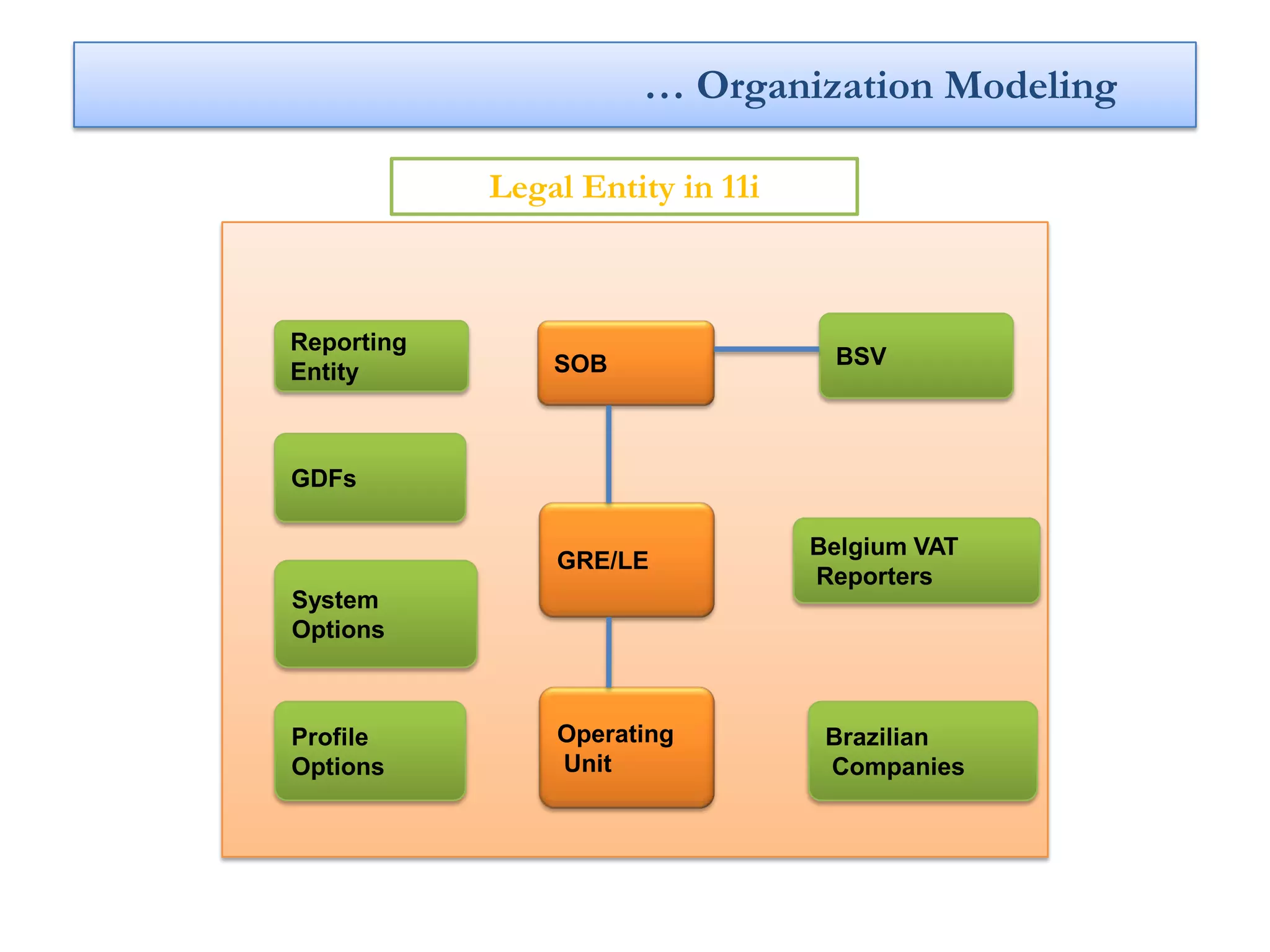

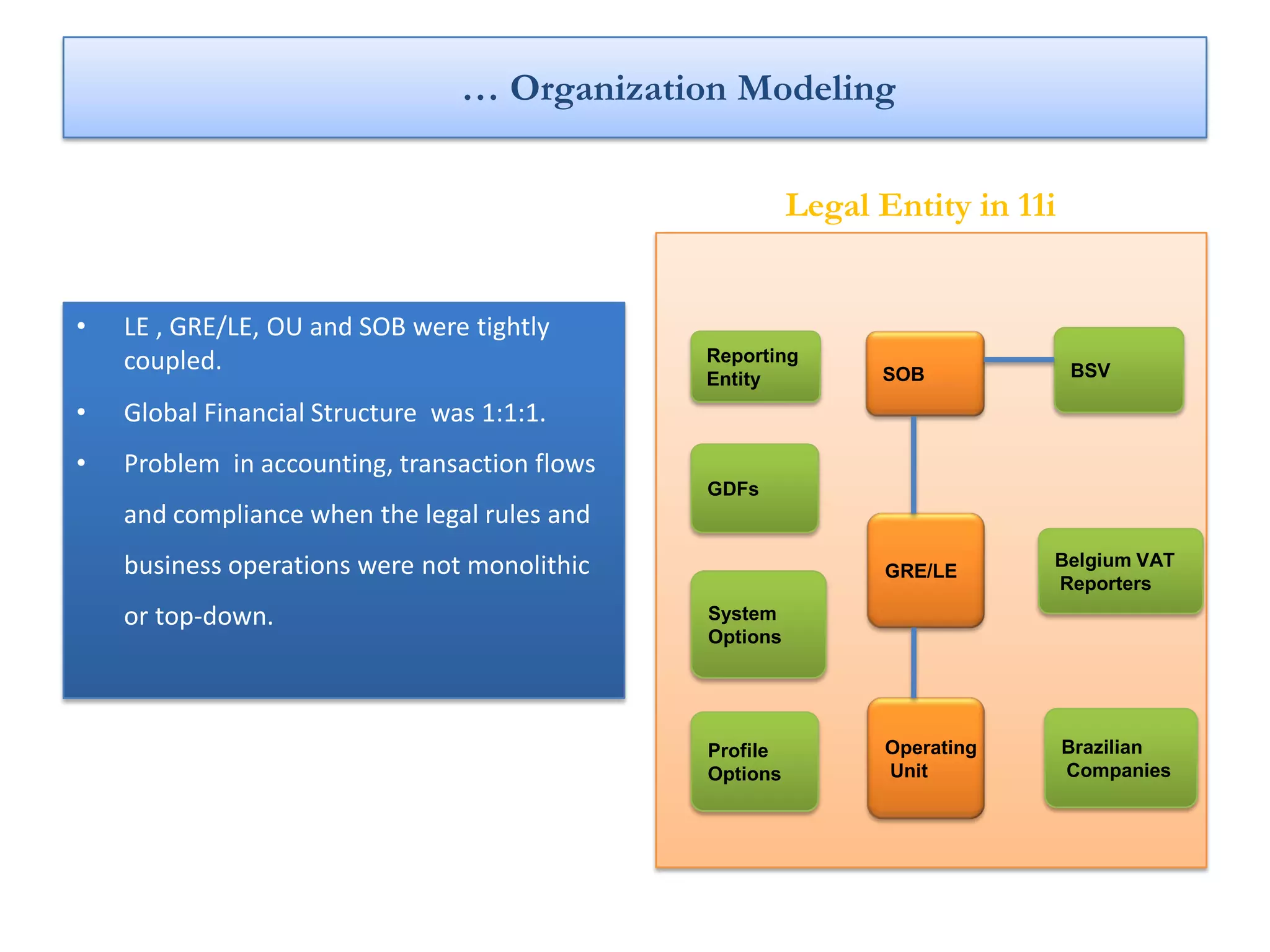

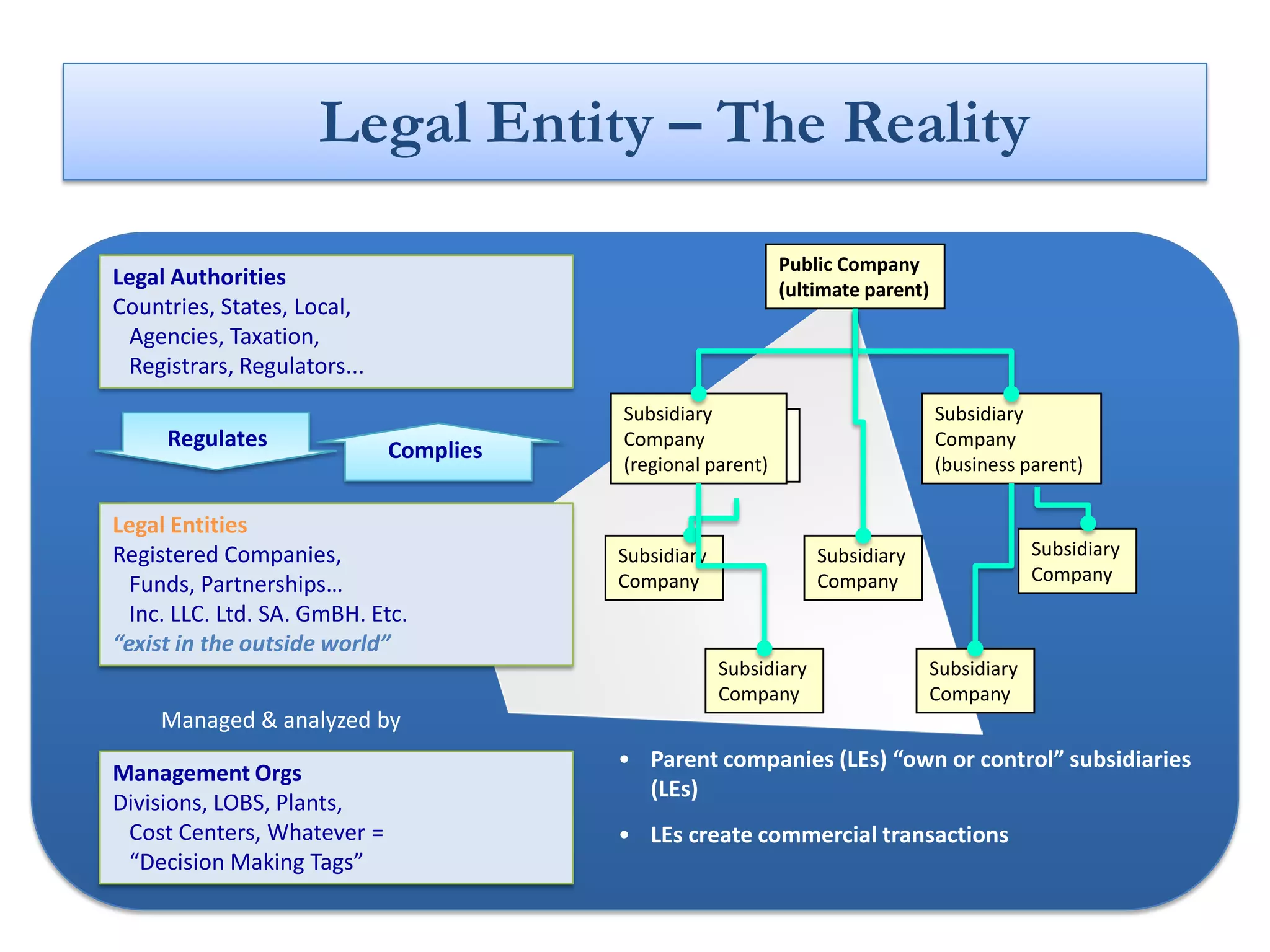

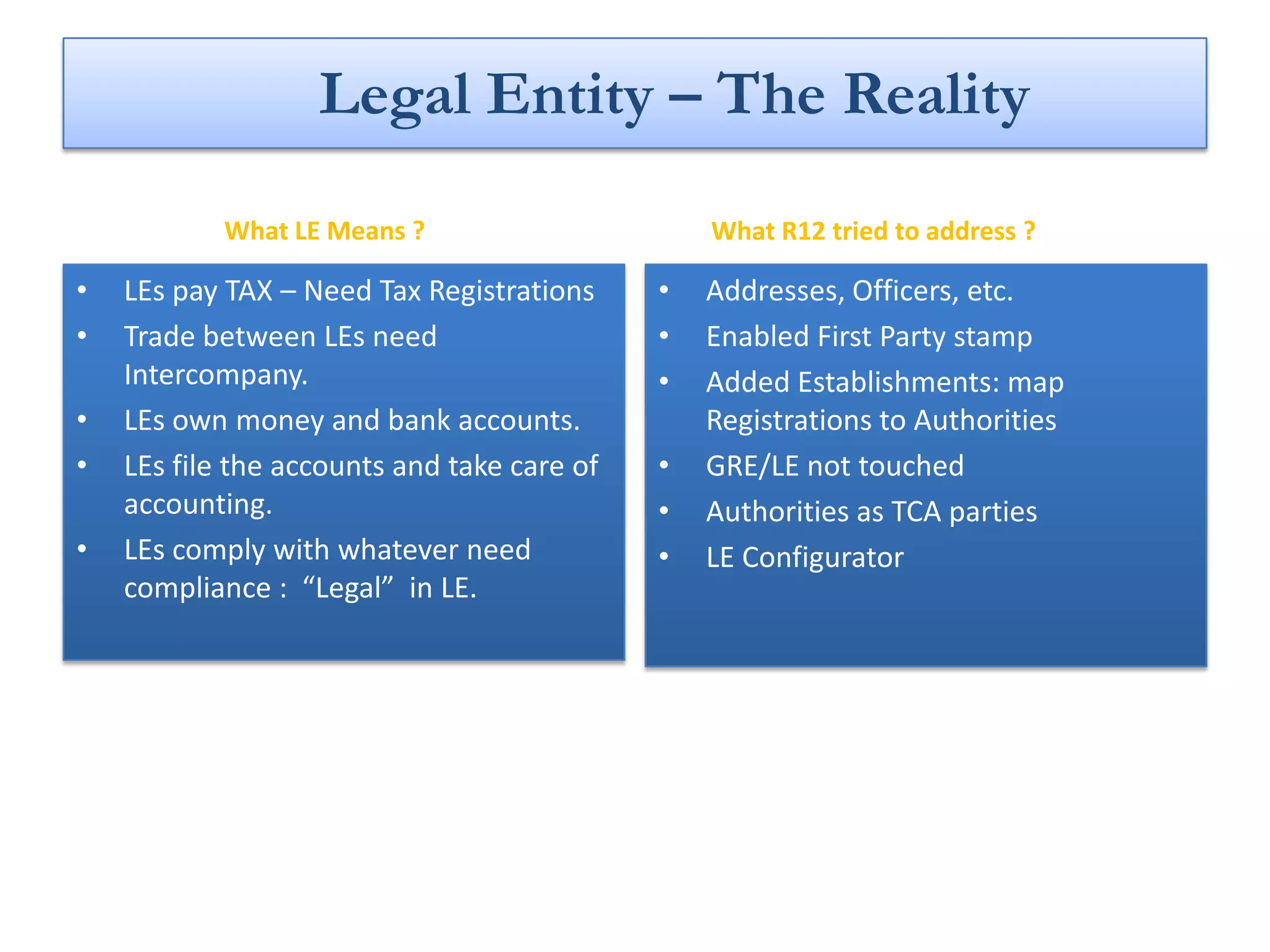

