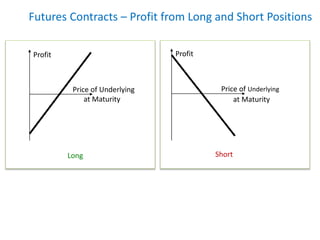

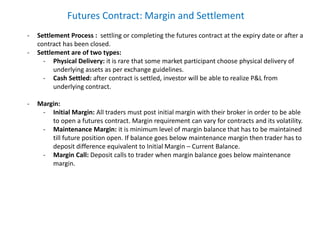

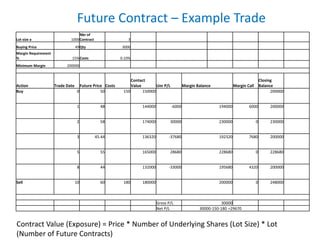

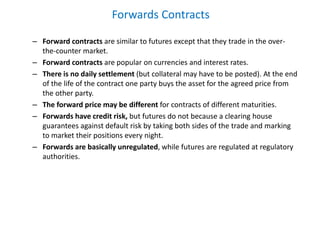

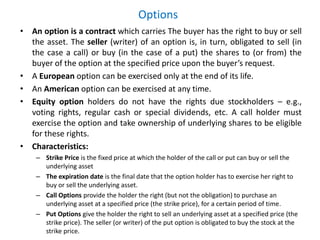

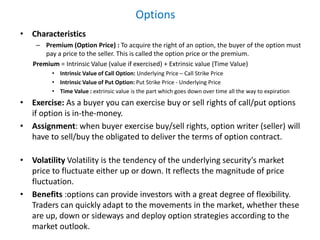

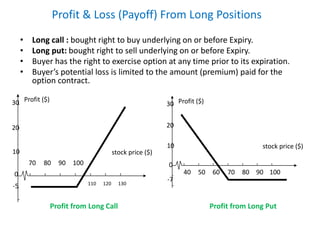

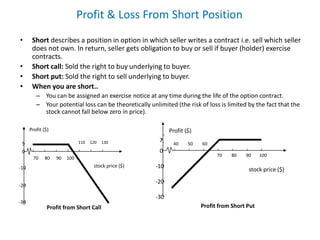

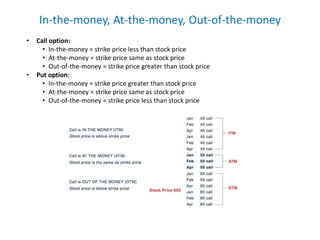

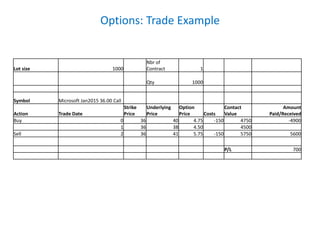

The document provides an overview of futures, forwards, and options contracts. It defines each type of contract and describes their key characteristics and differences. Futures contracts involve an obligation to buy or sell an asset at a set price and date. Forwards are similar but traded over-the-counter. Options provide the right but not obligation to buy or sell an asset and have different payoff profiles depending on long or short positions. The document includes examples of how profits and losses are realized for each contract type.