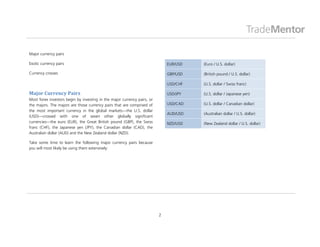

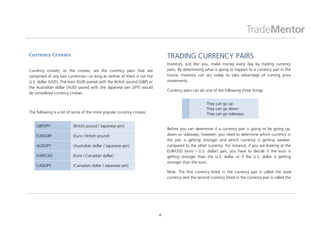

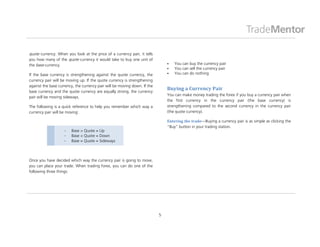

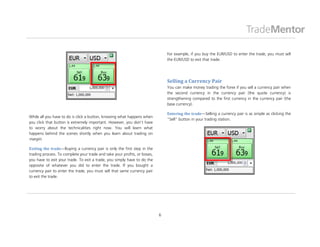

This document provides an introduction to forex trading, emphasizing that currencies are traded in pairs, which allow investors to determine the strength of one currency against another. It explains how to trade currency pairs, highlighting the different types such as major, exotic, and crosses, and outlines the concepts of buying, selling, leverage, margin, and spreads. The text aims to set a solid foundation for new forex traders by detailing essential terminology and trading mechanics.