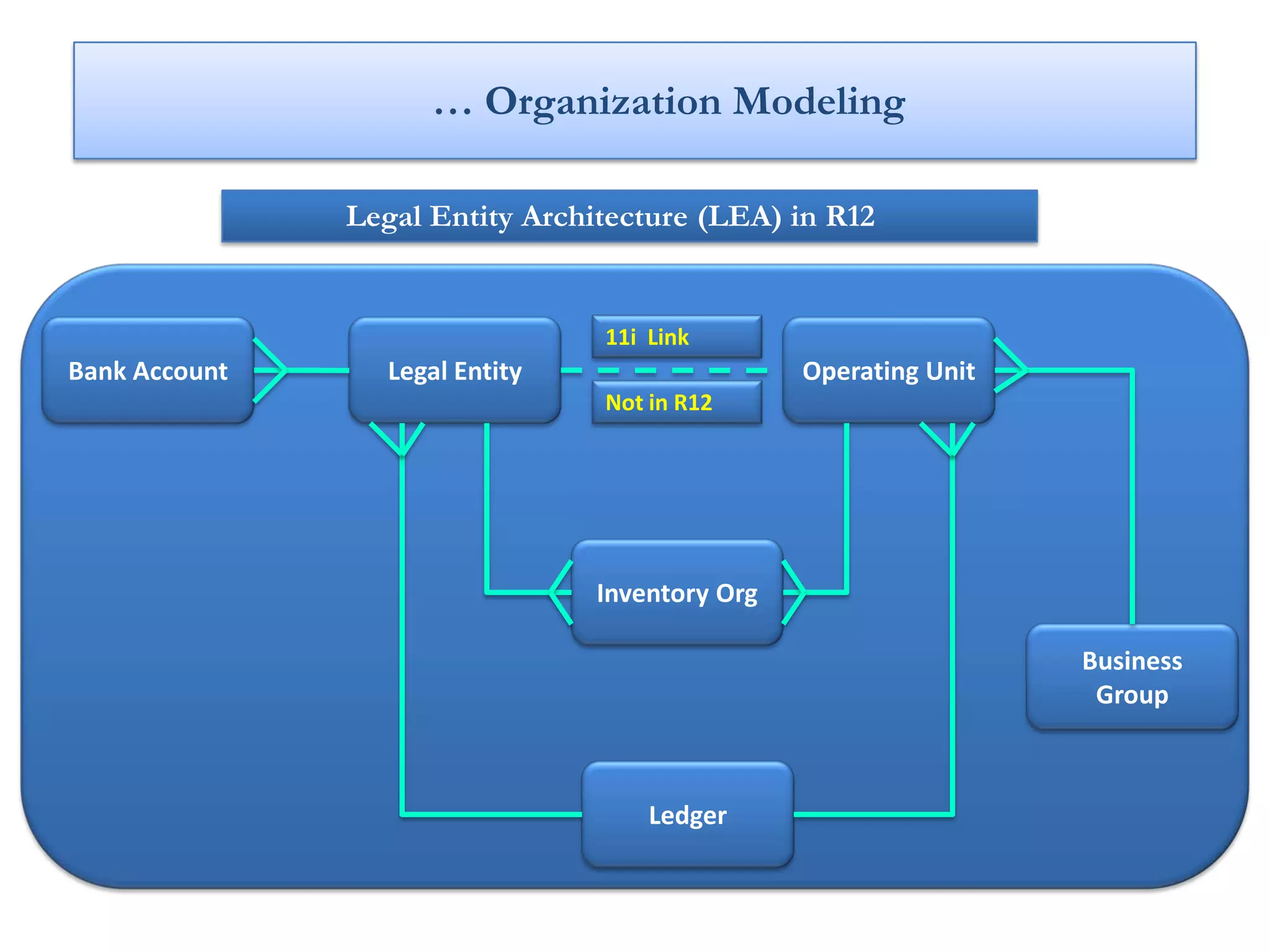

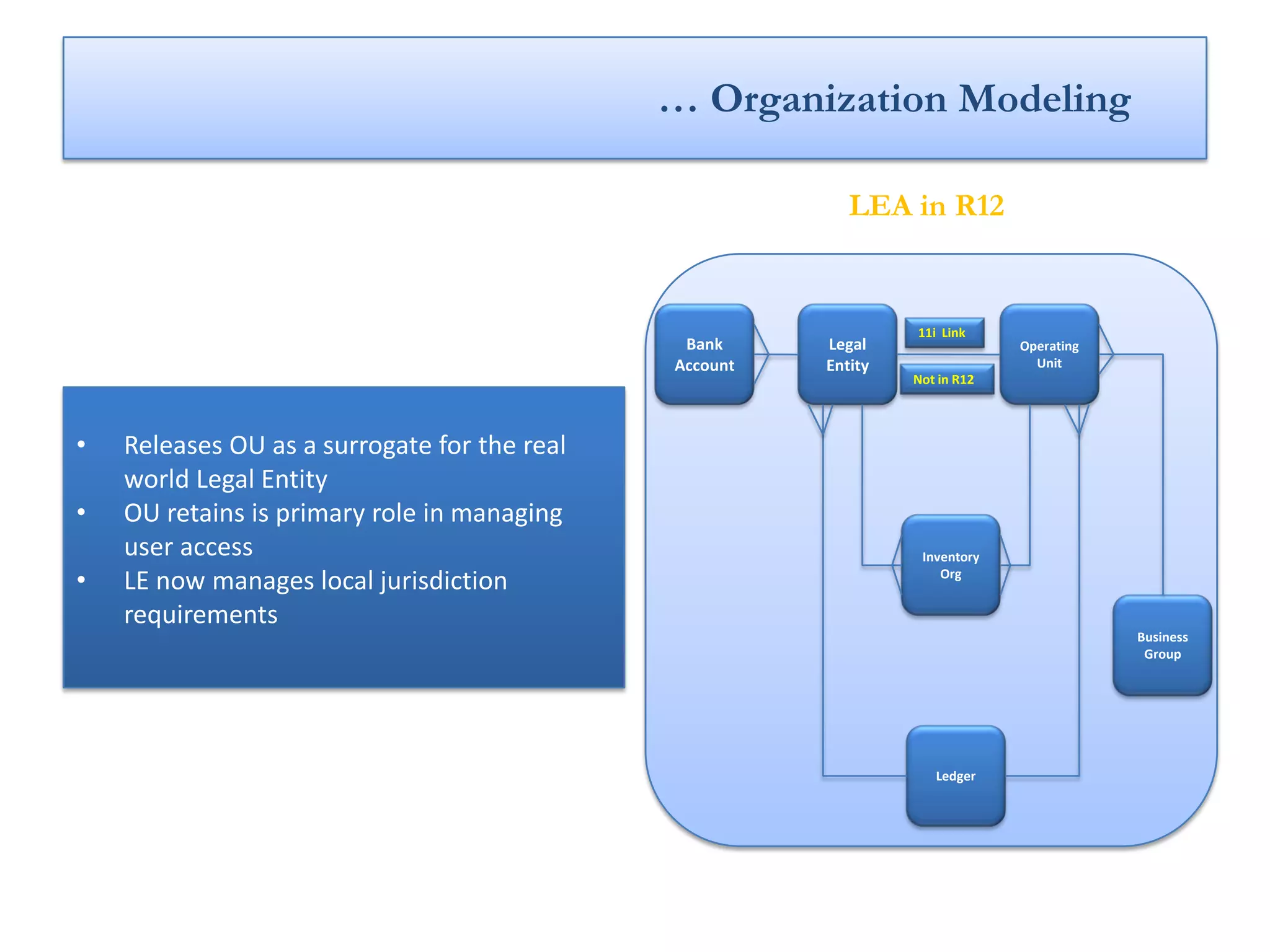

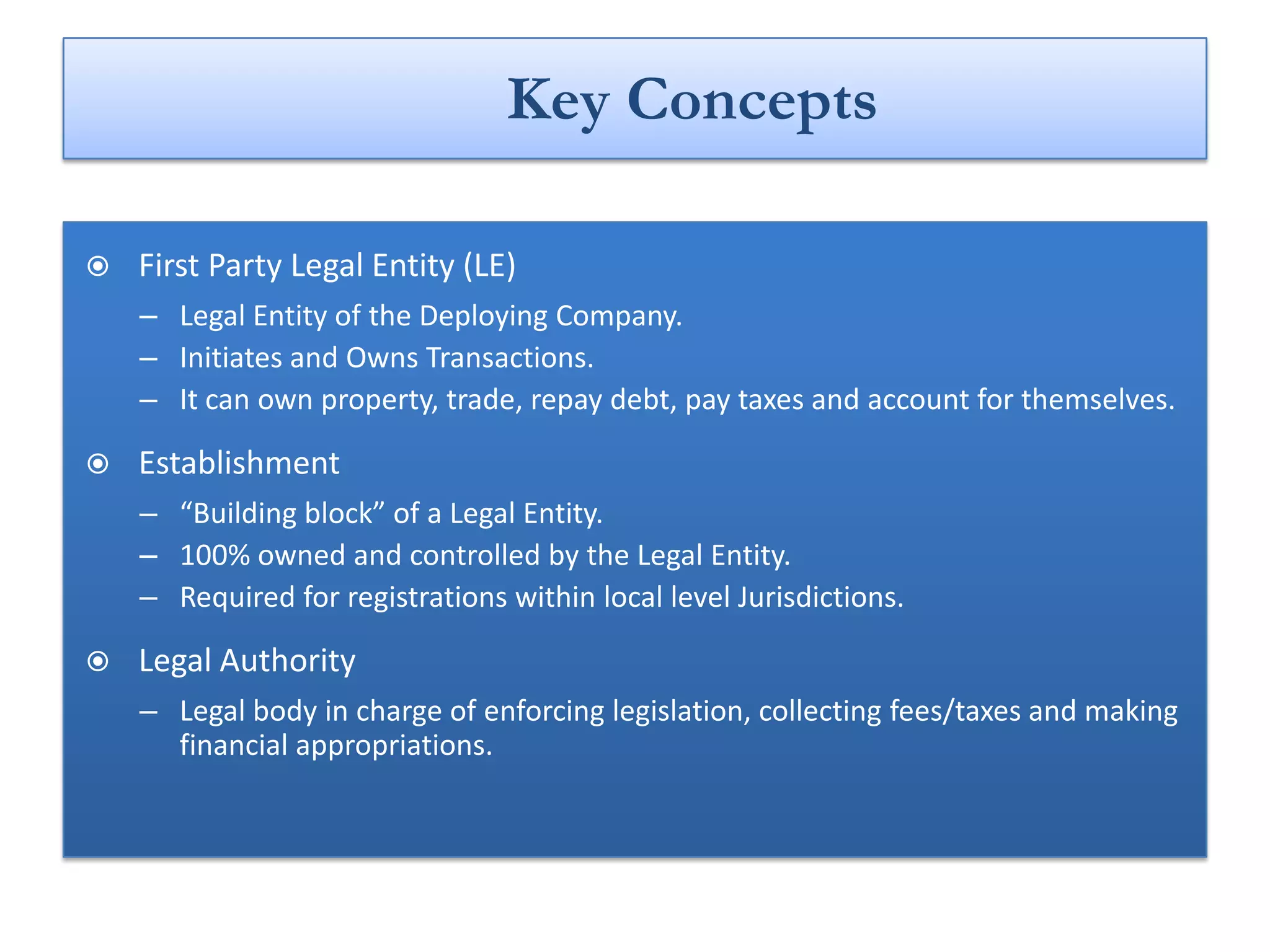

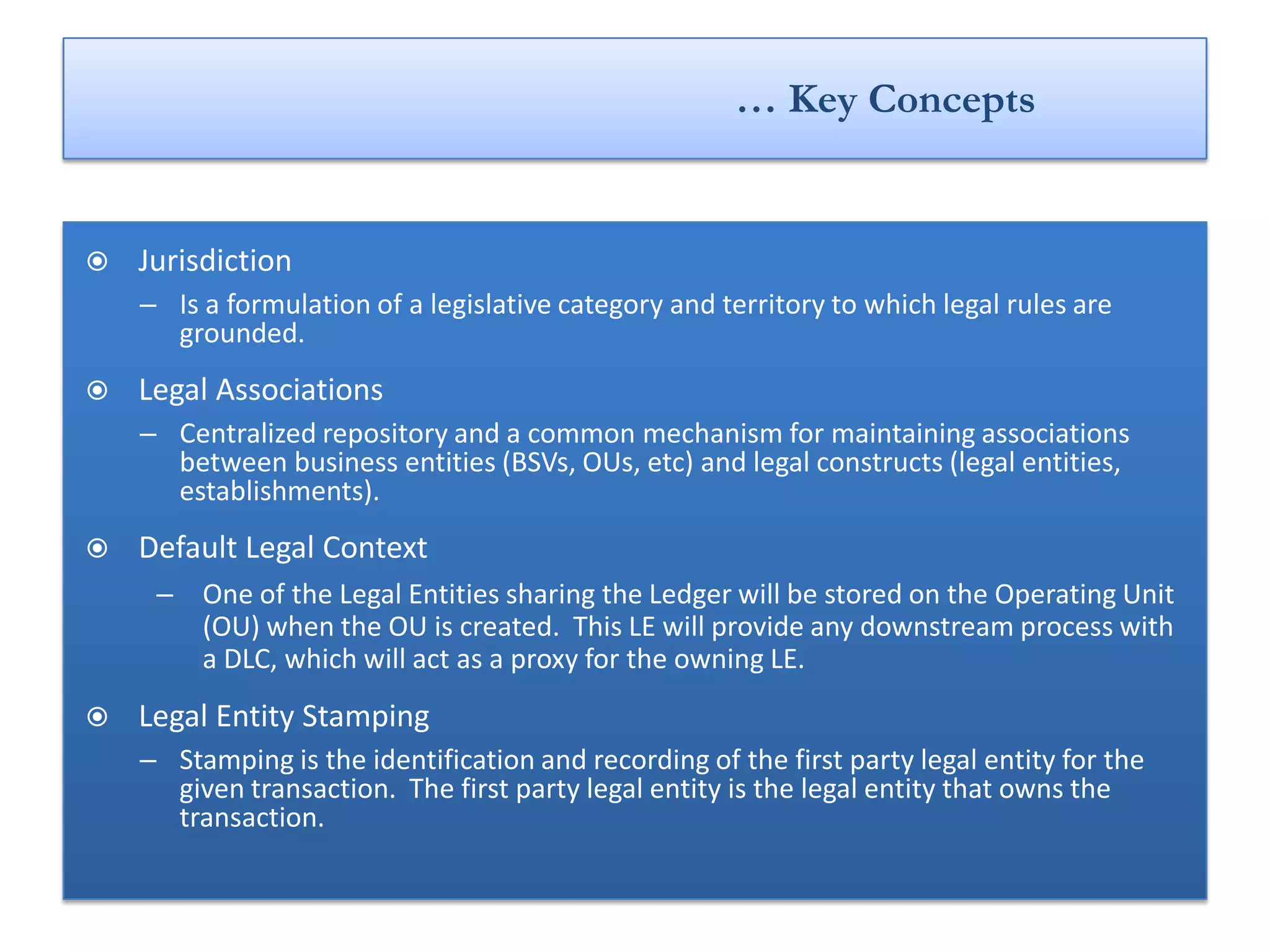

R12 introduced a new Legal Entity architecture that separates the legal and operational aspects of an organization. The key changes include:

