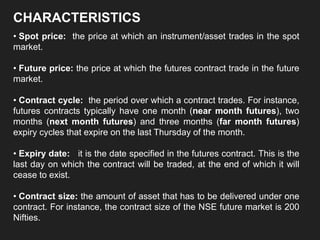

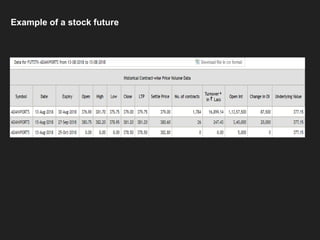

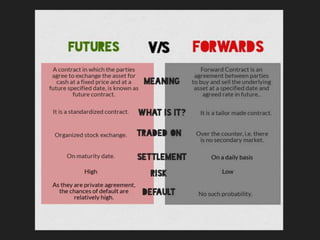

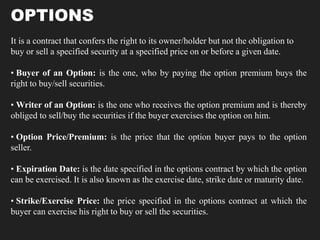

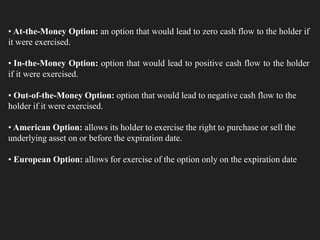

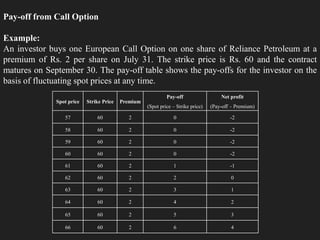

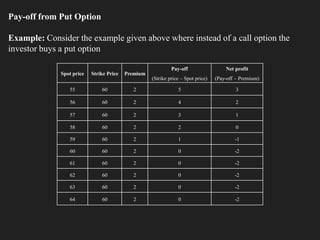

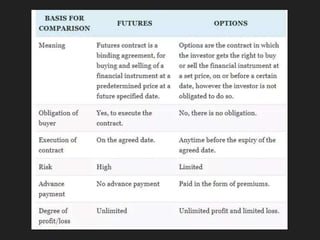

The document outlines the concepts of futures and options, detailing their definitions, characteristics, and various types. Futures contracts obligate buyers and sellers to transact at a specified price on an expiration date, while options provide the right, but not the obligation, to buy or sell a specific security before a given expiration date. It includes examples of stock futures, call options, and put options, illustrating how they operate and their respective financial implications.