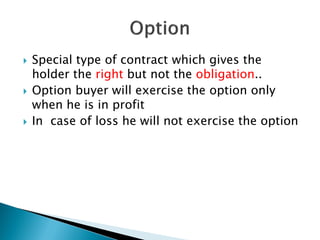

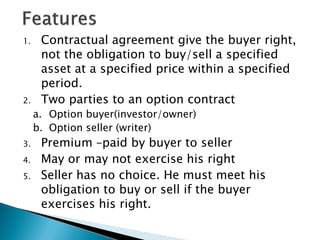

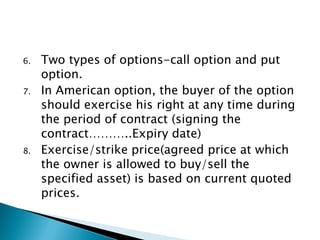

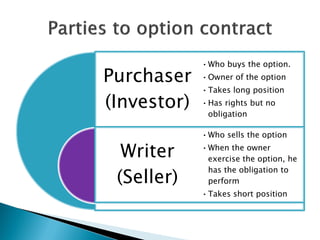

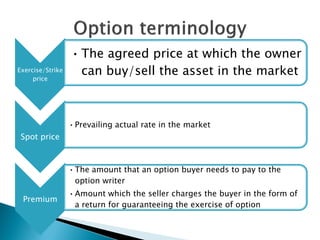

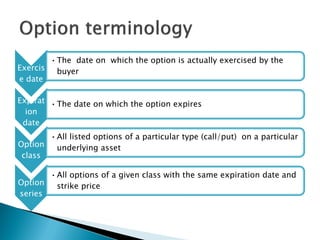

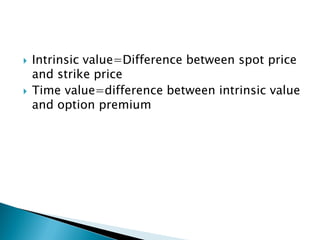

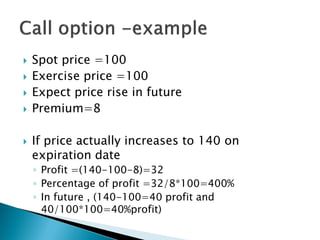

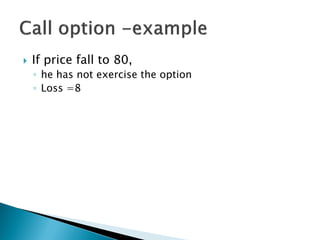

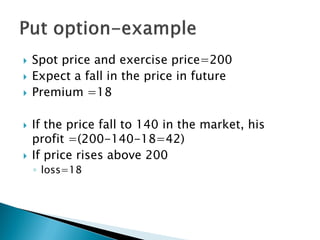

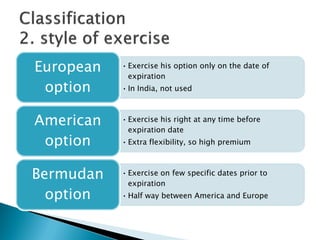

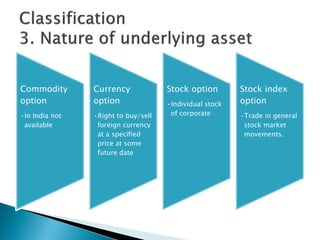

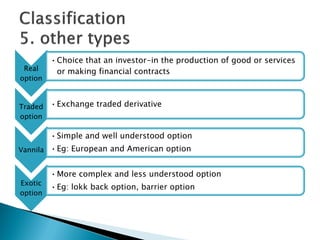

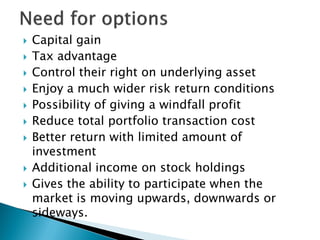

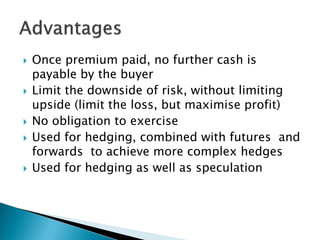

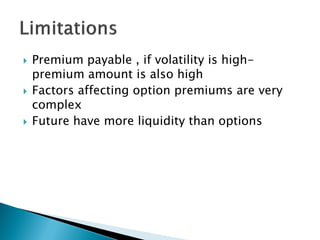

This document discusses options and their key concepts. It defines options as contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price. The main types are calls, which are options to buy, and puts, which are options to sell. Key terms discussed include premiums, strike prices, expiration dates, and intrinsic and time value. The uses of options for hedging and speculation are also summarized. Overall, the document provides a high-level overview of options, their characteristics and applications.