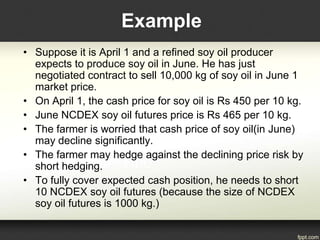

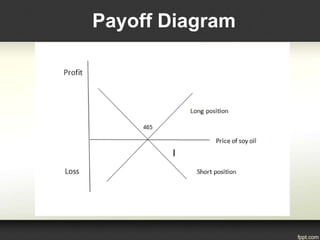

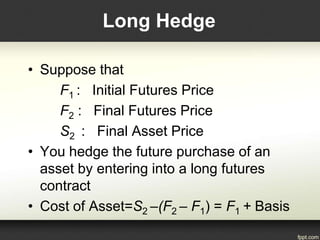

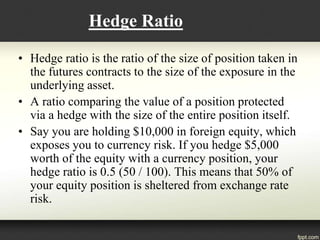

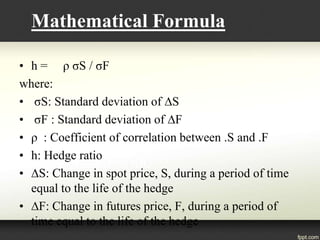

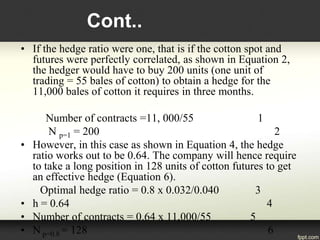

This document discusses hedging strategies used by participants in commodity markets to reduce price risk. It describes how hedgers use derivatives contracts like futures to lock in prices for transactions that will occur in the future. There are two main types of hedges - short hedges where the hedger sells an asset, used by producers worried about falling prices, and long hedges where the hedger buys an asset, used by buyers concerned about rising prices. The optimal hedge ratio, which minimizes risk, depends on the correlation between the underlying asset price and futures price as well as their standard deviations. An example calculates the optimal number of cotton futures contracts a company should purchase to hedge its need to buy 11,