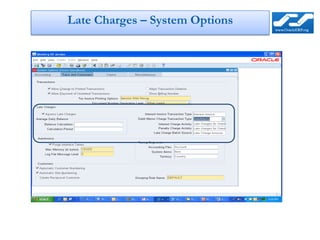

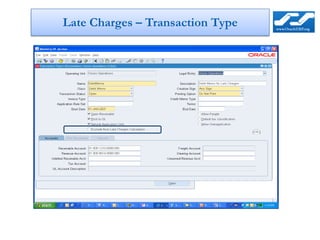

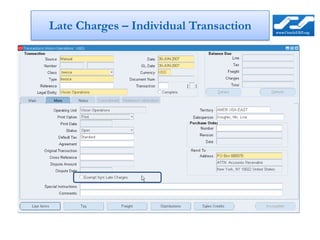

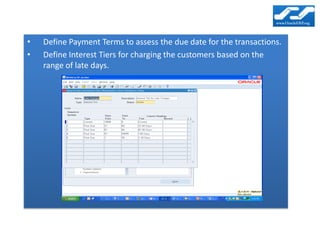

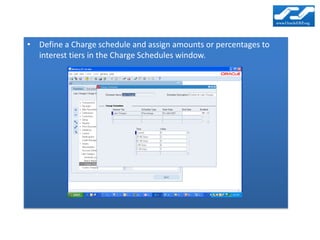

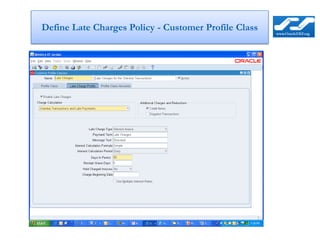

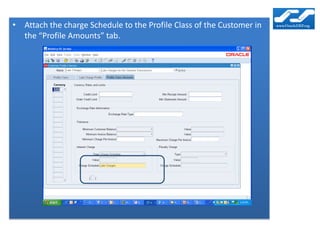

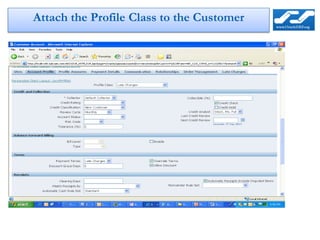

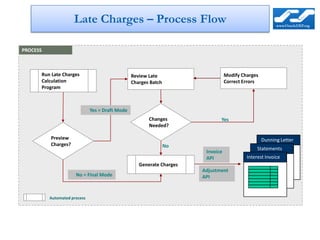

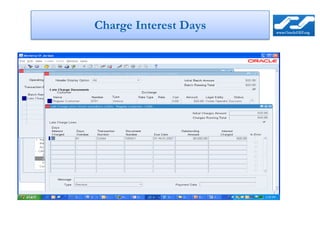

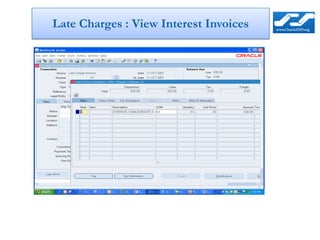

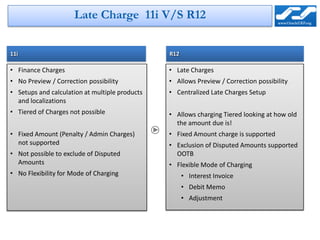

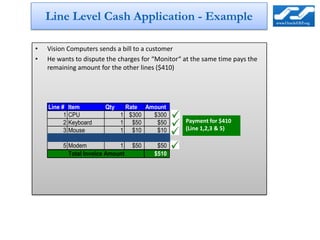

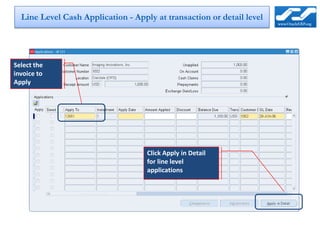

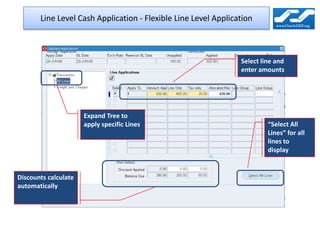

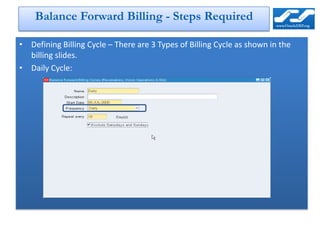

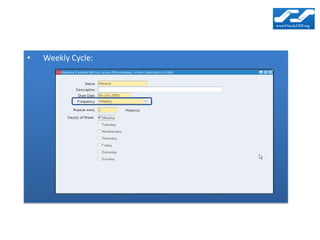

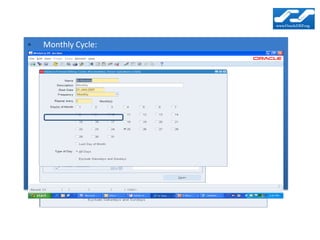

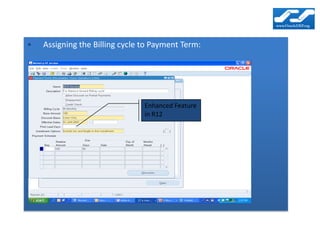

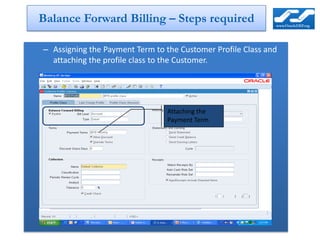