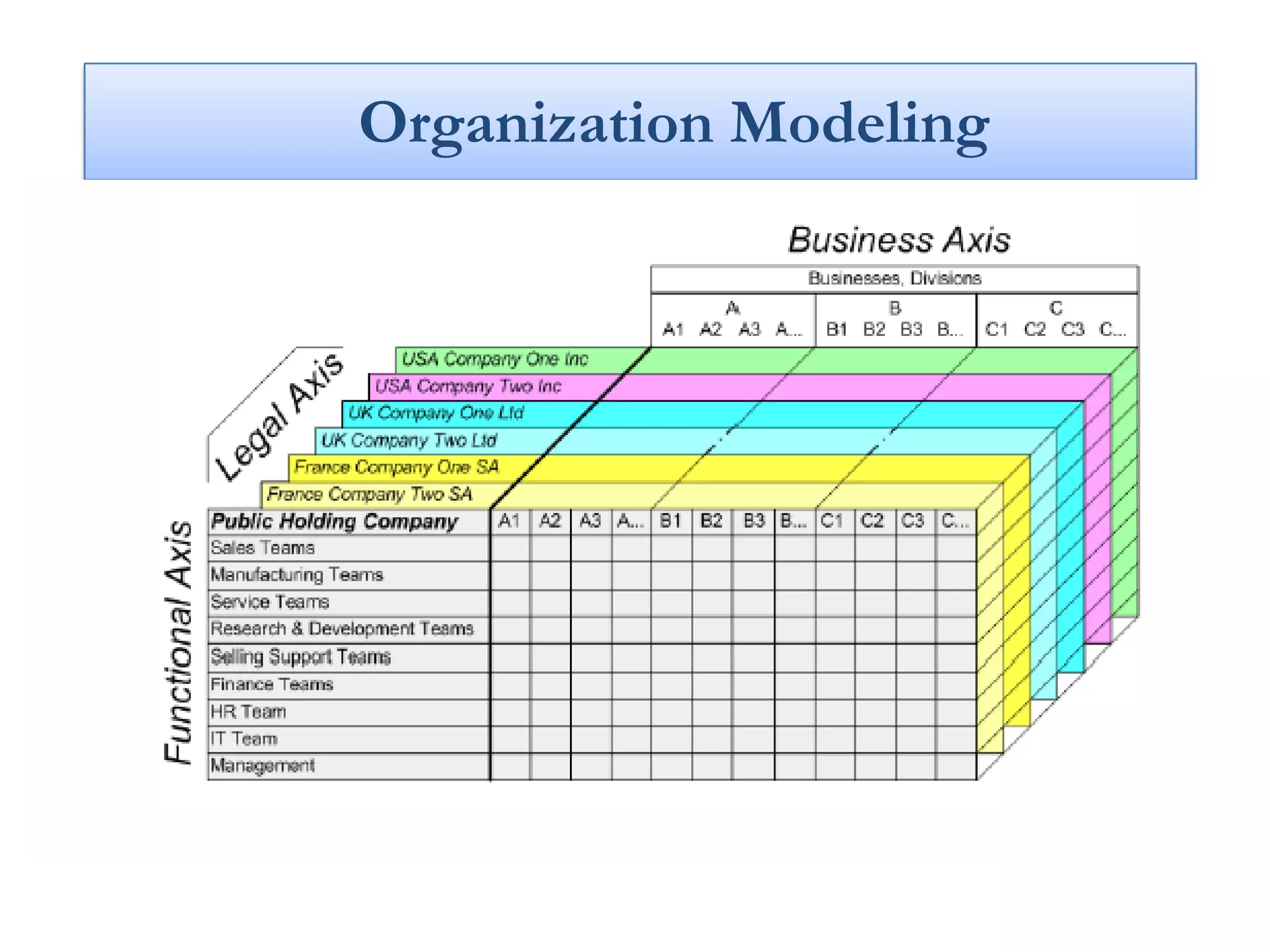

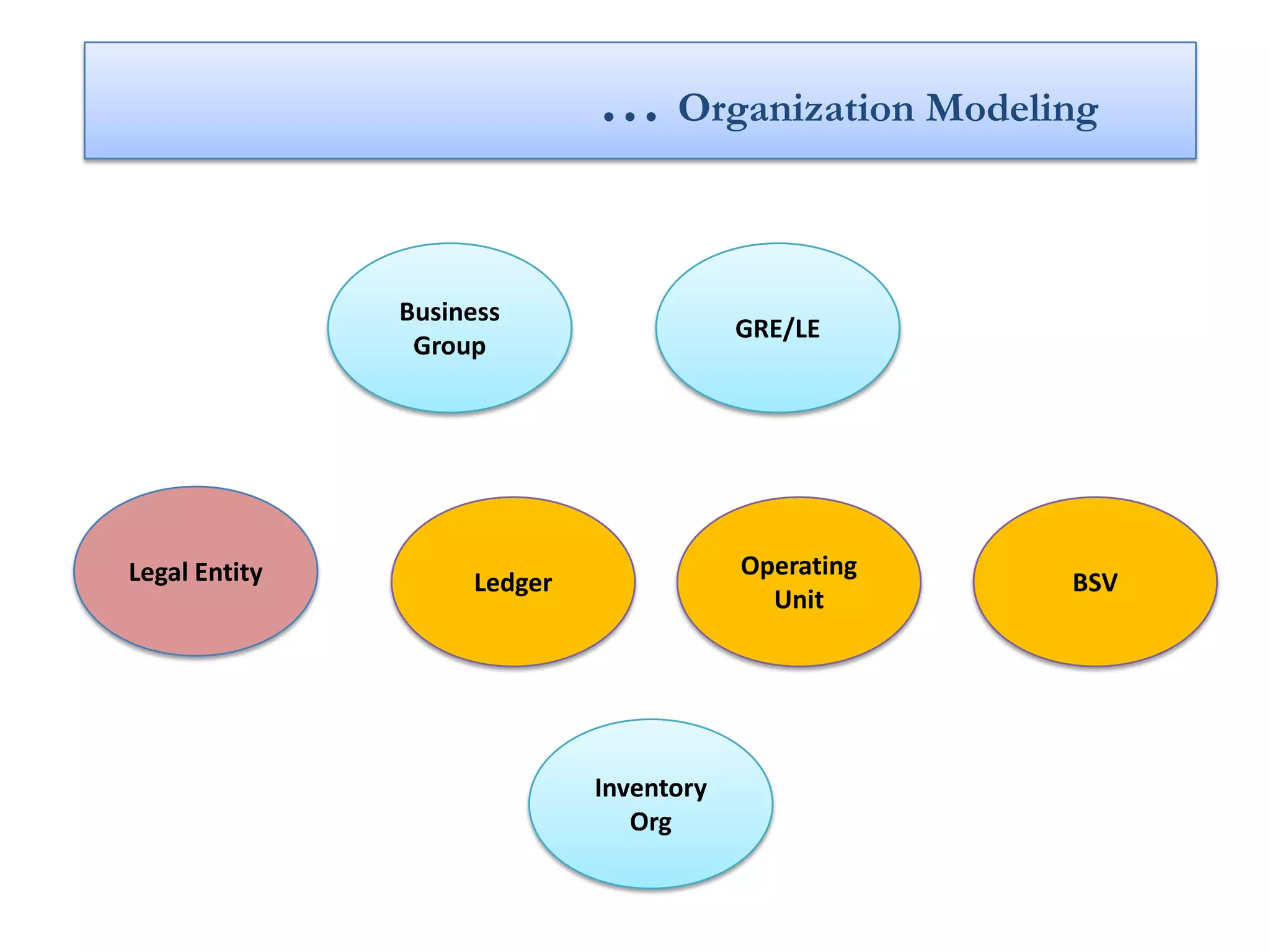

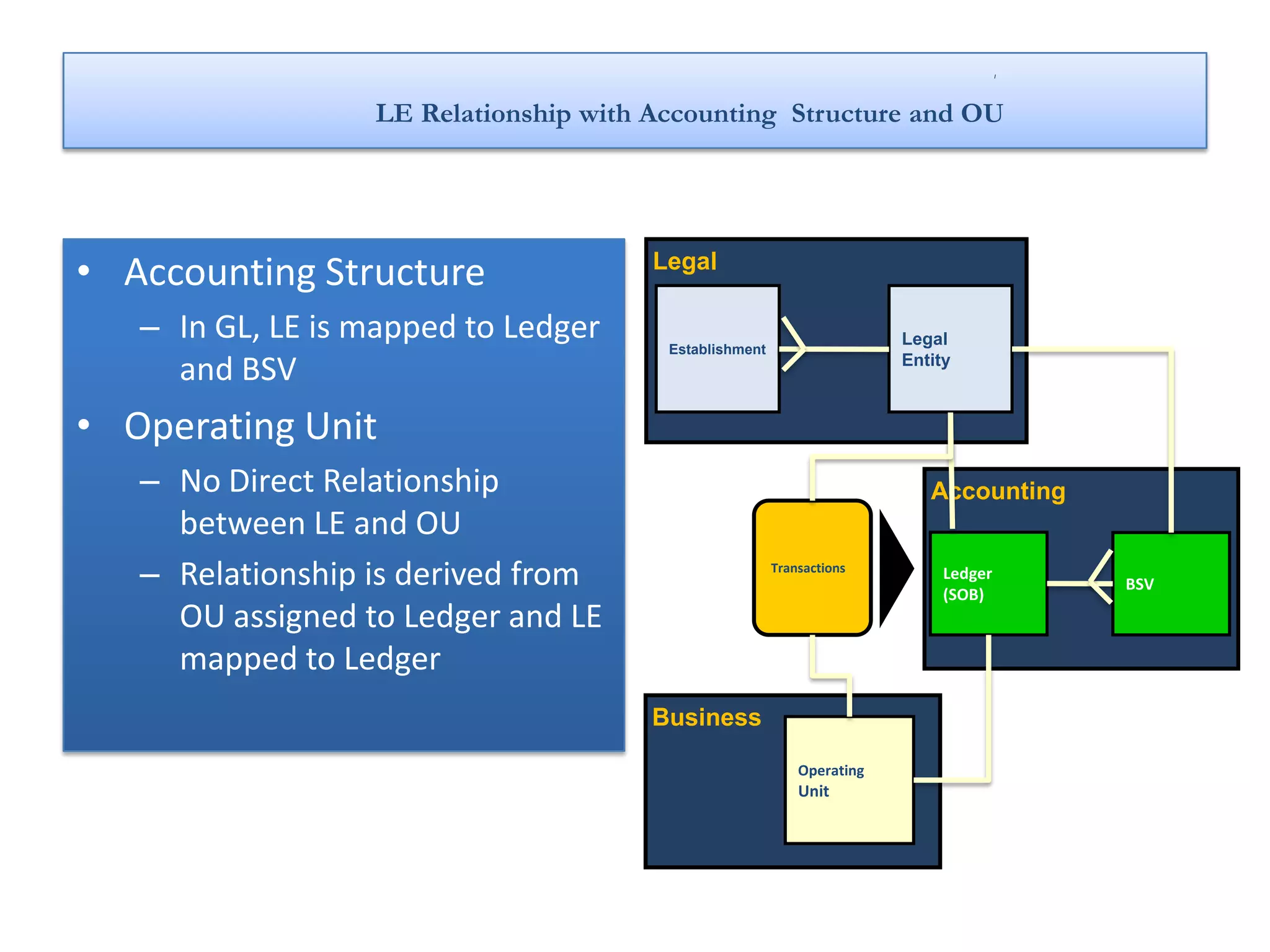

- Legal Entities are now distinct from Operating Units and can be mapped to multiple balancing segment values and ledgers. This allows companies to better model multi-entity structures.

