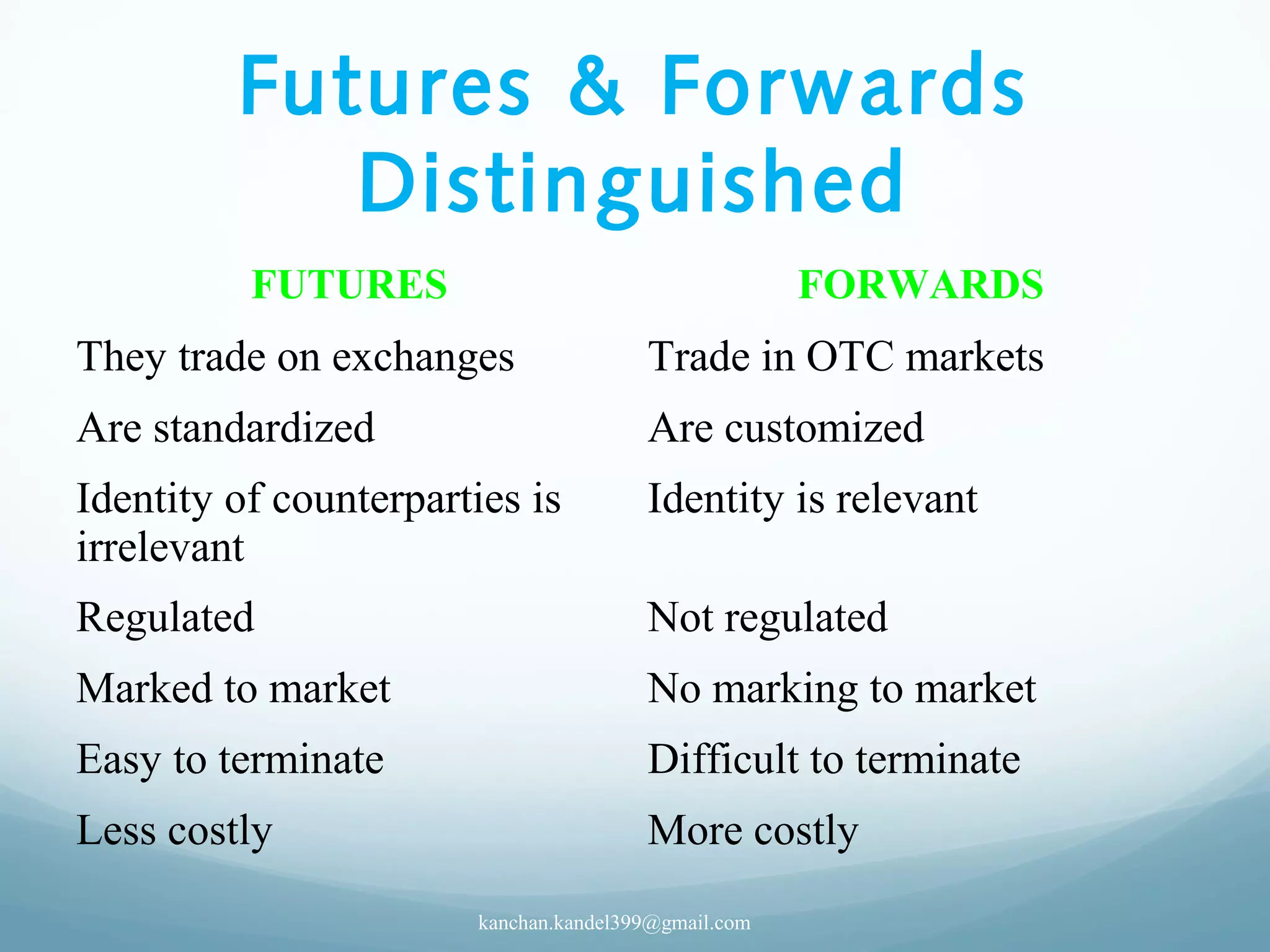

Futures are standardized contracts that require deferred delivery of an underlying asset at a specified price and date. Forwards are customized contracts negotiated over-the-counter. Forwards are useful when futures do not exist for a particular commodity or asset or when standard futures contracts do not match needs. Futures are traded on exchanges, have standardized terms, and parties are anonymous while forwards are traded over-the-counter, are customized, and parties are known to each other.

