The document discusses key concepts related to option pricing models. It provides explanations of intrinsic value, time value, put-call parity, binomial option pricing model, and Black-Scholes option pricing model. The binomial model uses a discrete-time approach to value options, while Black-Scholes uses a continuous-time approach and calculus. Both aim to determine the fair price of an option based on factors like the underlying asset price, strike price, time to expiration, risk-free rate, and volatility.

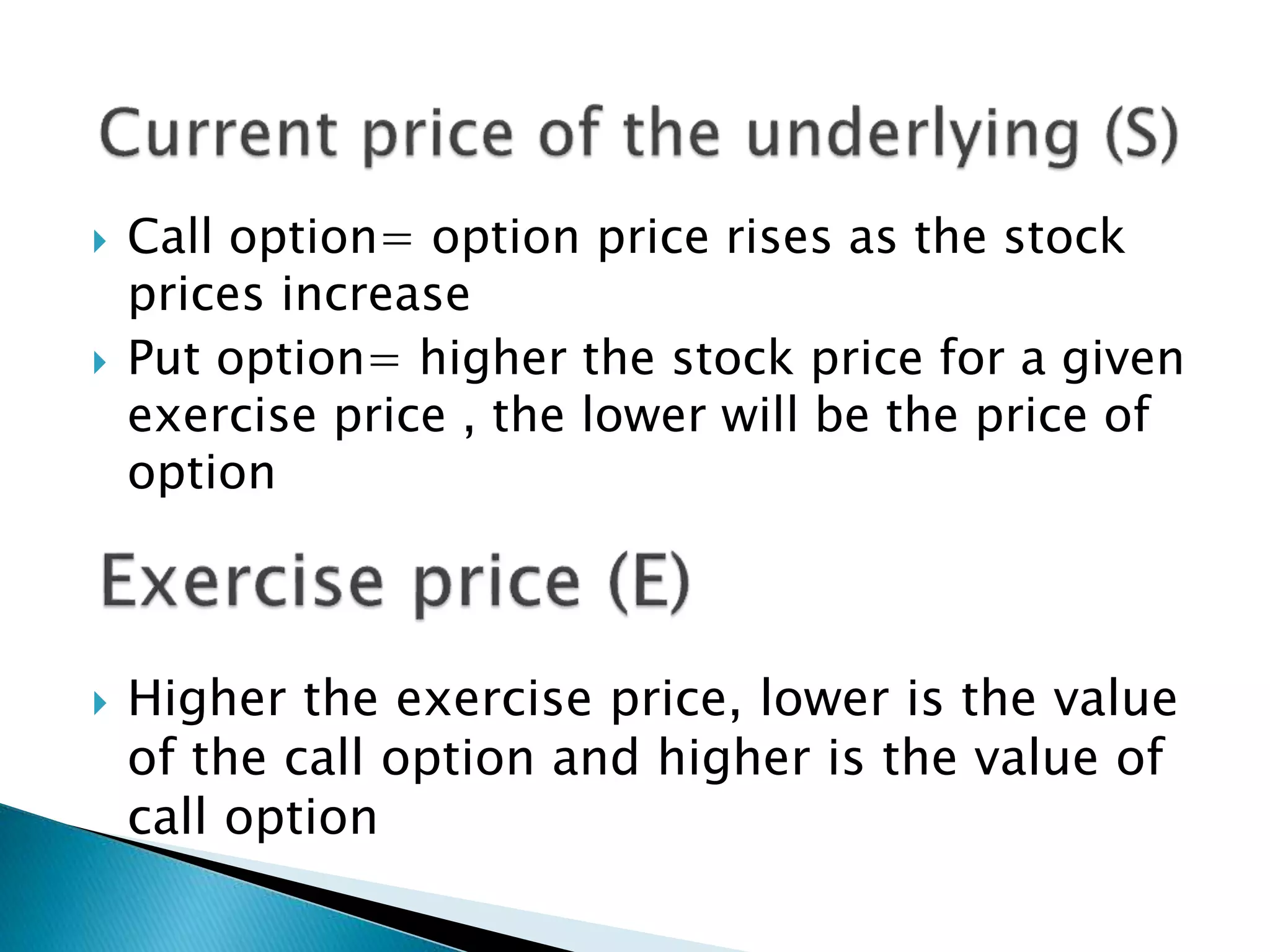

![ Discrete time model

Length of the time interval remains constant

throughout the tree

Volatility remains constant throughout the

tree

The probaility of an up movement and down

movement remains same in the entire tree]