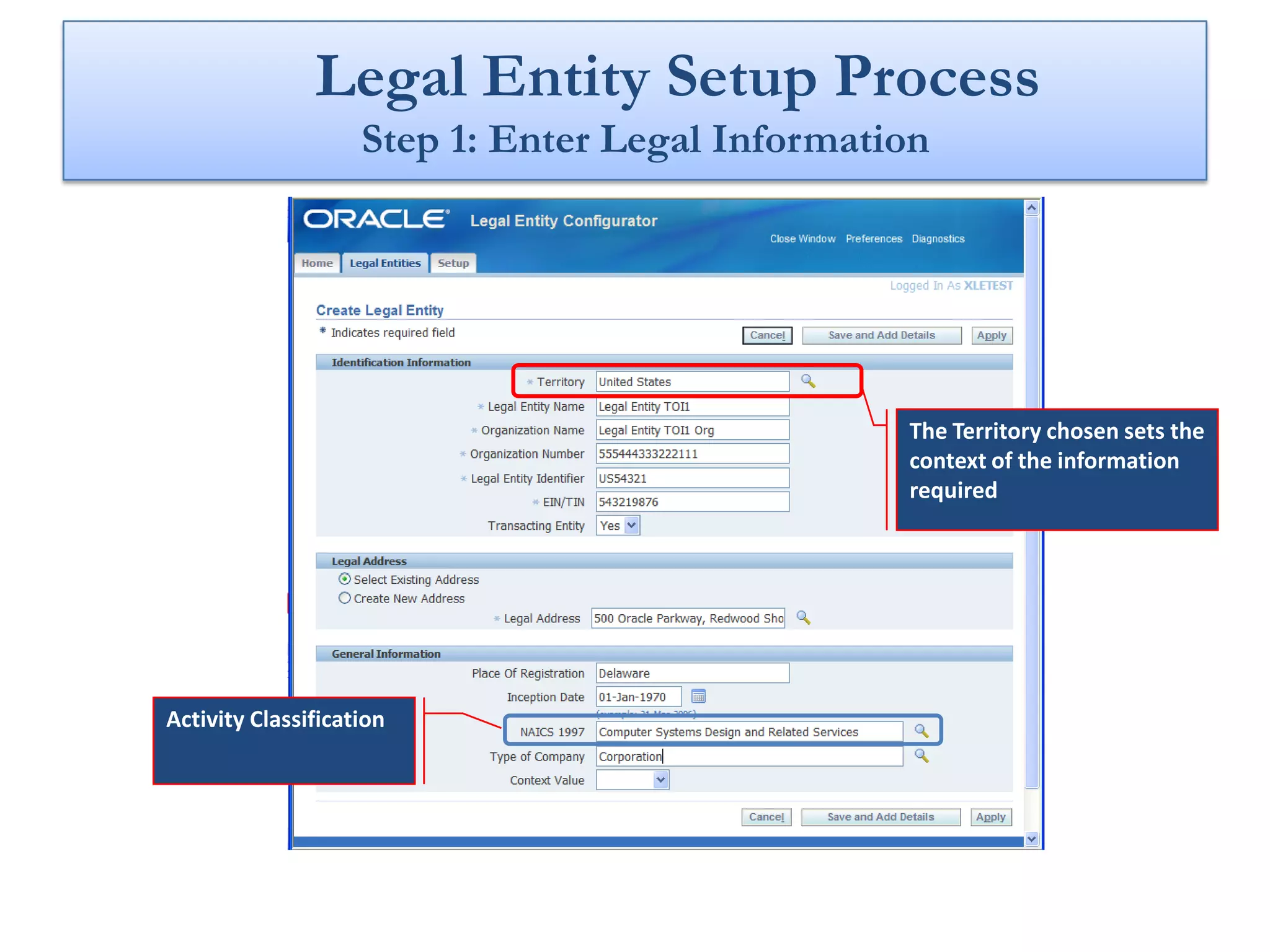

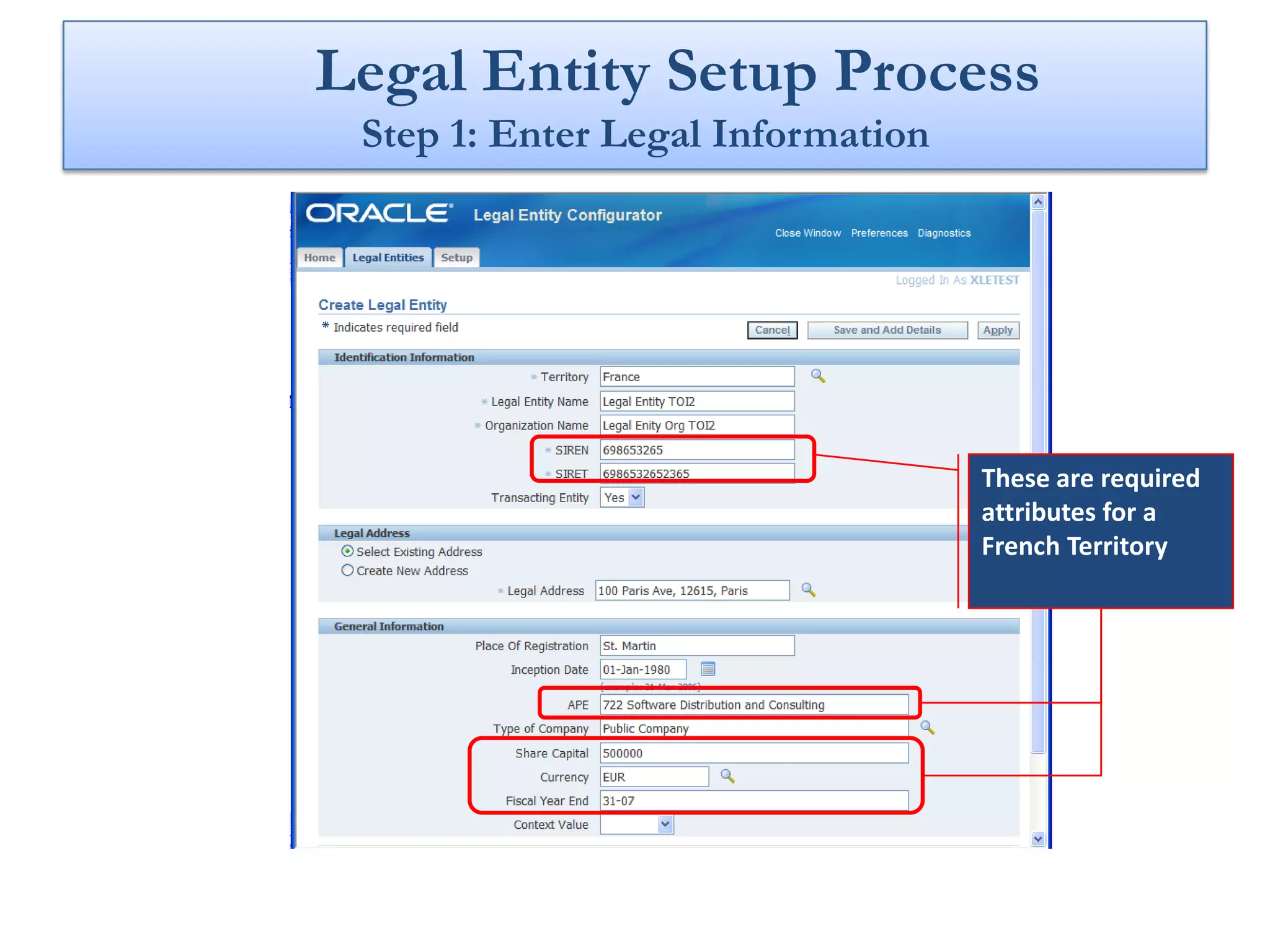

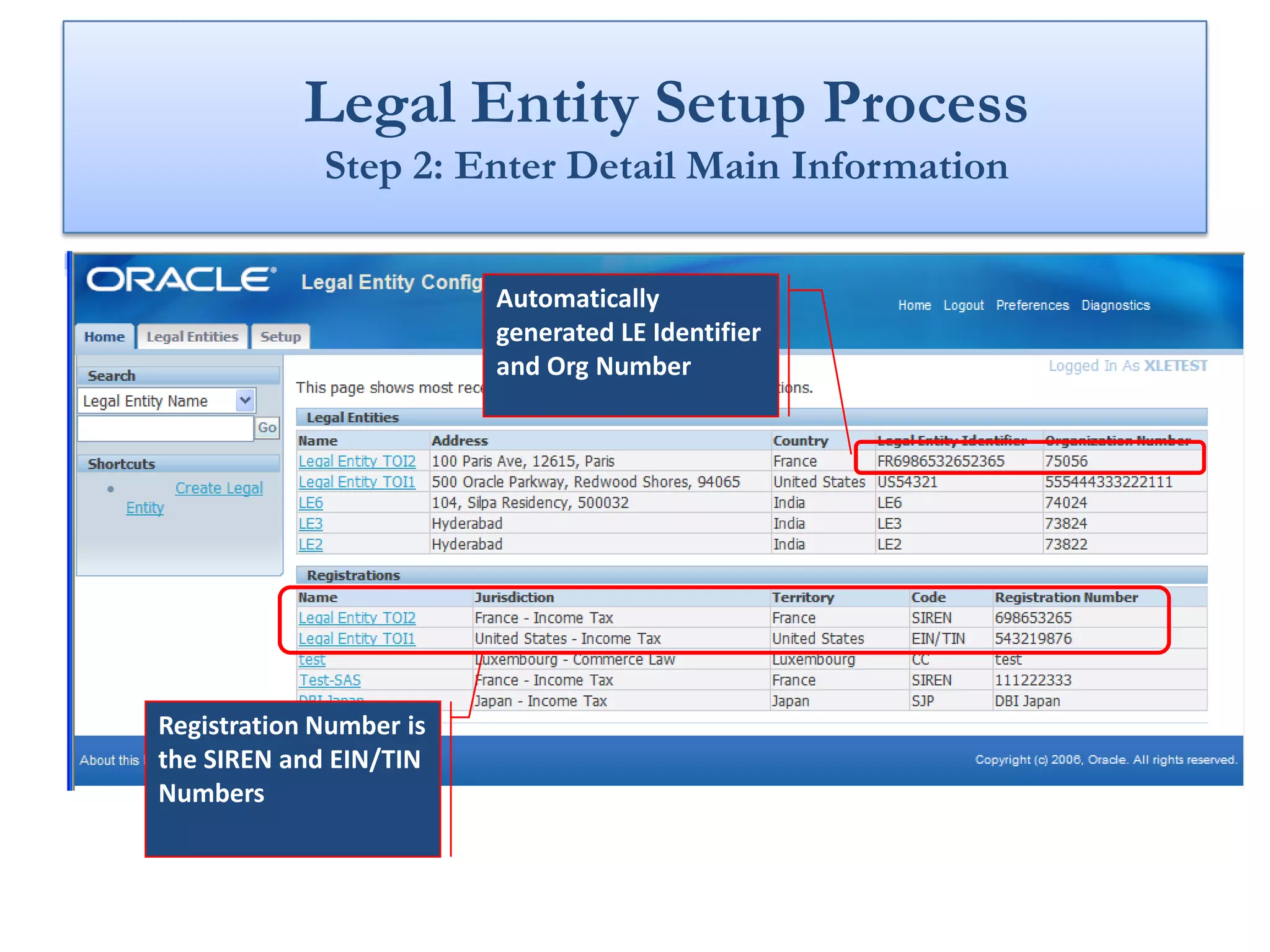

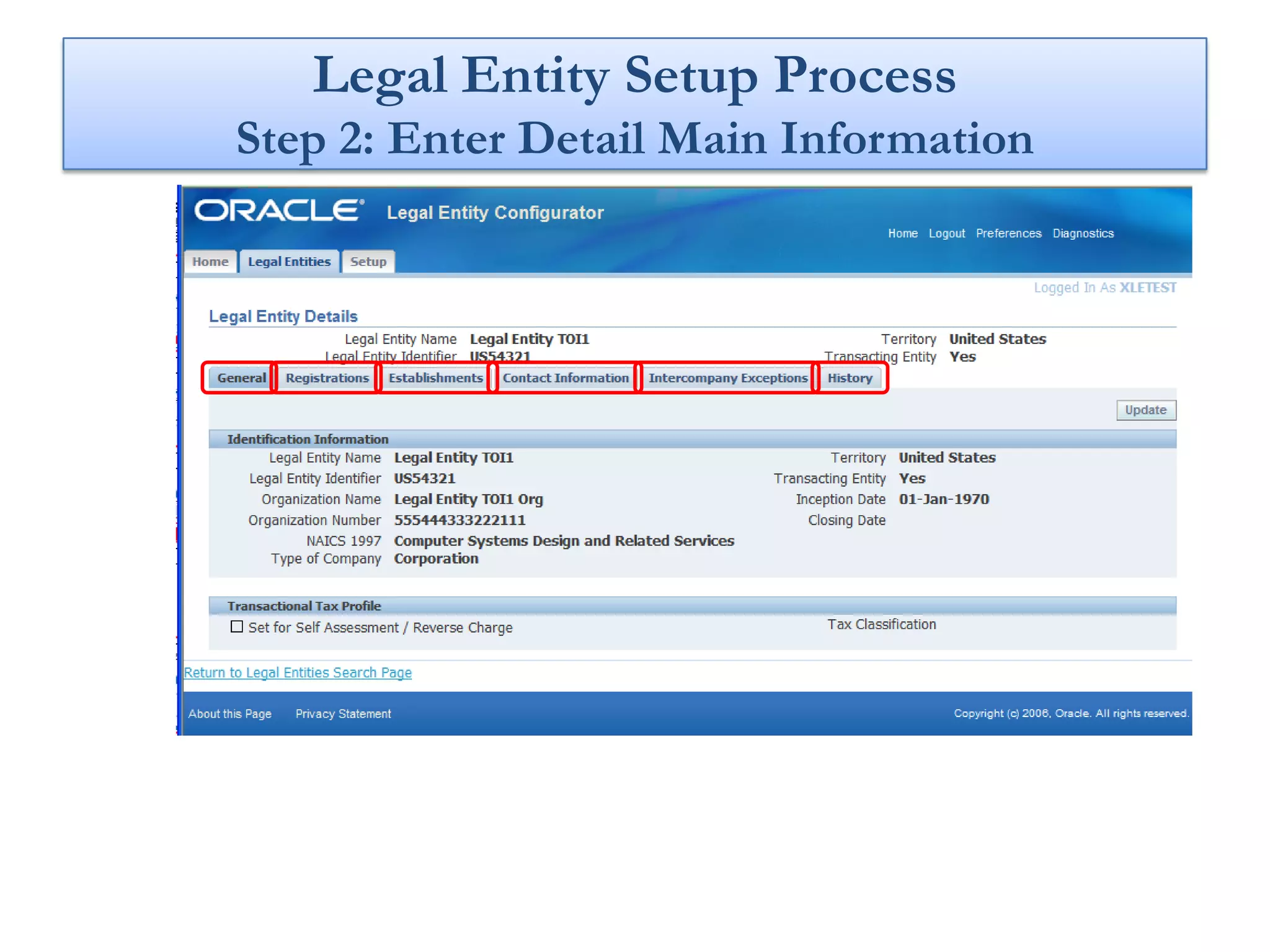

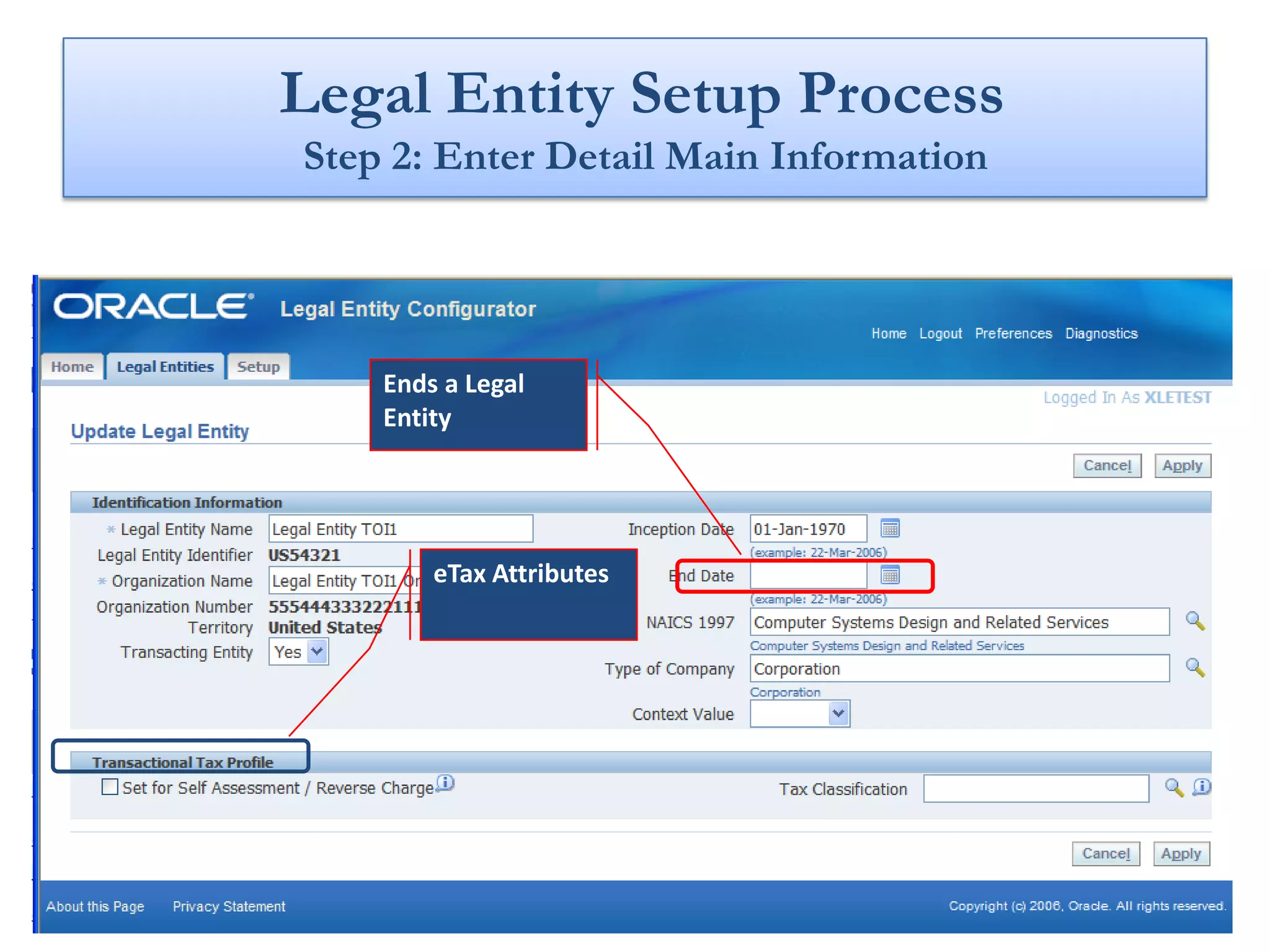