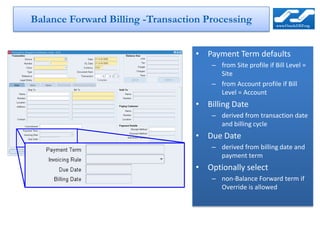

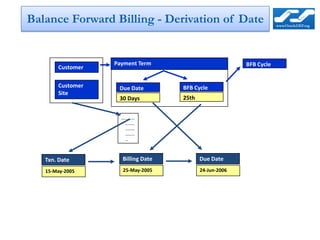

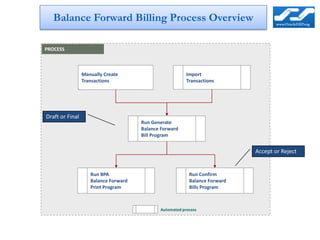

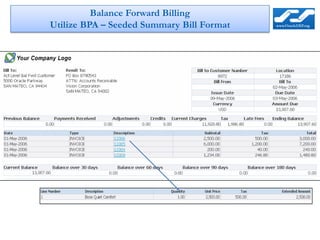

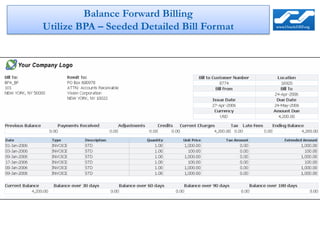

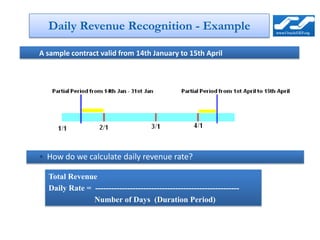

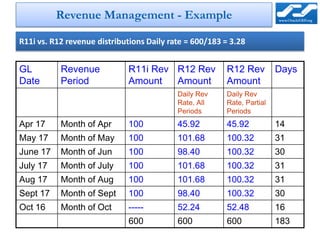

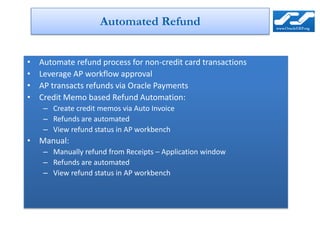

The document provides an overview of enhancements to receivables management in R12, including more flexible late charge policies, line-level cash application, and balance forward billing. Key features include assessing late charges by invoice, debit memo, or adjustment; tiered late fee schedules; previewing late charges; and defining billing cycles to generate regular consolidated bills for customers. The enhancements provide more control, flexibility, and integration across receivables processes.