Binomial tree is recombinant

Option price is calculated by backward

process calculation(from expiration to the

present)](https://image.slidesharecdn.com/valuationofoptions-210510054909/75/Valuation-of-options-34-2048.jpg)

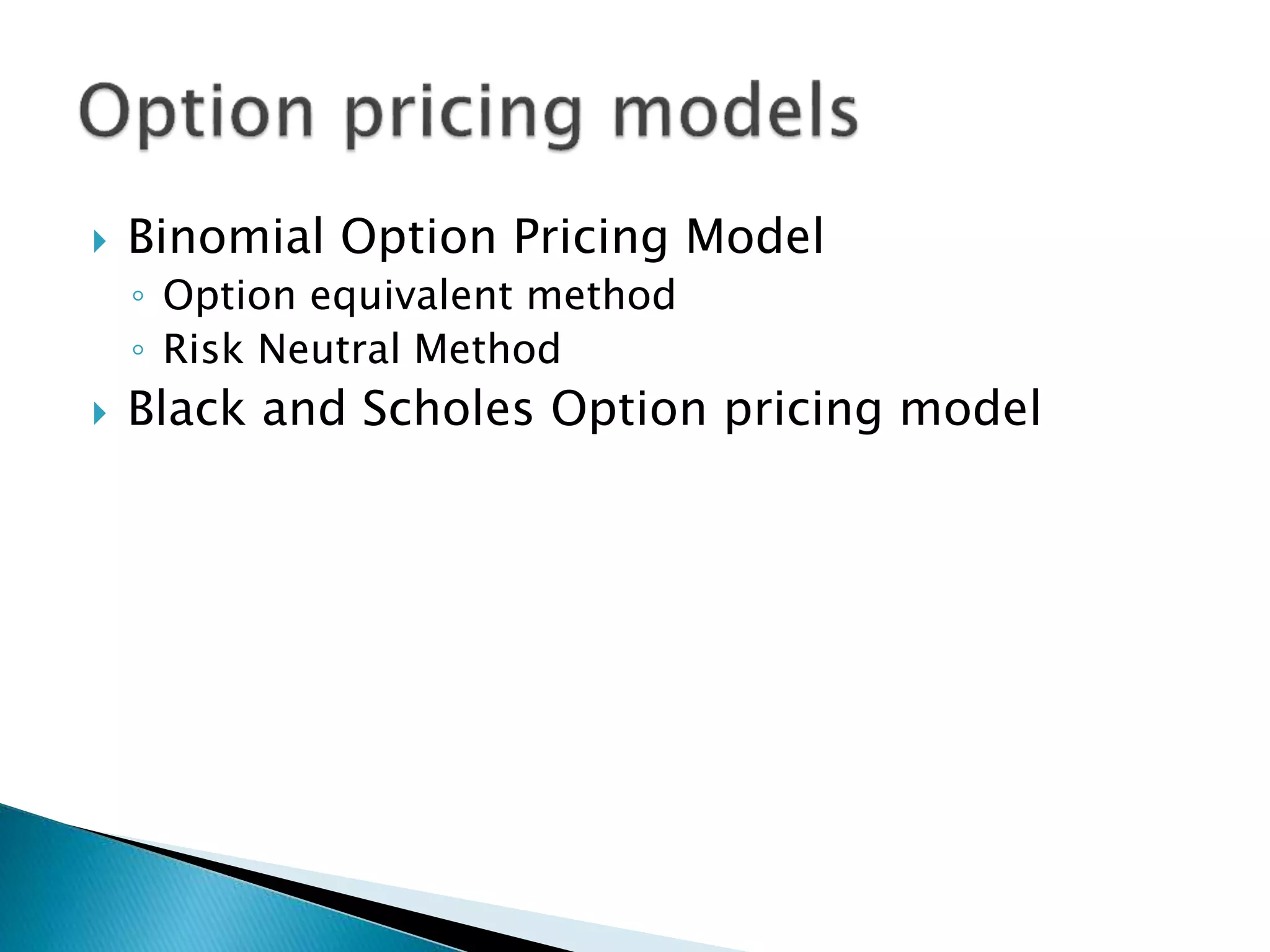

![1. Estimate the highest value of the call

Cu=Su-E

2. Estimate the lowest value of the call

Cd=(Maximum(Sd-E),zero)

3. Estimate the probability of increase in the spot

price of the underlying shares on the expiration

date. (It is calculated with the help of expected

return of the investor or the risk free rate of

return)