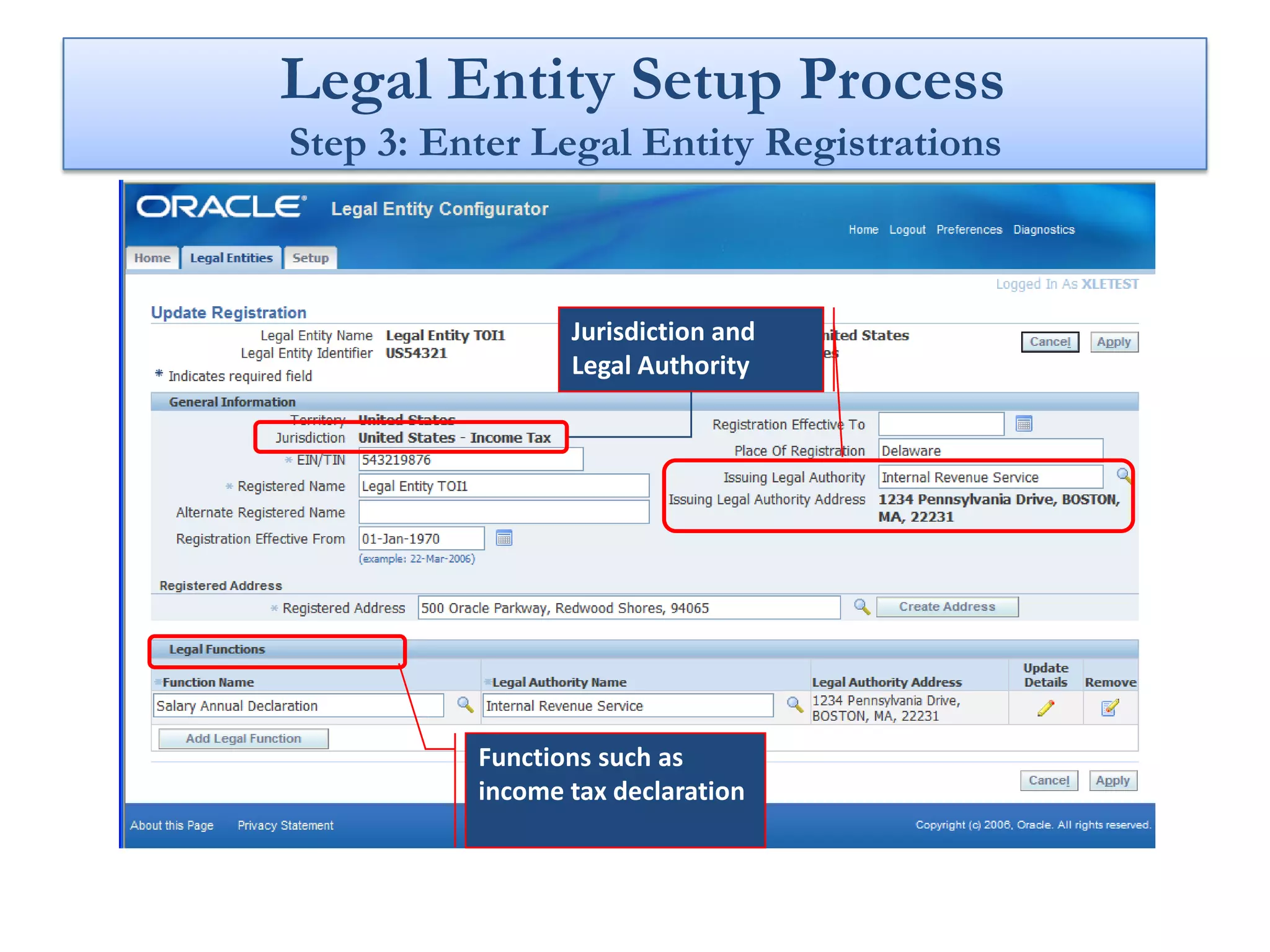

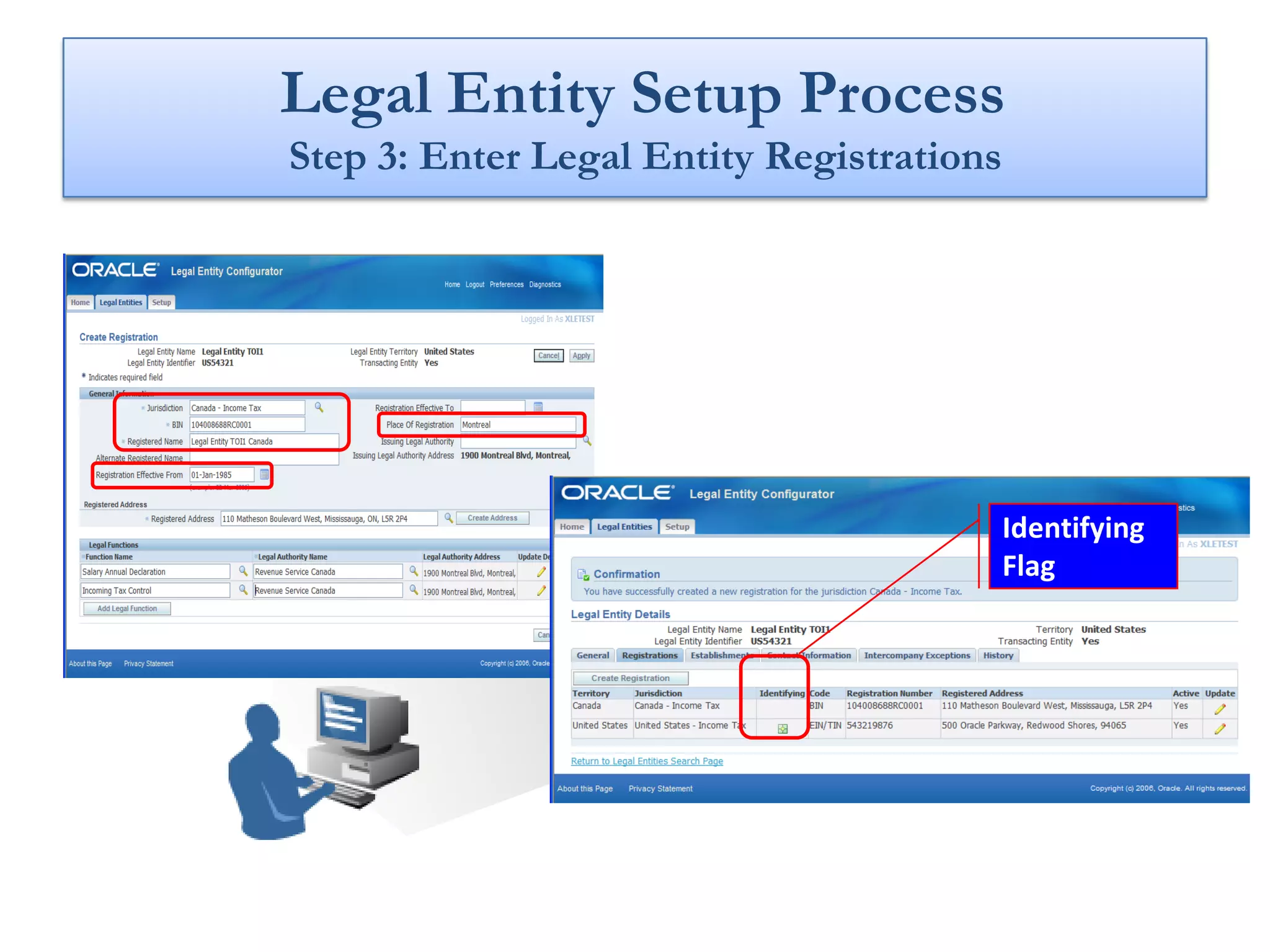

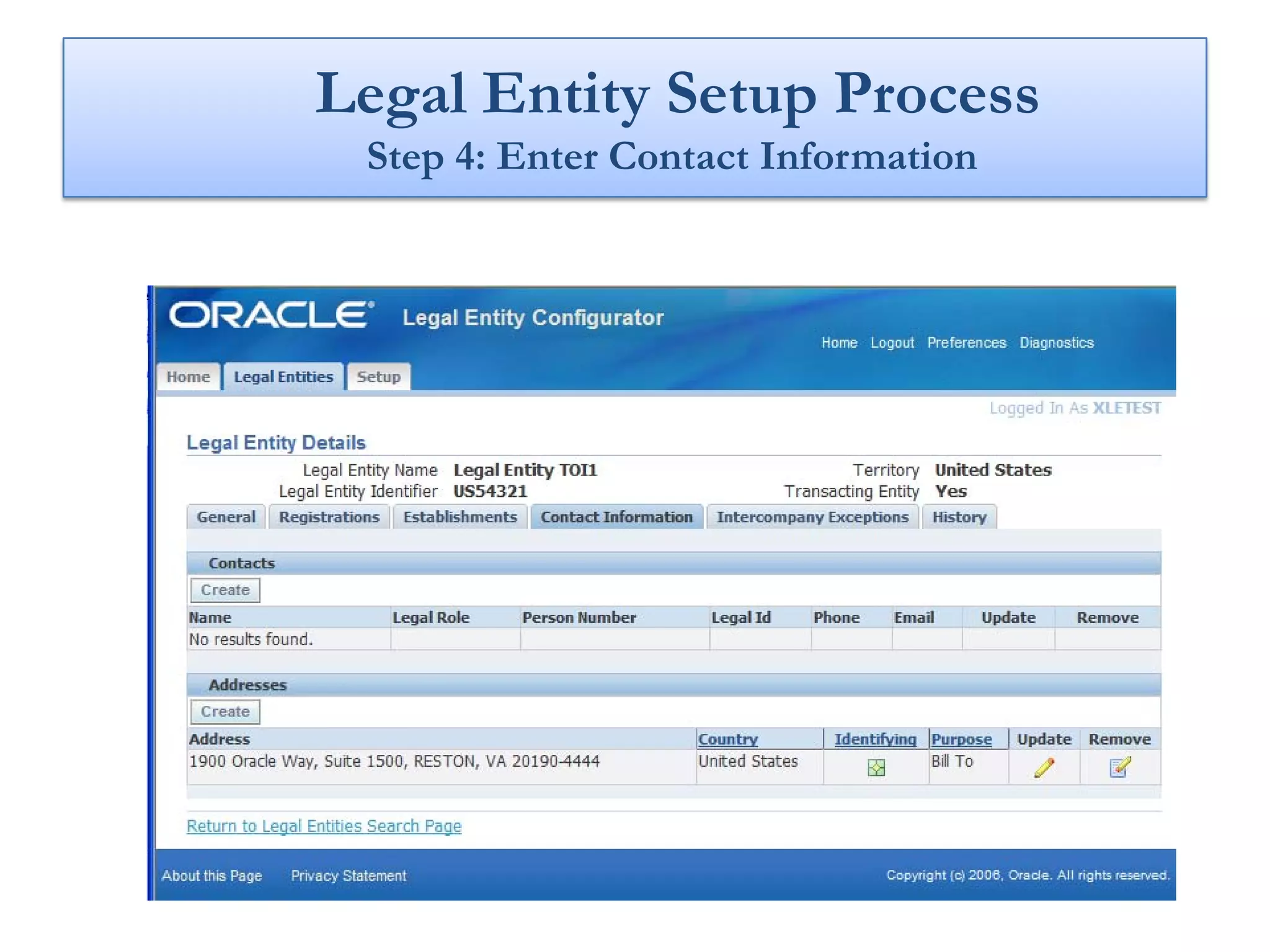

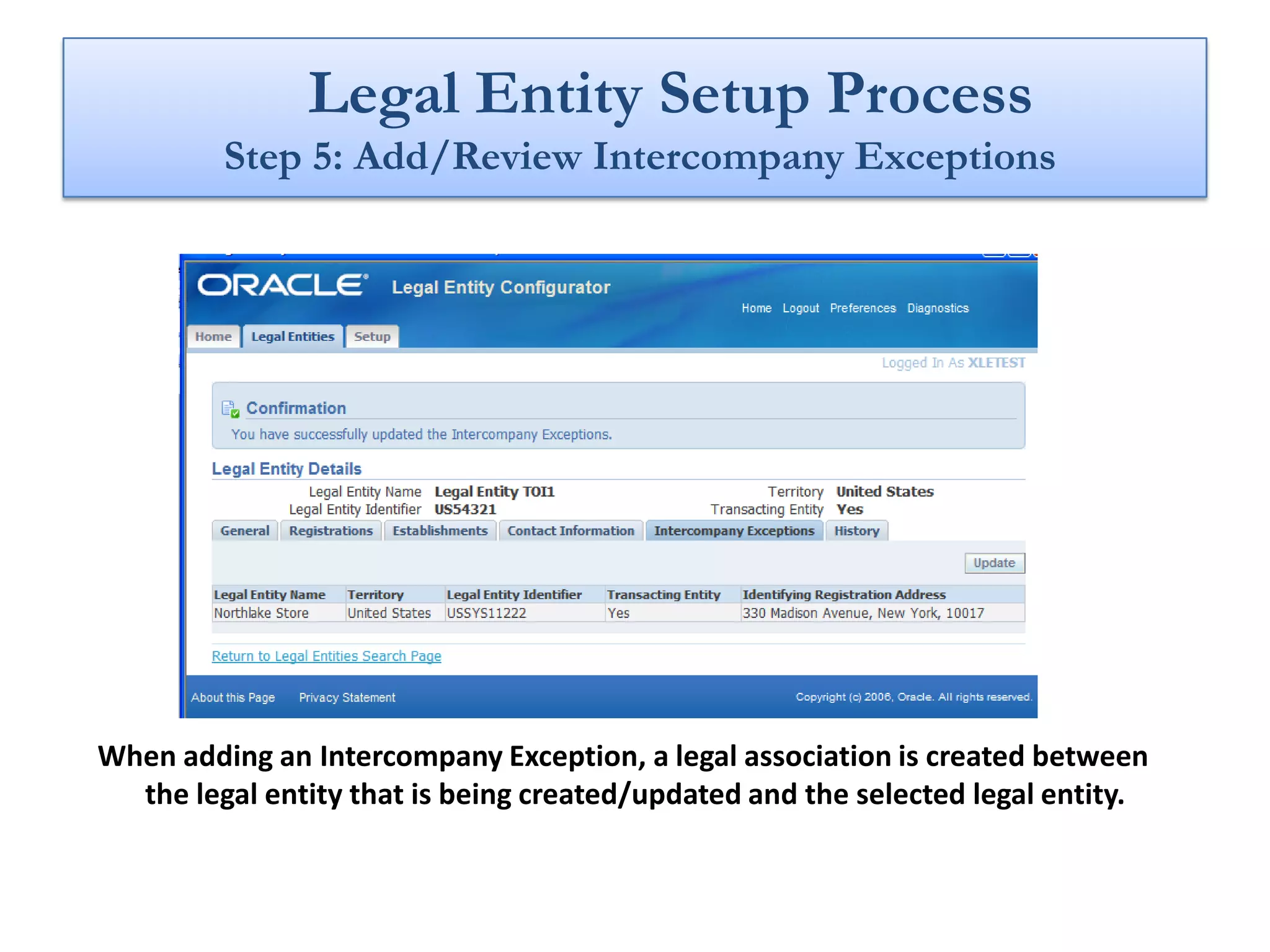

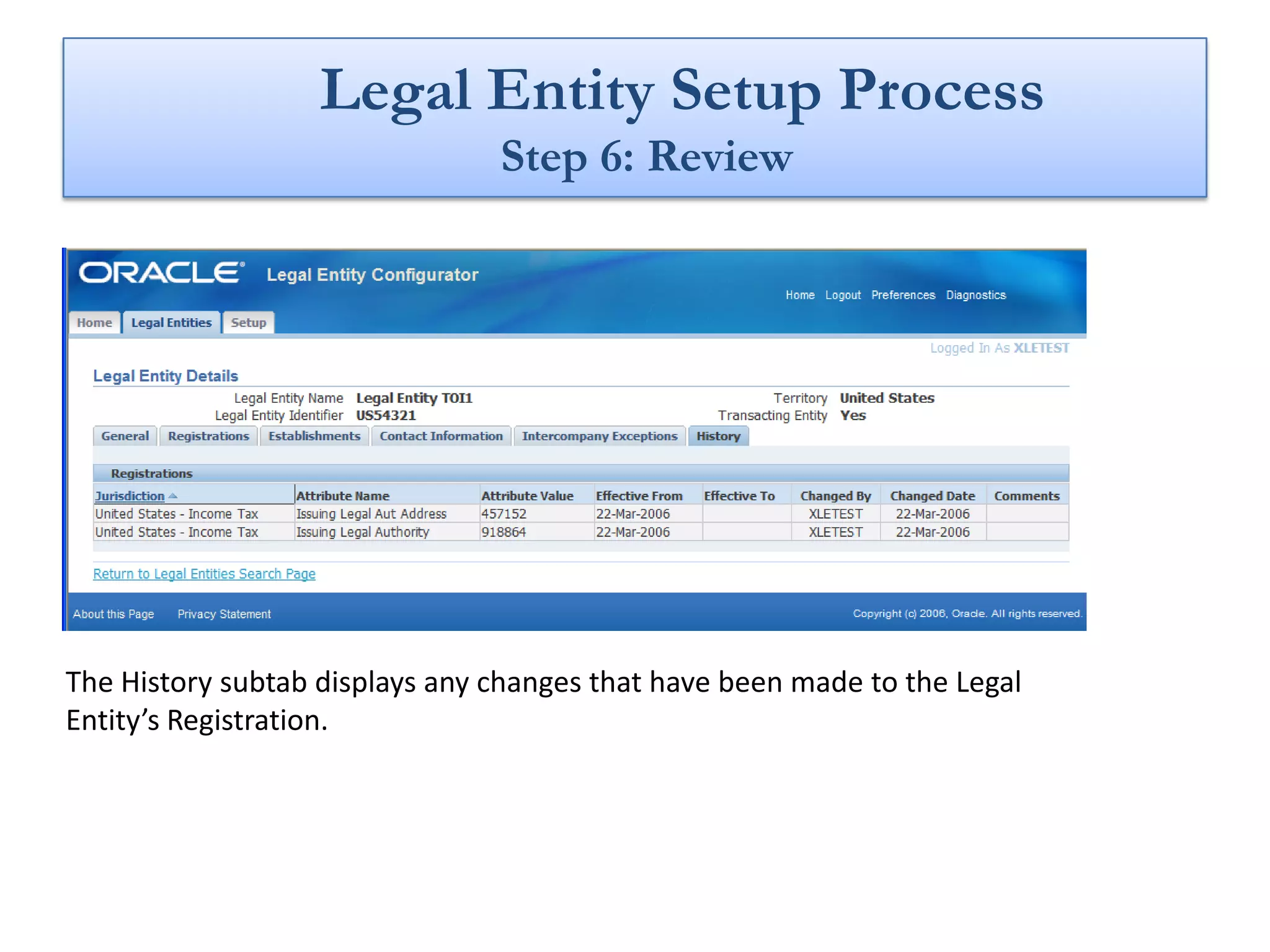

- Legal Entity Configurator centralizes the setup and maintenance of legal entities, establishments, registrations, and other legal attributes.

- Legal associations link legal constructs like entities and establishments to business entities and enable tax calculations.

- The new design aims to better address legal requirements like local registrations and intercompany transactions between separate legal entities.