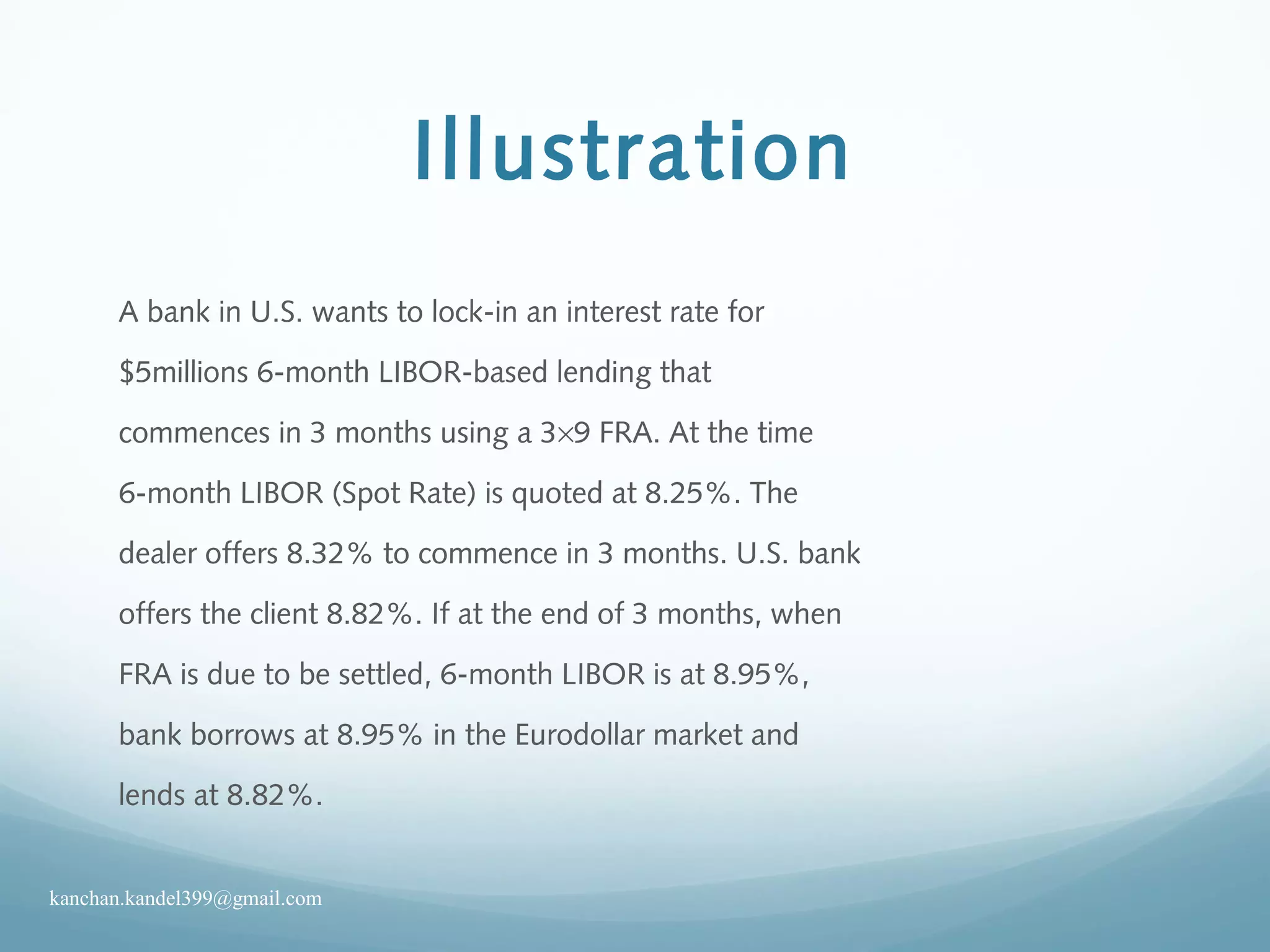

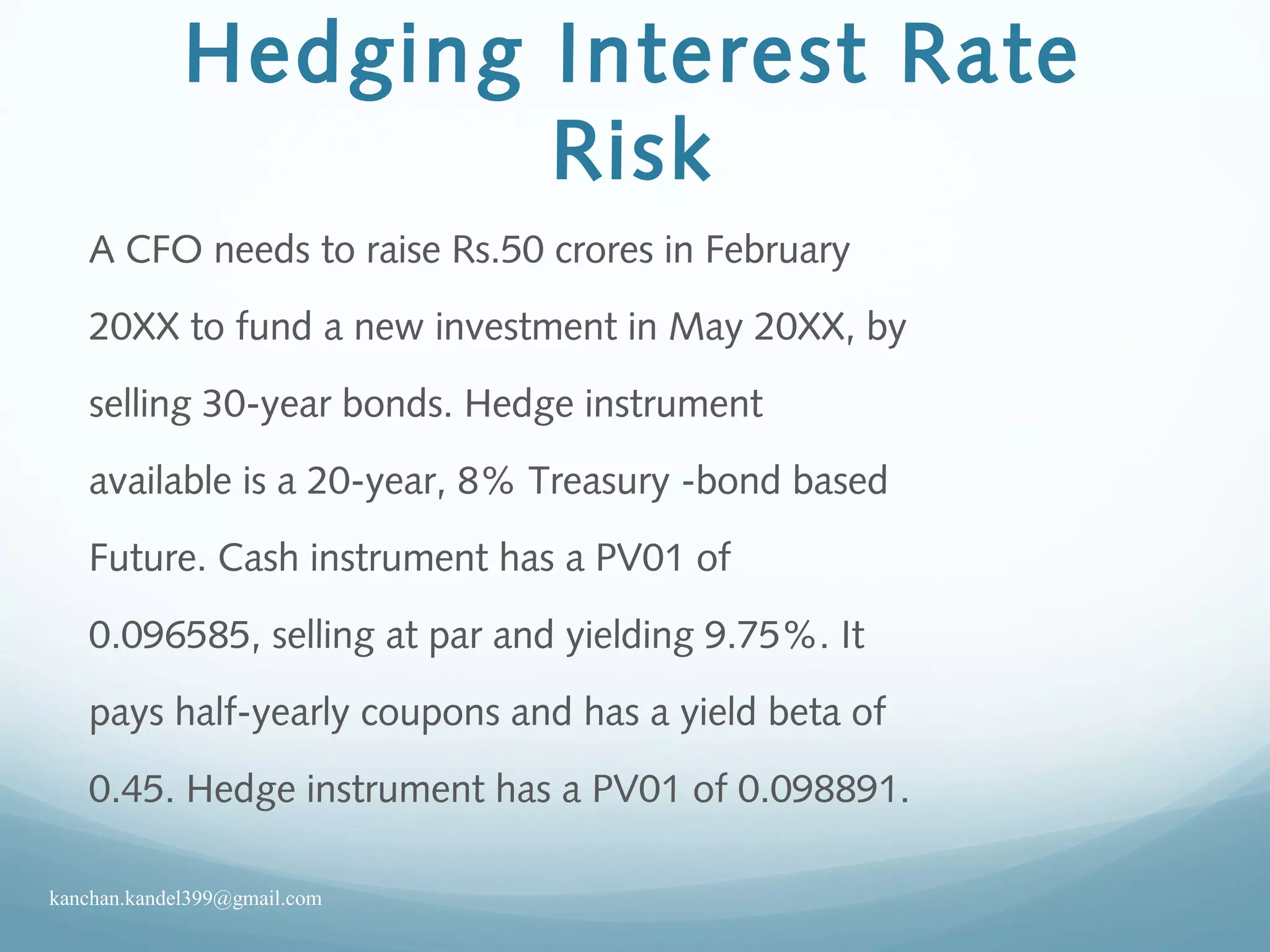

![Hedging Interest Rate

Risk

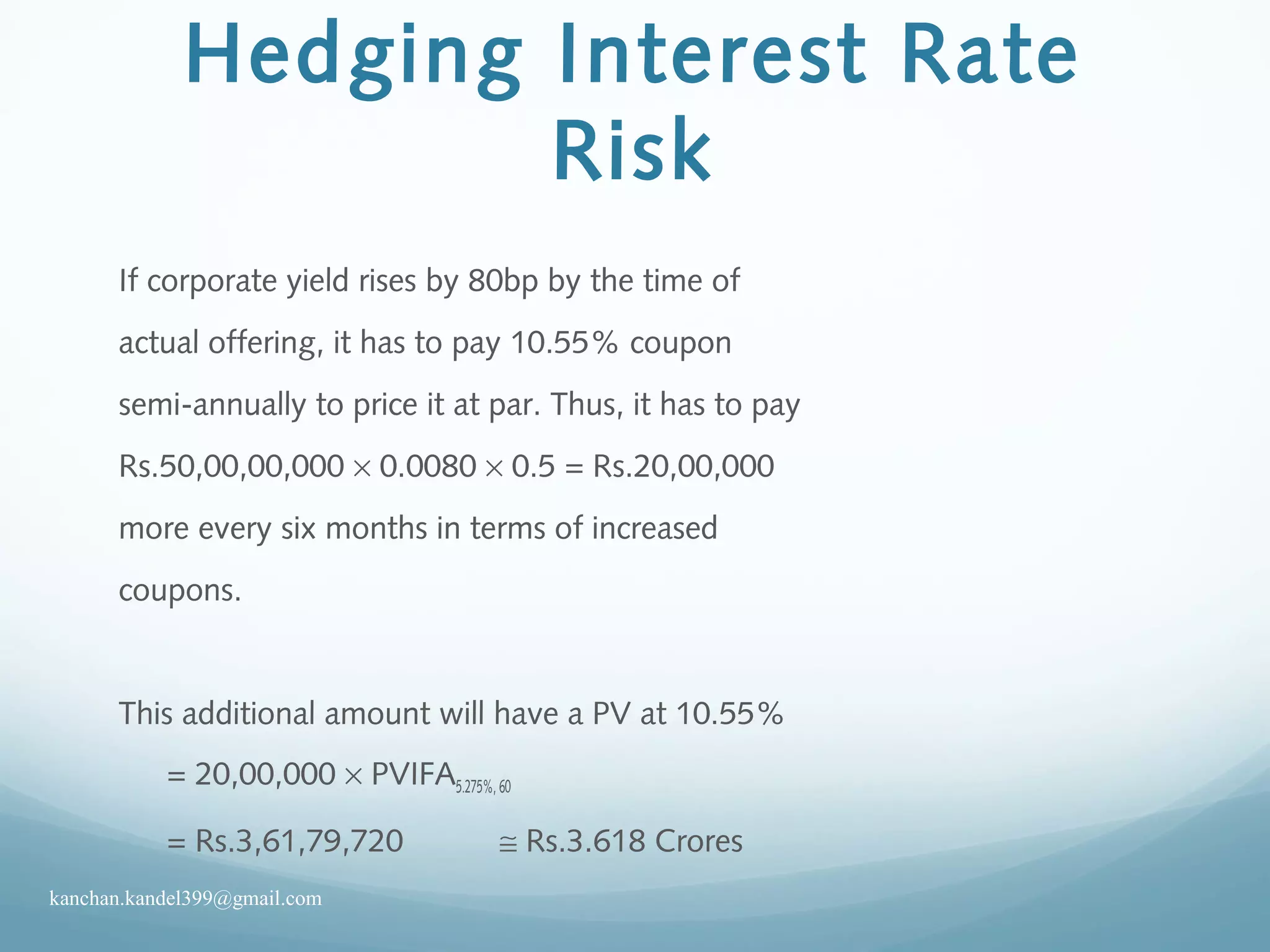

Hence, FVh = FVc × [PV01c / PV01h] × βy

= 50 × [0.096585 / 0.098891] × 0.45

= Rs.21.98 Crores

If FV of a single T-Bond Future is Rs.10,00,000

then, Number of Futures (Nf) = 21.98/0.1

= 219.8 Futures

kanchan.kandel399@gmail.com](https://image.slidesharecdn.com/forwardandfutureinterestrate-150913144745-lva1-app6892/75/Forward-and-future-interest-rate-11-2048.jpg)