E(r)=[(p*percentage increase)+(1-p*percentage

decrease)]](https://image.slidesharecdn.com/valuationofoptions-210510054909/75/Valuation-of-options-43-2048.jpg)

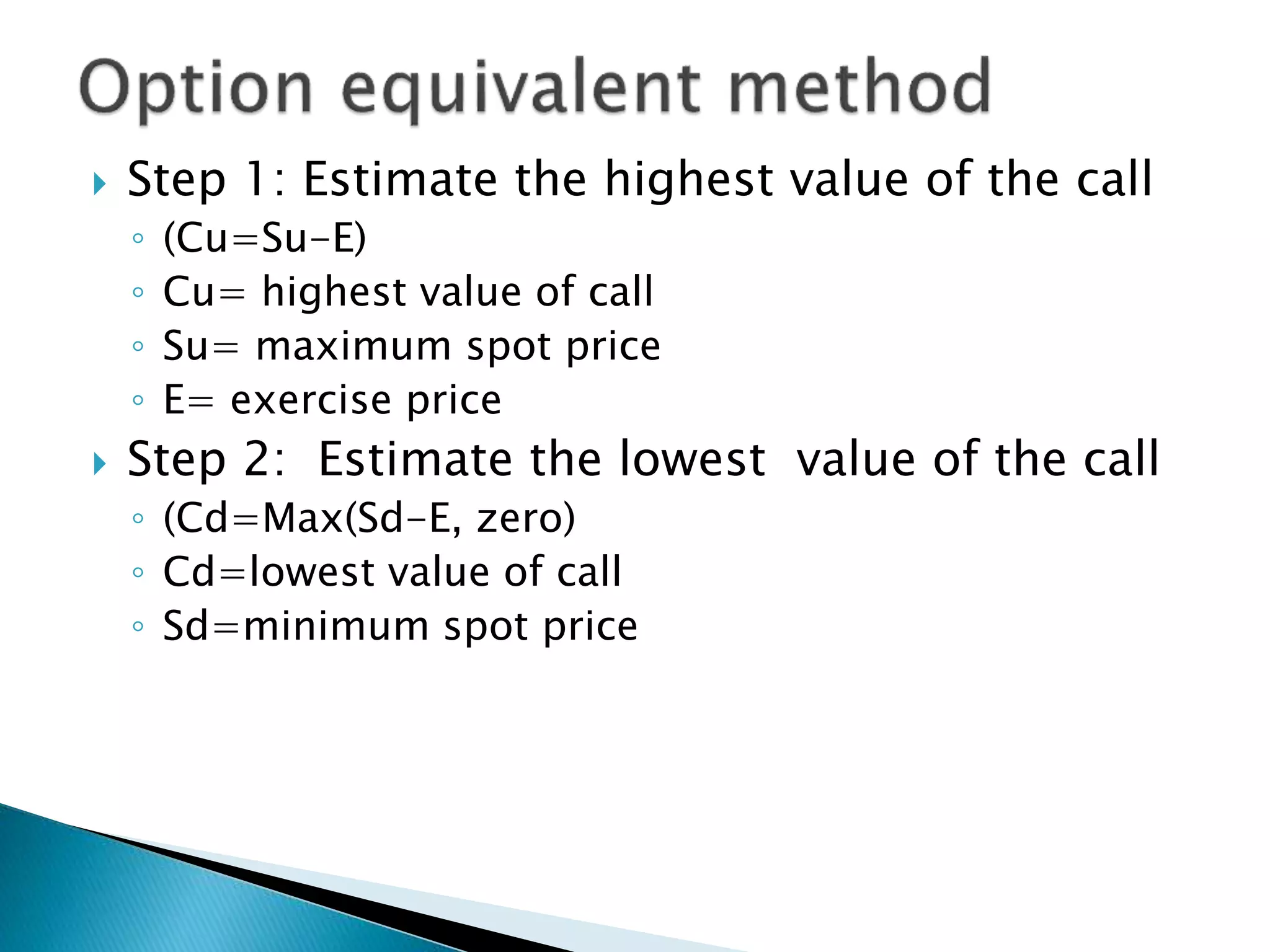

![4. Calculate the expected future value of the

call option with the help of probability

Cu*p+[cd*(1-p)]

5. Calculate the present value of the call

Future value/(1+r)n](https://image.slidesharecdn.com/valuationofoptions-210510054909/75/Valuation-of-options-44-2048.jpg)